Tax Shortfalls and Slow Growth Complicate Indonesia’s Budget Plans

Indonesia’s fiscal position is coming under renewed strain, as weaker-than-expected revenue collection forces the government to widen its 2025 budget deficit to 2.78% of GDP—above initial targets but still below the legal threshold. Delays in VAT implementation, falling commodity prices, and modest growth in the Free Meal Programme have added to fiscal stress. Meanwhile, external debt continues to rise, led by government and central bank borrowing, as private sector liabilities contract.

Indonesia’s fiscal performance in H1-2025 reflects a growing gap between ambitious budget assumptions and implementation realities. The fiscal deficit widened to 0.81% of GDP in H1, with the Finance Ministry now projecting a full-year shortfall of 2.78% of GDP—overshooting the original 2.53% target. While still below the legal threshold of 3%, the upward revision underscores mounting revenue pressure and growing reliance on cash buffers and spending discipline to keep debt issuance in check.

Tax collection has underperformed, with domestic tax revenues falling 6.2% yr/yr and reaching just 38.3% of the annual target. The government blames this on the limited implementation of the 1pp VAT hike, exemptions introduced earlier this year, and the impact of weaker oil prices on non-tax revenues. Moreover, some state-owned enterprise (SOE) dividends were rerouted to the sovereign wealth fund Danantara, adding further strain on direct budget inflows. The budget shortfall widened as total revenues reached IDR 1,210.1tn (40.3% of target), while spending came in at IDR 1,407.1tn (38.9% of target). Central government spending lagged at 37.3%, while regional transfers outpaced the average at 43.5%. The primary surplus also narrowed sharply to IDR 50.2tn from IDR 192.1tn in May.

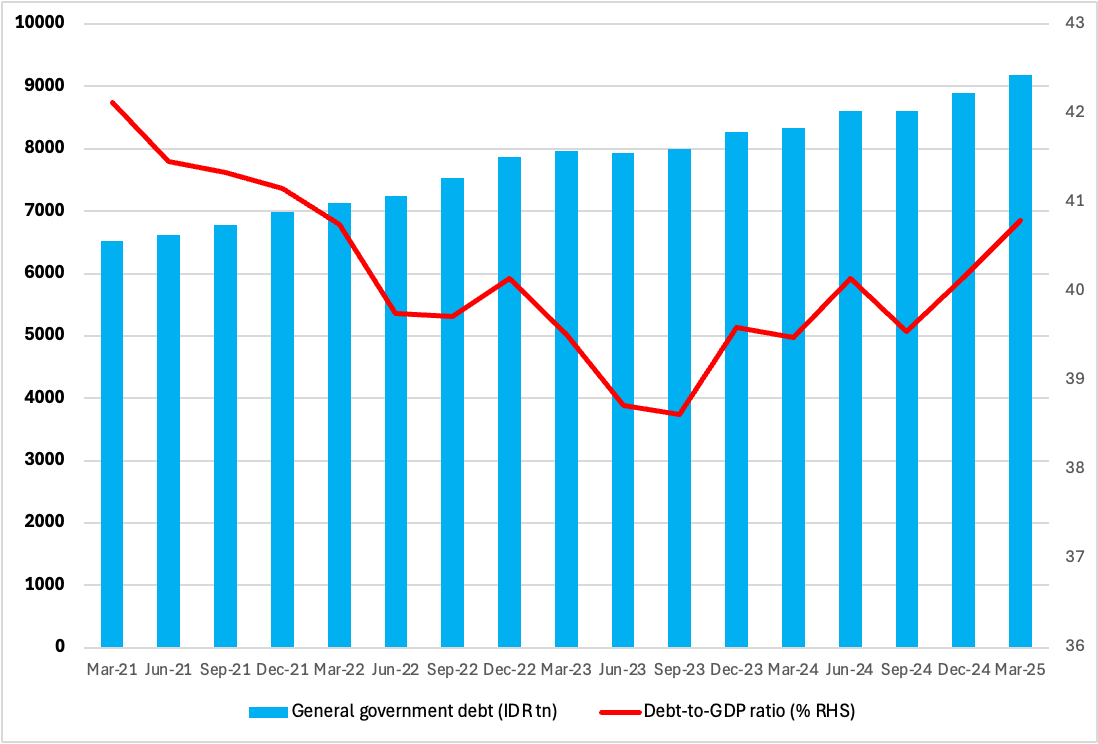

Figure 1: Gross General Government Debt

Source: Continuum Economics

To manage the growing gap, the government is leaning on both cash buffers and more frontloaded borrowing. The gross bond issuance target for Q3 has been raised to IDR 252tn—up from IDR 208tn in Q2 and IDR 222.2tn in Q1—and marks a significant step up from the IDR 199.2tn realised in Q3 last year. Issuance will be balanced between conventional and Sukuk instruments, with nine auctions scheduled through the quarter. Nominally, the FY2025 deficit is now expected to rise to IDR 663tn, from the earlier IDR 616.2tn target. The Ministry of Finance will seek approval to use IDR 85.6tn from the Excess Budget Balance (SAL), which will reduce the need for additional borrowing—a prudent move to protect debt dynamics as global yields remain volatile.

