EMEA Outlook: Uncertainties Give Mixed Signals

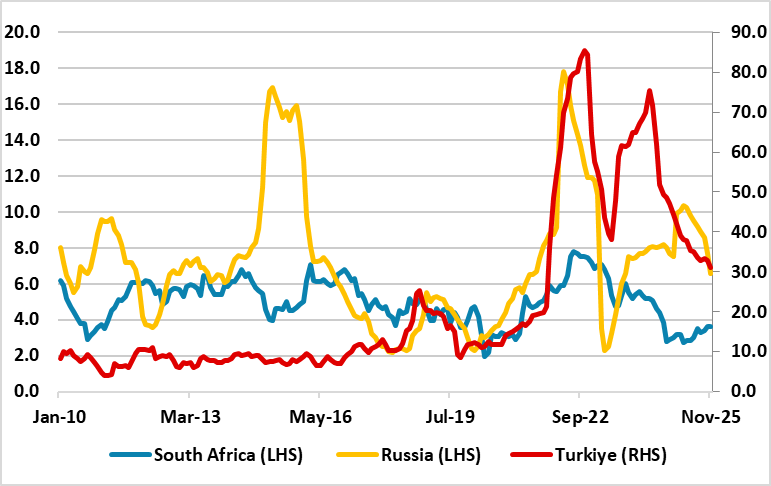

· In South Africa, we foresee average headline inflation will stand at 3.8% and 3.5% in 2026 and 2027, respectively. Upside risks to inflation remain such as, utility costs, and supply chain destructions. We see growth to be 1.4% and 1.5% in 2026 and 2027, respectively. Risks to the growth outlook are broadly balanced, with faster reform implementation and suspended load shedding representing an upside risk to growth while uncertainties about the U.S. and Chinese economies and the risk of new tariffs by the U.S. on South Africa in 2026 could cause problems. Our end-year policy rate predictions are at 6.75% for 2026 and 6.5% for 2027.

· In Turkiye, deteriorated pricing behaviour, the arrests of opposition mayors, sticky services prices continue to risk the disinflationary process couple with loss in investor confidence and currency volatility. Our average inflation forecasts stand at 26.5% and 20.2% for 2026 and 2027 respectively since inflation expectations and pricing behavior remain fragile. We think Central Bank of Republic of Turkiye (CBRT) will likely reduce the rate to 29% by end-2026, while stubborn inflation will limit the size of the cuts. We forecast the economy to expand by 3.4% in 2026 and 3.7% in 2027 backed by robust investments, construction projects and government spending while high inflation and tighter fiscal stance will continue to dent growth. A high risk exists that the presidential election could occur Oct-Nov 2027 rather than 2028.

· In Russia, the Ukraine war continues to create high military spending, strong fiscal stimulus in addition to aggravation of staff shortages. Our baseline scenario is now a Russia friendly peace deal (70%) and the alternative is for the war to continue (30%), though a deal is likely to come late 2026. Our 2026 average headline inflation forecast is 6.2% YoY owing to lagged impacts of previous aggressive monetary tightening, and relative resilience of RUB despite sanctions and supply chain inefficiencies. Our end-year policy rate prediction stands at 13% for 2026, and 11.5% for 2027 as we foresee Central Bank of Russia (CBR) will continue its easing cycle, but with a slower pace when compared to 2025. We envisage growth to hit 1.3% and 1.4% in 2026 and 2027.

Forecast changes: From our September outlook, we have lifted our 2026 end-year key policy rate for Turkiye to 29.0% due to stubborn inflation; and hiked our 2026 average inflation forecast for Turkiye to 26.5% due to inflationary risks and sticky services (particularly education and housing) prices.

EMEA Dynamics: Global Uncertainties and Diverse Domestic Dynamics Continue to Dominate

We think volatile U.S. economy, slowing Chinese economy, trade tariffs, and especially country specific factors continue to rule the EMEA outlook. The pace of EMEA monetary easing cycles continue to differ, as progress towards inflation targets and domestic factors vary. We foresee EMEA countries will see divergent growth prospects in 2026/7, given differing levels of U.S. tariffs and internal growth dynamics.

