Asia/Pacific (ex-China/Japan) Outlook: Balancing Moderation with Resilience

· Asia’s growth trajectory in 2026 reflects regional resilience under strain. Investment-led economies like India and Malaysia are sustaining momentum via infrastructure push, public capex, and digital industrial policy, while Indonesia’s outlook is clouded by fiscal recalibration and subdued consumer confidence. Export-heavy economies—including Vietnam and South Korea—face structural headwinds from the tech cycle, elevated tariffs, and weak Chinese demand.

· Domestic demand remains the central growth anchor, but recovery is uneven. Urban wage stagnation in India, high household leverage in Malaysia, and fiscal policy shifts in Indonesia are limiting the breadth of consumption rebound. Services and tourism are supporting growth across the region, but consumer sentiment remains fragile amid job market frictions and cautious credit conditions. Tax reforms in India will provide some tailwinds to urban consumption.

· Disinflation trends have solidified, allowing policy space. CPI in India has dipped to multi-year lows, Malaysia’s inflation is stable near 1.3%, and Indonesia is undershooting the lower band of its target. This has enabled central banks across the region to initiate or continue easing cycles—though the pace is now moderating. Exchange rate sensitivity, climate-linked food volatility, and fiscal populism will keep policy on a cautious path.

· External conditions remain fragmented and uncertain. Global oil price swings, a subdued China, and continued US tariff unpredictability are weighing on Asia’s trade dynamics. While India and Malaysia are adapting through industrial diversification, Indonesia’s balance of payments has deteriorated, with trade surpluses narrowing sharply. Regional supply chain strategies continue to evolve in response to geopolitical risk and protectionism.

· Fiscal stances are diverging across Asia. India is deploying its RBI windfall to combine infrastructure stimulus with gradual deficit reduction. Tax reforms will limit spending in the medium-term though. Indonesia is pursuing a politically ambitious budget for 2026, prioritising free meals, defence, and renewables, but faces pressure to preserve fiscal credibility. Malaysia’s fiscal reforms—ranging from SST changes to fuel subsidy rationalisation—are reshaping spending priorities, though implementation risks remain.

· Forecast changes: Given the slowing growth momentum in H1, we have revised down our growth forecasts for Indonesia. In contrast, strong growth in Q1 in India, has prompted upward revision to our 2025 growth forecast. Meanwhile, inflation remains subdued across Asia, but has shown signs of emerging pressures, which has prompted upward revisions to our inflation forecast for Indonesia and Malaysia. Meanwhile, given increased headroom for central banks and slowing real GDP, monetary outlooks have been revised to reflect expectations of front loading of rate cuts.

