Turkiye MPC Review: Cautious CBRT Reduced Key Rate by 100 bps to 39.5%

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) cut the policy rate by 100 bps to 39.5% during the MPC meeting on October 23 citing slowdown in disinflationary process due to renewed inflationary risks. Our end year key rate prediction remains at 37.0% for 2025 despite the fact that it will be not be surprising if CBRT decides to cut the rate to 37.5%-38% (or even halt the easing cycle) during the next MPC on December 11, provided that inflation pressures mount in Q4, which is not our major scenario.

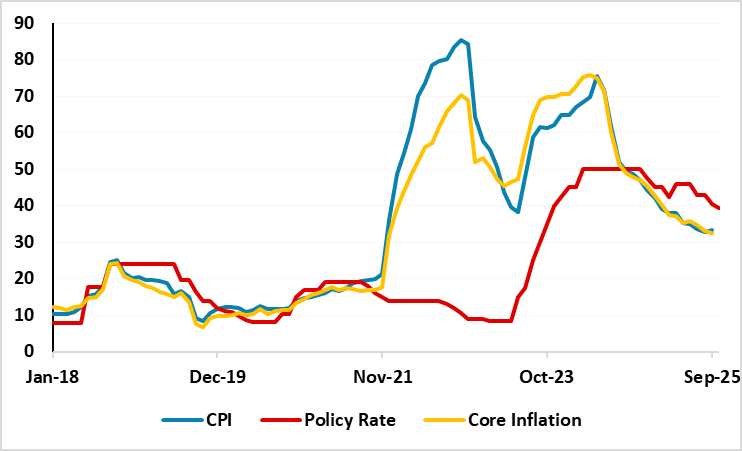

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – October 2025

Source: Continuum Economics

After softening for fifteen consecutive months and hitting 32.9% y/y in August, CPI slightly edged up to 33.3% y/y in September as education, housing and food prices lead the rise in the index ignited by the start of the school year and drought. After inflation came in higher than expected in September, CBRT cautiously reduced the policy rate by 100 bps to 39.5% during the MPC meeting on October 23.

It is now more obvious that renewed inflation risks continue to pressurize the ongoing disinflation process while the deceleration trend in inflation continues moderately in Turkiye supported by lagged impacts of previous monetary tightening, tighter fiscal measures and relative TRY stability.

CBRT said in a statement on October 23 that "The risks posed by recent price developments, particularly in food, to the disinflation process through inflation expectations and pricing behavior have become more pronounced. (…) The tight monetary policy stance, which will be maintained until price stability is achieved, will strengthen the disinflation process through demand, exchange rate, and expectation channels." The impact of the announcement on markets was limited as we saw a moderate movement in Turkish financial markets, and a modest decline in TRY.

Under current circumstances, CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis given domestic inflationary risks and unpredictable outlook for the global economy. Our end year key rate prediction remains at 37.0% for 2025 despite the fact that it will be not be surprising if CBRT decides to cut the rate to 37.5%-38% (or even halt the easing cycle) during the next MPC on December 11, provided that inflation pressures mount in Q4, which is not our major scenario.

Despite the CBRT’s inflation target for this year at 24%, (and even though it is forecasting inflation of between 25% and 29%), the road will be very bumpy due to risks. Our average headline inflation forecast stays at 34.5% for 2025 as we foresee upside risks to inflation emanating from stickiness of services inflation, and adverse domestic political developments. We envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly considering inflation becomes stickier requiring high interest to remain for some time.