Trump Tariffs: China, Mexico and Semiconductors

· Our baseline (60% probability) remains that a U.S./China trade deal will be agreed in Q4/Q1 2026 and it is possible though unlikely that this could be announced at the Trump/Xi meeting at the October 31 APEC summit – China requests that the U.S. changes policy on Taiwan could slow progress. Meanwhile, a further extension for Mexico is likely for U.S. reciprocal tariffs, before the real pressure starts in January 2026 with the U.S. demands for the USMCA agreement. The U.S. could also announce some targeted product tariffs on semiconductors in the coming months. Finally, we feel that the Supreme Court will likely rule in favor of Trump’s reciprocal and fentanyl tariffs, though a surprise rejection would like see the Trump administration introduce alternative tariffs. Overall, less material changes than earlier in 2025, but still some extra trade uncertainty as a headwind.

President Donald Trump is not yet finished with his tariff crusade, but what will be next?

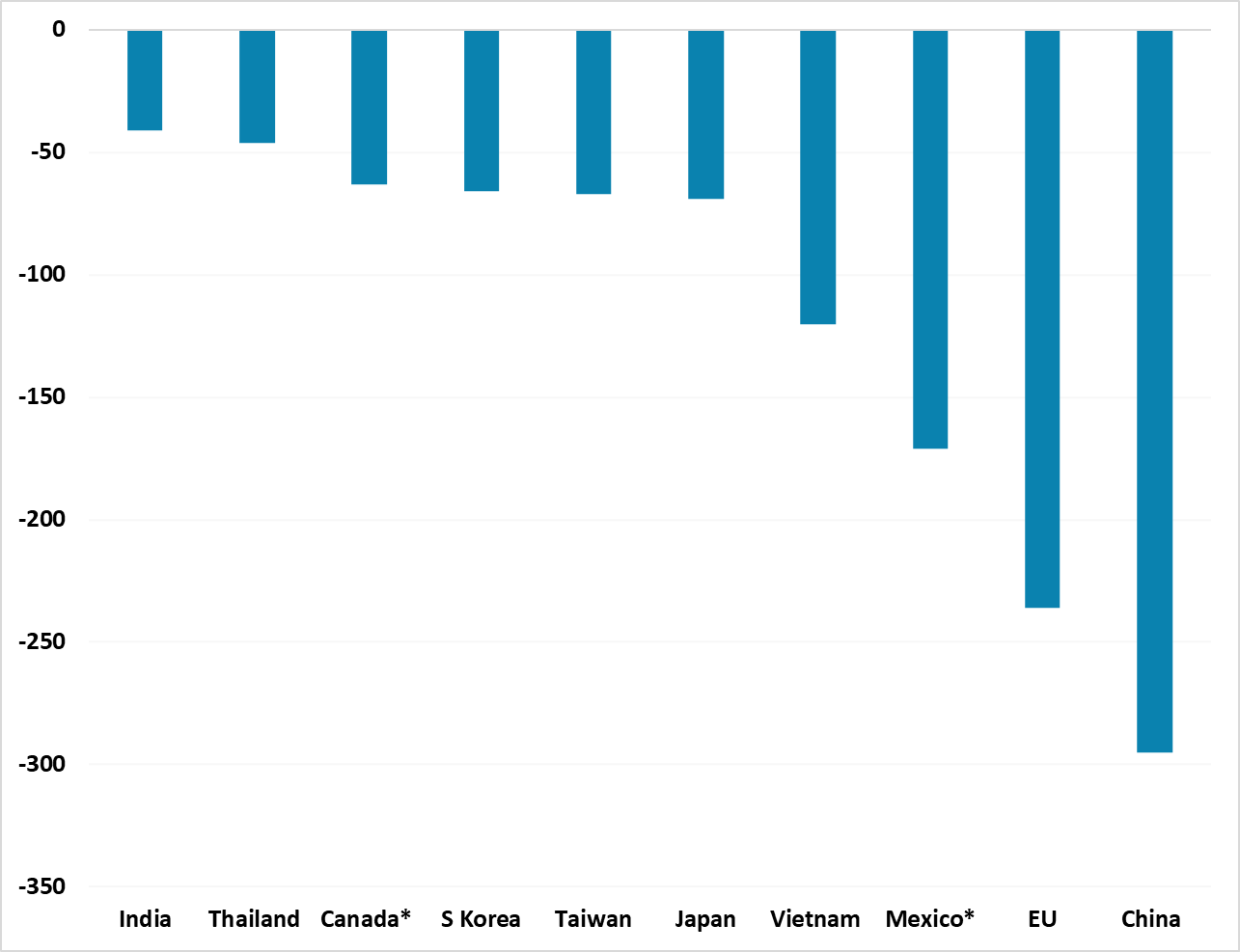

Figure 1: 2024 Bilateral U.S. Trade Deficits (USD Blns)

