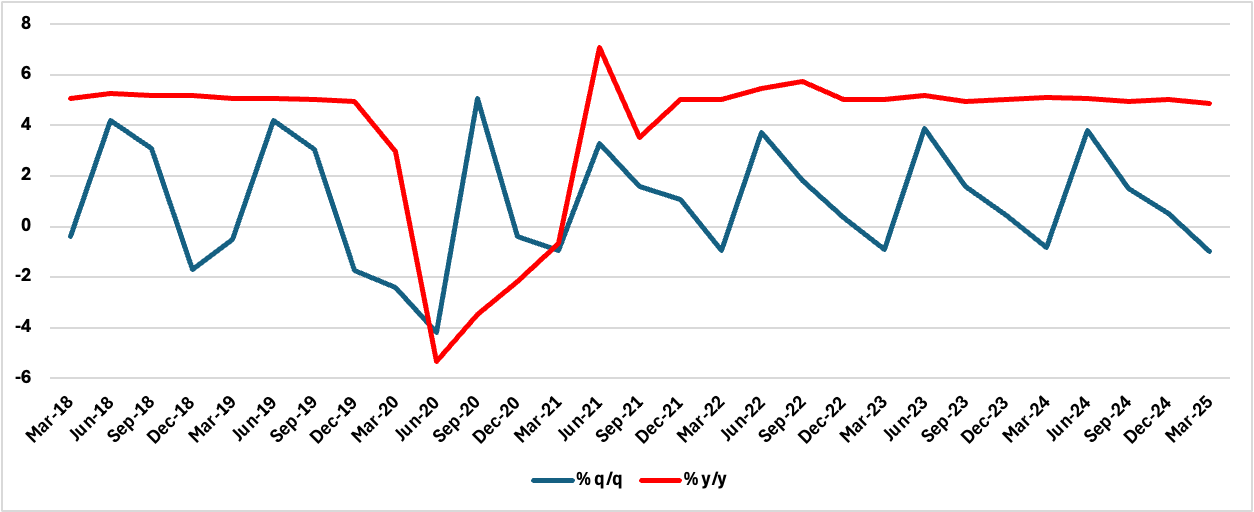

Indonesia’s Q1 GDP Disappoints, Deepening Case for Rate Cut

Bottom line: Indonesia’s Q1 GDP growth slipped to 4.87% yr/yr, missing the 5% target as public spending declined. Household consumption edged down and fixed investment declined sharply. Looking ahead, Q2 may bring further softening.

Indonesia’s economy grew by 4.87% y/ryr in Q1 2025, slipping from 5.02% in Q4 2024 and marking the weakest expansion since Q3 2021. On a quarterly basis, the economy contracted by 0.98%, its first decline in a year, as base effects, faltering investment and weak construction activity weighed heavily on output.

Figure 1: Indonesia Real GDP Growth (%)

