EM Central Banks

View:

January 02, 2026

December 22, 2025

December 19, 2025

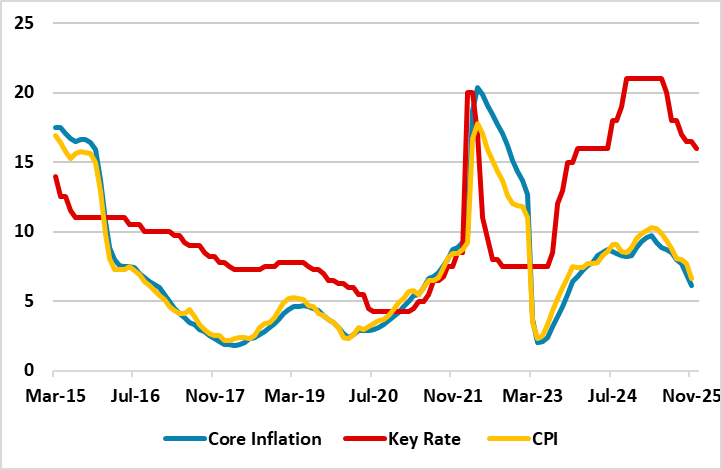

Easing Cycle Continues: CBR Reduced Key Rate to 16% on December 19

December 19, 2025 11:09 AM UTC

Bottom Line: As expected, Central Bank of Russia (CBR) reduced the key rate by 50 bps to 16% during the MPC on December 19 since the pace of the fall in inflation accelerated in November. CBR said in its written statement that monetary policy will remain tight for a long period, and further decision

Mexico: 25bps Cut and Now Pause

December 19, 2025 8:15 AM UTC

Banxico cut by 25bps to 7.0% as expected with a downward revision to 0.3% for 2025 GDP growth. Below trend GDP is forecast in 2026 and we see this prompting further easing in March and June 2026 by 25bps each, but MXN weakness restraining Banxico pace. We then see Banxico going on hold for the rem

December 18, 2025

EM FX Outlook: High Real Yields Still Help

December 18, 2025 12:14 PM UTC

• EM currency 2026 prospects come against a backdrop of a further but slower USD depreciation against DM currencies, but inflation differentials, domestic central bank policy and politics also matter. We forecast the Mexican Peso (MXN) will likely be more volatile, as President Donald Tru

December 17, 2025

Outlook Overview: Turbulent Times

December 17, 2025 7:44 AM UTC

· The U.S. slowdown remains in focus as the lagged effects of President Trump’s tariff increases continues to feedthrough, though our baseline is for a 2026 soft-landing. The Supreme court will likely rule against part of Trump’s reciprocal tariffs, which will create short-term

December 16, 2025

Asia/Pacific (ex-China/Japan) Outlook: Managing Slower Growth Without Losing the Cycle

December 16, 2025 2:43 PM UTC

· Asia’s 2026 growth is normalizing, not weakening, though the growth outlook reflects resilience under mounting strain rather than acceleration. Larger investment-led economies such as India and Malaysia are sustaining momentum through public capex, infrastructure pipelines, and indu

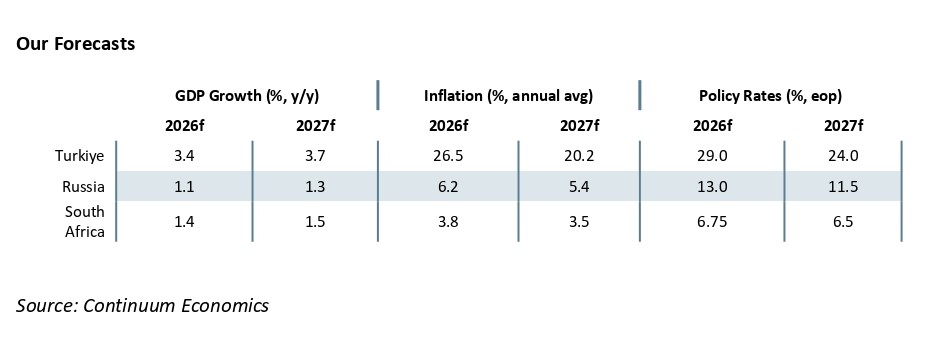

EMEA Outlook: Uncertainties Give Mixed Signals

December 16, 2025 7:00 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.8% and 3.5% in 2026 and 2027, respectively. Upside risks to inflation remain such as, utility costs, and supply chain destructions. We see growth to be 1.4% and 1.5% in 2026 and 2027, respectively. Risks to the growth

