Fed: Hold Then Cautious Easing

Though the SEP reduced growth forecasts and boosted inflation, the guidance from the Fed remains that policy is on hold in the coming meetings. Though the FOMC median still has two 2025 cuts, the breakdown shows that this was a close call and a lot of members see no cut or only 25bps. We look for a 25bps Q4 cut and then three 25bps cuts in Q2-Q4 before the Fed delivers one final cut in 2027.

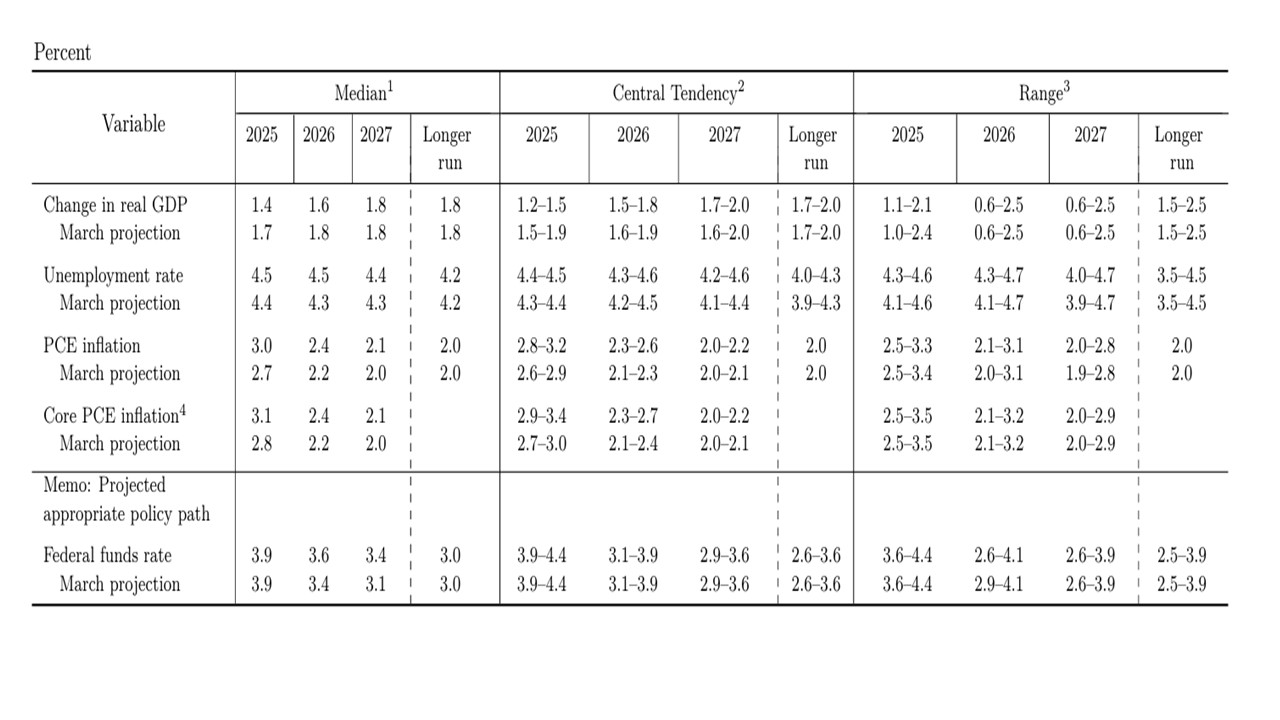

Figure 1: Fed June Summary of Economic Projections (SEP)

Source: Fed (June SEP)

The June FOMC statement and Fed Chair Powell Q/A provide a number of clues on prospective policy. Key points include

· Inflation and growth uncertainties. The SEP (Figure 1) saw the net tariff effect of the last 3 months since March boost core CPI projections for 2025-26 and reduce GDP for the same two years. This is measured rather than aggressive in nature on both GDP and inflation. The 2.4% median projection for 2026 core PCE inflation would also still represent progress towards target, but also crucially FOMC officials view that the tariff inflation effect will largely be 1 round effects and not persist. The FOMC statement also noted that uncertainty about the economy had diminished but remains elevated. We agree with this, as the Trump administration actions have been curtailed by markets and supply chain concerns and we see the end average tariffs rate being 13-15% (here). Fed chair Powell echoed this view as well in the Q/A.

· Guidance on Interest rates. The SEP medians still show two 25bps rate cuts for 2025, but 2026 has been trimmed to one 25bps cut. The breakdown of the FOMC members view shows that 7 out of 19 see no cut this year from the current 4.25-4.50% and for 2026 the split show two major groups at 3.75-4.00% and 3.25-3.50% -- with the 2026 median happening to be in between. This underlines that the FOMC members have diverging views for 2025 and 2026 and that the median of two cuts for 2025 is not high confidence. Fed Powell also tried to temper the 2026 and 2027 Fed Funds medians and focus more on 2025. Powell during the Q/A was reluctant to be drawn on hints on timing and once again showed a patience on maintaining current policy rates.

· 2025/26 rate prospects. The Fed is not sufficiently worried about the economy at the moment to overlook what it anticipates will be a temporary boost to inflation. This argues for policy to remain on hold in the coming meetings in July and September, unless the real sector data deteriorates sharply. October is possible, but we still prefer a 25bps cut at the December meeting. After a solitary move in Q4 2025, we expect the Fed to pause in Q1 2026 before delivering 25bps moves in Q2, Q3 and Q4. This reflects our view that core PCE inflation will move towards target, with the Fed likely to focus on monthly changes into the winter and spring. Additionally, we see easing driven by the desire to get growth back up towards trend. That would leave the upper bound of the Fed Funds target range at 3.5% at the end of 2026, still slightly above the 3.0% that the Fed currently sees as neutral. We suspect that in a less globalized word, the long-term neutral rate will edge slightly above 3.0%.