Bank Indonesia Holds Rates at 4.75% Amid Global Uncertainty:

BI opted to hold its interest rate steady at 4.75% after trimming it in a surprise in September. BI will now wait to see the transmission of earlier rate cuts before proceeding with further action. We expect a steady policy rate going into 2026.

Bank Indonesia (BI) kept its benchmark interest rate unchanged at 4.75% in its October 2025 meeting, pausing after three consecutive cuts that had cumulatively lowered borrowing costs by 150 basis points since late 2024. The decision reflects BI’s desire to balance growth support with currency stability at a time when global markets remain volatile and the rupiah (IDR) faces intermittent pressure from a strong US dollar.

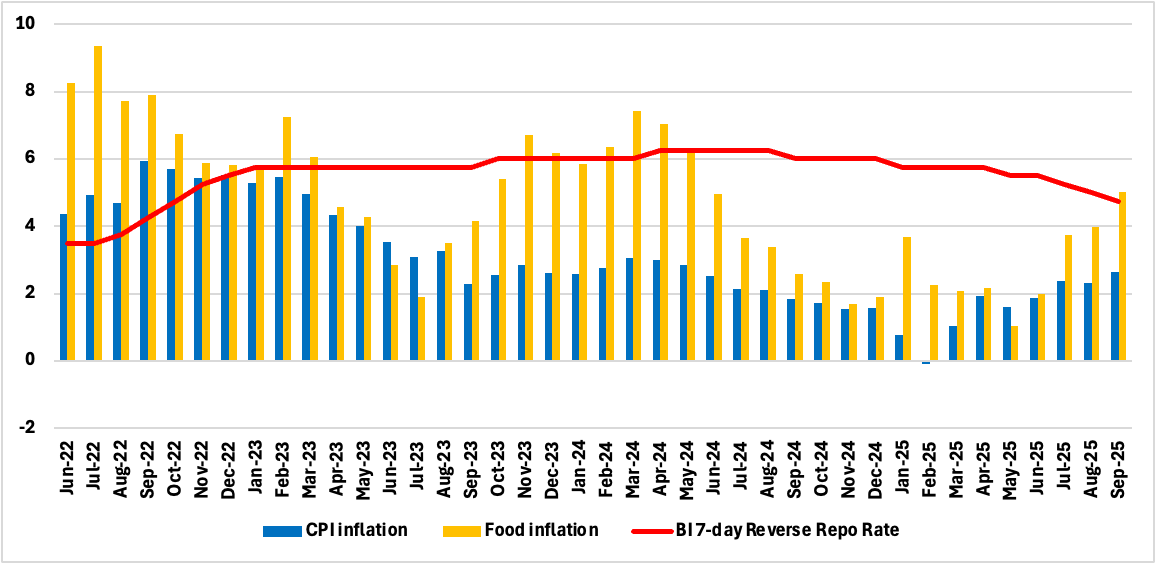

Figure 1: Indonesia CPI, Food Inflation and Main Policy Rate (%)

Governor Perry Warjiyo emphasised that BI’s stance remains “accommodative but cautious,” signalling that further easing remains an option if domestic demand weakens. The deposit facility rate was maintained at 3.75% and the lending facility at 5.50%, consistent with the current policy corridor. BI’s pause was underpinned by three factors. First, stable inflation, consumer prices rose 2.65% y/y in September—comfortably within the central bank’s 2.5% ±1% target range. Second, the currency held firm despite periods of global risk aversion, aided by targeted FX interventions and strong reserve buffers. Finally, GDP expanded 5.12% y/y in Q2 2025, the fastest in two years, though still below potential output as investment and exports remain subdued. Warjiyo noted that the pause was “a strategic opportunity to assess policy transmission,” as earlier rate cuts filter through credit markets and household consumption.

The decision underscores BI’s shift from aggressive stimulus to tactical observation. With inflation well-anchored and liquidity conditions improving, the central bank is prioritising the sustainability of growth over short-term acceleration. Lower borrowing costs from earlier cuts have begun to revive credit growth and household consumption, while infrastructure investment continues to anchor output. However, the external environment remains a key risk. Prolonged high interest rates in the US, renewed tariff frictions, and regional geopolitical uncertainty could disrupt capital inflows and heighten exchange rate volatility.

Financial markets viewed the October decision as a prudent pause rather than a pivot. The rupiah traded broadly stable, and bond yields held near six-month lows, suggesting investor confidence in BI’s data-driven posture. Warjiyo reiterated that “further room for cuts remains open” if inflation continues to ease and domestic demand softens.

The near-term policy outlook remains finely balanced. BI’s next move is likely to be a continued rate hold into 2026, in our view. Another rate cut hinges on moderating real GDP growth,