EM FX Outlook: USD Less in Favor, but EM Mixed

- We forecast a further decline in the overvalued USD against DM currencies and this should spill over to extend the Brazilian Real (BRL) rebound to 5.20 versus USD by end 2026. The Mexican Peso (MXN) will likely be more volatile, as President Donald Trump wants to renegotiate USMCA.

- The Chinese Yuan (CNY) will gain some marginal ground versus the USD, but will likely be restrained by China's authorities desire to maintain competitiveness. Indian Rupee (INR) will likely by choppy, with a cooling of trade tensions likely to be seen in 2026 but inflation differentials remain adverse. Other EM currencies will be mixed versus the USD on a spot basis, though the Turkish Lira (TRL) will fall given the still high inflation.

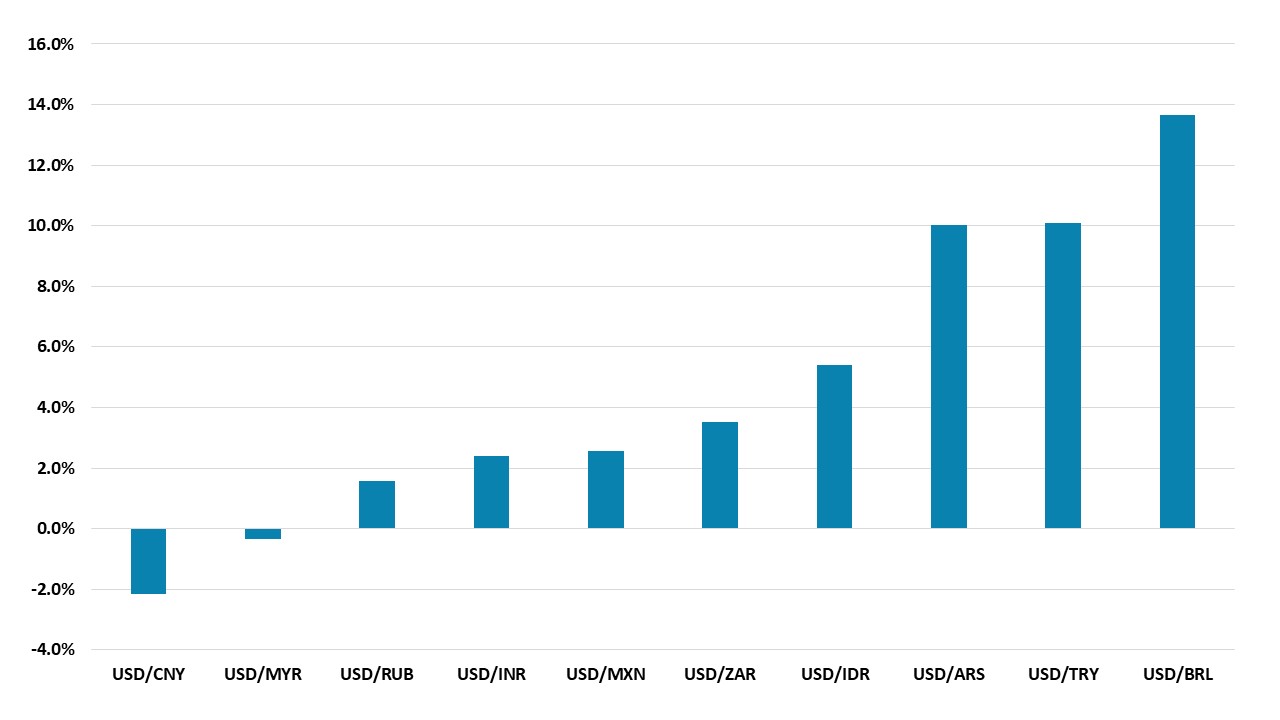

- On a total return basis over the next 15 months, BRL stands out due to the prospect of still very wide interest rate differentials and spot appreciation. The TRL will attract carry trades also, but will likely be more volatile. The CNY will likely see negative total returns versus the USD (Figure 1), as interest rate differentials will remain adverse.

