RBI Holds Rates, Balances Growth Optimism with Global Risks

The RBI held the repo rate at 5.5% in its October review, keeping policy neutral after 100 bps of cuts earlier this year. Inflation was sharply revised down to 2.6% in FY26, while growth was upgraded to 6.8%, reflecting resilient domestic demand. The decision reflects a strategy of stability—pausing now while retaining room to act if global risks intensify.

The Reserve Bank of India (RBI) left the policy repo rate unchanged at 5.5%, in line with expectations, as Governor Sanjay Malhotra signalled a neutral stance from the Monetary Policy Committee (MPC). The standing deposit facility remains at 5.25%, while the marginal standing facility and bank rate stay at 5.75%, maintaining stability after three cuts earlier this year.

Governor Malhotra explained that the pause followed a detailed review of macroeconomic conditions, with inflation easing much faster than anticipated. The RBI now projects headline CPI inflation at 2.6% in FY26, compared to earlier estimates of 3.7% in June and 3.1% in August. The sharp downward revision reflects the impact of falling food prices, GST rate rationalisation, and a favourable monsoon. Strong kharif sowing and comfortable reservoir levels are expected to keep food inflation subdued, although the governor cautioned against complacency given global commodity risks.

On growth, the RBI turned more optimistic, raising its FY26 forecast to 6.8% from 6.5%, with quarterly projections of 7.8% in Q1, 7% in Q2, 6.4% in Q3, and 6.2% in Q4. For Q1 FY27, growth is expected at 6.4%. This brings FY26 forecast closer to ours of 6.7% y/y. Malhotra credited resilient domestic demand, lower inflation, and earlier policy easing for sustaining momentum, though he acknowledged that US tariffs on Indian exports and weak global demand could act as drags later in the year.

Crucially, the governor stressed that the RBI has already front-loaded 100 bps of rate cuts in 2025, and the prudent course is to let those measures and recent tax reforms, including GST rationalisation, filter through before considering further action. At the same time, Malhotra flagged risks from rupee depreciation and capital flow volatility, though he underlined that India’s strong fundamentals—ranging from record foreign exchange reserves to healthy fiscal buffers—provide resilience. “The RBI is focused on stability and flexibility—anchoring inflation while supporting growth. By holding rates now, the MPC retains room to act if conditions change,” Malhotra said.

The October decision underscores a central bank balancing optimism on growth with caution over global headwinds. With inflation well below target, but trade tensions and currency pressures still looming, the RBI has opted for a steady hand, keeping policy space available should conditions deteriorate in the months ahead. In our view, an additional rate cut of 25bps is likely in Q4 to prop up growth.

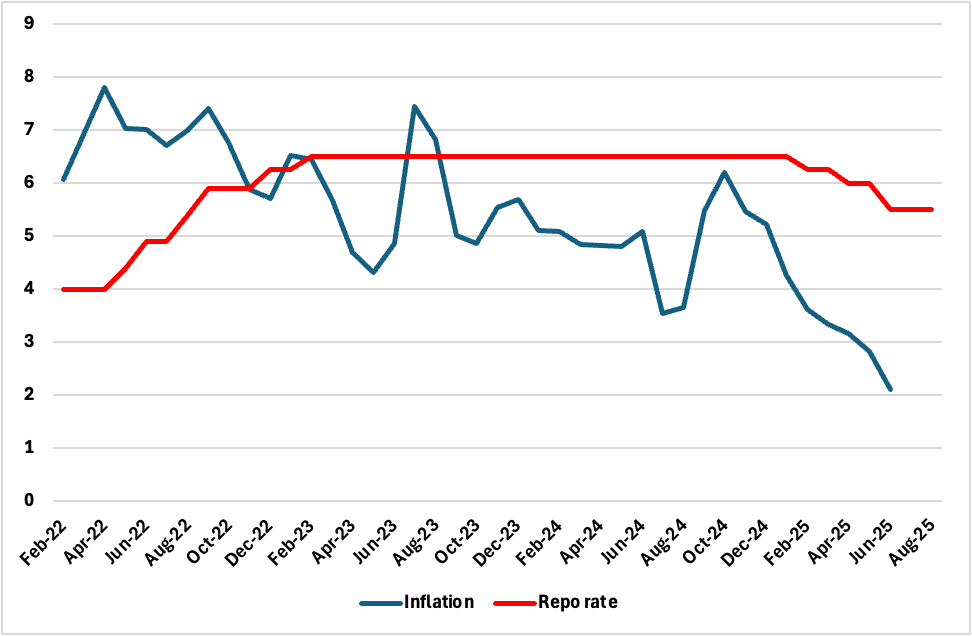

Figure 1: India CPI and Repo Rate (%)

Source: Continuum Economics, RBI