Unexpectedly, CBR Reduced Key Rate to 16.5% on October 24

Bottom Line: Despite we expected Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; CBR decided to cut the policy rate unexpectedly by 50bps to 16.5% saying the Russian economy continues to return to a balanced growth path.

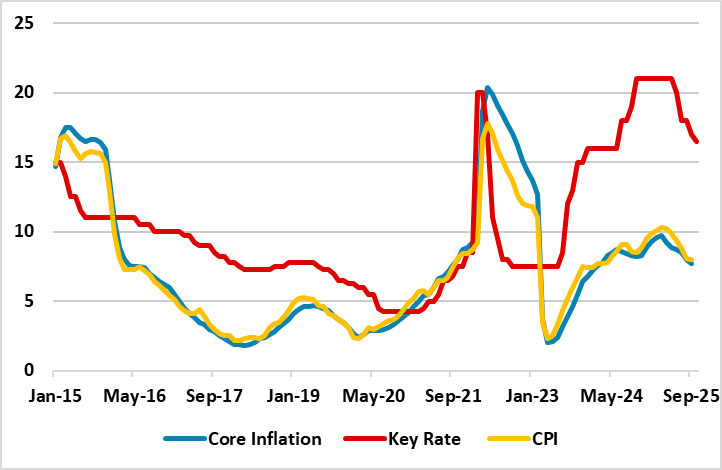

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – October 2025

Source: Continuum Economics

Despite we foresaw CBR to hold the key rate at 17% during the MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine recently hit various oil refineries in Russia, CBR reduced the rate by 50 bps to 16.5% considering inflation hit the lowest in 17-months after with 7.98% y/y in September and the inflation expectations have not changed considerably in recent months.

CBR said in its written statement that Russian economy continues to return to a balanced growth path. CBR added that "Underlying measures of current price growth have not changed significantly remaining above 4% in annualized terms, and annual inflation is expected to decline to 4.0–5.0% in 2026 given the monetary policy stance."

Talking about the future rate decisions, CBR governor Nabiullina stated on October 24 that "I believe that we are in a cycle of monetary policy easing, either way. It may happen with pauses, but you can see the trajectory of the rate that we have set for next year. (…) We see that demand growth is slowing down, demand overheating is subsiding, and we expect the demand gap to close in the first half of next year."

We believe reaching 4% target will be tough in 2026, since cooling off inflation will take longer than CBR anticipates as war in Ukraine continues with pace, military spending remains elevated, sanctions dominate, and global uncertainties remain strong. (Note: Our average inflation predictions are at 9.1% and 6.1% in 2025 and 2026, respectively, as sanctions dominate the economy igniting labor shortages, and supply-chain disruptions).

The bank’s updated outlook suggests interest rates will average 13%-15% in 2026, up from the July forecast of 12%-13%. We think CBR will likely resume cutting rates (moderately) in 2026 if the inflation trajectory allows, RUB stabilizes and inflation expectations converge to CBR’s forecasts.

We continue to think a peace deal in Ukraine is the real key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia; despite sealing a full-scale peace deal in Ukraine is very unlikely in 2025. CBR needs to be cautious since the pace of government spending could turn pro-inflationary if Ukraine war continues in 2026.