Importantly, the downward revision in GDP growth assumptions—to 4.7–5.0% from the earlier 4.7–5.2%—will also weigh on indirect taxes, particularly VAT, which depends heavily on domestic consumption. The VAT exemptions and a still-incomplete rollout have already limited revenue gains from the January rate hike. One of the most closely watched components of the 2025 budget is President Prabowo’s flagship Free Meal Programme (MBG). Implementation has been slow: by end-June, just IDR 5tn had been spent—only 5% of the full-year IDR 71tn allocation. The programme had reached 5.58mn people, far short of the 17.9mn target for 2025, let alone the multi-year goal of 82.9mn. Nonetheless, there was a clear acceleration in June, after a sluggish Q1–Q2 rollout. The additional IDR 100tn budget allocation is expected to boost implementation in H2, but it will also put pressure on the expenditure side.

External Debt Trends: Public Sector Driving the Buildup

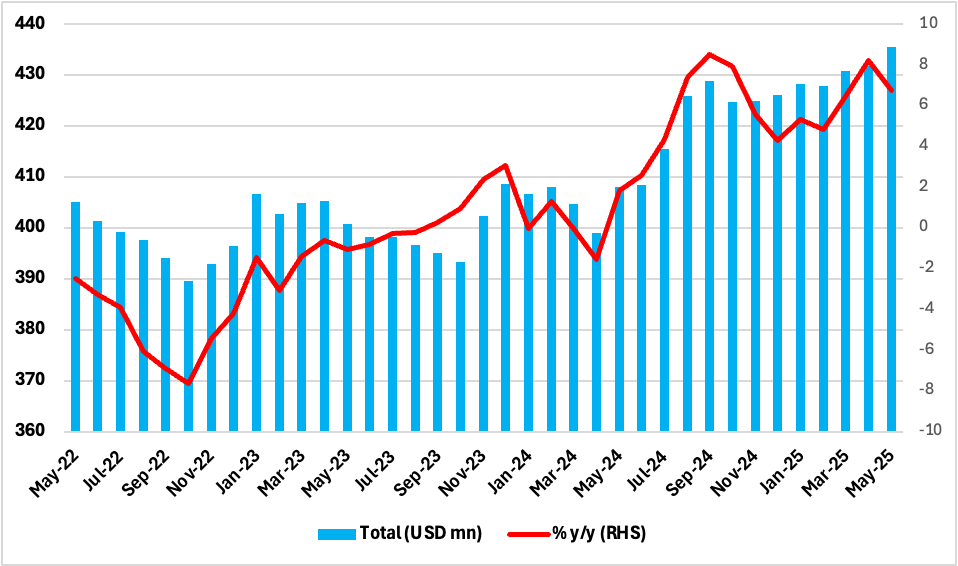

Parallel to the fiscal slippage, Indonesia’s external debt has continued to rise. As of end-May, gross external debt rose 6.8% y/y to USD 435.6bn, up 0.9% m/m—an acceleration from the 0.2% monthly growth seen in April. This marks a slower annual pace than the previous month (8.2% y/y), but points to a sustained upward trend in liabilities.

Figure 2: Gross External Debt

Source: Bank Indonesia

The latest increase is being driven by the public sector. Both the central government and Bank Indonesia have contributed to the expansion, with the latter issuing FX stabilisation bonds earlier in the year. Although the central bank has since moderated its issuance, the government’s borrowing needs remain elevated. Meanwhile, private sector external debt declined 0.9% y/y in May, continuing a nine-month contraction trend. The contraction is largely due to lower corporate borrowing, even as the banking sector has modestly increased its foreign liabilities.

Notably, the structural shift in 2025 appears to be a mild re-leveraging of the private sector—especially among banks—while the government assumes a larger share of external borrowing. With tax revenues underperforming and bond issuance rising, external financing could become an increasingly important tool for budget support, especially if domestic yields firm up.

While overall levels remain manageable, Indonesia must balance rising external exposure with fiscal prudence, especially in an environment of fragile capital flows and currency sensitivity. If H2 sees further revenue shortfalls, the temptation to rely more heavily on foreign issuance may grow.