Preview: Due July 3 - U.S. June Employment (Non-Farm Payrolls) - Increasing signs of slowing, but not a recession

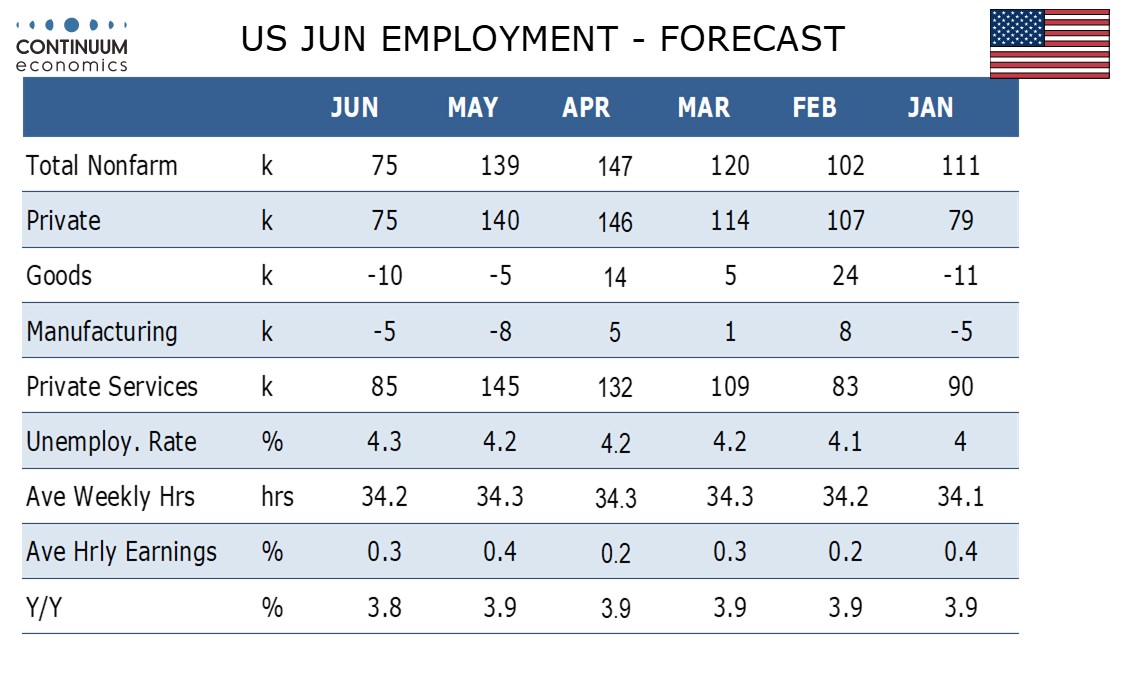

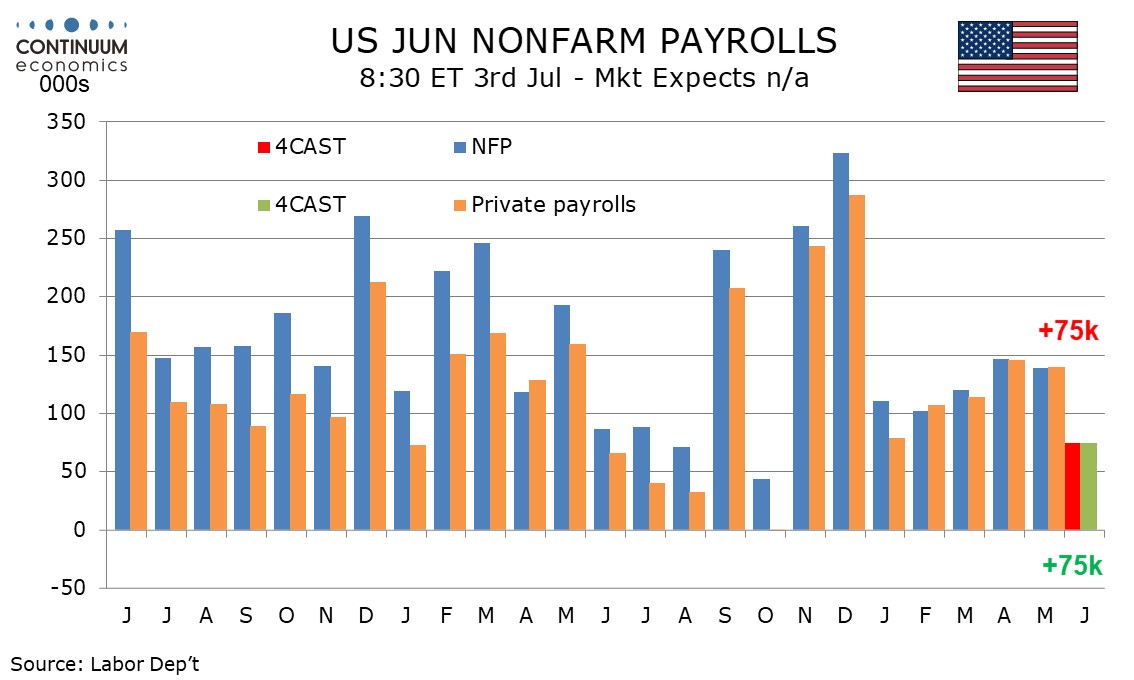

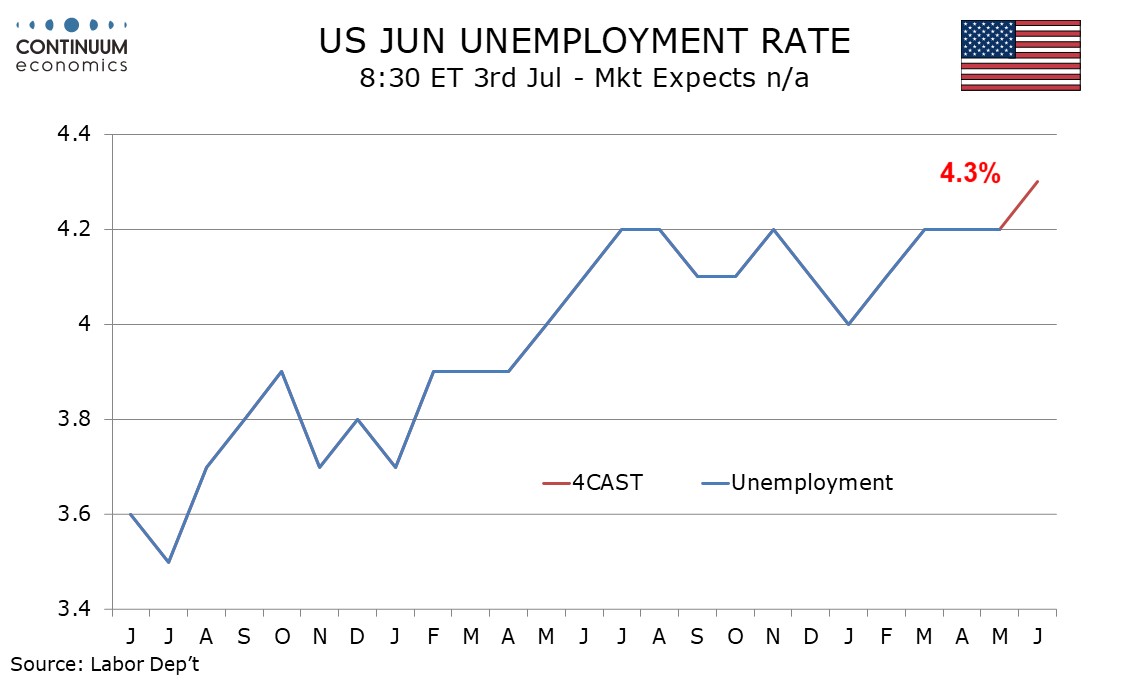

We expect a 75k increase in June’s non-farm payroll, significantly slower than May’s 139k though consistent with a slowdown in growth rather than an economy entering recession. We expect an in line with trend 0.3% increase in average hourly earnings and an uptick in unemployment to 4.3% after three straight months at 4.2%.