Inflation remains the major concern for some EMEA economies since they remain elevated in Russia and Turkey while previous aggressive monetary tightening cycles are still feeding through helping inflation to follow a downward trend. South African Reserve Bank (SARB) continued its easing cycle in 2025 as inflation stays under control; while the new 3% inflation anchor and inflation risks will likely cause SARB to halt easing in H1 2026 and then one small 25bps in 2027. Taking into account that inflation started to soften in Russia after June, CBR resumed its easing cycle as inflationary pressures moderately softened. Turkiye will likely resume its cutting cycle in 2026 despite the pace of disinflationary process slowed down in Q4 2025 due to stubborn education and housing prices. The sizes of the cuts by the CBRT in 2026 will depend on the course of the inflation, domestic politics and global developments.

We think with negative lagged impacts of 2025 U.S. tariffs could darken the EMEA growth prospects in 2026. Slowing Chinese economy coupled with the U.S. slowdown will continue to pressurize EMEA economies. For EMEA countries, the 2025 tariffs are significant headwinds for exports and capex, with the scale influenced by the scale of openness for the economies. The content and the timing of U.S.- China trade negotiations will also be a significant factor for the EMEA trajectory. (Note: we see the China/U.S. trade truce holding but a comprehensive trade deal remains doubtful). As mentioned, Chinese economic momentum is slowing into 2026 due to a modest consumer, plus continued drag from residential investment and slowing exports and we think these could also worsen growth trajectories for South Africa and Russia commodity demand.

Permanent peace deals in Ukraine and Gaza coupled with lowered tension in the Middle East could particularly help Russian and Turkish economies to feel relieved. (Note: Our baseline view in Ukraine is Trump’s latest peace proposal will likely be used as a starting point turning into a Russia friendly peace deal (70% probability) late 2026/early 2027 or war dragging into 2027 (30% probability).

Figure 1: South Africa, Russia (LHS) and Turkiye Inflation (RHS) (%, YoY), January 2010 – November 2025

Source: Continuum Economics, Datastream

South Africa

Despite South Africa facing structural challenges such as declining real per capita growth, high unemployment and poverty rates, the economy continues to enjoy moderate growth and inflation remaining within SARB’s new target band of 2% and 4%. (Note: annual inflation stood at 3.6% YoY in October).

The macroeconomic outlook remains positive owing to moderate progress on reforms. South Africa was officially removed from the Financial Action Task Force's (FATF) greylist on October 24 which could potentially lower transaction costs for businesses in the medium term. South Africa has also secured its first credit upgrade in two decades on November 14, after S&P Global Ratings lifted the country’s sovereign ratings by one notch to BB on the back of reforms and growing fiscal revenue, was also a significant development.

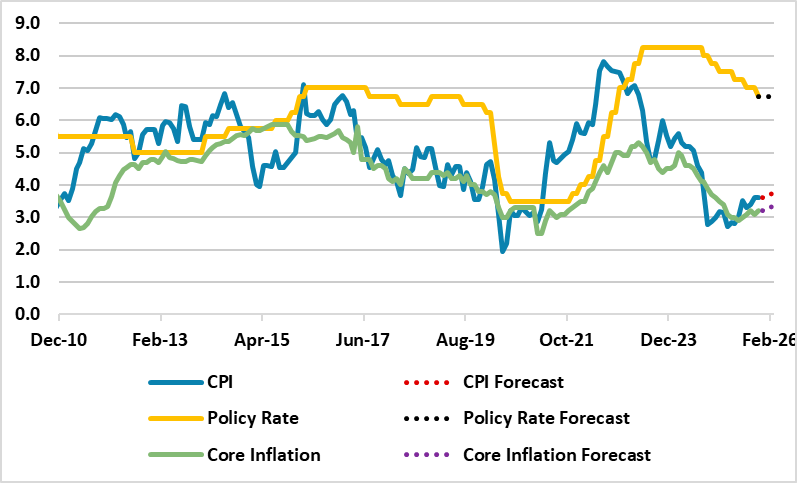

One other good news for the inflation outlook has been the recent drop in inflation expectations. The Bureau for Economic Research’s (BER) latest survey for the SARB in December showed that in Q4 2025 (the first survey after the inflation target changed to 3%), the two- and five-year inflation expectations on average, fell to a record low of 3.7% (from 4.2% before). Next-year expectations were also down by a significant margin (0.4% pts) to 3.8%. Household inflation expectations resumed its downward trend, after a brief pause in Q3; one-year expectations were observed at 5.3% (5.5% previously).