Source: BEA/Continuum Economics. US does not have trade deals with China/Taiwan/India, with Canada/Mexico largely exempt due to USMCA

Trump’s tariff push is less intense than April and August, but is not finished with a selection of product tariffs last week and outstanding trade disputes. Key points to note.

· Branded Pharma and others. The 100% tariff on branded pharmaceuticals has less bite than the headline, as companies are exempt if they are starting construction projects for new manufacturing in the U.S. Additionally, the U.S. has clarified that existing deals with the EU and Japan will cap branded pharma products at 15%, as agreed in bilateral trade deals. Finally, on pharma the Trump administration has been restrained by the opposing desire not to raise domestic pharma prices, which is an important political topic. Targeted tariffs were also announced in other areas e.g. heavy trucks/furniture. The U.S. could announce some targeted tariff on semiconductors in the coming months, as the next installment in product tariffs but could then pause. The announcements are part theatre to show the world that Trump can still impose tariffs and also keeping the U.S. options open in case the U.S. Supreme Court rejects the reciprocal tariffs in late Q4/early Q1 2026 – unlikely but possible. Uncertainty remains high with the Supreme Court set to consider an appeals court ruling against Trump’s reciprocal and fentanyl tariffs. While Trump’s claim that trade deficits represented an emergency is a dubious one, we expect the Supreme Court will rule in favor of these tariffs, though we would not rule out the possibility of them seeking some middle ground. If the Supreme Court does rule against these tariffs, Trump has legal means that he could pursue to impose other tariffs, and deals made with various trading partners are likely to stick.

· China. President Trump and Xi are scheduled to meet at the APEC summit in S Korea on October 31. The pace of trade negotiations has picked up, with a positive 4th round set of discussions in Madrid and a cordial Trump/Xi phone call on September 19 – the U.S. has also stalled an agreement with Taiwan not to upset China. An agreement by October 31 is possible, but unlikely. If no deal is seen by November 10, then a further extension is highly likely. China is pushing for the U.S. to change policy to opposing Taiwan independence (a request repeatedly rejected by the Biden administration). Xi is testing the water, but Trump is unlikely to compromise fully on the strategic ambiguity policy on Taiwan. While this remains in place, a China invasion of Taiwan risks bringing the U.S. in on a military basis and this is too high risk for Xi. We feel China will likely continue the grey warfare to pressure Taiwan (here). On the U.S./China trade deal, we still attach a 60% probability to a deal being agreed in Q4 or Q1 that could see a reduction in reciprocal/fentanyl tariffs from 30% to 20% (here), though the risk of no deal is still a high 40%.

· Mexico. The 90 day extension for Mexico is due to end on October 10, but the good relationship between President Trump and Sheinbaum should mean that a further extension is seen. Though this process is creating some uncertainty, it is worth remembering that most goods are USMCA exempt from reciprocal or product tariffs. Even so, Trump wants an improved USMCA deal, which is due to be extended in July 2026 by a further 16 years – if not extended it would still run until 2036. Trump will likely pressure Mexico and Canada in Q1 2026 on USMCA, with the USTR due to report to Congress in January 2026 and likely to start revealing U.S. demands. This means that the Mexico/Canada tariff story will evolve into a 2026 USMCA review debate, which is more important for the countries.

Overall, Trump love of tariffs suggests that he will always want to flex his muscles, but with a lot of reciprocal and product tariffs already announced the average effective tariff rate is settling around 17% and the key issue remains the adverse feedthrough to real GDP and boost to inflation. We covered this in our September U.S. Outlook (here) and our baseline view is for a soft landing for the U.S. economy.