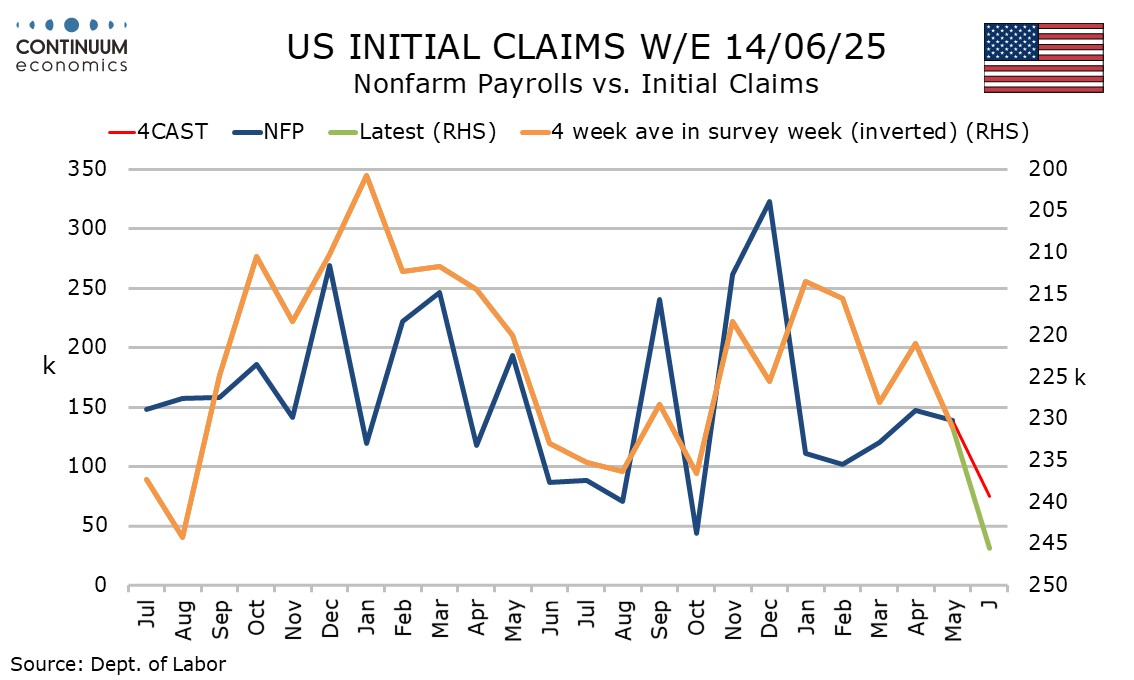

While the FOMC saw uncertainty as having diminished since May, it remains high and the impact of past and current uncertainty appears to be feeding into employment, with initial claims having seen a significant uptick since mid-May.

Seasonal adjustments assume significant hiring in June which adds to downside risk in seasonally adjusted data. We expect private sector payrolls to also rise by 75k. Government hiring has been close to flat in the last four months as gains at the local level offset declines at the federal.

Two months in 2024 saw overall employment rise by less than 75k (August and a weather-influence October) while June and July also saw private sector payrolls rise by less than 75k. This will put June’s slowdown in perspective.

The unemployment rate was 4.24% in May before rounding, meaning that labor force growth has to only marginally exceed that of employment, which is likely to slow, to lift the unemployment rate to 4.3%, as we expect. However labor force growth is being restrained by stricter immigration control.

