RBI Cuts Repo Rate to 5.25% as Inflation Hits Record Lows

The RBI’s December cut marks a decisive shift toward pro-growth policy at a moment of exceptionally low inflation. With the economy outperforming and price pressures collapsing, the central bank is signalling confidence—but the trajectory of the rupee and the uncertainty of US trade policy remain the two variables that could shape how far the easing cycle ultimately runs.

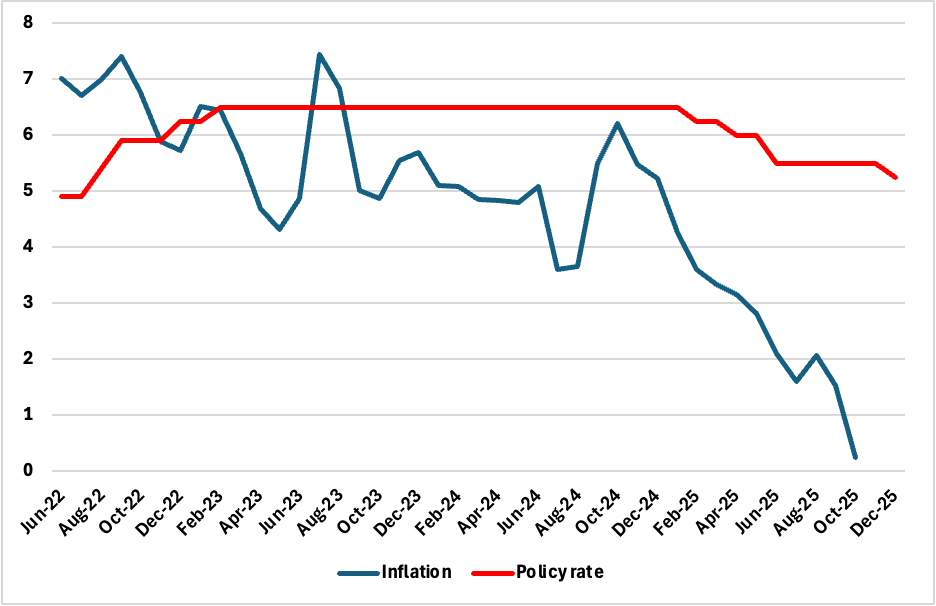

Figure 1: India CPI and Policy Rate (%)

Commensurate with our view, India’s central bank delivered a 25-basis-point rate cut today, lowering the repo rate to 5.25% and extending one of the most aggressive easing cycles since the pandemic. The move takes total reductions in 2025 to 125 bps, underscoring policymakers’ confidence that India has entered a rare period of strong growth and ultra-low inflation despite a weakening rupee and global trade headwinds.

Announcing the decision, Governor Sanjay Malhotra described the current macro environment as a “rare goldilocks phase,” with headline inflation falling far more sharply than anticipated and growth continuing to outperform. The Monetary Policy Committee (MPC) voted unanimously to cut rates and retained a neutral stance, signalling that further adjustments remain data-dependent rather than pre-committed. The standing deposit facility rate was lowered to 5.00%, while the marginal standing facility and bank rate were reduced to 5.50%. Malhotra dismissed concerns about the rupee—now trading below 90 per USD—arguing that the central bank is “comfortable with the external sector” and would allow the currency to seek its appropriate level.

The case for easing was strengthened by an extraordinary collapse in inflation. Headline CPI fell to 0.25% in October, driven by deep food deflation, GST rationalisation, and powerful base effects. This is the lowest reading since the CPI series began. At the same time, India’s growth narrative has strengthened: Q2 FY26 GDP rose 8.2%, beating both RBI and our expectations. Policymakers appear to have prioritised the downside risks to demand from tariffs, weak consumption pockets, and global uncertainty over currency volatility—a notable shift toward growth-sensitive policymaking. Meanwhile. to ensure liquidity remains supportive, the RBI also announced up to INR 1tn of OMO purchases, signalling that monetary transmission will be actively reinforced.

The rate cut offers immediate relief for households and businesses, with borrowing costs set to decline across mortgages, consumer loans, and corporate credit. Consumption-led sectors—real estate, automobiles, durables—stand to benefit as banks reduce lending rates. But risks remain. Persistent rupee weakness could complicate monetary transmission, particularly if US tariffs on Indian exports remain at 50% and trigger fresh equity outflows. A widening current account deficit amid strong import demand may also limit the RBI’s room for manoeuvre.

The central bank sharply upgraded its FY26 growth forecast to 7.3% from 6.8% and cut its inflation projection from 2.6% to 2%, suggesting a long runway of benign price dynamics. Quarterly inflation is expected to remain below 3% through FY26, keeping policy space wide open. While the December minutes (due 19 December) will indicate how the MPC views the balance of risks, we expect at least one more cut in early 2026 if disinflation persists and global conditions do not deteriorate sharply.