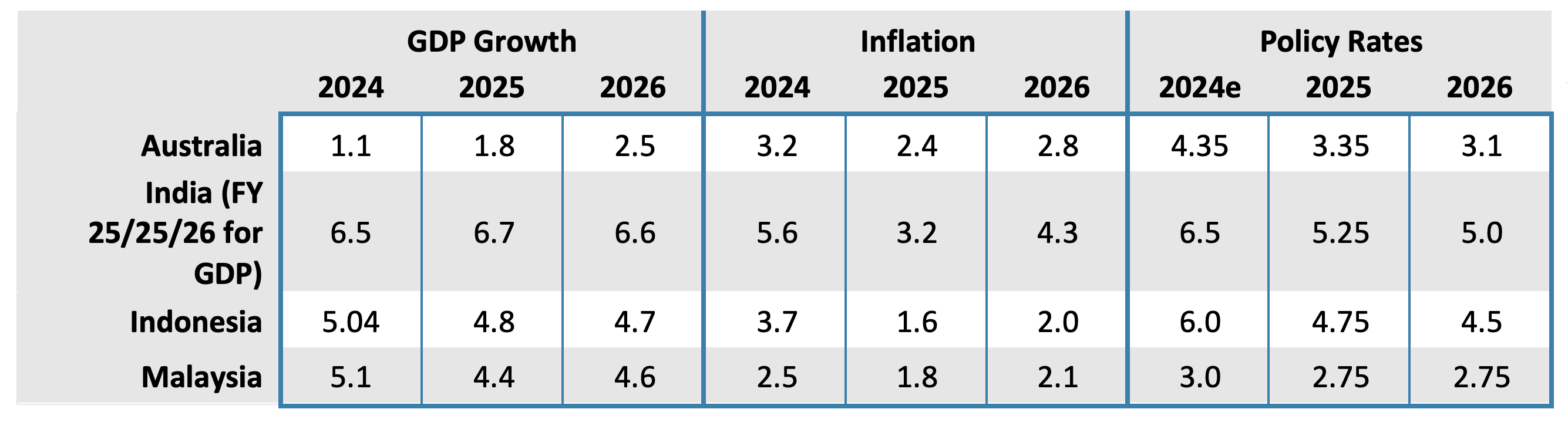

Our Forecasts

Source: Continuum Economics

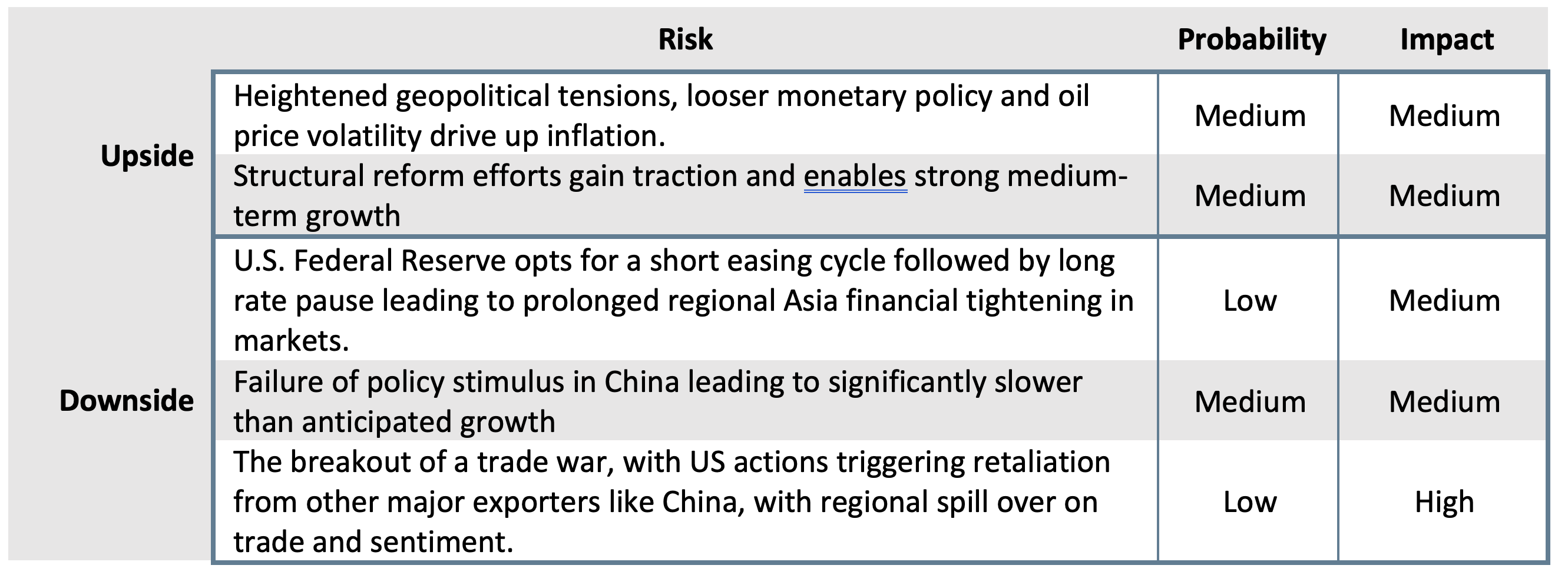

Risks to Our Views

Source: Continuum Economics

Regional Dynamics: Growth Realignment Amid Trade Shocks

Asia is set to deliver a year of moderate but resilient growth in 2026, navigating a complex macroeconomic landscape defined by trade policy uncertainty, geopolitical risk, and evolving consumer dynamics. While headline GDP growth is likely to ease from post-pandemic highs, the region remains a global outlier in terms of expansion, digital acceleration, and structural adaptability.

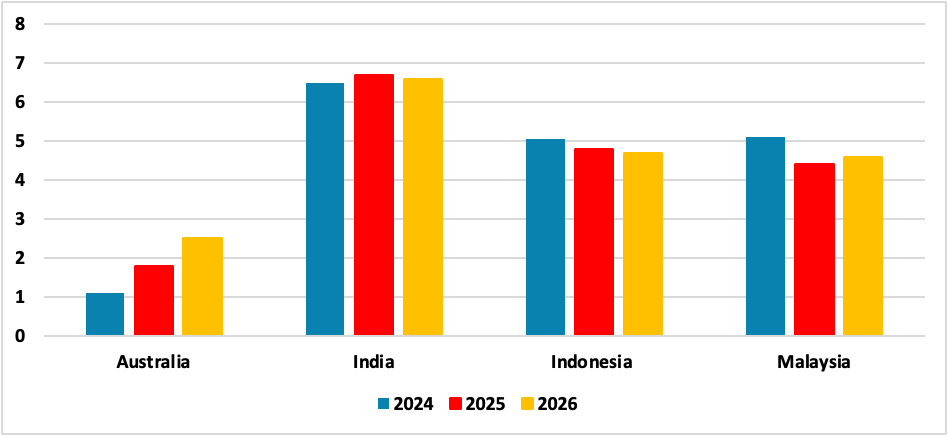

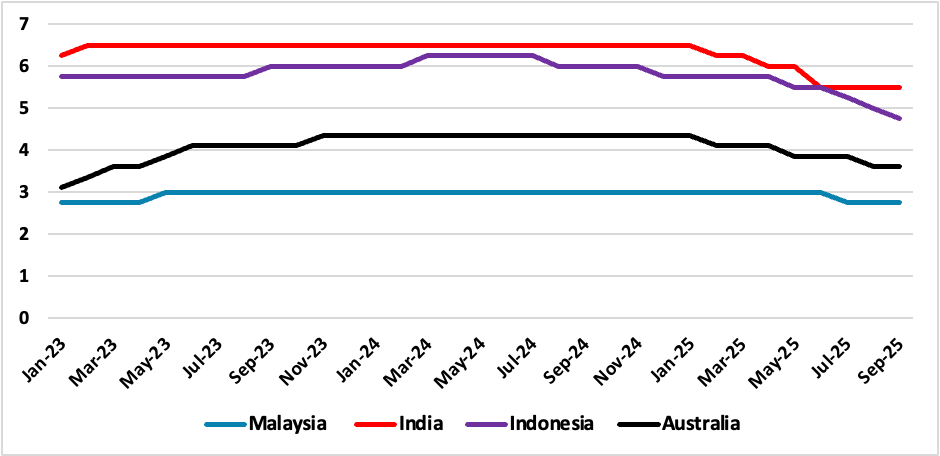

Figure 1: Real GDP Growth Forecast (% yr/yr)