Figure 2: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2010 – April 2026

Source: Continuum Economics

Despite favorable macro developments, there are some modest worrying signals about the inflation trajectory heading to 2026, and we consider it is set to move closer to 4% in 2026 as increase in utility costs and climate-related agricultural disruptions will likely continue to pressurize prices. (Note: SARB now targets to keep inflation at 3%, with a one percentage point tolerance band, making the implicit target 2% to 4%, which was announced in November).

We still feel a significant risk factor for the inflation trajectory is the power cuts (load shedding) as Stage 2-3 load shedding was implemented in Q2. (Note: Eskom announced on December 12 that South Africa has now experienced 210 consecutive days without an interrupted supply, with only 26 hours of loadshedding recorded in April and May). Despite few load shedding in H2, some energy analysts think blackouts are still a threat and further power disruptions are likely while continued investment build out of energy infrastructure remain the key.

Under current circumstances, we foresee average inflation will hit 3.8% and 3.5% in 2026 and 2027, respectively, supported moderately by long lagged impacts of previous tightening, and a relatively stable ZAR. We believe the key for the inflation trajectory will be the global developments, tariffs, government’s determination to address the electricity shortages, logistical constraints and financing needs – though we forecast a decline in oil prices, which will help on the margin. Global uncertainties such as 30% additional tariffs over South Africa by the U.S. is a threat, particularly for South African cars manufacturers and agricultural producers. Despite talks on a possible trade deal continuing between the U.S. and South Africa, no trade deal is signed by the end-2025 is worrisome, partly showing Trump’s discontent about South African politics. (It is worth mentioning that U.S. tariffs are disinflationary, as it would hurt South Africa exports and output/employment).

It is worth mentioning that SARB announced some important forecast changes on November 20. Accordingly, the inflation forecasts for 2025 and 2026 were slightly revised downward to 3.3% (from 3.4%) and 3.5% (from 3.6%), respectively. On the GDP growth front, the SARB raised its 2025 growth forecast to 1.3% (previously 1.2%) and maintained the 2026 projection at 1.4%.

SARB continued its cutting cycle in November and decreased key rate to 6.75% owing to moderate inflation, stronger ZAR, few power cuts in H2, balanced growth risks, and stable oil prices. We foresee cautious and data-dependent SARB will likely try to bring inflation down to new 3% anchor and assess the impact of earlier cuts before continuing it’s easing cycle in 2026. Thus, we think SARB will likely halt its cutting cycle H1. We expect SARB could consider reducing the rates in H2 2026, which will depend on the inflation trajectory, while this is not our baseline scenario since data-dependent SARB will likely act cautious against any expected inflation uptick taking the new inflation target into consideration. Our end-year key rate predictions remain at 6.75% and 6.5% for 2026 and 2027, respectively. As an alternative scenario and inflation undershoots our forecast, then SARB could do a little more easing in 2026 and 2027.

Political uncertainty, slow reform implementation, and any fiscal slippage pose internal risks. More importantly, the ANC-DA led coalition remains under pressure due to clashes over tax policy and the adoption of contentious land-expropriation, health insurance and education legislation. Some political analysts forecast that the coalition will not last until 2029, which is not our baseline scenario.

Despite these concerns, taking into account that inflation is currently contained well and there is potential for further improvements in fiscal metrics and government debt stabilisation after a medium-term budget update in November partly signaling that government debt was coming under control, the fiscal situation is not deteriorating.

Figure 3: SARB Interest Rate Forecast (%), 2019 – 2028

Source: SARB Forecast Report (December 2025)

