U.S./China Trade Framework: Avoiding Escalation

· The U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. The economic effects will likely be small and the deal main aim appears to be avoiding escalation.

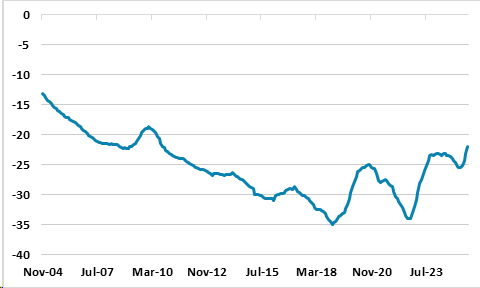

Figure 1: U.S./China Trade (USD Blns)

Source: Continuum Economics

The much anticipated President Trump and Xi summit saw a trade framework deal that avoids escalation, but leaves unclear whether a trade deal will be reached in 2026. Key points to note.

· 1yr descalation. China agreement to remove exports controls on rare earth minerals for 1yr saw the U.S. reduce the fentanyl related tariff from 20% to 10%. China also agreed to restart buying U.S. soyabeans at 25mln tonnes pa 2026-28, which is similar to the 2024 pace and suits China’s need for food and the U.S. is making noises about exporting more semiconductor chips to China. Perhaps further elements can be added in the coming months, but this is unlikely to be a comprehensive trade deal. Trump is scheduled to visit China in April 2026, but it is difficult to see the two sides moving to agree a set of polices to reduce the bilateral trade imbalance or allow major reduction in tariffs. Additionally, Trump and Xi could slip on this agreement as they have done in the past and this could potentially cause some tensions in 2026.

· Economic effects. The trade framework deal tempers trade policy uncertainty and on the margin reduce trade frictions between the U.S. and China, but the economic effects are small. The framework does avoid worse case scenarios of a new escalation occurring, which will likely be the case through 2026. Trump will want a China visit to project his perceived success ahead of the November U.S. mid-term election, while Xi will want to avoid a return to April’s super high tariff levels.

· Comprehensive deal difficult. Negotiations over the last six months have only been able to deliver this framework deal. The U.S. wants to keep tariff pressure on China, but China is reluctant to agree to specific import levels; a path to reducing the bilateral imbalance or penalties for missed targets. China success so far in 2025 in redirecting exports to other countries means that the U.S. tariffs levels are not causing net exports to be an adverse big picture macroeconomic drag. However, China’s ability to redirect exports may not be sustained, given that other countries are wary of dumping. Meanwhile, China policymakers have also not been able to rebalance the economy away from investment to consumption, with China households remaining wary. This makes hitting 5% growth in 2026 difficult and thus could eventually result in some concessions by China on U.S. trade but looks unlikely to deliver a comprehensive trade deal.

· Taiwan. Reports suggest that Taiwan was not discussed by Trump and Xi. This is a missed opportunity for Xi to pressure Trump on Taiwan to either ask to reject any Taiwan independence attempt or ask the U.S. to acknowledge that reunification will eventually happen. U.S. China hawks will have warned Trump beforehand that Xi could raise these issues and Xi may have decided not to risks rejection by the U.S. However, it is puzzling that it was not discussed. We do maintain the view that an invasion is highly unlikely due to the high risk for China/Xi and CCP and our baseline remains for continued grey warfare to pressure Taiwan.