Source: Continuum Economics

Growth: Shifting To Domestic Anchors

Growth across Asia will remain steady but uneven, with clear divergence between investment-led economies and trade-exposed markets. India, Malaysia, and select Southeast Asian economies will outperform—benefiting from sustained infrastructure momentum, proactive fiscal policy, and digital upgrading. In contrast, export-reliant markets like Vietnam and South Korea will face external headwinds, particularly from US-China tariff dynamics and weaker electronics demand.

Domestic demand will be the main growth buffer, supported by real wage recovery, targeted subsidies, and resilient services sectors. Policy reforms such as India’s GST and income tax rationalisation, Malaysia’s gig worker protections, and Indonesia’s social spending drive will support household incomes. However, structural constraints remain: urban consumption fatigue in India, subdued credit appetite in Indonesia, and rising household debt in Australia temper the strength of recovery.

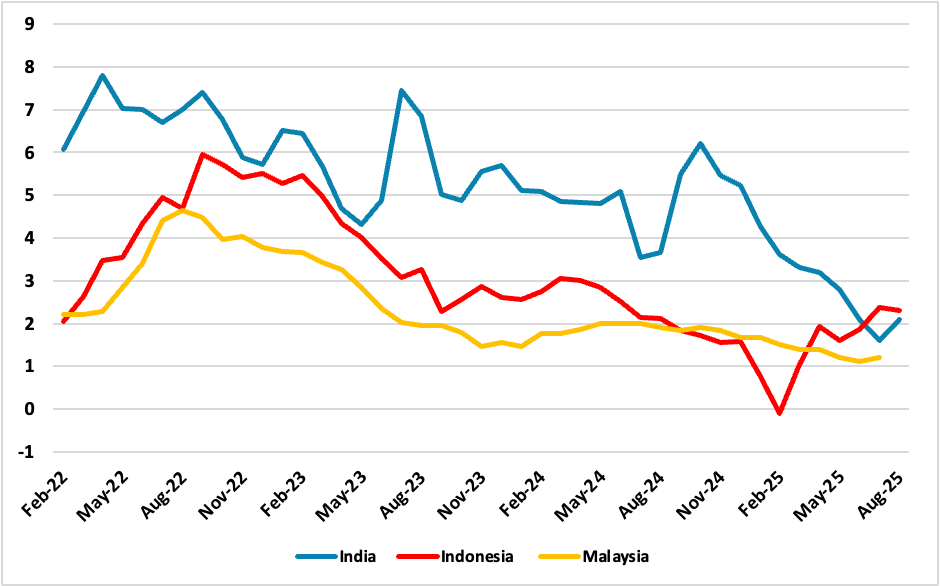

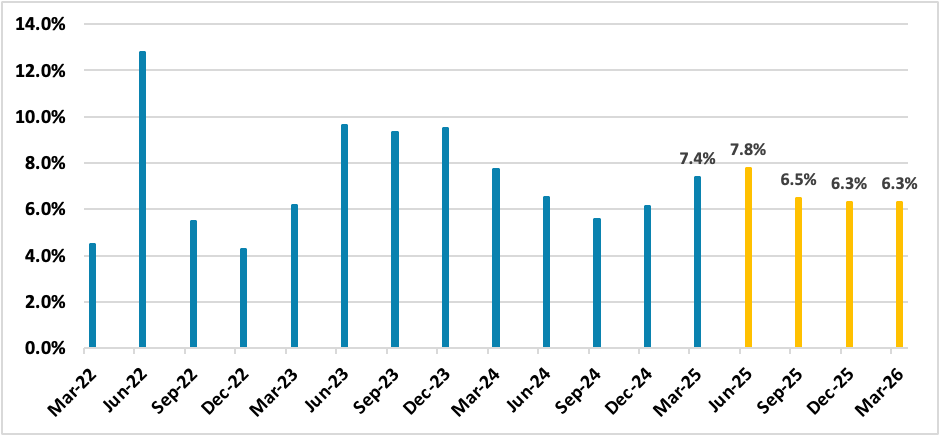

Figure 2: Asia Inflation Trajectory (% change, yr/yr)

Source: Continuum Economics

Inflation: Broadly Contained, Selectively Volatile

Inflation is broadly under control across the region, creating room for gradual monetary easing. Headline inflation is expected to average between 2–4% in most major markets, with easing food and fuel prices offsetting subsidy reform and currency volatility. Central banks are pivoting toward pro-growth policies but remain cautious. India is expected to cut interest rate once more in 2025 before pausing for a bit. Meanwhile, Bank Indonesia may deliver one final cut in mid-2026. Malaysia and South Korea are unlikely to ease further unless external shocks intensify.

