RBI Likely to Hold Rates, Watchful of Tariffs and Festive Demand

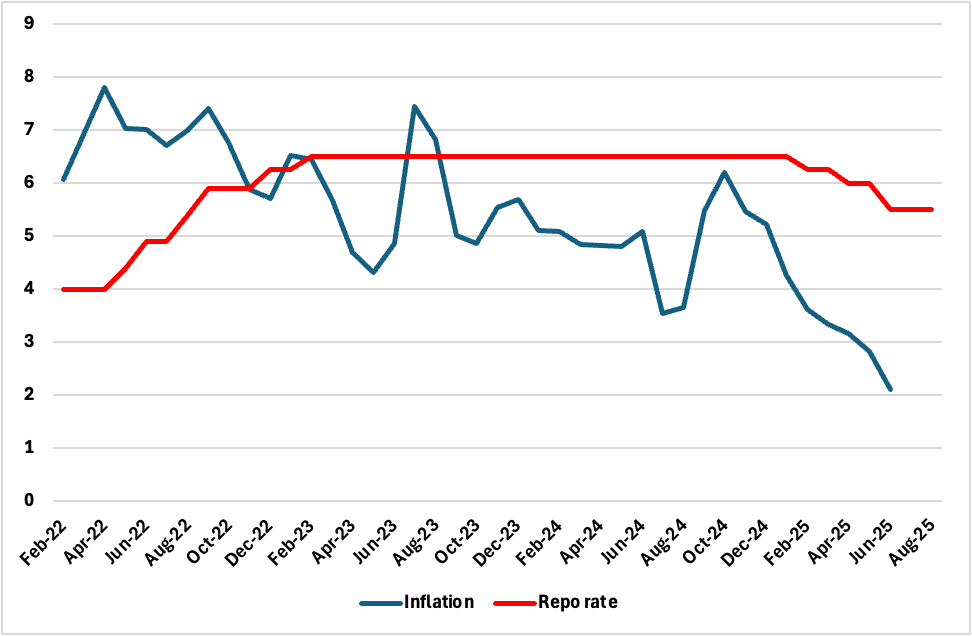

The RBI is expected to keep the repo rate unchanged at 5.5% in its October review, pausing after three consecutive cuts earlier this year. With inflation undershooting and GST rationalisation set to push CPI lower, policymakers see little need for immediate action. The central bank will instead wait to assess festive demand and the outcome of US tariff negotiations before considering further easing.

The Reserve Bank of India’s Monetary Policy Committee (MPC) is widely expected to keep the policy repo rate unchanged at 5.5% in its upcoming meeting scheduled for September 29–October 1. After a cumulative 100 bps of easing since February, the central bank is now likely to pause, assessing the combined effects of recent GST rationalisation, subdued inflation, and external trade risks.

Inflation remains well within target, with the Consumer Price Index (CPI) at 2.07% in August, up modestly from July’s 1.61%. The GST overhaul, effective from September 22, is expected to further trim headline CPI by 25–50 bps over FY26–27, lowering the full-year average to around 2.6%, compared with the RBI’s earlier projection of 3.7%. While October–November could mark fresh inflation lows, the trajectory thereafter is expected to tilt upward as demand strengthens.

Growth dynamics are more complex. India posted a robust 7.8% expansion in Q1 FY26, buoyed by government spending and resilient services. The RBI is expected to retain its 6.5% GDP growth forecast for FY26, even as risks from 50% US tariffs on Indian goods weigh on the external outlook. Policymakers will want to observe the festival-season demand cycle and the outcome of trade negotiations before altering their growth view.

The RBI’s stance reflects a deliberate balancing act: recent disinflation and tax-driven relief provide space for accommodative policy, yet global uncertainty—particularly around tariffs and oil prices—calls for caution. By holding rates now, the central bank signals confidence in India’s macro fundamentals while keeping flexibility to adjust policy later in the year if demand falters or trade shocks intensify.

In short, the October policy is set to be one of consolidation, not action. With growth holding firm and inflation undershooting, the RBI is using this pause to gauge how its earlier cuts and structural reforms are filtering through the economy. A more decisive move—potentially another cut—may only come towards the end of 2025, once tariff negotiations and festive demand patterns provide clarity.

Figure 1: India CPI and Repo Rate (%)

Source: Continuum Economics, RBI

I,Sanya Suri, the Senior Asia Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.