SARB Holds Rate Stable at 7.0% to Bring the Inflation Down to New 3% Anchor and Assess Impacts of Earlier Cuts

Bottom Line: South African Reserve Bank (SARB) held the policy rate at 7.0% during the MPC on September 18 as annual inflation hit 3.3% YoY in August which is above new inflation anchor coupled with surged core inflation. SARB governor Kganyago said on September 18 that MPC expects headline inflation to rise over the next few months, peaking at around 4%. Under current circumstances, cautious and data-dependent SARB will likely try to bring inflation down to new 3% anchor and assess impacts of earlier cuts before restarting easing cycle, particularly considering current geopolitical uncertainty and upside risks to the inflation outlook prevailing.

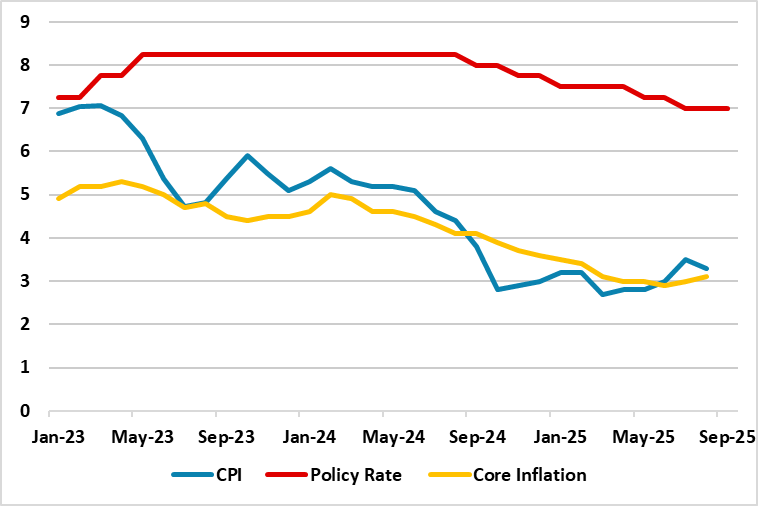

Figure 1: Policy Rate (%), CPI and Core Inflation (YoY, % Change), April 2023 – September 2025

Source: Continuum Economics

SARB’s MPC convened on September 18 announcing the fifth key rate decision of 2025. SARB halted its easing cycle given uncertainty around United States tariffs and rising domestic food inflation. (Note: Annual inflation hit 3.3% YoY in August which is above new 3% inflation anchor, and core inflation surged to 3.1% YoY). The decision was not unanimous, as four MPC members preferred to keep rates on hold while the other two favoured a 25-basis-point cut.

SARB governor Kganyago indicated during the press conference that MPC expects headline inflation to rise over the next few months, peaking at around 4%. “Our inflation projections also have upward adjustments to food and services prices, partly offset by a stronger exchange rate assumption,” Kganyago mentioned. “Since September last year, we have reduced rates by 125 basis points, and we want to see how this is affecting the economy, how expectations evolve, and how inflation risks are resolved,” Kganyago added. SARB expects headline inflation to average 3.4% this year, and 3.6% next year, before reverting to 3% during 2027.

Under current circumstances, we also foresee average inflation will hit 3.4% in 2025. We believe the key for the inflation trajectory will be the global developments, tariffs, oil prices and government’s determination to address the electricity shortages, logistical constraints and financing needs. Global uncertainties such as 30% additional tariffs over South Africa is a major threat while the SARB has said the impact from the tariffs on growth and inflation could be modest, which is yet to be viewed in official data.

Under these circumstances, cautious and data-dependent SARB will likely try to bring inflation down to new 3% anchor and assess impacts of earlier cuts before restarting easing cycle, particularly considering current geopolitical uncertainty and upside risks to the inflation outlook prevailing.