China Outlook: Headwinds Get Stronger

· Private domestic demand remains modest, with consumption ranging from modest to moderate (slowed by the housing wealth hit and soft jobs/wage growth) and investment further impacted by the ongoing adverse drag of the residential property bust. China’s authorities prefer a long and slow adjustment to the property bust, rather than aggressive policies to clear the residential property market. Combined with population aging, this likely means trend growth of 4.0% for 2026, with AI and high tech helping but not enough – net exports will also help but less than 2025. With moderate extra fiscal spending, we forecast 4.4% for 2026 and 4.2% for 2027. Reported GDP could be higher for social and political cohesion reasons.

· One consequence is aggressive disinflation pressures, as production exceeds domestic demand and export potential. Though China’s authorities are keen to avoid price wars, they will not aggressively push for excess production capacity to be shut as this would provide a vicious adverse circle for China’s economy. We forecast CPI at 0.5% in 2026 and 0.4% in 2027.

· China’s authorities feel fiscally constrained by the surge in the general government debt/GDP ratio on the IMF measure. Aggressive fiscal policy is being held in reserve for emergencies. Meanwhile, PBOC remains reluctant to cut interest rates much further, as it could undermine banking system profitability and lending.

Risks to the Outlook. In terms of alternative scenarios, a great impact from structural headwinds could mean 3.5-4.0% growth in 2026, but we would only attach a 15% probability to this scenario given the boost from high tech and AI for the economy. An invasion of Taiwan/blockade is very high impact, but we still only attach a 5% probability in 2026 and 10% in 2027 to such a high risk Taiwan policy (here).

Our Forecasts

Source: Continuum Economics

China unbalanced growth continues, with the negative headwinds intermittently producing a drag on growth. Key points to note include:

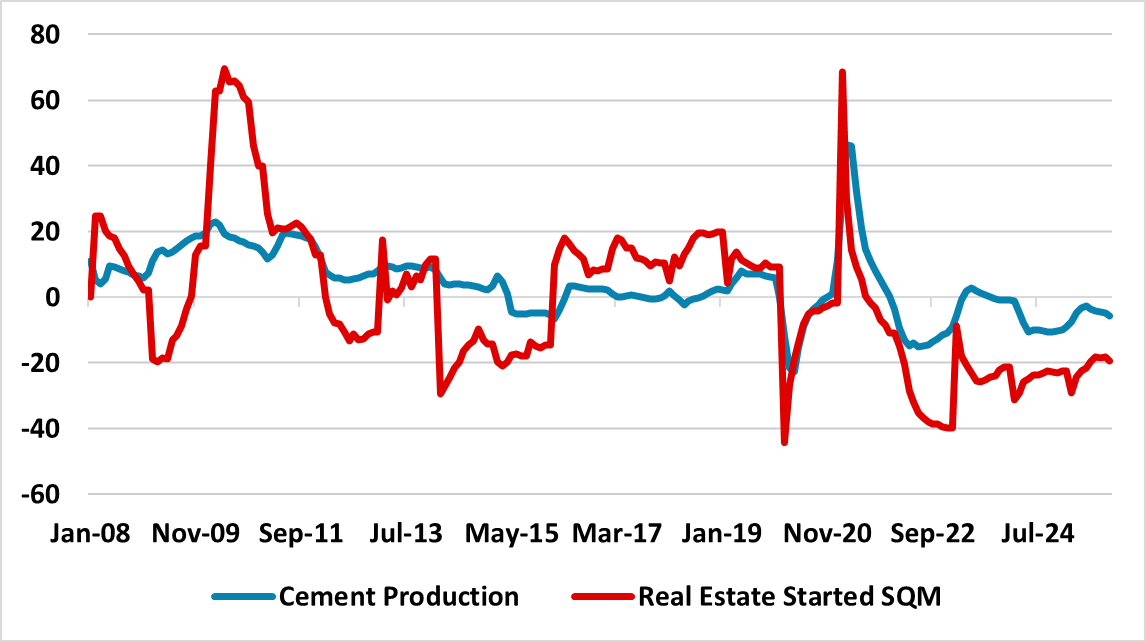

· • Residential property hangover for years. Though we see the negative drag from residential property on GDP less directly in 2026/27 than 2023/24, housing being completed continue to be higher than new property purchases. Households' property optimism has also been significantly dented by the bust of the last few years, which is restraining purchases. Secondly, a large inventory of complete and uncomplete property curtails the interest in new residential construction. Thirdly, property developer’s finances remain volatile, while government intervention is moderate rather than aggressive. This means ongoing negative residential property investment (Figure 1), which is also hurting related industries such as cement and steel production/property related services and finance. Then, we also have an adverse wealth effect on households and consumption, given the disproportionate size of housing in wealth. Aggressive local and central government purchases of property would help market clearing and reduce downward pressure on house prices, but the authorities prefer moderate steps. The official view remains for a move away from residential property to high tech production. Residential property will thus remain adverse to GDP directly and indirectly (circa 1% in 2026 and 2027).

