China: Fiscal Stimulus Modest Rather than Large?

• Overall, we see around a Yuan2.0-2.5trn fiscal stimulus for 2026 and some of this could be announced in December but the majority in March 2026. This reflects the fiscal constraints on China authorities; the targeted focus in the 2026-31 five year plan and reluctance to spending on households. The stimulus could be at the bottom end, if the authorities set the 2026 real GDP target at 4.5% rather than 5% -- which would be a struggle to achieve.

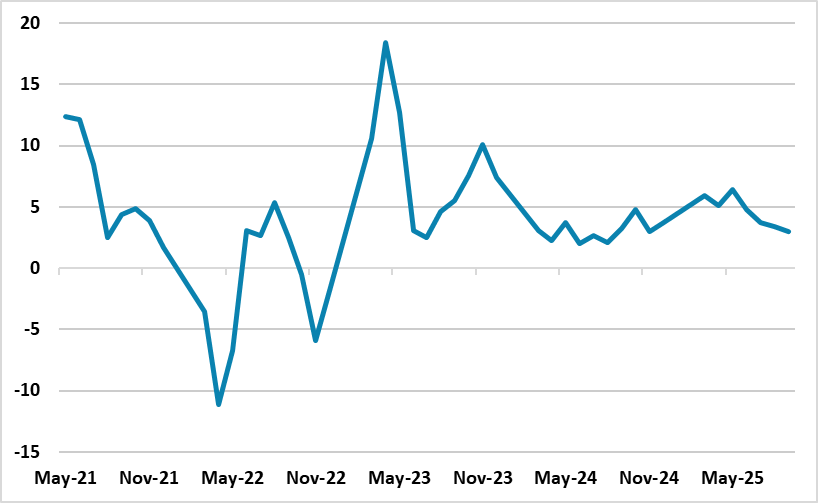

Figure 1: China Retail Sales (% Yr/Yr)  Source: Continuum Economics

Source: Continuum Economics

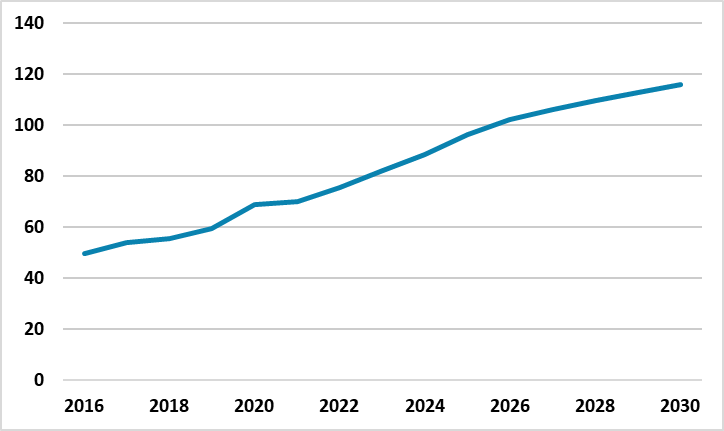

China growth remains unbalanced and struggling to sustain 5% GDP growth into 2026. What are the prospects for further fiscal stimulus? • 5yr plan high tech rollout the key. The 2026-31 five year plan puts modernized industry ahead of further technological innovation, as China seeks to use the innovation seen in recent years and still in the pipeline. This will likely mean extra fiscal stimulus in 2026 to help industries meet the high tech ambitions. However, it will likely be targeted rather than broad in nature, as in recent years as the authorities have not wanted to stimulate low tech or old economy businesses. • Households: Structural rather than Cyclical support. The statement for the 5 yr plan suggests that cyclical support for households is likely to remain small to modest for 2026. This could mean further trade in programs, but the problem is that repeat programs tend to have diminishing returns. However, common prosperity was cited again, while the five year plan also links household policies to structural growth resilience. This could mean more support for unemployment; health; childcare and pension safety nets. However, the measures for 2025 were incremental in nature rather than the substantive increases need to reduce precautionary savings. China authorities have also been reluctant to boost households, as they see production and investment/exports driving the economy. Nevertheless, soft retail sales (Figure 1) and weak private business investment and employment growth are headwinds for growth, alongside the ongoing restructuring in residential property investment. Without fiscal stimulus the economy would probably grow at 4.0% in 2026, given these headwinds and with a slowdown in net exports from tariff impact. • U.S. effective tariff lower than headlines. Yale budget lab estimates that the effective tariff rate is around 17% (here) after last week 10% cut for China, rather than the much higher standard rates quoted by the Trump administration. Exemptions for semiconductors/ pharmaceutical and other goods drags the effective average down. This will still hurt net exports into 2026, as China frontloaded exports to the U.S. and other countries will push back against China export dumping risks. However, the effective rate will mean that China’s authorities are less worried about having to use fiscal stimulus to counter the net export slowdown. A comprehensive trade deal with the U.S. will also be difficult (here). • Fiscal space limited. The final issue is that China authorities in recent years have acted as those fiscal space is limited, despite the official central government numbers showing moderate government debt/GDP. Their restraint is consistent with the higher trajectory seen under the IMF baseline, which includes most of the local government financing vehicles and other debt (Figure 2).

Figure 2: China General Government Debt/GDP (%)  Source: IMF Fiscal Monitor Oct 25

Source: IMF Fiscal Monitor Oct 25

Overall, we see around a Yuan2.0-2.5trn fiscal stimulus for 2026 and some of this could be announced in December but the majority in March 2026. This reflects the fiscal constraints on China authorities; the targeted focus in the 2026-31 five year plan and reluctance to spending on households. The stimulus could be at the bottom end, if the authorities set the 2026 real GDP target at 4.5% rather than 5% -- which would be a struggle to achieve.