China Outlook: Headwinds into 2026?

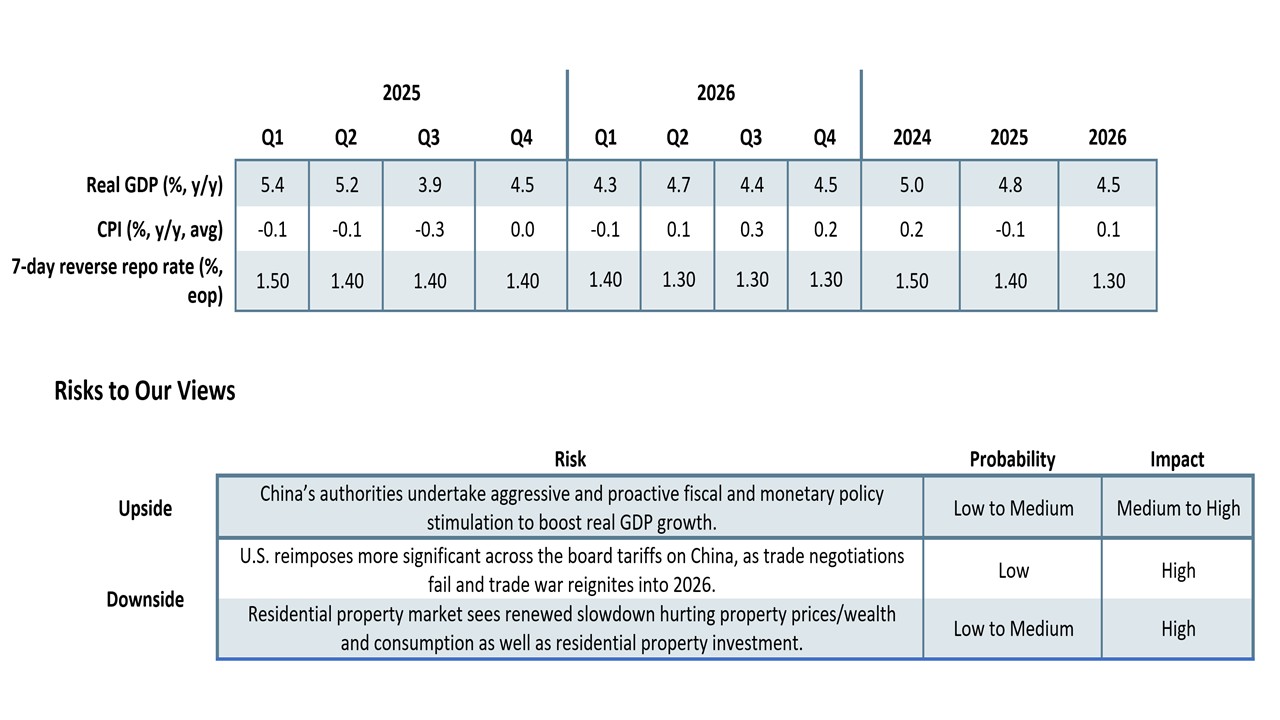

• Overall, net exports contribution to GDP growth should be tempered in H2 2025, as 30% tariffs bite more progressively and other countries more closely monitor the redirection of China’s exports. A trade deal with the U.S. remains our baseline, which should reduce tariffs to around 20% and help net exports be a modest GDP contribution in 2026. However, residential property investment remains a negative contribution to GDP, while underlying consumer spending is modest due to wealth effects and uncertainty over employment and income growth.

• H2 2025 will likely see a slowdown to a 4% growth trend and overall, we forecast 4.8% for 2025. A pick-up in 2026 is dependent on new government infrastructure spending, but we see this being moderate and we maintain a 4.5% GDP forecast.

