CBRT’s Inflation Target for end-2025 will Likely Be Missed as Actual Inflation Deviates from the Targets

Bottom line: After inflation slightly increased to 33.3% y/y in September from 32.9% y/y in August driven by higher education, housing and food prices, Central Bank of Turkiye (CBRT) governor Karahan announced on October 7 that CBRT will ensure that inflation remains consistent with interim targets while the disinflationary process, which has been ongoing since June 2024, has recently decelerated. Despite CBRT predicts end year-end inflation to stand at 24%, with an upper band of 29%, we foresee the annual average headline inflation will hit 34.5% in 2025 since inflation remains stickier than expected, which re-ignites concerns over CBRT’s credibility. We expect the disinflation process will be very bumpy due to risks and we believe it will be (very) difficult to grind stubborn inflation from 30%s to 10%s due to sticky food and services prices.

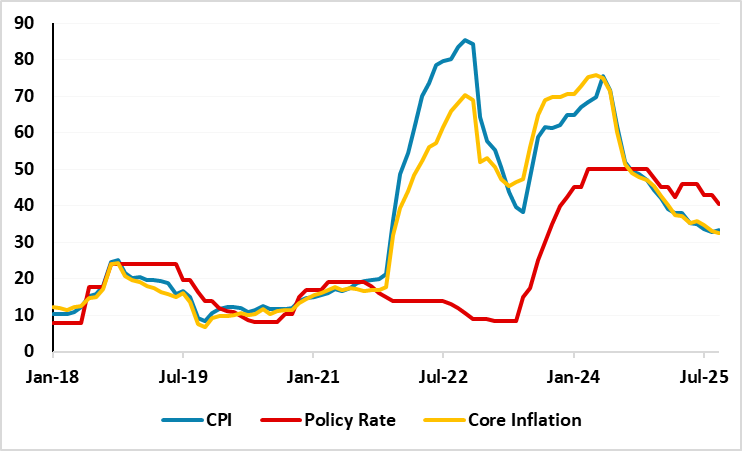

Figure 1: CPI, Core Inflation (YoY, % Change) and Policy Rate (%), January 2018 – September 2025

Source: Continuum Economics

After softening for fifteen consecutive months and hitting the lowest rate in August since November 2021 with 32.9% y/y, CPI edged up to 33.3% y/y as education, housing and food prices lead the rise in the index. MoM inflation rose by 3.23% in September, up from 2.04% in August, exceeded market expectations of 2.6% and infirmed the success of the ongoing disinflationary program. Following unexpected surge, CBRT governor Karahan announced on October 7 that CBRT will ensure that inflation remains consistent with interim targets while the disinflationary process, which has been ongoing since June 2024, has recently decelerated.

We think that core inflation remains sticky due to structural price pressures in food, housing, and services. We expect moderate softening to continue, but with a slower pace in Q4, supported by the lagged impacts of previous monetary tightening and tighter fiscal measures while the extent of the decline will be determined by food inflation, energy prices, and TRY volatility.

Despite the CBRT is forecasting the annual headline inflation will stand between 25%-29% at the end of 2025, we foresee the annual average headline inflation will hit 34.5% in 2025. (Note: According to CBRT’s inflation report dated August 14, CBRT maintained its end year-end inflation forecast at 24% while increasing 2026 forecast to 16% from 12% and end-2027 forecast to 9% from 8%). We anticipate the wage-inflation spiral, deteriorated pricing behavior, stickiness of services inflation, and geopolitical risks will keep inflation pressures alive in Q4 2025 and 2026. If the Ukraine-Russia war will come to a surprising end, this will be positive for Turkish inflation outlook, while this is not our main scenario.

We envisage it will be difficult to grind sticky inflation from 30%s to 10%s rapidly, taking into account that inflation has become stickier due to sticky food and services prices and require high interest to remain for some time. It appears it would be necessary to make concessions on growth to achieve inflation in the 10’s. We anticipate domestic and geopolitical risks will keep inflation pressures alive for a longer period, and it will be unlikely to reach a single digit inflation by 2027.

More importantly, we think it became common for the CBRT missing inflation targets in the recent years. To illustrate it, the CBRT changed its 2025 inflation target twice in the last ten months: First raising target from 21% to 24% with the first report in February 2025, the regulator introduced new interim year-end targets, 25%-29%, in its third inflation report of the year published in August.

We believe changing targets often and missing them affects CBRT’s creditworthiness negatively. Taking into account that sustained economic recovery hinges on the independence of the CBRT and rule-of-law reforms, we think any backsliding could easily trigger market volatility. There is a serious domestic criticism about the credibility of the CBRT since the actual inflation continues to significantly deviate from the CBRT’s targets and CBRT’s decisions are controlled by the current government, particularly in the last five years, causing CBRT’s forward communication to be weaker than expected.

Under current circumstances, taking into account that CBRT signalled slowing the pace of easing depending on inflation dynamics in the MPC report last month, we think increasing inflation, upside-tilted inflationary risks and adverse global developments will likely ignite CBRT to reduce the easing size, or even totally halt the easing cycle during the next MPC on October 23.