Figure 3: Benchmark Policy Rate (%)

Source: Reserve Bank of India, Bank Indonesia, Reserve Bank of Australia, Bank Negara Malaysia

Trade: Slowing Momentum, Shifting Composition

Asia’s overall trade growth is set to decelerate in 2026, as export-oriented economies confront a mix of softening global demand, tech cycle volatility, and rising tariff barriers—particularly on high-value goods such as semiconductors, electronics, and consumer durables. East Asia will see exports ease further amid China’s ongoing structural deceleration, while India and Southeast Asia are likely to register firmer gains in areas like digital services, textiles, and commodity-linked exports. These gains will be driven by resilient domestic demand, supply chain diversification, and targeted industrial policies.

Geopolitical Risks and Tariff Pressures

The fallout from recent U.S. tariff escalations on Chinese and Asian exports represents the most pressing external risk. With uncertainty around the 2026 U.S. mid term election and the prospect of additional trade actions, firms are responding by accelerating “China+1” and “China+2” sourcing strategies. This realignment is already benefitting markets like Vietnam, Malaysia, and India, which are capturing larger shares of FDI and export flows in sensitive value chains such as electronics, automotive components, and green technologies. However, retaliatory measures and policy ambiguity will continue to weigh on sentiment and may prompt further supply chain fragmentation across the region.

India: Growth Moderates, But Policy Support Anchors

India’s macroeconomic momentum is expected to slow moderately in 2026 (FY27), with real GDP growth projected at 6.6%, down from an estimated 6.7% in FY26 (April 2025–March 2026). While India will retain its position as one of the world’s fastest-growing major economies, the quality and breadth of growth will come under increasing scrutiny, especially amid rising trade headwinds, policy recalibration, and signs of domestic demand fatigue. Still, a combination of public investment, easing inflation, and strategic industrial policy will provide a durable anchor for the expansion.

Figure 4: India GDP Forecast (% change, yr/yr)

Source: Continuum Economics

India’s 2026 growth will be driven by resilient rural demand, a gradual recovery in private investment, and ongoing infrastructure momentum. Sectors such as construction, defence manufacturing, financial services, and public administration are expected to remain key contributors. Fixed capital formation, which grew 7.8% yr/yr in Q1 FY25, should gain further traction in 2026 as looser financial conditions, fiscal allocations, and improved business sentiment support capex planning.

However, the headline strength will mask important disparities. Urban consumption—typically the backbone of Indian domestic demand—has shown signs of fatigue, particularly in discretionary spending categories. In contrast, rural consumption is firming, supported by healthy kharif sowing, improved agricultural earnings, and expanded rural welfare schemes. Still, high youth unemployment, weak real wage growth, and global uncertainties could weigh on broader consumer sentiment. That said, the recent personal income tax threshold adjustments and GST rate rationalisation, implemented in late 2025, are expected to deliver a meaningful boost to household disposable incomes. These reforms will help lift consumption in both rural and semi-urban belts, partially offsetting the drag from weaker exports and improving aggregate demand into 2026.

Export-oriented sectors will remain under pressure as U.S. tariffs on Indian goods double to 50%, affecting key segments like textiles, jewellery, leather, and marine products. The impact of these tariffs could shave up to 0.4% off India’s 2026 growth rate, depending on the pace and success of tariff negotiations. However, India's low export-to-GDP ratio and the resilience of services exports—particularly in IT and business process outsourcing—will buffer external shocks.

Meanwhile, India’s industrial policy framework, particularly the Production-Linked Incentive (PLI) schemes, will continue to underpin manufacturing expansion. Electronics, white goods, and automotive components remain strongholds, with added support directed toward chip fabrication, defence production, and rail equipment. Despite bureaucratic hurdles and uneven policy implementation across states, manufacturing’s share of GDP is expected to rise gradually in 2026.

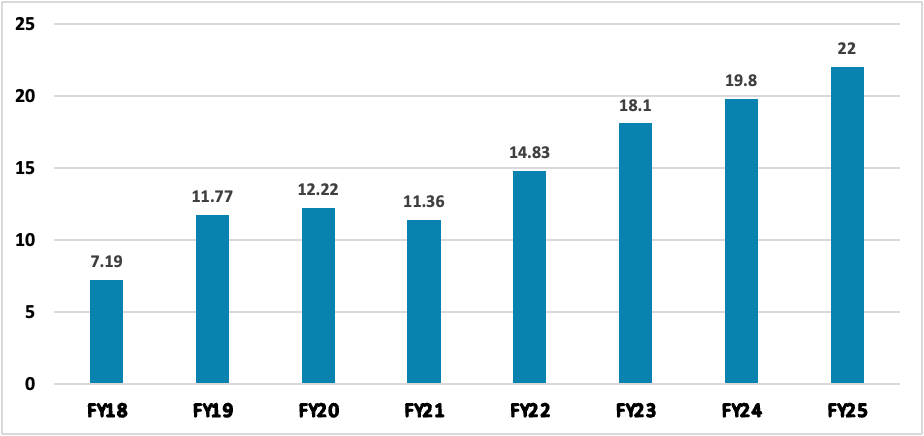

Figure 5: India Goods and Services Tax Collection (INR tn)

Source: Ministry of Finance, Continuum Economics

With inflation under control and public capex momentum intact, the government has ample room to balance consolidation with growth-supportive spending. The 2026 budget will likely sustain allocations toward transportation, defence, and housing, while introducing targeted subsidies to cushion low-income households from global price shocks. Tax reforms and further digitisation are expected to boost compliance and disposable incomes—especially in middle-income households. While large-scale structural reforms (e.g. land, labour, privatisation) may stall due to a narrower BJP majority, the government is expected to prioritise high-visibility, low-friction reforms, particularly in logistics, digital infrastructure, and SME credit facilitation.