• China still faces aggressive disinflation however. We forecast -0.1% for 2025 CPI inflation and 0.1% for 2026, which reflects the excess of production over consumption. The stiff competition in certain sectors has prompted the government to try and control price wars. Strong evidence of persistent deflation does not exist however. Meanwhile, the PBOC is reluctant to try to boost inflation, as it is concerned that further rate cuts could hurt banks interest margins and lending. We see only one 10bps cut in the 7 day reverse repo rate to 1.3% in 2026.

• Risks to the Outlook. U.S./China do not agree a trade deal and tariffs are left at 30% or raised to super high levels; that would hurt China’s net exports and worst case risks a 3.5-4.0% growth outcome in 2026. Alternatively, an early surprise invasion of Taiwan occurs and this leads to major sanctions against China, though we see this as 5% probability before 2027 – in 2027 our base line is grey warfare continuing, but a 20% risk of a naval quarantine (here).

Our Forecasts

China continues to see positive and negative developments for the growth outlook. Key points to note

• Net exports. So far China has been able to weather the fall in exports to the U.S./Mexico by sustaining and growing exports to other countries. This will become progressively more difficult, as other countries become watchful of China’s exports being rerouted. The 30% tariffs from the U.S. will also likely have more cumulative adverse effects as time goes on and reinforced by 40% transhipment tariffs through Vietnam and other countries. China’s competitiveness and competition should still ensure that exports hold higher levels, but the H2 2025 contribution to GDP growth will be less. Net exports in 2026 depend on a trade deal with the U.S. Our baseline remains for a deal that reduces the current scale of tariffs, but the prospect of no deal and prolonged 30% tariff has increased to a 30% probability (Figure 1). President Xi could ask Trump for an understanding on Taiwan reunification, but the U.S. is likely to keep the strategic ambiguity policy. While this strategic ambiguity policy towards Taiwan remains in place, a military invasion of Taiwan would be too high risk for Xi (here). On the baseline assumption of a deal, net exports should be a modest positive contribution to GDP growth in 2026.

Figure 1: U.S./China Trade Scenarios

Source: Continuum Economics

• Residential property still negative. The residential property sector is becoming less of a negative drag on GDP growth compared to 2024, but the drag will now likely be around -1.25% in 2025 and -0.75% in 2026. The collapse in new construction means the flow of new complete homes is getting closer to the rate of sale of properties, while house price declines are slowing in tier 1 and 2 cities. However, the overhang of complete and uncomplete homes remains large, especially in tier 3 cities. This can mean divergence in construction and related activities between tier 1 and 2 cities versus tier 3. Households are also cautious about purchases of residential property, as the 2021-23 period has left psychological scars and property still remains expensive versus earnings. Finally, government support is slowing the adjustment but has not provided a bottom for the housing market.

• Underlying consumer spending modest. Spending on appliances has been strong helped by government trade in programs, but this appears to have peaked. Other consumer spending is modest, as confidence has been hurt by the hit to housing wealth and uncertainty about employment and income growth. Modest consumption will likely be the underlying picture into 2026. It is also worth mentioning that China’s population aging also has an impact on consumption, as people in their late 50’s onwards have lower absolute consumption on average (here). Government measures to boost consumption are modest in size and it remains unlikely that the government will engineer a major pivot to consumption through massive fiscal transfers; much bigger health/unemployment and pension safety nets and scrapping Hukou (the regulated migration from rural to urban).

• AI/High-tech production/Infrastructure spending. The bright spot for the economy remains AI and high-tech manufacturing with government support having helped ignite a spending wave in these areas that should be sustained well into 2026. China’s manufacturing sector is also aggressively investing in robots to replace workers and increase profit margins. The agreed 2025 government infrastructure spending has also to be completed in H2 2025 and we also look for new infrastructure investment in 2026 to help try to push GDP growth back up again in 2026 after a slowing in H2 2025. Most will be announced at the March 2026 NPC meeting, but so could be announced in Q4.

