Preview: CBR will Likely Hold the Key Rate Stable at 17% on October 24

Bottom Line: We expect Central Bank of Russia (CBR) to hold the policy rate constant at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine stepped up hitting oil refineries in Russia; which could also slow down decrease in inflation expectations. The decision on October 24 will still be a close call since it will not be surprising if CBR reduces the policy rate by 100 bps to 16% considering inflation hit the lowest in 17-months after with 7.98% y/y in September as downward trend continues.

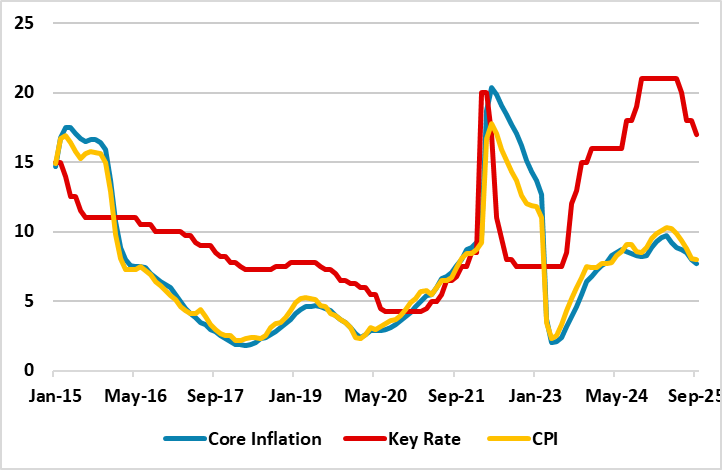

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – September 2025

Source: Continuum Economics

We foresee CBR to hold the key rate at 17% during the next MPC on October 24 since the pace of the fall in inflation decelerated in September due to heightened gasoline prices after Ukraine recently hit various oil refineries in Russia. (Note: Inflation slowed to 8.0% YoY in September after hitting 8.1% YoY in August. Core inflation also eased to 7.7% y/y in September from 8% y/y the previous month). In addition to this, the inflation expectations have not changed considerably in recent months impeding a sustainable slowdown in inflation.

Talking about the price pressures, CBR governor Nabiullina stated last week that "The rise in gasoline prices could slow down the decrease in inflation expectations. Unfortunately, they remain at an elevated level for now." Nabiullina added that CBR will take this into account when taking its rate decision.

According to Reuters, prices for gasoline are up 10.2% since the start of the year due to step up in Ukrainian attacks on Russian refineries. Reuters calculations in August showed that Ukrainian attacks and maintenance works reduced Russian oil refining by almost a fifth on certain days. (Note: Russia recently extended a ban on exports of gasoline to keep domestic prices under control).

It is worth mentioning that CBR highlighted in its written statement in September that it will maintain a level of monetary policy tightness necessary to bring inflation back to target at 4% by 2026. We still believe reaching 4% target will be tough in 2026, since cooling off inflation will take longer than CBR anticipates as war in Ukraine continues with pace, military spending remains elevated, sanctions dominate, and global uncertainties remain strong.

We continue to think a peace deal in Ukraine is the real key to ease some pressure on inflation and alleviate demand-supply imbalances in Russia; despite sealing a full-scale peace deal in Ukraine is very unlikely in 2025. CBR needs to be cautious since the pace of government spending could turn pro-inflationary if Ukraine war continues in 2026.