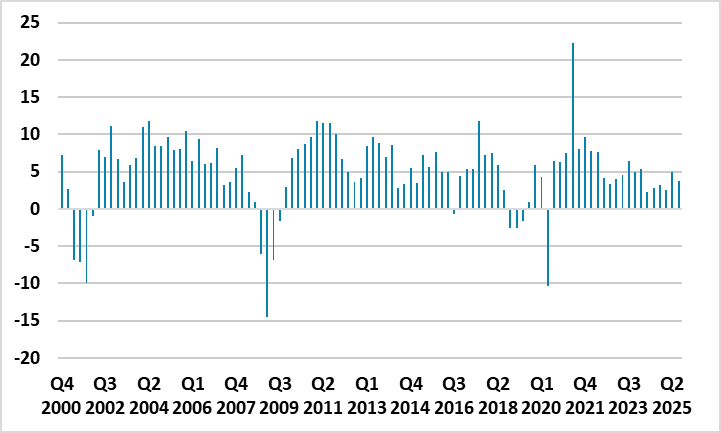

South African economy grew by 2.1% YoY in Q3, the fastest expansion since Q3 2022. The expenditure side of the economy was lifted by stronger gross fixed capital formation, household consumption, and government consumption. Household spending expanded for a sixth consecutive quarter in Q3, rising by 0.7%. After three consecutive quarters of decline, gross fixed capital formation (spending on infrastructure and other fixed assets) expanded by 1.6%. We also think that the growth momentum will continue to be supported by low inflation, improved consumer sentiment, fewer loadshedding, moderate oil prices and interest rate cuts. Uncertain global environment, slowing external demand and logistical constrains would be downside factors.

We assess the economy will grow by 1.4% and 1.5% y/y in 2026 and 2027, respectively. Domestic factors such as persistent structural challenges such as unemployment and lack of fiscal space will continue to temper the outlook. (note: Unemployment remains stubbornly high at around 33% in South Africa which require urgent labor market reforms to unlock inclusive growth. We think continued implementation of Operation Vulindlela reforms - targeting energy, logistics, water, and digital infrastructure – will also be key to unlocking productivity and competitiveness).

Turkiye

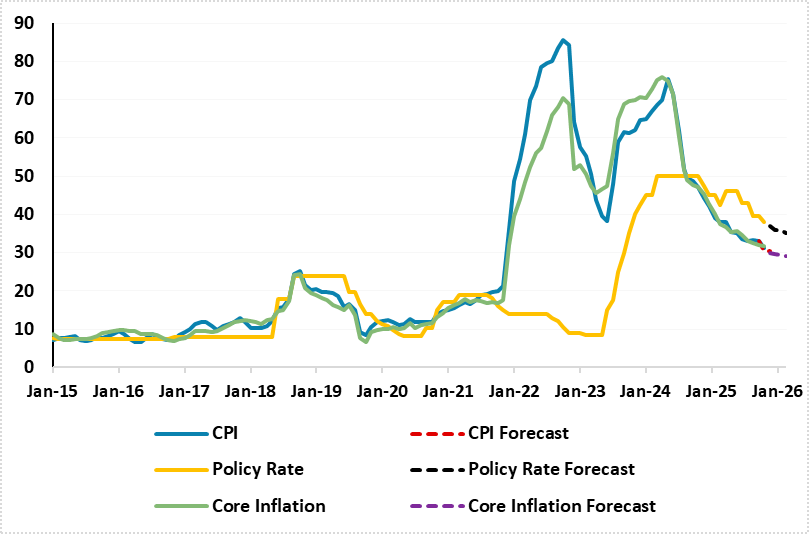

Despite decelerated less-than-expected, Yr/Yr inflation in Turkiye continued to soften in H2 backed by lagged impacts of the tightening cycle, tighter fiscal measures and suppressed wages, and relative slowdown in credit growth. CPI cooled down to 32.9% in October, and we expect the slowdown to continue, but with a slower pace in 2026. The extent of the decline will be determined by minimum wage hike, services prices, global developments and TRY volatility. We think volatile food and energy prices in TRY terms could also pose upside risks to the inflation trajectory, though in USD terms we look for oil prices to soften.

According to the CBRT’s November 2025 inflation report, the inflation targets for end-2026 and end-2027 have been set at 16% and 9%, respectively, while the forecast range kept at 13-19% for 2026. We anticipate the wage-inflation spiral, deteriorated pricing behavior and stickiness of services inflation will keep inflation pressures strong in 2026. If the Ukraine-Russia war will come to an end, this will be suppressing the Turkish inflation outlook.

Our forecast for the annual average headline inflation for 2026 remain high at 26.5% since the deceleration in the pace of disinflation process will likely continue in 2026. Inflation expectations and pricing behavior remain fragile. We feel TRY remains exposed to any major changes in the global risk sentiment and domestic political shifts, while a sudden depreciation could easily reverse disinflation gains.