December 15, 2025

China: Weak Growth

December 15, 2025 7:39 AM UTC

• November figures show weak growth and are a concern for momentum going into 2026. Retail sales continues to be hurt by adverse wealth effects and slow job and income growth. Though the authorities are promising to boost consumption, we see this only being modest rather than aggressive

December 11, 2025

Softer November CPI Print Encouraged CBRT to Cut Key Rate to 38% on December 11

December 11, 2025 8:54 PM UTC

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) cut the policy rate by 150 bps to 38% during the MPC meeting on December 11 encouraged by softer November inflation. The committee said inflation expectations and pricing behavior are showing signs of improvement even as they continue to po

China Outlook: Headwinds Get Stronger

December 11, 2025 10:30 AM UTC

· Private domestic demand remains modest, with consumption ranging from modest to moderate (slowed by the housing wealth hit and soft jobs/wage growth) and investment further impacted by the ongoing adverse drag of the residential property bust. China’s authorities prefer a long and

Brazil: March 50bps Cut?

December 11, 2025 8:00 AM UTC

BCB remain focused on getting inflation converging towards the centre of the inflation target range at 3% looking at the December statement. It appears that the economic weakness is not yet great enough to get the BCB to signal a January cut. Nevertheless, with headline inflation falling, the real i

December 05, 2025

RBI Cuts Repo Rate to 5.25% as Inflation Hits Record Lows

December 5, 2025 4:28 PM UTC

The RBI’s December cut marks a decisive shift toward pro-growth policy at a moment of exceptionally low inflation. With the economy outperforming and price pressures collapsing, the central bank is signalling confidence—but the trajectory of the rupee and the uncertainty of US trade policy remai

December 03, 2025

Turkiye’s Inflation Eased to 31.1% y/y in November, Hitting Below Expectations

December 3, 2025 1:40 PM UTC

Bottom line: According to Turkish Statistical Institute’s (TUIK) announcement on December 3, Turkiye’s inflation softened to 31.1% y/y in November backed by moderate unprocessed food prices. We continue to think upside-tilted inflation risks will likely limit the downward trend during the disin

December 01, 2025

Indonesia’s Inflation Eases in November, Strengthening Case for Prolonged Policy Hold

December 1, 2025 8:14 AM UTC

Indonesia’s November CPI print reinforces a narrative of stability—subdued price pressures, anchored core inflation and a central bank in no rush to move. With inflation well within target and external risks still elevated, Bank Indonesia has the cover it needs to extend its policy pause, keepin

India GDP Review: India’s Economy Surges 8.2% in Q2

December 1, 2025 7:43 AM UTC

India’s GDP grew 8.2% in Q2 FY26, far exceeding market and RBI expectations and marking its strongest performance in six quarters. The expansion was powered by manufacturing, services and a sharp rebound in consumption, amplified by a favourable deflator and GST rate cuts. With first-half growth n

November 28, 2025

China’s Hidden Gold Buying: Why?

November 28, 2025 1:05 PM UTC

Speculation has been growing in the gold market that the surge in unrecorded gold purchases could be linked to China.

Overall, some unreported buying of gold by China could have occurred in 2025 and also in 2022-24. This could be a combination of wanting to avoid upsetting Trump during a tense U.S.-C

November 27, 2025

USMCA Renegotiation: Hostage To Trump

November 27, 2025 2:55 PM UTC

• Trump could decide to go on an early offensive over the July 2026 USMCA review or could wait until after the November congressional elections to act tough given it could cause new cost of living fears for U.S. voters. This could mean that at times the USMCA negotiations are upsetting fo

November 24, 2025

Bank Indonesia Holds Rates at 4.75%; December Cut Likely

November 24, 2025 11:17 AM UTC

Bank Indonesia held rates in November as expected, prioritising rupiah and inflation stability over premature easing. While a December cut remains likely—especially if the Fed turns dovish—BI has made clear it will move only under the right conditions.

November 21, 2025

U.S. Asset Inflows After April’s Trump Tariffs

November 21, 2025 8:00 AM UTC

· Net foreign portfolio inflows have not been hurt by Trump’s April tariff drama, with the AI and tech boom attracting new equity inflows. Flows could become more volatile with a U.S. equity bear market or recession, but these are modest risk alternative scenarios rather than high r

November 20, 2025

SARB Reduced Key Rate to 6.75% Following Favorable Inflation Outlook

November 20, 2025 3:21 PM UTC

Bottom Line: South African Reserve Bank (SARB) cut the policy rate by 25 bps to 6.75% during the MPC on November 20 owing to moderate inflation, stronger ZAR, few power cuts (loadshedding) in Q3, balanced growth risks, and lower oil prices. The MPC decision was unanimous. SARB governor Kganyago ment