Figure 1: 15mth Total Returns Versus the USD (%)

Source: Continuum Economics

Asia

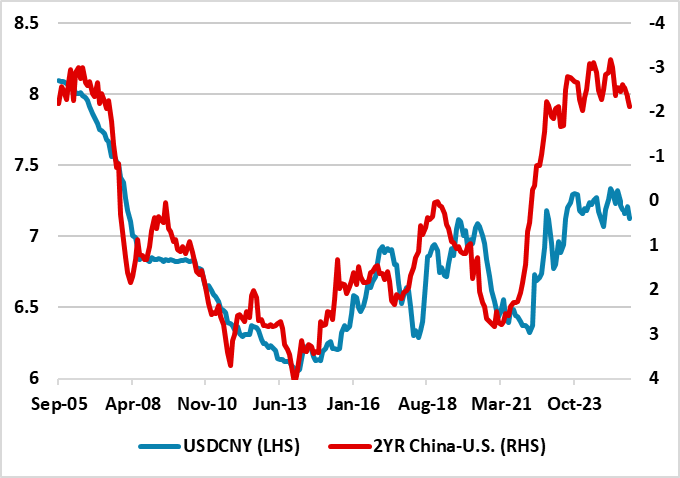

Figure 2: USDCNY and 2yr China-U.S. Government Bond Spread (%)

Source: Datastream/Continuum Economics

The USD downtrend against DM currencies has spilled over to allow a recovery in the CNY this year. We now forecast 7.10 for end 2025. What happens into 2026 when we forecast a further moderate decline in the USD generally? Some upward pressure for the CNY will come from this. However, interest rate differentials will still remain adverse unless the U.S. has a hard landing and cuts interest rate substantially. In our baseline of a U.S. soft landing, the interest rate differential will restrain CNY gains. We also suspect that China authorities will restrain USDCNY around 7.00 with or without a trade deal with the U.S. – we still attach a 65% probability of a trade deal being reached. Exports to the U.S. have seen a permanent step lower and China will want to maintain some competitiveness. H1 2026 will likely see USDCNY touch 7.00 after a trade deal is announced, but official exchange rate management will likely stabilise USDCNY at 7.10 by end 2026.

The INR remained under pressure through much of 2025, weighed down by weak FDI inflows, intermittent portfolio outflows, and policy uncertainty—particularly around U.S. trade ties and the India–Pakistan conflict in May. Easing domestic rates add to depreciation pressures, though RBI intervention will offer periodic support going forward. A US trade deal, if finalised in Q4, could also stabilise sentiment. We expect USDINR to rise to 87.8by end-2025, from 85.6 at end-2024. Over the medium term, strong growth and falling inflation will lend some support, but structural pressures—such as a persistent current account deficit and softening capital inflows—will keep USDINR on a gradual rising path through 2026 to 88.3. Meanwhile, the Indonesian Rupiah (IDR) regained ground against the US dollar in Q2, largely due to dollar weakness. We expect a small recovery in the near term, supported by Fed rate cuts, less political tension in Indonesia and Bank Indonesia’s healthy FX reserves, which enable intervention. However, long-term political uncertainty and concerns over central bank independence will weigh on investor confidence, restraining IDR appreciation versus the USD through 2026.

In contrast, Malaysia’s current-account surplus and Bank Negara’s active intervention—backed by ample reserves—will help limit currency swings. These buffers, built up from strong trade performance, support exchange rate stability. Looking ahead, we expect the Malaysian Ringgit (MYR) to remain broadly stable over 2026, driven by easing trade uncertainty, US dollar weakness and a narrowing U.S.–Malaysia rate differential. We expect 4.20 on USDMYR by end-2026.

LatAm: Rebound Limits?

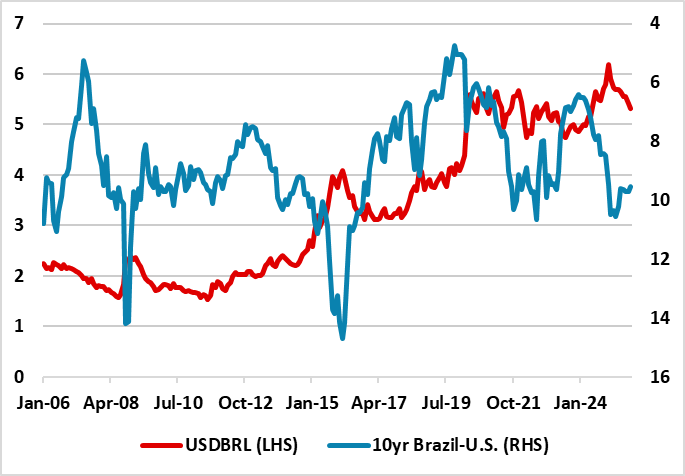

BRL and MXN have seen strong recoveries against the USD in 2025, but how much further can this go into 2026? We still forecast 5.40 for USD/BRL by end 2025.

