Preview: Due June 6 - U.S. May Employment (Non-Farm Payrolls) - Some slowing, but not a recession signal

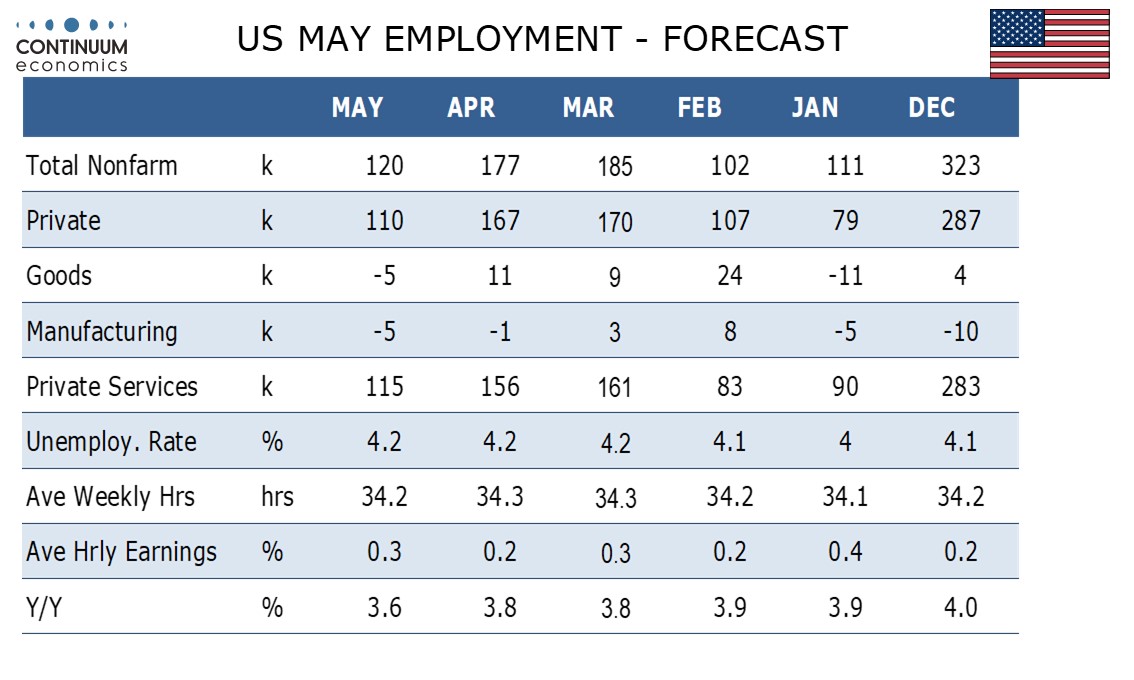

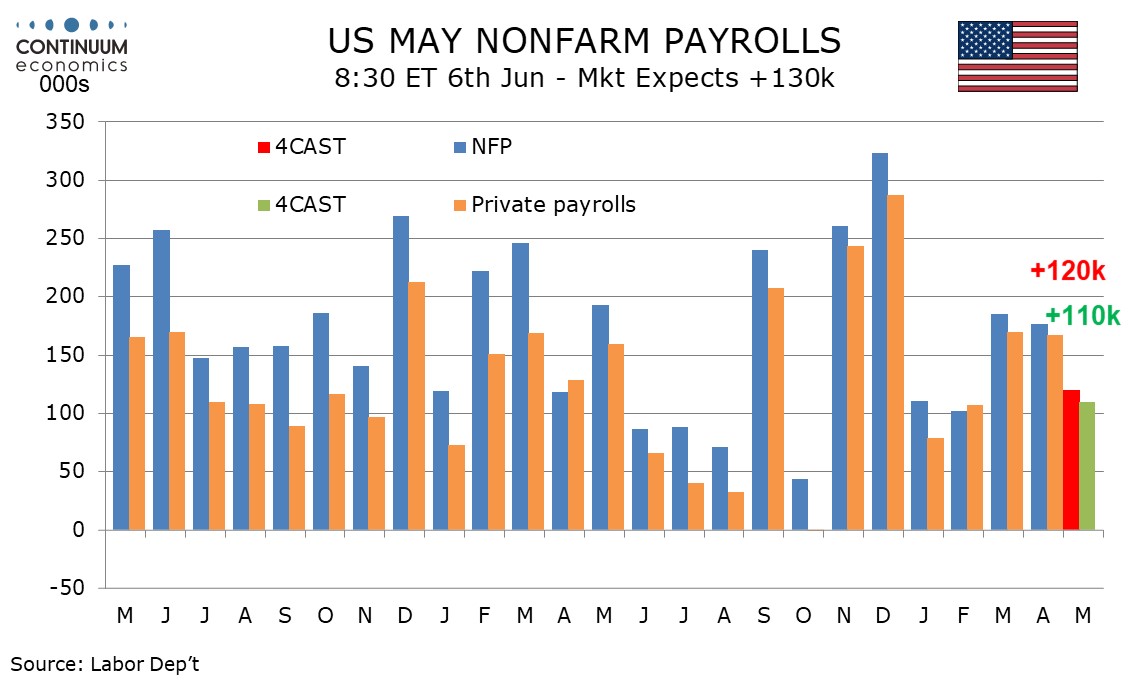

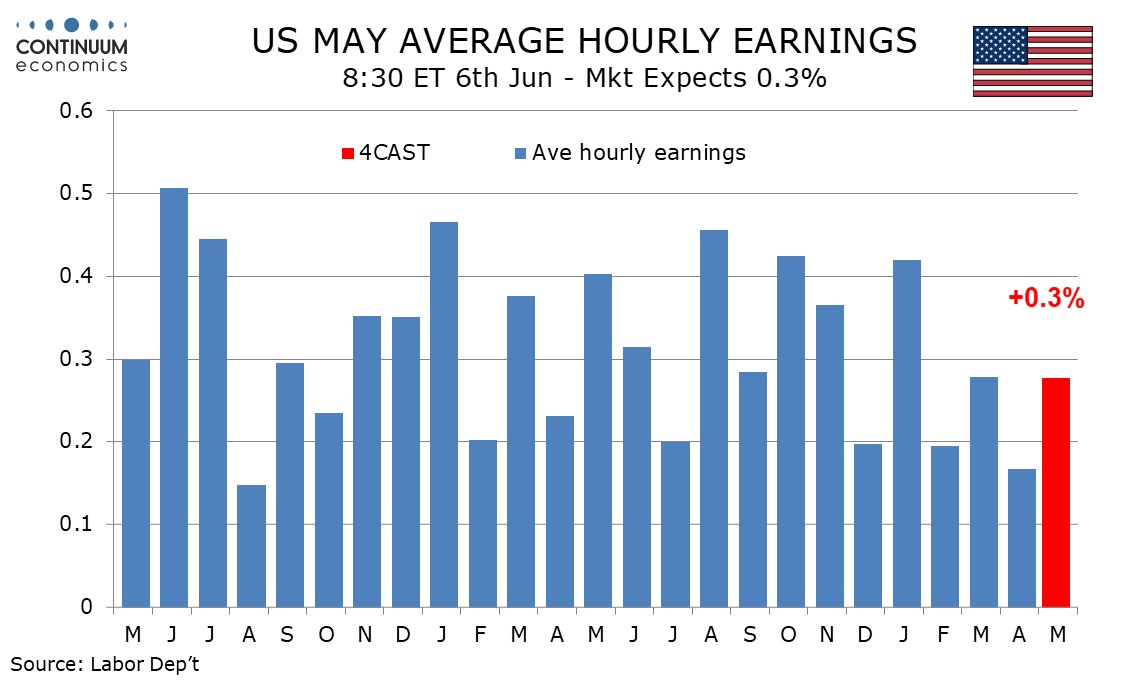

We expect a 120k increase in May’s non-farm payroll, with 110k in the private sector, slower than seen in March and April but stronger than what may have been weather-restrained months in January and February. We expect a slightly stronger 0.3% rise in average hourly earnings and an unchanged unemployment rate of 4.2%.

Initial claims have edged up in May but only marginally, and suggest layoffs remain low. However seasonal adjustments in May assume strong hiring and that could bring some downside risk to seasonally adjusted data.

A rise of 120k would be consistent with the low of the 6-month average seen on October of 2024. Four months in 2024 saw gains of less than 100k and with the economy showing signs of slowing a more significant slowing than in our forecast is not to be ruled out. We would however need to see a negative month to give a warning of recession.