November 18, 2025

Markets 2026

November 18, 2025 10:30 AM UTC

· The Fed, ECB and BOE will likely drive further 10-2yr government bond yield curve steepening, with 10yr Bund yields rising due to ECB QT and German fiscal expansion. 10yr JGB yields are set to surge through 2%, as BOJ QT remains excessive and underestimated. The BOJ could partiall

November 14, 2025

China: Unbalanced Growth

November 14, 2025 8:15 AM UTC

· The slowdown in China retail sales continues, with excess production still evident. Nevertheless, the slowdown in industrial production and private sector business investment suggests that companies are becoming less upbeat about domestic demand. Underlying growth is 4.0%, though

November 10, 2025

China: CPI Rises Helped By Government Pressure

November 10, 2025 8:24 AM UTC

• Less food price decline, plus government pressure to curtail price wars, helped headline and core CPI move higher. However, the September industrial production and retail sales figure shows that the imbalance between supply and domestic demand remains in place. The imbalance of supply a

November 07, 2025

China’s 2nd Tier Banking Problems

November 7, 2025 2:45 PM UTC

China’s residential property bust continues to feedthrough to some bank’s non-performing loans and financial stability. Even so, the latest PBOC financial stability report shows the percentage of high risk rated banks has not increased over the last 12 months, while China authorities early warni

Banxico: December In Doubt and Pause Closer

November 7, 2025 9:56 AM UTC

The December Banxico meeting is not guaranteed to see a further 25bps cut, with the November Banxico statement showing more caution over persistent core inflation pressures and given the cumulative easing already seen. Combined with the risk of a Fed pause in December, plus Banxico’s Mexican Peso

Indonesia CPI Review: Sticky Food Prices Lift CPI

November 7, 2025 6:53 AM UTC

Indonesia’s October CPI inflation print of 2.86%—the highest since April—reinforces that price pressures, while still within target, are gradually building. The uptick limits Bank Indonesia’s room to ease policy further in the near term and suggests a more cautious monetary stance ahead.

November 03, 2025

China: Fiscal Stimulus Modest Rather than Large?

November 3, 2025 9:07 AM UTC

• Overall, we see around a Yuan2.0-2.5trn fiscal stimulus for 2026 and some of this could be announced in December but the majority in March 2026. This reflects the fiscal constraints on China authorities; the targeted focus in the 2026-31 five year plan and reluctance to spending on hous

October 31, 2025

U.S./China Trade Framework: Avoiding Escalation

October 31, 2025 7:48 AM UTC

· The U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. The economic effects will likely be small and the deal main aim app

October 29, 2025

Indonesia CPI Preview: CPI to edge up in October

October 29, 2025 1:18 PM UTC

Indonesia’s inflation rate is set to edge up in October, but the uptick should remain well within the central bank’s comfort zone. For now, BI is expected to stay on hold in its next policy meeting, focusing instead on growth stability and external risks.

October 27, 2025

Bank Indonesia Holds Rates at 4.75% Amid Global Uncertainty:

October 27, 2025 11:54 AM UTC

BI opted to hold its interest rate steady at 4.75% after trimming it in a surprise in September. BI will now wait to see the transmission of earlier rate cuts before proceeding with further action. We expect a steady policy rate going into 2026.

October 24, 2025

Unexpectedly, CBR Reduced Key Rate to 16.5% on October 24

October 24, 2025 4:53 PM UTC

Bottom Line: Despite we expected Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; CBR de

October 23, 2025

Turkiye MPC Review: Cautious CBRT Reduced Key Rate by 100 bps to 39.5%

October 23, 2025 2:18 PM UTC

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) cut the policy rate by 100 bps to 39.5% during the MPC meeting on October 23 citing slowdown in disinflationary process due to renewed inflationary risks. Our end year key rate prediction remains at 37.0% for 2025 despite the fact that it w

October 20, 2025

Turkiye MPC Preview: CBRT will Likely Continue its Easing Cycle on October 23

October 20, 2025 7:00 AM UTC

Bottom Line: We think Central Bank of Turkiye (CBRT) will likely reduce the policy rate to 39%-39.5% during the MPC meeting scheduled for October 23 taking deceleration trend in inflation and relative TRY stability into account. We think CBRT will have to proceed carefully on interest-rate adjustmen

October 16, 2025

Preview: CBR will Likely Hold the Key Rate Stable at 17% on October 24

October 16, 2025 1:09 PM UTC

Bottom Line: We expect Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; which could also