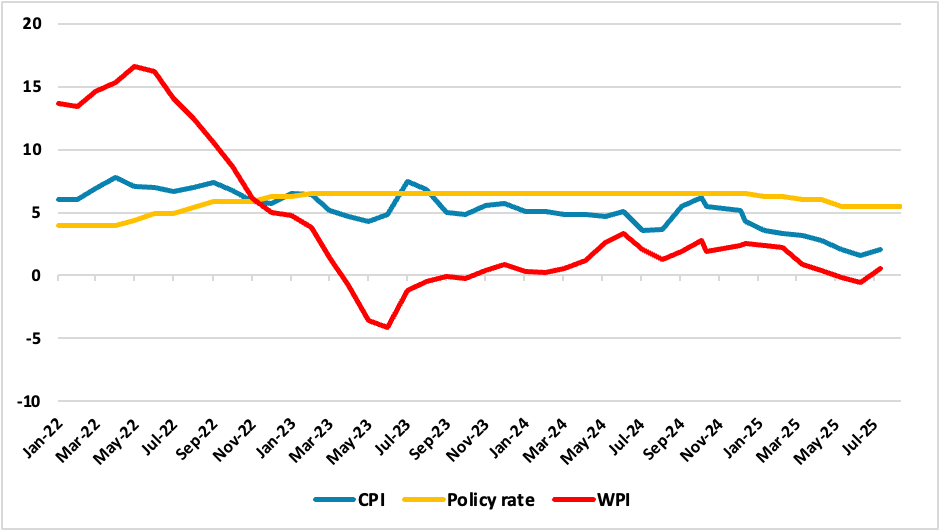

Figure 6: India Inflation and Policy Rate Trajectory (%)

Source: Continuum Economics

Headline CPI inflation is expected to average 4.3% in 2026, following a sharp decline in 2025 (estimated at 3.2%). A combination of above-average monsoon rains, declining vegetable prices, and stable fuel subsidies has led to a sustained disinflationary trend. Food inflation remains benign, with early kharif sowing and strong reservoir levels reducing supply risks. However, services inflation—particularly in healthcare, housing, and education—is expected to remain elevated due to structural demand. Risks to the inflation outlook include currency volatility, global oil price swings, and climatic anomalies such as excessive rainfall or heatwaves, which could disrupt agricultural output.

The Reserve Bank of India (RBI) extended its easing cycle in August 2025, following three consecutive cuts that brought the repo rate to 5.25%. A further 25bps cut in Q4 2025 remains our base case, but from 2026 onwards, the policy stance is expected to remain broadly neutral, with the moderate probability of a 25bps rate cut in mid-2026. Thereafter, the repo rate will be held steady through the year.

The RBI's emphasis on front-loading its rate cuts reflects rising concerns about growth moderation amid a relatively benign inflation environment. In parallel, the central bank will continue to rely on liquidity tools—notably the Cash Reserve Ratio (CRR)—to inject credit into the system and support private investment. Overall, policy rates are unlikely to move lower in 2026 unless geopolitical or trade-related shocks necessitate further accommodation. While India’s monetary framework remains credible, sustained currency volatility due to trade tensions or capital outflows could force the RBI to adopt a more cautious tone. Foreign exchange intervention, rather than further easing, will likely be the preferred tool for managing external imbalances in 2026.

India is set to retain its position as the world’s fastest-growing major economy in 2025, supported by easing inflation and strengthened fiscal buffers that provide ample room for policy support. However, downside risks persist—including uncertainty around US trade policy, potential disruptions from monsoon variability, and geopolitical tensions in the Middle East—that could temper the growth outlook.

Indonesia: Fiscal Push Meets Fragile Sentiment

Indonesia’s economic trajectory in 2026 will be shaped by an ambitious fiscal expansion, cautious further monetary recalibration, and lingering investor unease over institutional credibility. President Prabowo Subianto’s first full-year budget proposes a 7.3% yr/yr increase in public spending to IDR 3,786.5tn (USD 234bn), underpinned by a GDP growth target of 5.4%, a fiscal deficit of 2.48% of GDP, and aggressive pledges to eliminate the deficit entirely by 2028. While the budget signals intent to scale investment and consumption support, execution risks and market scepticism could complicate the outlook, in our view.

