Bank Indonesia Holds Rates at 4.75%; December Cut Likely

Bank Indonesia held rates in November as expected, prioritising rupiah and inflation stability over premature easing. While a December cut remains likely—especially if the Fed turns dovish—BI has made clear it will move only under the right conditions.

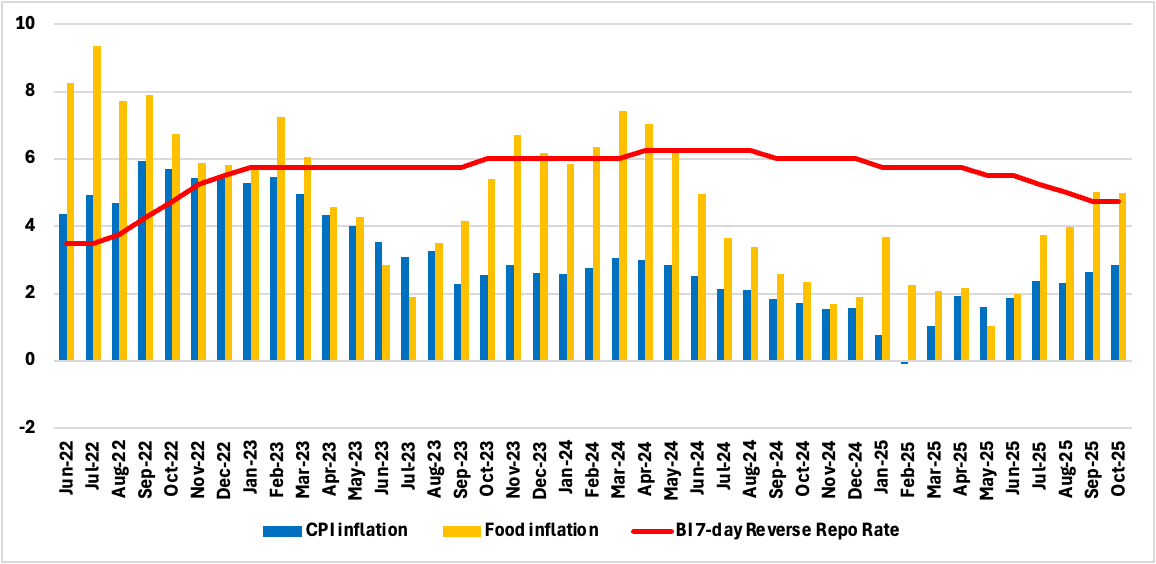

Bank Indonesia (BI) kept its benchmark seven-day reverse repo rate unchanged at 4.75% during its November 18–19 policy meeting, reaffirming a cautious yet flexible stance amid rising external volatility and a fragile global growth environment. This decision extends the central bank’s holding pattern following 150 basis points of cumulative cuts since September 2024, and reflects its dual commitment to rupiah stability and anchored inflation expectations.

BI Governor Perry Warjiyo emphasised that headline inflation, which rose to 2.86% y/y in October, remains well within the official 1.5–3.5% target band. Core inflation has also stayed muted, giving BI space to pause. Importantly, the rupiah has shown signs of relative resilience following earlier episodes of depreciation, thanks in part to FX market interventions. Warjiyo made clear that maintaining currency stability—particularly against a backdrop of rising US yields and AI-driven volatility in global markets—remains a top priority.

On growth, BI upgraded its 2025 GDP outlook to 4.7–5.5%, reflecting stronger-than-expected momentum in Q2 and government stimulus efforts to front-load public investment. However, the bank stopped short of declaring victory on the growth front, citing weak consumer fundamentals, persistent underperformance in construction, and softening machinery investment after a Q2 surge.

Crucially, the board reiterated that further easing remains on the table, but any rate cuts will hinge on a stable rupiah, continued disinflation, and a dovish pivot by the US Federal Reserve. We continue to anticipate a final 25bp cut in December, which could bring the policy rate down to 4.50%, marking the first neutral real rate in nearly two years.

Figure 1: Indonesia CPI, Food Inflation and Main Policy Rate (%)