Figure 1: Cement Production and Residential Property SQM Started (Yr/Yr %)

Source: Continuum Economics

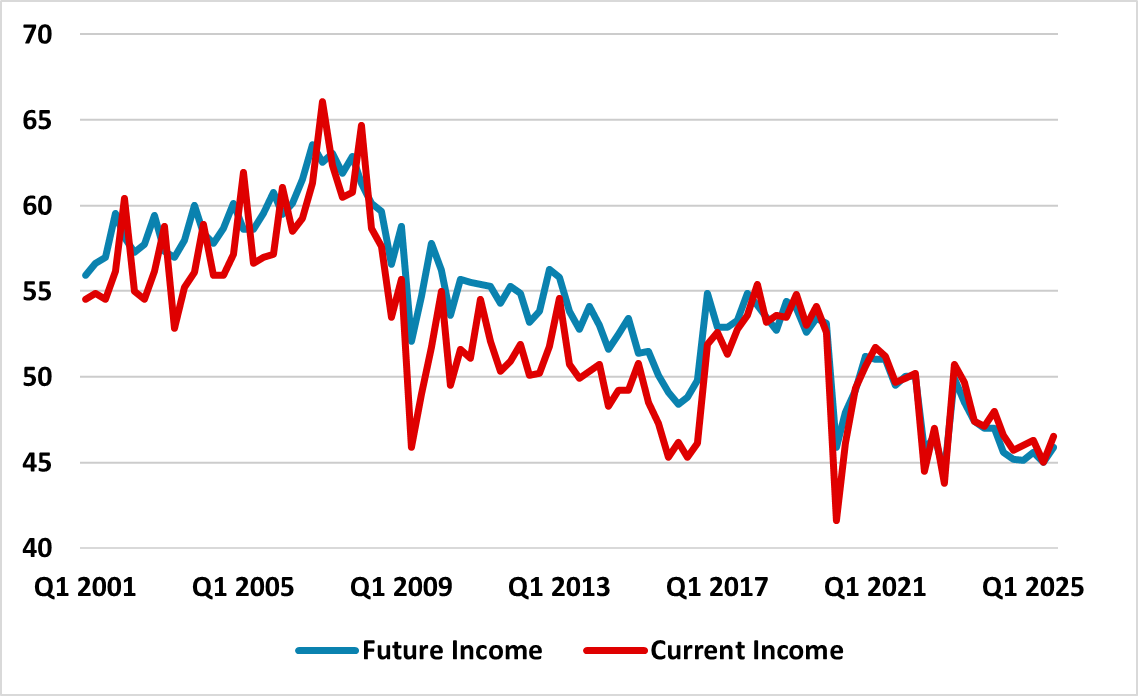

· Modest underlying consumer spending. Adverse housing wealth effects are not the only issue, as the cyclical weakness in employment and wage growth continues to restrain income expectations (Figure 2), which are the key driver of consumption growth. Though the latest IMF article IV on Dec 10 (here) outlined required measures to transition towards a more consumer based economy, action is likely to fall short of the aspiration outlined in the 15th five year plan for consumption led growth. A structural shift lower in high precautionary savings could help boost consumption, but we feel that China’s authorities, in March 2026, will likely only announce a moderate cyclical boost for consumers and improvement in structural safety nets (health/unemployment and pensions) and this will not bring savings down quickly to boost consumption. Modest momentum will likely be the story for 2026 and 2027 and still supported by the traditional broadening of services consumption as a middle-income country matures.

Figure 2: NBS Current and Future Income Expectations (Index)

Source: Datastream/Continuum Economics

· Net exports. H1 2025 saw a resilient China export performance, but the momentum is slowing heading into 2026. U.S. tariffs remain high enough to hurt exports, alongside 3rd country new growing restrictions on Chinese companies reexporting to the U.S. Other DM countries and large EM are also wary about China dumping goods, which is also a headwind into 2026. Net exports will likely be an add to GDP, but less reliable as a source of growth. The October U.S./China framework deal avoids renewed escalation of trade tension, but is unlikely to be followed by a comprehensive trade deal in 2026 as China does not want major import and bilateral trade commitments. Effective tariff rates are also not much above the EU/Japan deals, once exemptions are factored in. The economic effects will likely be small and the framework deal main aim appears to be avoiding escalation (here).

