Preview: Due June 11 - U.S. May CPI - Tariff impact still modest, but starting to build

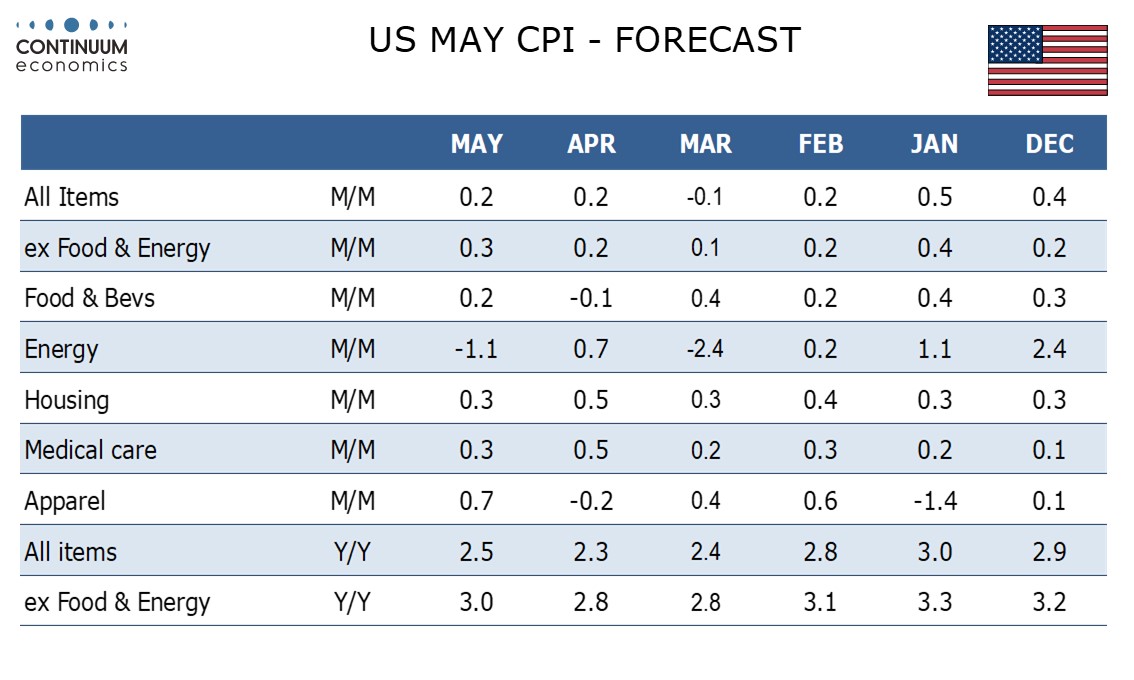

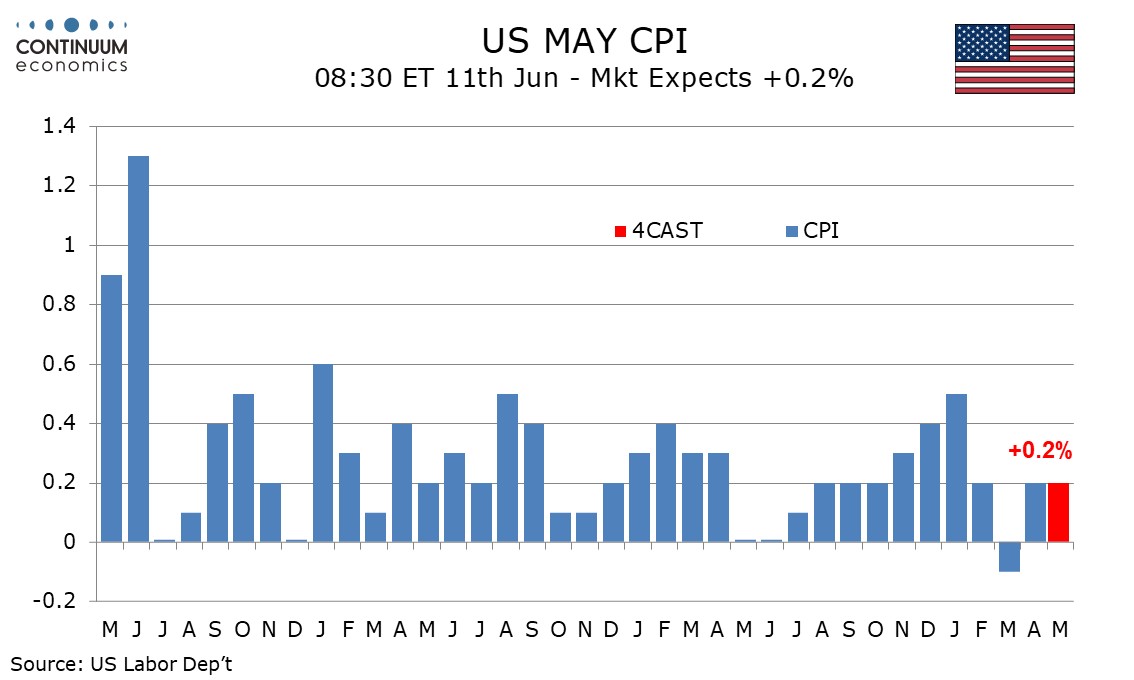

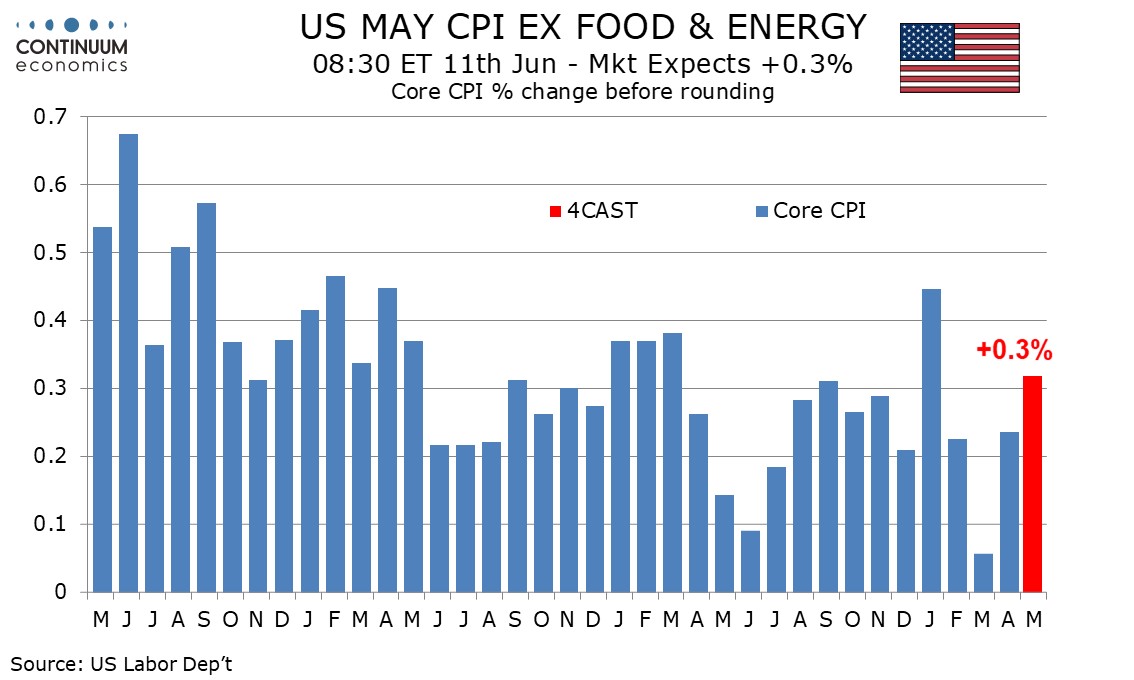

We expect May CPI to increase by 0.2% overall and by 0.3% ex food and energy, the core rate still seeing a modest impact from tariffs given a Q1 inventory build up and uncertainty over low long tariffs will persist, though at 0.32% before rounding we expect the strongest rise in the core rate since January, and up from 0.24% in April. The core rate is likely to accelerate further in coming months.

We expect commodities ex food and energy to rise by 0.4%, up from 0.1% in April, with some of the components that were surprisingly negative in April, notably used autos and apparel, to rebound. This will suggest that tariffs rate starting to have some impact. We expect services less energy to match April’s 0.3% increase. Air fares are likely to remain weak after three straight significant declines though the negative may be less pronounced in May. Auto services are however likely to see a slower rise than in April which corrected a very weak March, when services less energy rose by only 0.1%.

Gasoline prices look set to fall, particularly in the seasonally adjusted data. We expect a 0.2% rise in food after a 0.1% decline in April. Eggs are likely to continue reversing from recent inflated levels but prices of some imported foods may pick up on tariffs.

Our forecasts would see yr/yr growth edging up to 2.5% from 2.3% overall and to 3.0% from 2.8% ex food and energy. Further gains are likely in coming months as tariffs are increasingly passed on. April’s yr/yr core rate was the weakest since February 2021, but likely to prove a floor for this year.