SARB Reduced Key Rate to 6.75% Following Favorable Inflation Outlook

Bottom Line: South African Reserve Bank (SARB) cut the policy rate by 25 bps to 6.75% during the MPC on November 20 owing to moderate inflation, stronger ZAR, few power cuts (loadshedding) in Q3, balanced growth risks, and lower oil prices. The MPC decision was unanimous. SARB governor Kganyago mentioned on November 20 that MPC members agreed there was scope now to make the policy stance less restrictive, in the context of an improved inflation outlook.

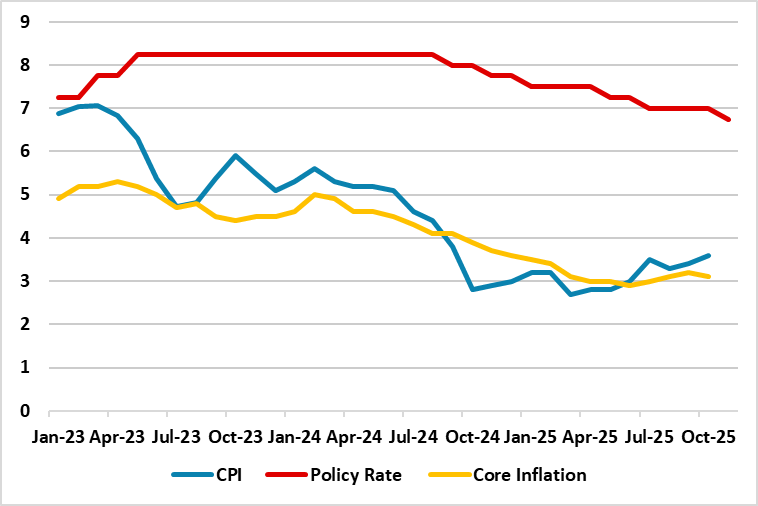

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), April 2023 – November 2025

Source: Continuum Economics

SARB’s MPC convened on November 20 announcing the last key rate decision of 2025, and reduced policy rate by 25 bps to 6.75% owing to moderate inflation, stronger ZAR, few power cuts (loadshedding) in Q3, positive macroeconomic outlook, balanced growth risks and lower oil prices. (Note: Despite annual inflation stood at 3.6% YoY in October which is above new 3% inflation anchor, it remained within the tolerance band of 1 percentage point either side of 3%). The MPC decision was unanimous.

First, it is worth noting that SARB now targets to keep inflation at 3%, with a one percentage point tolerance band, making the implicit target 2% to 4%. As announced last week, SARB changed its 3-6% target range which was established 25 years ago; following finance minister Godongwana endorsing the new 3% target by providing indirect political support to the SARB, according to sources.

SARB announced some important forecast changes on November 20 as well. Accordingly, the inflation forecasts for 2025 and 2026 were slightly revised downward to 3.3% (from 3.4%) and 3.5% (from 3.6%), respectively. On the GDP growth front, the SARB raised its 2025 growth forecast to 1.3% (previously 1.2%) and maintained the 2026 projection at 1.4%.

Speaking about the rate cut, SARB governor Kganyago mentioned that the MPC assessed the risks to South Africa’s inflation outlook as balanced. Kganyago added that "Because of these downside surprises, together with a stronger rand and a lower oil price assumption, we have small downward revisions to our inflation outlook, for both 2025 and 2026. We remain on track to deliver 3% inflation over the medium term."

We think the rate cut decision was also backed by positive macroeconomic outlook and recent progress on reforms. South Africa was officially removed from the Financial Action Task Force's (FATF) greylist on October 24 which could potentially lower transaction costs for businesses in the medium term. South Africa has also secured its first credit upgrade in two decades on November 14, after S&P Global Ratings lifted the country’s sovereign ratings by one notch to BB on the back of reforms and growing fiscal revenue, was also a significant development.

Taking into account that inflation is currently contained well and there is potential for further improvements in fiscal metrics and government debt stabilisation after a medium-term budget update in November partly signaling that government debt was coming under control, these will likely provide room for SARB for further cuts in 2026 but will depend on various matters including inflation trajectory, global uncertainties, tariffs, oil prices and government’s determination to address the electricity shortages, logistical constraints and financing needs.

I,Volkan Sezgin, the Senior EMEA Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.