We continue to envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation (especially services) has become stickier and requiring high nominal and real interest rates to remain for some time. It appears it would be necessary to make concessions on growth to achieve inflation in the 10 percent’s. We anticipate domestic risks will keep inflation pressures alive for a longer period, and it will be very unlikely to reach a single digit inflation by 2027.

It is worth emphasizing that the arrests of opposition mayors including Istanbul, Adana and Antalya in 2025 continue to risk the disinflationary process due to loss in investor confidence and potential future currency volatility. Opposition’s presidential candidate, Ekrem Imamoglu is still in jail and prosecutors recently have accused Imamoglu of 142 corruption offences that command jail terms ranging from 828 to 2,352 years.

Despite CBRT cutting the policy rate by 150 bps to 38% during the MPC meeting on December 11 (encouraged by softer November inflation), it was interesting to see that MPC indicated that inflation expectations and pricing behavior are showing some signs of improvement even as they continue to pose risks to the disinflation process. We expect a CBRT will continue its cutting cycle in 2026, but with caution due to inflation risks, unless there is a sustained surge in the underlying trend of monthly inflation is observed and heightened political instability. Our end year key rate prediction for 2026 and 2027 stand at 29% and 24%, respectively, higher than the September outlook due to deceleration in the slowdown of inflation. We expect the monetary easing cycle to support a continued normalization of funding cost towards the policy rate, but slowly.

It is worth mentioning that parliamentary elections in Turkiye are scheduled to occur no later than May 7, 2028, alongside presidential elections. We expect the elections to be held in October/November 2027, earlier than the scheduled time. It will not be surprising if Erdogan would want a faster easing cycle in 2027 aiming to pump up the economy, which could significantly change CBRT’s plans for 2027 and onwards.

Another major issue related to CBRT is its creditworthiness. Taking into account that sustained economic recovery hinges on the independence of the CBRT and rule-of-law reforms, we think any backsliding could easily trigger market volatility. There is serious domestic criticism about the credibility of the CBRT since the actual inflation continues to significantly deviate from the CBRT’s targets and CBRT’s decisions are controlled by the current government, particularly in the last five years, causing CBRT’s forward communication to be weak and discredited.

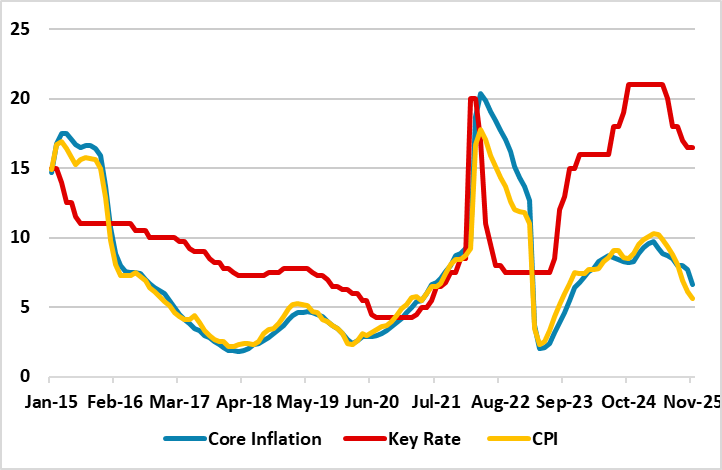

Figure 4: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – April 2026

Source: Continuum Economics

Despite the weight of high interest rates and inflation continue to dominate growth outlook, the Turkish economy grew by 3.7% YoY in Q3 backed by robust household consumption, investments, and government spending.

We think 2026 growth will be likely be higher than 2025, hitting 3.4% YoY, supported by positive impacts of the rate cuts. The government has recently launched the Century Housing Project, a major initiative to build 500,000 social housing units across all 81 provinces. This is in addition to ongoing construction projects for the ones affected from earthquakes in 2023, which will also stimulate growth next year. We foresee 2027 growth will be likely higher than 2026 with 3.7% supported by increasing business confidence assuming no dramatic impact from weaker external demand and no major political turbulence. We think a drop in the inflation rate and rate cuts could boost confidence in the medium term, coupled with accelerated structural reforms, and stable global conditions could lift growth back toward potential of around 4% after 2027.

On the other side of the coin, tight monetary and income policies, any unexpected resurgence of inflation, any accelerated TRY depreciation, and persistently high interest rates could derail recovery and reignite macro instability. There is still a downside risk that growth can be lower than expected, particularly considering all the tightening measures in place.