BRL has headwinds from the October 2026 presidential elections, which will likely see a runoff between Lula and Freitas (an ex Bolsonaro minister here). With tight opinion polls the risk is for pre-election fiscal slippage and this could hurt domestic sentiment. However, global investors are not concerned provided worst case fiscal situations do not play out and they are more focused on the still large carry and bond yield differentials versus the U.S. When the USD saw a multi-year downtrend in 2002-08, the BRL appreciated significantly against the USD. The U.S. tariffs on Brazil do not change this picture due to exemptions and the modest percentage of exports going to the U.S. However, we would not look for this scale of appreciation to be repeated, but we can see USDBRL to 5.20 in H1 2026 on yield plays. The BRL real effective exchange rate is still around 9% below the 10yr average. H2 will likely see a pause around the election and will have different outcomes depending on who is the victor, but our baseline for now is 5.20 – a Freitas victory could see a test of 5.00, as BCB easing in H2 2026 will likely only be modest.

Figure 3: Brazil Exchange Rate, 10-year Yield Spread, and Policy Rate Spread with U.S

Source: Datastream and Continuum Economics

For the MXN, President Donald Trump wants to renegotiate USMCA in 2026, which will deepen the trade drama going into 2026 and likely mean a correction in the MXN by end 2025. A renegotiation will be problematic, but we feel that Mexico sees the big picture and will concede to keep most exports going to the U.S. This could mean a choppy and weaker MXN in H1 2026, before a deal is agreed. H2 could see some renewed upward pressure for the MXN with a USD downtrend and Banxico slowing the pace of easing and the Fed restarting. The policy rate differential with the U.S. will likely move back towards 4%. However, the real effective exchange rate for MXN is 14% above the 10yr average in contrast to the BRL picture. Additionally, the MXN saw little benefit from the major USD downtrend 2002-08. Thus we see a recovery in the MXN in H2 2026, but only to 18.8 on USDMXN.

EMEA

EMEA currencies will continue to be divergent depending on inflation and interest rate differentials, and 2026 will likely see more divergence across EMEA given global uncertainties facing the world economy in terms of both the impact of tariffs and geopolitics.

First, we expect the downward pressure will remain for TRY and RUB as inflation differentials remain large, despite inflation easing slowly in both countries following previous aggressive monetary tightening. We envisage RUB would remain volatile in 2026 since inflationary pressures won’t likely soften as quickly as CBR expected coupled with foreign capital inflows remaining weak until sanctions are lifted. Macroeconomic instability is substantial unless the Ukraine war comes to a surprising end, which is nor our main scenario. RUB will still be falling on a spot basis in 2026 due to inflation differentials and our end year USD/RUB rate predictions are at 83.5 and 90 for 2025 and 2026, respectively.

When it comes to TRY, we continue to see losses for TRY in 2026 as inflation remains much higher than Turkiye’s main trading partners, the current account deficit is large and foreign capital inflows are weaker-than-expected. The arrest of opposition mayors in 2025 have risked the disinflationary process, triggered market losses coupled with loss in investor confidence. In 2026, TRY will still be falling on a spot basis but at a slower pace than the interest rate differentials against the USD, since we expect CBRT will continue its cutting cycle in 2026, but at a cautious pace due to stickiness in inflation and domestic and geopolitical risks. (Note: Our end year key rate prediction for 2025 and 2026 are at 37% and 24%, respectively). Our prediction for the USD/TRY rate stands at 42 by the end of 2025, and 48 for end 2026. It is worth noting that sticky inflation could stay above expectations due to surging food and services prices and adverse geopolitical developments, which would mean more TRY depreciation than our central scenario, likely pushing the rate over 50 for end 2026.

