Easing Cycle Continues: CBR Reduced Key Rate to 16% on December 19

Bottom Line: As expected, Central Bank of Russia (CBR) reduced the key rate by 50 bps to 16% during the MPC on December 19 since the pace of the fall in inflation accelerated in November. CBR said in its written statement that monetary policy will remain tight for a long period, and further decisions on the key rate will be made depending on the sustainability of the inflation slowdown and the dynamics of inflation expectations. We think CBR will likely resume cutting rates (moderately) in 2026 if the inflation trajectory allows, RUB stabilizes and inflation expectations converge towards CBR’s forecasts. Our end-year key rate forecast is at 13% and 11.5% for 2026 and 2027, respectively, since Russia will have to keep rates high as the country need higher real yields.

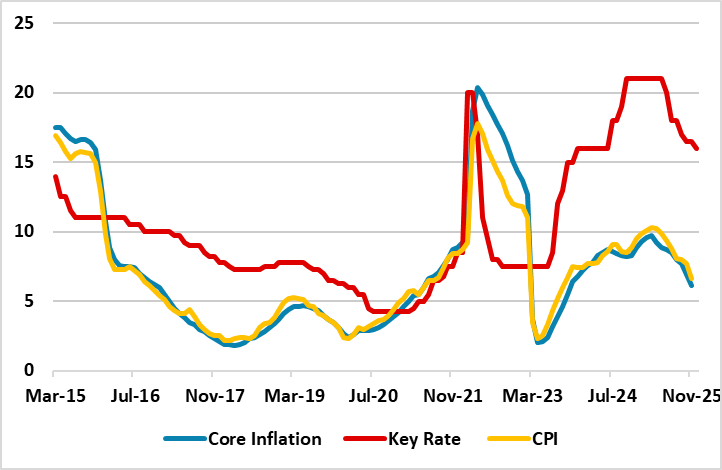

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – December 2025

Source: Continuum Economics

As we predicted, CBR reduced the policy rate by 50 bps to 16% since the pace of the fall in inflation accelerated in November. Russian inflation edged down to 6.6% in November owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite food and services prices continued to surge in November.

CBR said in its written statement on December 19 that "CBR will maintain monetary conditions as tight as required to return inflation to the target. This means that monetary policy will remain tight for a long period. Further decisions on the key rate will be made depending on the sustainability of the inflation slowdown and the dynamics of inflation expectations." CBR added that underlying measures of current price growth declined in November, despite inflation expectations have edged up in recent months and lending activity remained high.

According to the CBR’s forecast, annual inflation will decline to 4.0–5.0% in 2026 and underlying inflation will reach 4% in 2026 H2. Despite this, we believe reaching 4%-5% target band will be tough in 2026, since cooling off inflation will take longer than CBR anticipates due to sanctions, adverse effects of the VAT increase (in 2026) and administered prices coupled with continued surge in military spending. Elevated inflation expectations may also impede a sustainable slowdown in inflation. (Note: President Putin recently approved raising the VAT to 22% from 20% for 2026. Speaking about VAT hike, Finance Minister Anton Siluanov also said on December 9 that VAT hike aims to fund soaring defense and security spending is expected to drive consumer prices up by around 1% next year).

Our 2026 average headline inflation projection stays at 6.2%. We think CBR will likely resume cutting rates (moderately) in 2026 if the inflation trajectory allows, RUB stabilizes and inflation expectations converge towards CBR’s forecasts. Our end-year key rate forecast is at 13% and 11.5% for 2026 and 2027, respectively, since Russia will have to keep rates high as the country need higher real yields.