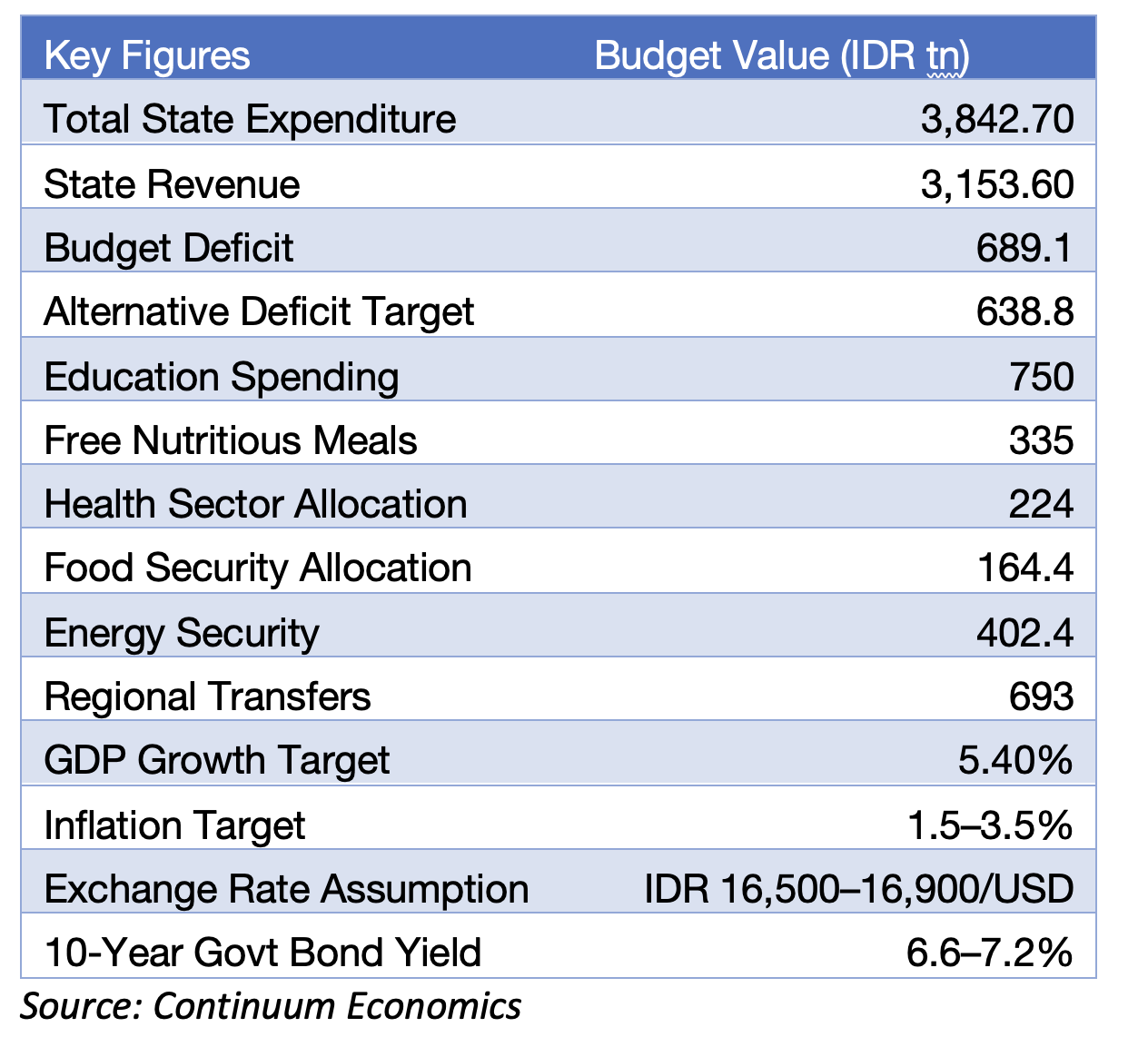

Figure 7: Indonesia 2026 Budget Details

The 2026 budget marks a decisive fiscal shift. The administration plans to double down on flagship initiatives, particularly free school meals, with allocation jumping to IDR 335tn—nearly double the 2025 allocation. Defence spending will also rise by 37% to IDR 335.3tn, reflecting Prabowo’s push to modernise military hardware and assert Indonesia’s strategic autonomy. In parallel, the energy resilience envelope has been set at IDR 402.4tn, with expanded subsidies and incentives for renewables, aligning with the President’s longer-term goal to phase out coal dependence.

To create fiscal space, the government proposes a 25% cut in cash transfers to sub-national governments, even as it seeks to crowd in private sector capital through “creative financing” and the sovereign wealth fund Danantara. Still, questions remain over revenue mobilisation, with the 2026 revenue target set nearly 10% higher than the 2025 estimate, without clear implementation pathways.

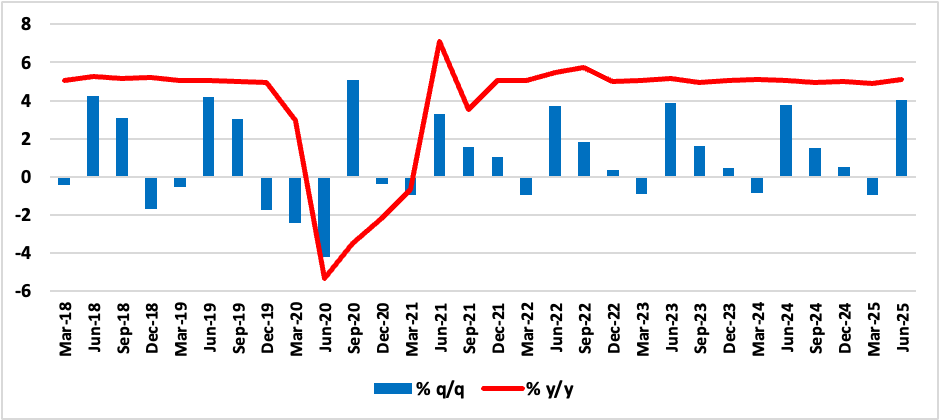

Figure 8: Indonesia Real GDP Growth (%)

Source: Continuum Economics, Badan Pusat Statistik Indonesia

Indonesia’s real GDP growth is projected to ease further to 4.7% in 2026, down from an estimated 4.8% in 2025, as the temporary boost from fiscal stimulus is offset by mounting structural and external headwinds. While Prabowo’s administration has outlined an expansive budget to reignite momentum—focusing on social spending, defence modernisation, and energy resilience—the quality and efficiency of execution remain uncertain. Much of the 2026 growth will depend on infrastructure rollout, public sector capex realisation, and the recovery of private investment, which showed signs of life in mid-2025 with a sharp rebound in capital goods imports.

