China: Weak Growth

• November figures show weak growth and are a concern for momentum going into 2026. Retail sales continues to be hurt by adverse wealth effects and slow job and income growth. Though the authorities are promising to boost consumption, we see this only being modest rather than aggressive fiscal policy stimulus. Meanwhile, monetary easing in 2026 will be small and we look for 10bps cut in the 7 day reverse repo rate. We stick with 4.4% GDP growth for 2026.

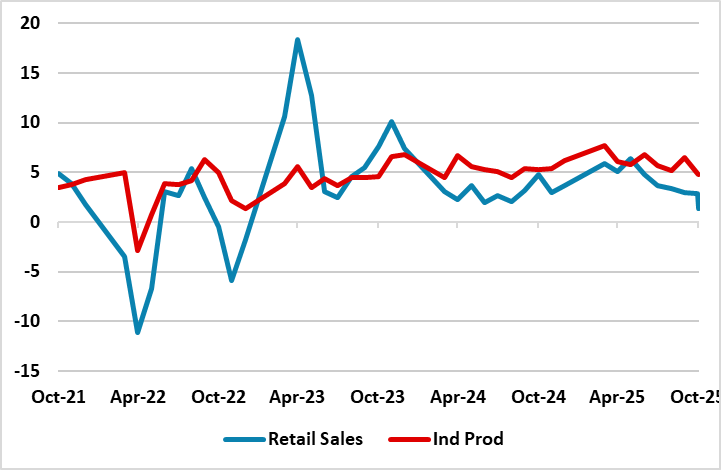

Figure 1: Industrial production and Retail Sales (Yr/Yr %)

Source: Datastream/Continuum Economics

The November monthly numbers from China were weaker than expected. Key points include.

• Retail sales and investment weak. Retail sales at 1.3% Yr/Yr was very weak, partially due to base effects (trade programs started Nov 2024) and the Singles day promotion starting early and dragging consumption into October says the NBS. Even so, the breakdown shows true weakness with home appliances now subtracting from growth (-19% Yr/Yr) and car sales (-8% Yr/Yr). Adverse wealth effects and slow job and income growth remain the key cause and will continue in 2026 (here for our China Outlook). Equally concern was the -2.6% Yr/Yr YTD for fixed asset investment. Of greatest concern was the -1.1% for public infrastructure investment, with questions raised whether the local authority debt clean up is causing caution and reducing infrastructure investment. Property investment at -15.9% Yr/Yr YTD reflects the ongoing after effects of the property bust, but has been getting worse in recent months. Though property sales are not as awful, they are still -8.1% Yr/Yr YTD.

• Industrial production divergence. The 4.8% Yr/Yr industrial production figure was led by electric vehicles/robots and integrated circuits at +15.6% Yr/Yr. This reflects the boom in high tech production. However, the old economy suffered from the weakness in domestic demand, with crude steel and cement production at -10.9% and -8.2% Yr/Yr respectively. With weak domestic demand, old economy production could remain weak into early 2026.

• 2026 Modest fiscal easing and slight monetary policy help. The statement from the December central economic work conference (CEWC) suggest that more stimulation will be announced to boost growth in March 2026 – President Xi attended as normal. The statement change of language included emphasis on focusing on stabilizing the residential property market caught some attention, but the wording is incremental or restating the same policy stimulation as 2025. Separately, President Xi has noted that the economy should not be judged on GDP numbers alone. We see around Yuan2.5trn on extra government spending mainly on infrastructure (China Outlook here), with some modest consumption measures. This will likely fall well short of the more aggressive suggestions from the IMF from the December article IV (here). On monetary policy the CEWC statement noted that the rate and RRR cuts will be used flexibly and efficiently. In reality we look for only one 10bps cut in the 7 day reverse repo rate, as policymakers are concerned that more rate cuts could hurt bank margins and lending!