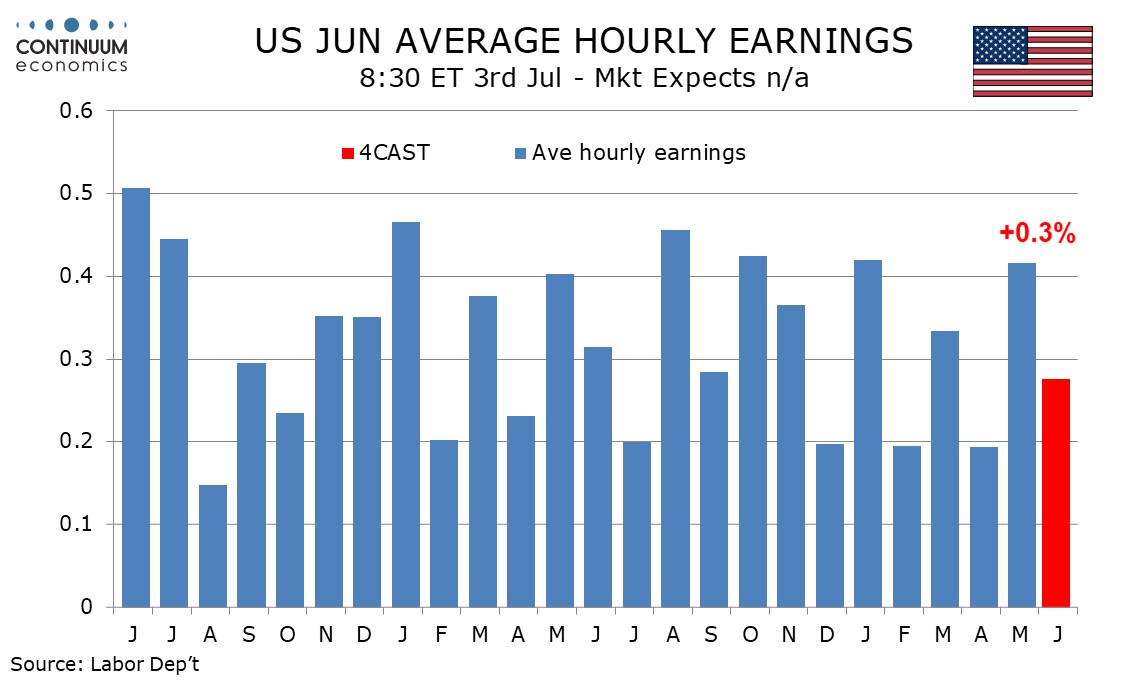

Average hourly earnings rose by 0.4% in May as well as January, offset by gains of 0.2% in February and April. We expect June to be on trend at 0.3%, as was March, though we expect June to be below 0.3% before rounding, hinting at a marginal slowing in trend. Yr/yr growth would then slip to 3.8% after five straight months at 3.9%.

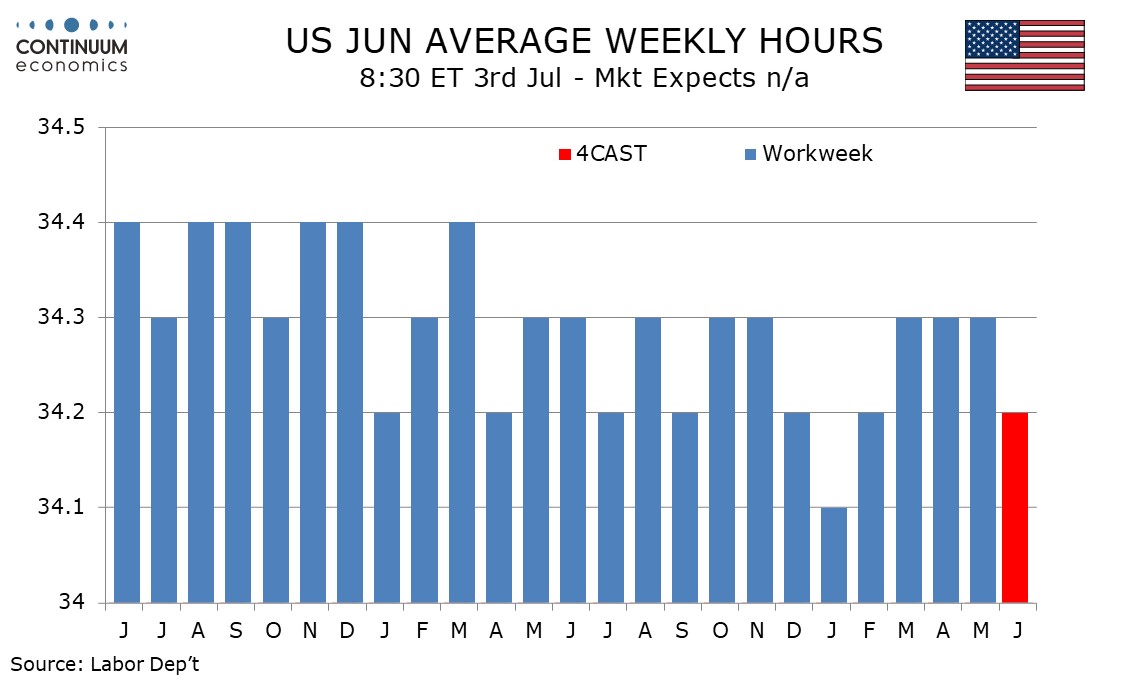

We expect the workweek to also hint at a loss of economic momentum, falling to 34.2 hours after three straight months at 34.3. We have not seen a month above 34.3 since March 2024, but have since seen six below that level. Our forecast still leaves aggerate hours worked up by 2.0% annualized in Q2, up from 0.7% in Q1.