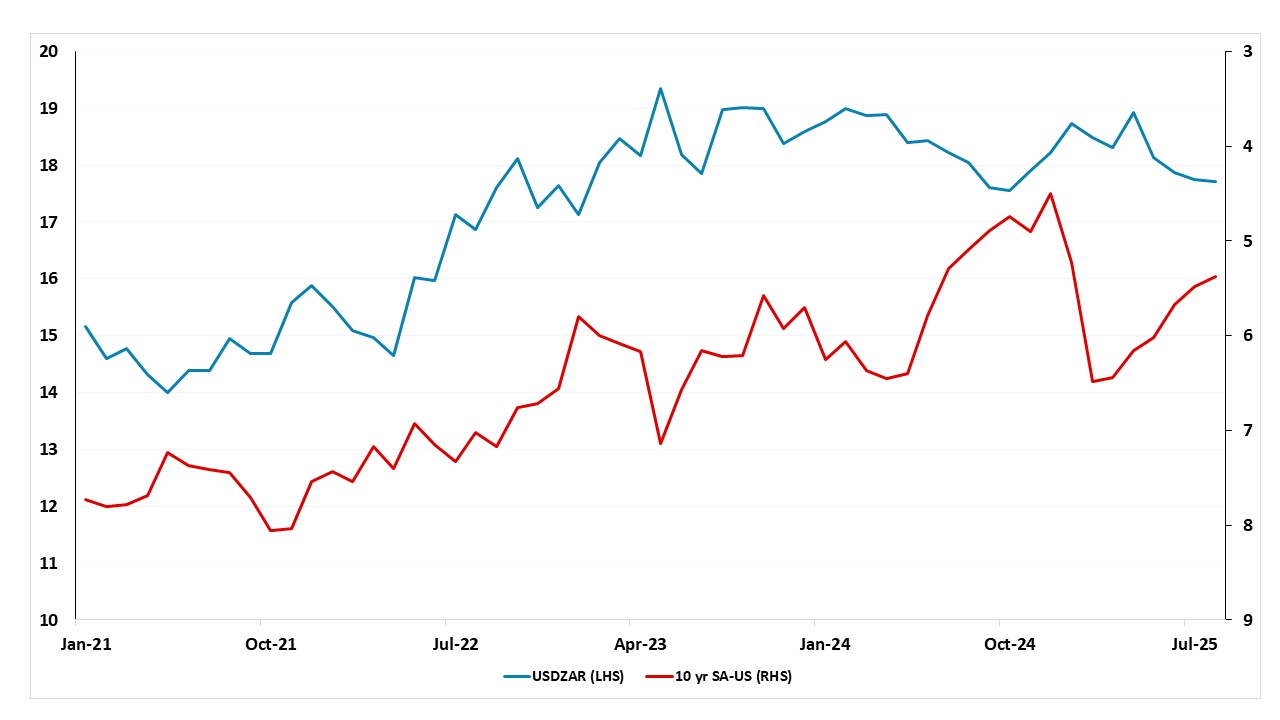

Turning to South Africa, we think the South African Reserve Bank (SARB) will continue its cutting cycle in 2026 carefully (unless steep hikes in domestic inflation occur) as inflation differentials remain modest against the U.S. As we foresee a Dollar downtrend, Fed to reduce the rate by 25bps in October/November and 50 bps in 2026, and SARB to cut key rate by 50 bps in 2026, the interest rate differentials will remain in favour of ZAR. (Note: Despite DM easing cycles continuing, we think SARB will have to be cautious due to global uncertainties like geopolitical risks, tariff wars, and new 3% inflation anchor in 2026, which could slow SARB policy easing). On the upside, if Trump relents on tariffs, power cuts are managed, inflation is contained and there is an improvement in the geopolitical situation, we are likely to see a more risk positive picture emerging with ZAR in 2026. We expect the South African economy will continue to be supported by a trade surplus coupled with a higher FDI and equity flows thanks to increasing investor appetite. Under current circumstances, our end year USD/ZAR rate prediction has decreased to 17.45 for 2025, and 17.40 for 2026, when compared with the June outlook.

Figure 4: USD/ZAR Rate and 10yr South Africa-U.S. Government Bond Yield (%)

Source: DataStream/Continuum Economics