· AI/High-tech production/ The bright spot for the economy remains AI and high-tech manufacturing, with government support having helped ignite a spending wave in these areas that should be sustained through 2026/27. China’s manufacturing sector is also aggressively investing in factory robots to replace workers and increase profit margins.

Overall, the headwinds to GDP growth remain and net exports will be less of a support. It is also worth mentioning that population aging is growing on a structural basis, which slows new house demand and absolute consumption levels for the over 55’s (here). The underlying momentum for 2026 looks like 4.0%. Though optimists could argue that the AI/tech wave could boost productivity, this is a long-term trend, while humanoid robotics is a 2030s story due to cost and battery problems (here). At times, the economy will feel softer than the GDP numbers suggest, which is already evident in H2 2025, with weak fixed investment and retail sales data on a monthly basis, suggesting GDP is only being held up by excessive inventory accumulation. However, we see further fiscal stimulus likely lifting GDP to around 4.4% for 2026. For 2027, we see a further trend slowing to below 4.0%, as the structural headwinds get larger. Even so, further moderate fiscal stimulation will likely come through in 2027 and we forecast 4.2%.

It could well be that the reported GDP numbers are higher than the actual reality. China could stick with a 5% growth target in 2026 and 2027, rather than accepting that trend growth is slowing. Though China’s authorities are placing more emphasis on quality growth, the illusion of 5% growth is useful for social and political cohesion.

One consequence of this is aggressive disinflation pressures, as production exceeds domestic demand and export potential. Though China authorities are keen to avoid price wars, they will not aggressively push for excess production capacity to be shut as this would provide a vicious adverse circle for China’s economy. We forecast CPI at 0.5% in 2026 and 0.4% in 2027.

In terms of alternative scenarios, a great impact from structural headwinds could mean 3.5-4.0% growth in 2026, but we would only attach a 15% probability to this scenario given the boost from high tech and AI for the economy. An invasion of Taiwan/blockade would cause western sanctions and a large export hit. However, we still only attach a 5% probability in 2026 and 10% in 2027 to such high risk Taiwan policies (here), with continued grey warfare more likely.

Fiscal and Monetary Policy

Further fiscal stimulus will be required for 2026, otherwise trend growth will be around 4.0%. We see infrastructure investment remaining the key element of extra fiscal stimulus and the usual main fiscal stimulus announcement at the March 2026 NPC meeting. Even so, there remains a concern in policy circles that the government deficit and debt trajectory mean only moderate fiscal space, with the authorities’ action suggesting that they believe the IMF estimate for the surging general government debt trajectory. One of the key problems is that tax/GDP remains low compared to other middle-income countries and the authorities are reluctant to fix this structural problem. IMF estimates China tax revenue at 25.1% compared to G20 EM and DM average of 25.9% and 35.7% respectively.