Figure 5: GDP Growth (%, YoY), Q1 2000 – Q3 2025

Source: Continuum Economics

Russia

Russian economy continues to face structural challenges; from sanctions and supply chain disruptions to demographic decline and fiscal pressures. The war in Ukraine remains determinant for all outlooks as it creates an increasing financial burden and labor constraints on Russia. The overall environment for doing business in and with Russia also remains unfavorable.

On the inflation front, CPI moderately edged down in H2 owing to lagged impacts of previous tight monetary policy and the RUB has shown relative resilience, particularly after June. Headline inflation hit 6.6% YoY in November despite food and services prices continued to be high but with a slower pace. Our CPI forecasts are at 6.2% and 5.4% in 2026 and 2027, respectively since we expect inflation will continue to soften in 2026 as previous tight monetary policy affect bank lending and private consumption.

Though CBR is projecting that inflation returns to the 4-5% target in 2026, we think reaching this target will be tough due to continued military spending, labor shortages, and supply-chain disruptions and import suppression causing upward pressure on prices coupled with adverse effects of the value-added tax (VAT) increase in 2026. (Note: President Putin recently approved raising the VAT to 22% from 20% for 2026. Speaking about VAT hike, Finance Minister Anton Siluanov said on December 9 that VAT hike aims to fund soaring defense and security spending is expected to drive consumer prices up by around 1% next year).

Backed by a softening inflation, CBR continued its easing cycle in H2 2025 and reduced the key rate to 16.5% per annum in October highlighting inflationary pressures continue to decline. We think CBR will likely resume cutting rates (moderately) in 2026 if the inflation trajectory allows, RUB stabilizes and inflation expectations converge towards CBR’s forecasts. Our end-year key rate forecast is at 13% and 11.5% for 2026 and 2027, respectively. Russia will have to keep rates high as the country need higher real yields. As an alternative scenario, we think a faster CBR easing cycle is likely in 2027, if a full scale peace deal is signed in Ukraine relieving the Russian economy and Putin wants a domestic demand boost as military spending slows.

As mentioned, the inflation trajectory and rate decisions will depend on how peace negotiations in Ukraine will proceed. A peace deal could help Russian economy to feel relief since military spending growth will slow; RUB will likely strengthen, average headline inflation will soften, and fiscal pressure will ease, particularly if sanctions will be lifted.

The probability of war continuing throughout 2026 and into 2027 is now at 30% since we think Trump’s peace proposal will likely be used as a framework document which could turn into a Russia-friendly peace deal (70%) in late 2026/early 2027 after some rounds of revisions. We continue to think Ukraine remains in a weaker negotiating place and, at some point Ukraine will have to admit giving up some land to Russia. Both parties are exhausted because of the war. Our main scenario is based on a Russia-friendly peace deal with Russia annexing areas in and around four Ukrainian oblasts that it occupied, securing no NATO membership for Ukraine and no foreign troops in Ukrainian territory.

Figure 6: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2015 – November 2025

Source: Continuum Economics

When it comes to growth, the main driver for Russian GDP growth remains the surge in military spending, supported by the improved consumer demand amid greater outlays on social support, higher wages and strong fiscal stimulus. Russia's GDP expanded by a moderate 0.6% y/y in Q3 2025, marking the slowest rate of growth since Q1 2023 showing the economic slowdown in Russia is more evident now. We think CBR’s previous aggressive monetary tightening coupled with sanctions, supply side constraints, low crude oil prices, softening natural gas exports due to European sanctions, relative RUB resilience and stubborn price pressures are headwinds for the economy.

Despite sanctions, Russia maintains energy export flows to non-Western markets, particularly China, India, and parts of Africa. We envisage growth to hit 1.1% and 1.3% in 2026 and 2027, respectively, as tightening cycle is still feeding through and easing effects will only come through fully into H2 2027/2028. Meanwhile, capacity utilization reached its maximum in years, and labor force supply problems due to troop call ups is unlikely to change in the near term. It is worth mentioning that population aging and emigration are also shrinking the labor force, undermining long-term growth potential in Russia. The key for Russian economic growth in the next few years will be if a deal in Ukraine will be sealed, and when (and which) sanctions will be lifted.