Softer November CPI Print Encouraged CBRT to Cut Key Rate to 38% on December 11

Bottom Line: As we expected, Central Bank of Turkiye (CBRT) cut the policy rate by 150 bps to 38% during the MPC meeting on December 11 encouraged by softer November inflation. The committee said inflation expectations and pricing behavior are showing signs of improvement even as they continue to pose risks to the disinflation process.

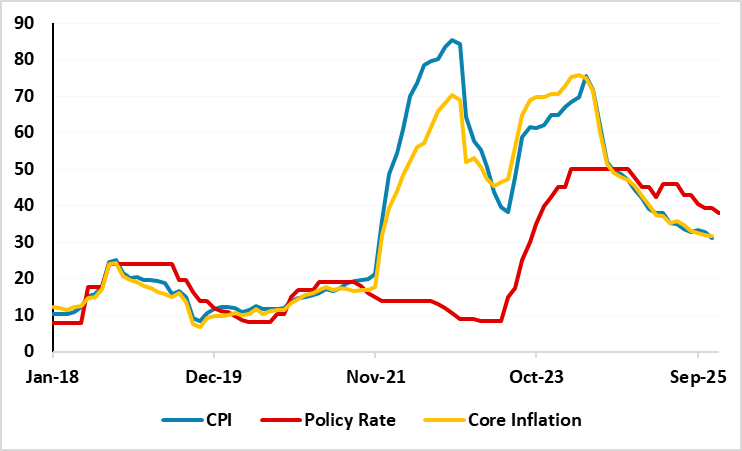

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – December 2025

Source: Continuum Economics

Turkiye’s inflation softened to 31.1% y/y in November, with a 0.87% monthly increase – both readings below expectations. The annual inflation rate is now at its lowest since late 2021. After inflation came in lower than expected, CBRT cautiously reduced the policy rate by 150 bps to 38% during the MPC meeting on December 11.

Despite this, we still think inflation risks continue to pressurize the ongoing disinflation process while the deceleration trend in inflation continues moderately in Turkiye supported by lagged impacts of previous monetary tightening, tighter fiscal measures and relative TRY stability.

CBRT said in a statement on December 11 that inflation expectations and pricing behavior are showing signs of improvement even as they continue to pose risks to the disinflation process. Leading indicators for the last quarter point out that demand conditions continue to support the disinflation process, it also added.

Under current circumstances, we believe CBRT will have to proceed carefully on interest-rate adjustments on a meeting-by-meeting basis given domestic inflationary risks and unpredictable outlook for the global economy. We think one decision that would likely affect both the inflation and rates path in 2026 will be how much the authorities decide to raise the minimum wage for next year.

We continue to envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly considering inflation becomes stickier requiring high interest to remain for some time.