Turkiye MPC Preview: CBRT will Likely Continue its Easing Cycle on October 23

Bottom Line: We think Central Bank of Turkiye (CBRT) will likely reduce the policy rate to 39%-39.5% during the MPC meeting scheduled for October 23 taking deceleration trend in inflation and relative TRY stability into account. We think CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis given domestic inflationary risks and unpredictable outlook for the global economy. Our end year key rate prediction remains at 37.0% for 2025.

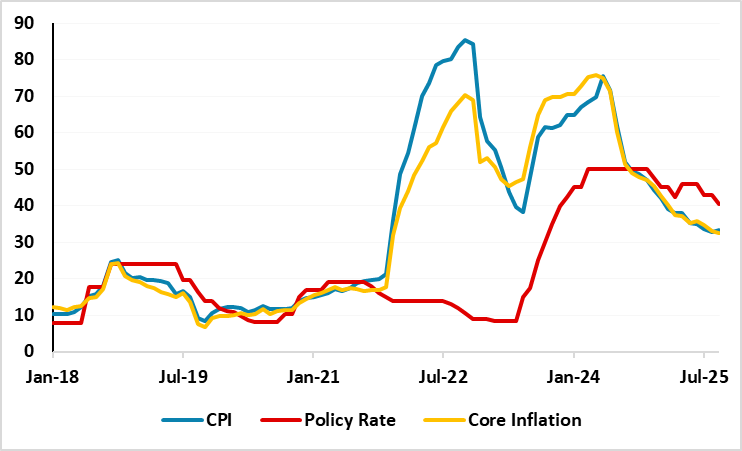

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – September 2025

Source: Continuum Economics

As the deceleration trend in inflation continues moderately in Turkiye supported by lagged impacts of previous monetary tightening, tighter fiscal measures and relative TRY stability, we think this leaves some room of choice for the CBRT during the next MPC meeting scheduled for October 23. (Note: After softening for fifteen consecutive months and hitting the lowest rate in August since November 2021 with 32.9% y/y, CPI slightly edged up to 33.3% y/y in September as education, housing and food prices lead the rise in the index. We think the start of the school year and drought ignited the inflation in September).

We believe CBRT will likely consider reducing the policy rate by 100-150 bps to 39%-39.5% on October 23. Of course, cautious CBRT could also keep the key rate constant since inflation slightly surged in September due to stubborn food and services prices and inflationary risks are still tilted to the upside, while CBRT keeping the rate constant is not our major scenario.

Despite risks, we continue to think the slowdown in inflation will moderately continue in Q4 supported by the lagged impacts of previous monetary tightening while the extent of the decline will be determined by food inflation, services prices, and TRY volatility.

Under current circumstances, CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis given domestic inflationary risks and unpredictable outlook for the global economy.

Our end year key rate prediction remains at 37.0% for 2025, and we feel Mth/Mth inflation readings will continue to be key in Q4 as CBRT will want to avoid reigniting inflation with too aggressive rate normalization until CBRT fully contains the inflation.