However, the upside remains constrained. The labour market remains under pressure, particularly in urban centres, with soft wage growth and uneven job creation limiting the strength of consumption recovery. At the same time, elevated public spending—particularly on non-productive subsidies and military outlays—may crowd out private sector investment unless revenue realisation improves significantly. On the external front, sluggish global demand, persistent trade frictions, and weaker exports to China will weigh on manufacturing and export-oriented sectors, delaying a broader industrial recovery.

President Prabowo’s assumption of a higher growth trajectory is predicated on a sharp acceleration in both FDI and exports—but both remain highly sensitive to political signals, global conditions, and investor perceptions of policy continuity. Structural bottlenecks—ranging from land acquisition delays to licensing uncertainty and ESG compliance burdens—also continue to hold back project execution. Unless these are addressed decisively, growth will likely remain below the administration’s 5.4% target, and continue to fall short of the 6–8% ambition set during the campaign.

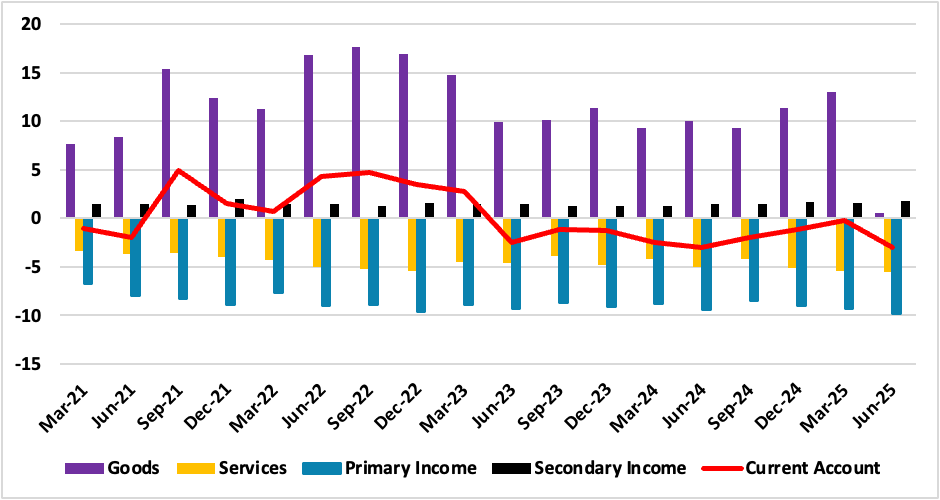

Figure 9: Indonesia Balance of Payments (USD bn)

Source: Continuum Economics, Bank Indonesia

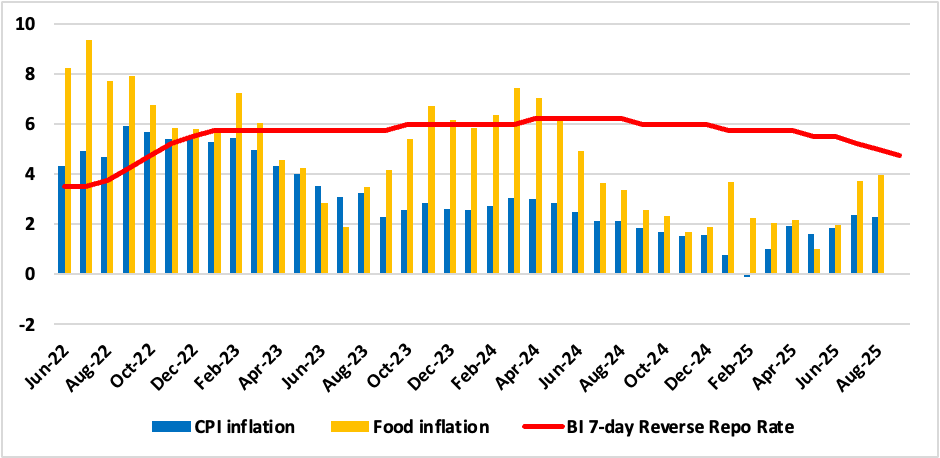

Bank Indonesia’s recent surprise rate cut in September—bringing the policy rate to 4.75%—has unsettled markets, raising concerns about institutional independence and political influence. The move has drawn comparisons to global episodes of monetary politicisation. Investor concerns were compounded by the abrupt dismissal of Finance Minister Sri Mulyani and rising pressure on the central bank to support Prabowo’s 8% growth ambition. Despite speculation, we do not expect BI to continue easing through 2025. Currency pressure (rupiah down 3% YTD), rising imported inflation risk, and the credibility gap will likely force a pause. We project only one additional rate cut of 25bps in mid-2026, taking the policy rate to 4.5%, after which BI is expected to hold. The central bank will prioritise foreign exchange stability over growth stimulus, especially if external volatility persists.

BI’s stance will remain highly data-driven, but forward guidance is likely to stay muted to avoid exacerbating rupiah volatility. With real rates still positive and inflation subdued, the bank retains room to adjust—but political optics and foreign investor sentiment will heavily influence its timing and tone.