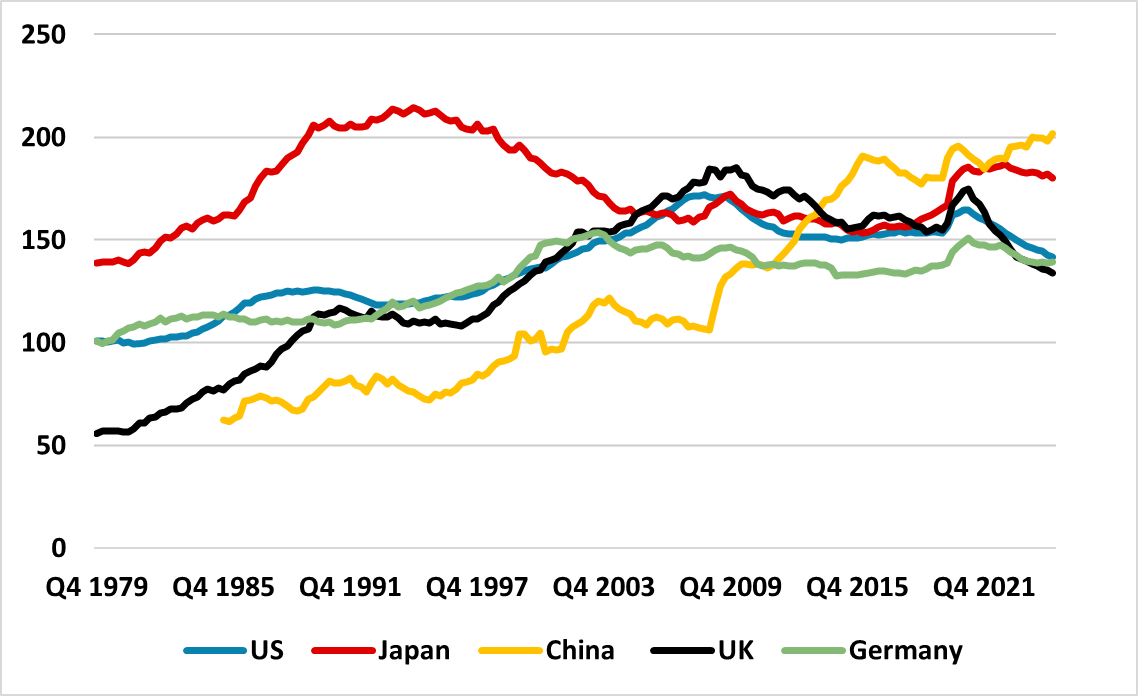

Figure 3: Total Household/Corporate Debt (% of GDP)

Source: Datastream/Continuum Economics

China’s authorities are also worried by the massive surge in Household and Corporate debt to GDP since 2008 (Figure 3), which now exceeds U.S./Japan and EZ and the post 1989 Japan and 2007 U.S. busts.

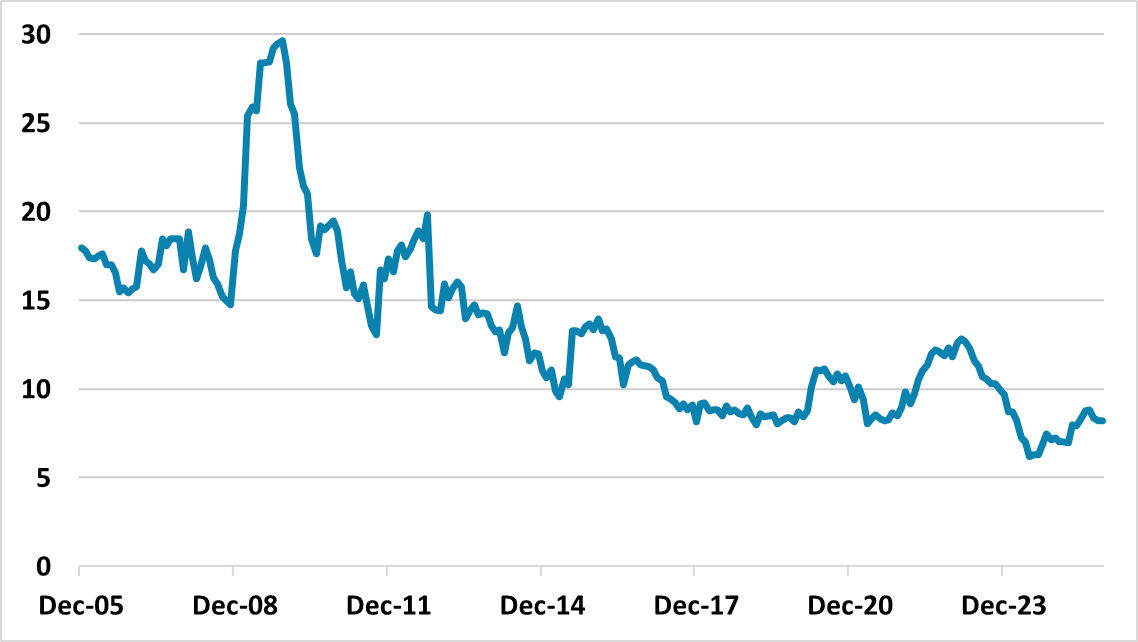

In terms of monetary policy, the authorities’ action continues to be restrained by concerns that too low interest rates could hurt China’s banking system interest margins and lending. Additionally, internal PBOC opposition to ultra-low interest rates and QE remains significant. The 2024 PBOC financial stability review (here) shows only 2% of banking assets in troubled banks, but the 2023 stress tests show this could surge with a 100% pick up in NPL’s and lower profitability (here). We now also only see 10bps of reduction in the seven-day reverse repo rate in 2026 to 1.3% and 50-75bps reduction in the RRR rate. The PBOC also feels less pressure with M2 growth rebounding and with the Yuan500bln capital injection to the six state banks likely to be helping credit supply. Even so, M2 growth is slow by China standards (Figure 4). Combined with lower private sector household and business borrowing demand, this makes 5% GDP growth difficult to achieve in reality.

For 2027, we see a further 10bps reduction in the 7 day reverse repo rate, which is restrained by PBOC concerns over the banking system but driven by the need to do something as a signal for the economy. Even so, current low interest rates are not stimulating the private sector, as some households and businesses are facing a balance sheet recession, which requires fiscal policy and market clearing polices to improve confidence.

Figure 4: M2 (Yr/Yr %)

Source: Datastream/Continuum Economics