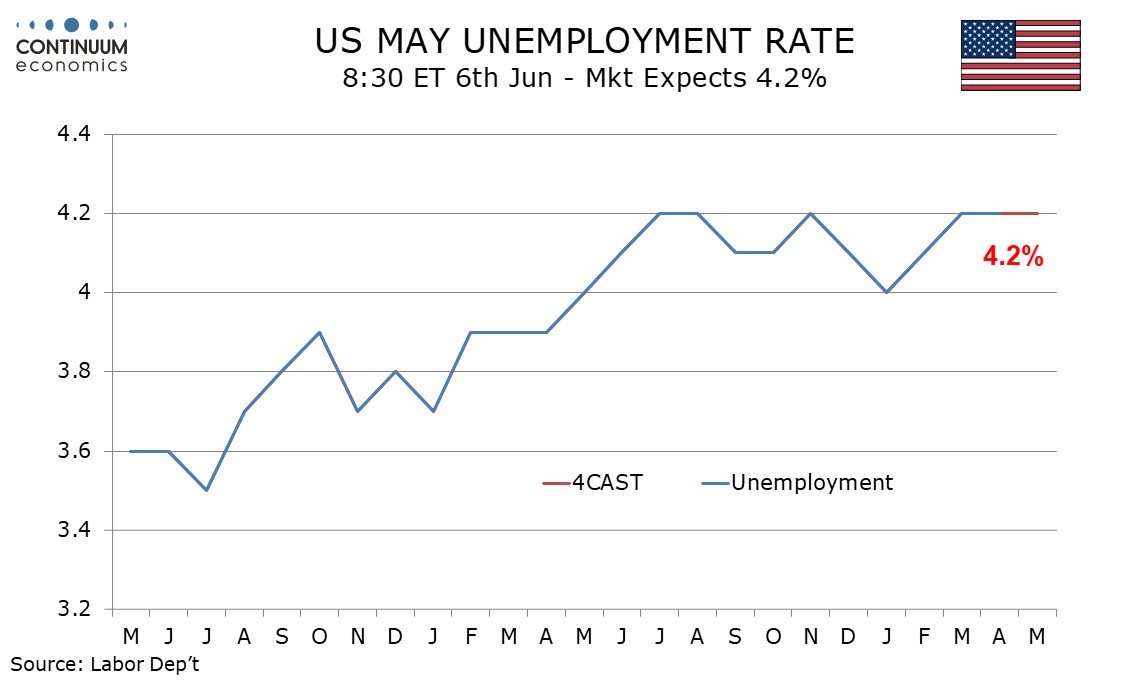

The household survey, which calculates the unemployment rate, showed strong gains in both the labor force and employment in March and both series could be vulnerable to a correction. We suspect employment will underperform the labor force, but not by quite enough to lift the unemployment rate, which was 4.185% in April before rounding, above 4.2% after rounding.

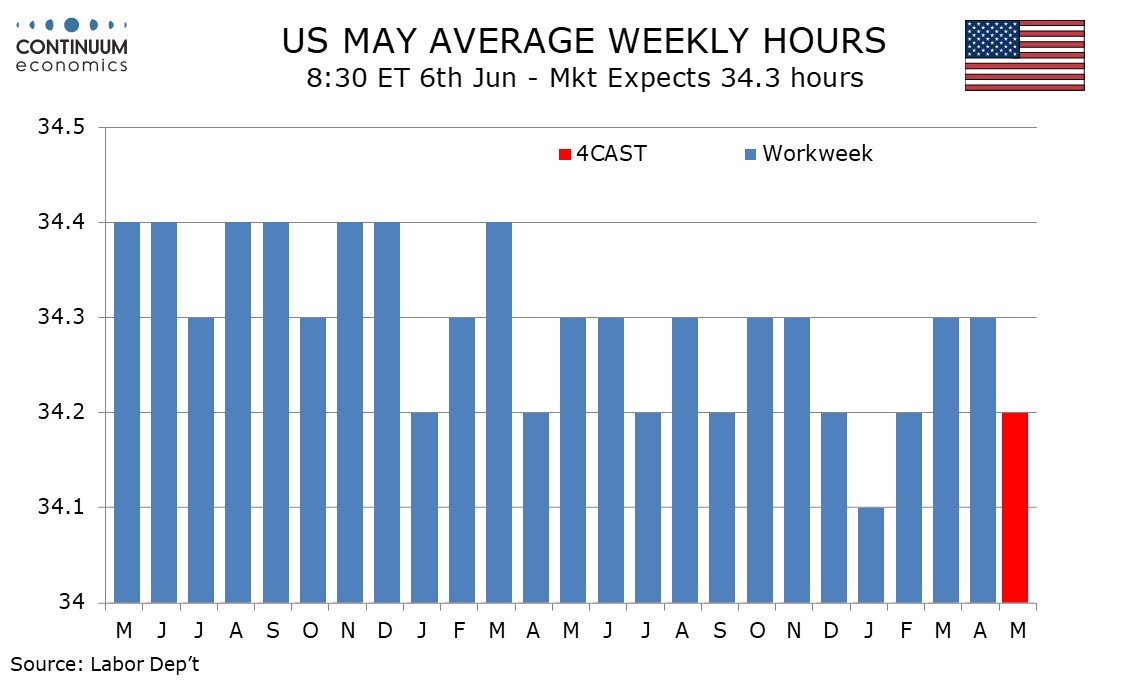

The workweek has seen two straight months at 34.3 hours but over the past year has seen several months below this pace but has not been above since March of 2024. If the economy is losing some momentum risk is for slippage to 34.2 in May. January’s 34.1 was however probably depressed by bad weather and is unlikely to be matched in May.

Average hourly earnings trend appears to be losing momentum but April’s rise of 0.17% before rounding was the lowest since August 2023 and we expect a correction higher in May, though our forecast of 0.28% before rounding is still consistent with a slowing in trend, with yr/yr growth set to slow to 3.6% from 3.8%. . A fall in the workweek could support the month's rise in average hourly earnings.