Overall, net exports contribution to GDP growth should be tempered in H2 2025, as 30% tariffs bite more progressively and other countries more closely monitor the redirection of China’s exports. A trade deal with the U.S. remains our baseline, which should reduce tariffs to around 20% and help net exports be a modest GDP contribution in 2026. However, residential property investment remains a negative contribution to GDP, while underlying consumer spending is modest due to wealth effects and uncertainty over employment and income growth. H2 2025 will likely see a slowdown towards a 4% growth trend and overall, we forecast 4.8% for 2025. Growth in 2026 is dependent on new government infrastructure spending, but we see this being moderate and we maintain a 4.5% GDP forecast.

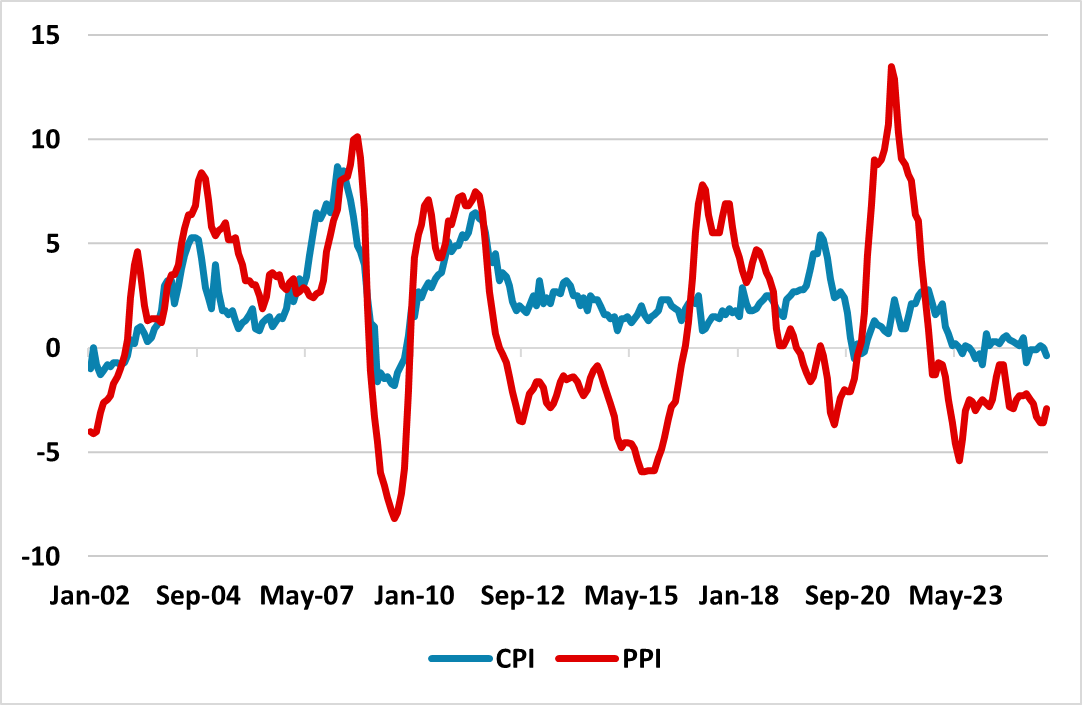

Figure 2: CPI and PPI (Yr/Yr %)  Source: Datastream/Continuum Economics

Source: Datastream/Continuum Economics

China still faces aggressive disinflation however. We forecast -0.1% for 2025 CPI inflation and 0.1% for 2026, which reflects the excess of production over consumption. This is reflected in the continued decline in PPI (Figure 2) and the stiff competition in certain sectors – government directives could temper aggressive disinflation domestically. Nevertheless, we do not yet see signs that real sector purchases are being delayed by low/weak CPI inflation and this is not CPI deflation. Though the GDP deflator has seen persistently small negative outcomes in recent quarters, we see this as being the split of nominal GDP boosting real GDP at the cost of pushing the GDP deflator into negative territory. Real GDP remains more politicised than other data points, especially as weak GDP would be a sign of weakness in China/U.S. trade negotiations.