Source: Continuum Economics

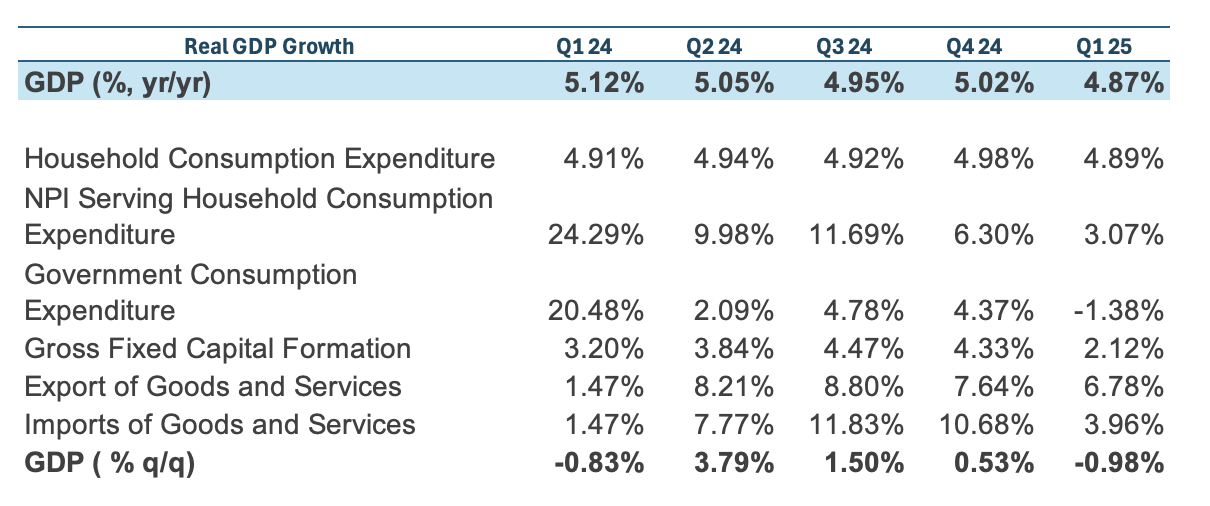

The headline figure was broadly in line with expectations, but a closer look reveals signs of softening momentum across most major demand and supply categories. Investment growth halved to 2.1% yr/yr (from 4.3% yr/yr in Q4-2024), dragged down by a sharp deceleration in building construction—which stalled in sequential terms—and weakening capital spending on machinery. Government consumption contracted by 1.4%, reflecting both base effects from last year’s election-linked spending and tighter fiscal conditions. Household consumption growth also edged lower, although it remained the largest contributor to GDP.

Figure 2: Real GDP Growth Components (% y/y)

Source: Continuum Economics

On the external side, net exports provided a modest lift to growth, as exports grew by 6.8%—outpacing imports, which slowed to 4.0% amid weaker investment and household demand. Still, the headline trade figures obscure a more fragile underlying picture. Merchandise exports declined quarter-on-quarter, and China’s weakening demand continues to weigh heavily on Indonesia’s export outlook. China’s manufacturing activity appears to be moderating.

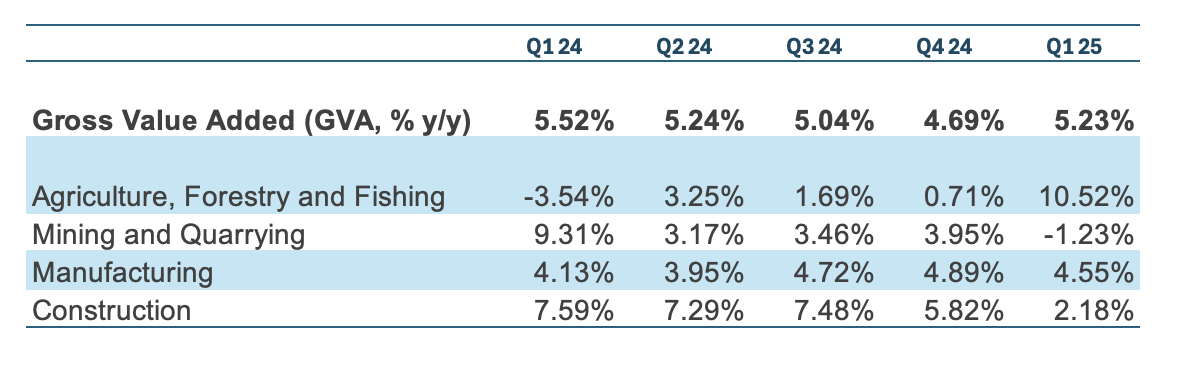

Sectoral data also painted a mixed picture. Mining output contracted for the first time since early 2021, and construction activity slowed to a two-year low. Manufacturing and retail trade growth remained soft, while utilities and accommodation also lost steam. On the upside, agriculture rebounded sharply, posting double-digit growth on the back of a low base and strong seasonal output. Transportation, financial services, and public administration provided modest support.

Figure 3: GVA and sectoral growth(% y/y)

Source: Continuum Economics

The GDP release adds to the pressure on Bank Indonesia to begin easing monetary policy. High real interest rates and fiscal consolidation have begun to bite, while core inflation remains subdued. At its last meeting, Bank Indonesia revised down its growth forecast to slightly below the midpoint of its 4.7–5.5% target range.

With machinery investment set to come under more pressure due to poor global demand and rising uncertainty over U.S. trade policy, domestic momentum looks fragile. Assuming rupiah volatility abates, a 50bp rate cut by year-end remains likely. For now, the outlook hinges on how quickly global headwinds ease—and whether fiscal and monetary tools can work in tandem to revive investment and confidence. We anticipate slower growth than previously forecast, and are revising real GDP growth down to 4.8% in 2025.