Indonesia’s 2026 Budget: Populist Spending Meets Fiscal Strain

October 16, 2025 6:17 AM UTC

Indonesia’s 2026 budget marks President Prabowo Subianto’s first full fiscal blueprint—anchored in expansive social spending and a sharp 30% rise in defence outlays, while sidelining his predecessor’s infrastructure push. With revenue targets based on optimistic assumptions and growth foreca

October 07, 2025

CBRT’s Inflation Target for end-2025 will Likely Be Missed as Actual Inflation Deviates from the Targets

October 7, 2025 5:45 PM UTC

Bottom line: After inflation slightly increased to 33.3% y/y in September from 32.9% y/y in August driven by higher education, housing and food prices, Central Bank of Turkiye (CBRT) governor Karahan announced on October 7 that CBRT will ensure that inflation remains consistent with interim targets

October 02, 2025

RBI Holds Rates, Balances Growth Optimism with Global Risks

October 2, 2025 6:09 AM UTC

The RBI held the repo rate at 5.5% in its October review, keeping policy neutral after 100 bps of cuts earlier this year. Inflation was sharply revised down to 2.6% in FY26, while growth was upgraded to 6.8%, reflecting resilient domestic demand. The decision reflects a strategy of stability—pausi

September 30, 2025

Trump Tariffs: China, Mexico and Semiconductors

September 30, 2025 8:00 AM UTC

· Our baseline (60% probability) remains that a U.S./China trade deal will be agreed in Q4/Q1 2026 and it is possible though unlikely that this could be announced at the Trump/Xi meeting at the October 31 APEC summit – China requests that the U.S. changes policy on Taiwan could slo

September 29, 2025

RBI Likely to Hold Rates, Watchful of Tariffs and Festive Demand

September 29, 2025 6:57 AM UTC

The RBI is expected to keep the repo rate unchanged at 5.5% in its October review, pausing after three consecutive cuts earlier this year. With inflation undershooting and GST rationalisation set to push CPI lower, policymakers see little need for immediate action. The central bank will instead wait

September 26, 2025

Banxico Review: Slower Pace for 25bps Cuts

September 26, 2025 6:39 AM UTC

Banxico cut by 25bps to 7.5%. However, Banxico pushed up the near term inflation forecasts, which could mean that the November 6 meeting does not see a rate cut but rather Banxico waits until the December 18 meeting. This is our view and we look for 25bps to 7.25%. We then see two further 25bps

September 25, 2025

September 23, 2025

Asia/Pacific (ex-China/Japan) Outlook: Balancing Moderation with Resilience

September 23, 2025 11:22 AM UTC

· Asia’s growth trajectory in 2026 reflects regional resilience under strain. Investment-led economies like India and Malaysia are sustaining momentum via infrastructure push, public capex, and digital industrial policy, while Indonesia’s outlook is clouded by fiscal recalibration a

Outlook Overview: Into 2026

September 23, 2025 8:25 AM UTC

· The critical question is how much the U.S. economy is slowing down with the feedthrough of President Donald Trump’s tariffs to boost inflation and restrain GDP growth, with the effective rate currently around 17% on U.S. imports. Though semiconductor tariffs are likely, the bulk of

September 22, 2025

EMEA Outlooks Stay Mixed into 2026: Domestic and Global Uncertainties

September 22, 2025 6:58 AM UTC

· In South Africa, we foresee average headline inflation will stand at 3.4% and 4.2% in 2025 and 2026, respectively, despite upside risks to inflation such as swings in food prices, supply chain destructions including energy shortages and port inefficiencies and global uncertainties. We see

September 19, 2025

China Outlook: Headwinds into 2026?

September 19, 2025 9:30 AM UTC

• Overall, net exports contribution to GDP growth should be tempered in H2 2025, as 30% tariffs bite more progressively and other countries more closely monitor the redirection of China’s exports. A trade deal with the U.S. remains our baseline, which should reduce tariffs to around 20%

September 18, 2025

SARB Holds Rate Stable at 7.0% to Bring the Inflation Down to New 3% Anchor and Assess Impacts of Earlier Cuts

September 18, 2025 6:36 PM UTC

Bottom Line: South African Reserve Bank (SARB) held the policy rate at 7.0% during the MPC on September 18 as annual inflation hit 3.3% YoY in August which is above new inflation anchor coupled with surged core inflation. SARB governor Kganyago said on September 18 that MPC expects headline inflatio

Brazil: 15% Well Into 2026

September 18, 2025 6:29 AM UTC

The BCB statement was clear that the deanchored inflation picture still requires interest rates to be kept at current levels for a very prolonged period of time. The consensus for economists is that this will change in Q1 2026 with a 50bps cut, though ideas of December are fading. We suspect it