China: CPI Rises Helped By Government Pressure

• Less food price decline, plus government pressure to curtail price wars, helped headline and core CPI move higher. However, the September industrial production and retail sales figure shows that the imbalance between supply and domestic demand remains in place. The imbalance of supply and domestic demand will remain into 2026 leading to ongoing disinflation.

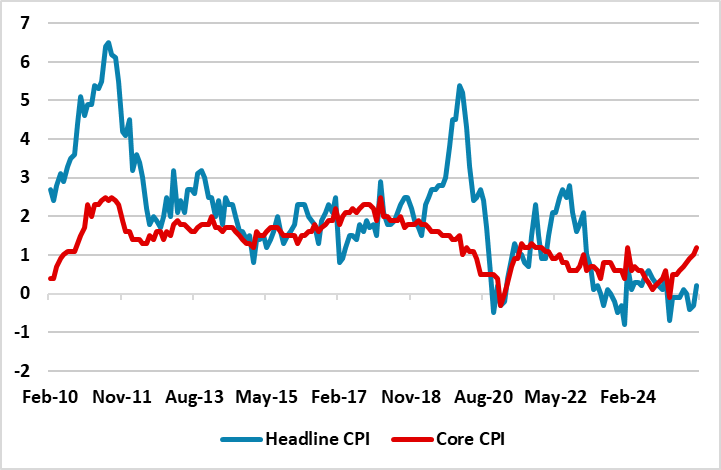

Figure 1: China Headline and Core CPI Yr/Yr (%)  Source: Datastream

Source: Datastream

The October CPI rose to +0.2% Yr/Yr helped by less food price deflation, with food prices falling 2.9% on the year rather than the -4.4% seen in September. Meanwhile, core inflation pushed up from 1.0% to 1.2% (Figure 1), while PPI declined -2.1% v -2.3% Yr/Yr seen in September. Government pressure to curtail price wars in a number of sectors appears to be leading to less price discounting, which is for now causing less disinflationary pressures.

However, the September industrial production and retail sales figure shows that the imbalance between supply and domestic demand remains in place. Meanwhile, October export figures have tapered off, which likely reflects the front loading of exports in H1 2025. The imbalance of supply and domestic demand will remain into 2026, as the government are reluctant to see production being cut. This leaves an unstable imbalance, where companies will seek to be price competitive without price wars. In turn this likely curtail the rebound in core CPI.

The biggest problem remains that consumers remain downbeat, as shown in consumer confidence data. The decline in house prices and housing wealth is combining with slow employment and wage growth to restrain consumer spending and willingness to chase competitive prices. Thus we forecast that active disinflation will remain in 2026 and restrain CPI inflation – we forecast +0.1% for 2026.