Fiscal and Monetary Policy

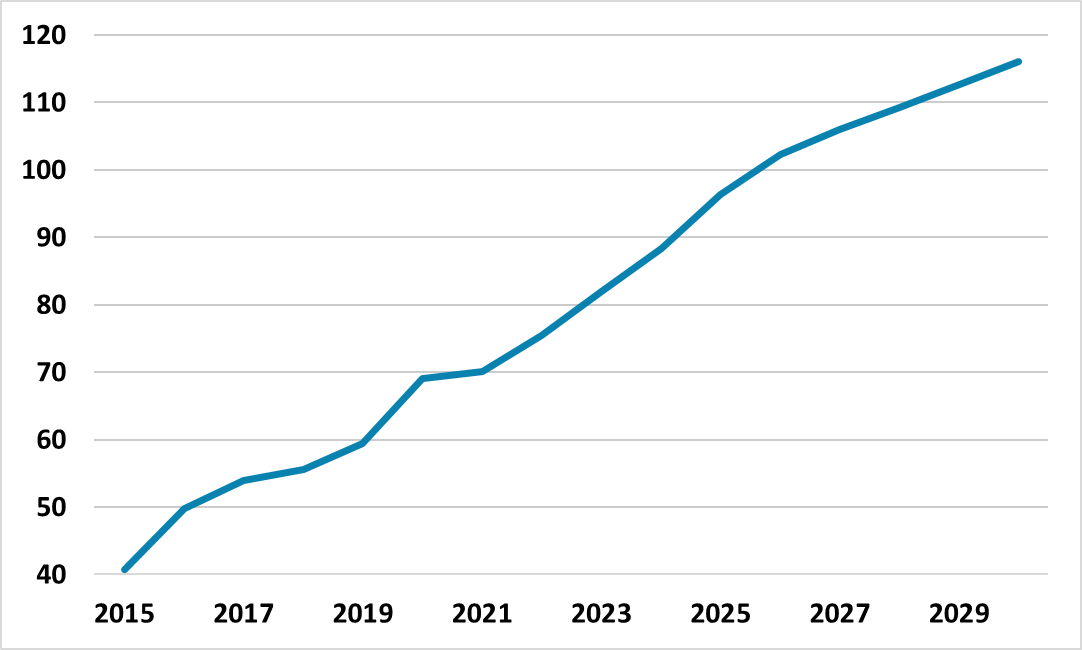

Further fiscal stimulus in 2025 now appear unlikely, as the economy is broadly on a trajectory of 5% real GDP growth and stimulus to combat disinflation is not a top political priority. However, further fiscal stimulus will be required for 2026, otherwise trend growth will be around 4.0%. We see infrastructure investment remaining the key element of extra fiscal stimulus and some could be announced Q4 ahead of 2026 and the usual main fiscal stimulus announcement at the March NPC meeting. Even so, there remains a concern in policy circles that the government deficit and debt trajectory mean only moderate fiscal space, with the authorities’ action suggesting that they believe the IMF estimate for the surging general government debt trajectory (Figure 3). One of the key problems is that tax/GDP remains low compared to other middle-income countries and the authorities are reluctant to fix this structural problem.

Figure 3: China General Government Debt/GDP (%) Source: IMF Fiscal Monitor (April 2025)

Source: IMF Fiscal Monitor (April 2025)

In terms of monetary policy, the authorities’ action continues to be restrained by concerns that too low interest rates could hurt China’s banking system interest margins and lending. Additionally, internal PBOC opposition to ultra-low interest rates and QE remains significant. We look for no further reduction in the seven-day reverse repo rate and 25bps further in the RRR rate in 2025. We now also only see 10bps of reduction in the seven-day reverse repo rate in 2026 to 1.3% and 50-75bps reduction in the RRR rate. The PBOC also feels less pressure with M2 growth rebounding and with the Yuan500bln capital injection to the six state banks likely to be helping credit supply.