Further, the risk of social unrest and youth-led protests remains elevated in 2026. While the government’s dual approach of security enforcement and minor concessions has temporarily eased tensions, dissatisfaction with governance, inequality, and perceived cronyism will linger. This may cloud parliamentary support for structural reforms, limit investor confidence, and trigger delays in key legislation, including labour market changes and tax restructuring.

Figure 10: Indonesia Inflation, Food Inflation and Main Policy Rate (%)

Source: Continuum Economics

Australia: Two Cuts in Two Quarters

The RBA cut by another 25bps in the August meeting to 3.6% and is expected to bring rates closer to 3% before Q2 2026. Domestic demand continues to contribute positively towards growth as headline real wage picks up. Australian consumers have once again turned back to consumption instead of saving with the household saving ratio droping to 4.2% after a year of building up. Australia’s labour market remains solid with participation rate close historical high and unemployment rate at 4.2%. Recent choppy headline labor data does not indicate a weaker but still balanced jobs market for Australia. Wage price index y/y has steadily been moderating and will likely persist on the balanced labor market.

Real wages are forecast to remain in positive territory throughout 2025/26 and should support more recovery in private consumption. The recovery in household consumption is welcoming and is showing further momentum. It indicates Australian consumers are getting more comfortable to consume at higher prices with higher household income (household consumption growing by 0.9%). Government spending also resumed after a soft Q1 2025. The Australian export picture has softened on broad based lower commodity prices but the trade balance is cushioned by also lower import prices. The global tariff impact seems to be rather muted for now.

The RBA acknowledged both the headline and trimmed mean inflation has moved lower, while underlying inflation is now forecasted to be around the midpoint of the target range throughout their outlook. Our central economic forecast is little changed and we believe the Australian economic growth will remain modest in 2025 (1.8%) and pick up its pace in 2026 (2.5%). We forecast headline y/y CPI to slightly rebound in H2 2025 and we look for 2.3% for the year as a whole. 2026 CPI will likely edge closer to the topside of target range at 2.6%.

The RBA sees much uncertainty in the global outlook with such impact tilting towards softer economy and inflation within the target range. With that in mind, the RBA will likely choose to keep their easing cycle fluid with data and not have a long gap until their next cuts. Our central forecast sees two 25bps cut in Q4 2025 and Q1 2026 to 3.1%, when they will pause on CPI rebounding towards the high end of target range band. This policy rate is also close to neutral rate estimates.

Malaysia: Formalising the Informal, Sustaining the Resilient

Malaysia enters 2026 navigating the dual challenge of external trade headwinds and domestic reform implementation. The country’s economic strategy remains anchored in household resilience, policy-driven industrial upgrading, and a cautious recalibration of fiscal and monetary levers.

Malaysia’s real GDP growth is expected to average 4.5% in 2026—reflective of a maturing economy adjusting to slower global trade. The domestic engine will continue to dominate the growth narrative, powered by resilient private consumption and a steady recovery in investment. Wage hikes, targeted subsidies, and the gradual implementation of the government’s Madani Rahmah support schemes have helped buffer households from cost-of-living pressures. Meanwhile, civil service salary adjustments and structured income support are aiding real wage recovery.

The government’s continued push to move up the value chain—particularly through the National Industrial Master Plan 2030 (NIMP2030)—is starting to yield results. Malaysia remains a preferred destination for semiconductor-related FDI, bolstered by geopolitical shifts and the global chip upcycle. The construction sector will continue to benefit from urban redevelopment projects under the proposed Urban Renewal Act. However, global protectionism and export softness will continue to weigh on headline growth, especially as early-year front-loading of shipments fades and inventories normalise in the US and EU.

A significant structural shift in 2025 came through the passage of the Gig Workers Bill, which for the first time provides statutory recognition and basic protections to Malaysia’s estimated 1.2 million platform-based gig workers. By codifying them as self-employed rather than employees, the legislation avoids the full cost burden of standard employment regulation but ensures baseline social protection, algorithmic transparency, and dispute resolution mechanisms via a new Gig Workers Tribunal. While compliance costs for platforms such as Grab and Foodpanda will rise, reputational and regulatory risk will fall, potentially making Malaysia a model in Southeast Asia for inclusive digital labour market reforms. Enforcement capacity remains a concern, with Malaysia’s inspectorate traditionally focused on formal employment. Overall, Malaysia’s growth profile in 2026 will remain services-led, with wholesale, retail, finance, tourism, and ICT driving output. The digital economy continues to receive significant investment, especially in data centres and cross-border special economic zones with Singapore.

Headline inflation is expected to average 2.1% in 2026, broadly stable but with some upward drift as delayed subsidy rationalisation begins to feed through. Core inflation pressures remain subdued, with energy, transport and food contributing modestly to the price basket. Bank Negara Malaysia (BNM) is likely to maintain its dovish tilt but proceed cautiously. After a 25 bps cut in July 2025, the overnight policy rate will likely be held at 2.75% through the rest of the year. No further cut is expected in 2026. BNM’s current positioning reflects confidence in domestic stability but awareness of ringgit vulnerability and high household debt. With no specific inflation target, the bank will likely err on the side of stability, using targeted liquidity tools over broader rate cuts. Policymakers will watch for renewed foreign exchange pressure, capital flow volatility, and US monetary policy.