North America

View:

October 02, 2025

DM Central Banks: Wider-Ranging Conditions More Than Neutral Rates

October 2, 2025 6:55 AM UTC

· Neutral policy rate estimates and forward guidance provide some help at the start of easing cycles, but less so at mid to mature stages. For the Fed, ECB and BOE we look at a wider array of economic and financial conditions, alongside our own projections over the next 2 years to m

October 01, 2025

AI/Humanoid Robots and Disinflation?

October 1, 2025 9:40 AM UTC

· Overall, a number of forces from the AI wave will impact inflation. Power demand could push up power prices, but productivity enhancements and product innovation could be disinflationary like Information and Communications technology (ICT). One other key uncertainty on a 1-5 year

September 26, 2025

September 25, 2025

September 23, 2025

DM Rates Outlook: Steepening Yield Curve The Old Normal?

September 23, 2025 7:53 AM UTC

• We continue to forecast further yield curve steepening across the U.S./EZ and UK, driven by cumulative easing. For the U.S. this can see a modest further decline in 2yr yields, but the prospect is for a move to a premium of 2yr to Fed Funds (unless a hard landing is seen). 10yr yields

Equities Outlook: Correction Then Up In 2026

September 23, 2025 7:15 AM UTC

• The U.S. equity market’s bullishness reflects good corporate earnings reality, buybacks and the AI story. However, we feel that the U.S. economy can deteriorate still further in the coming months, as the lagged effects of tariffs boost inflation and restrain spending/hurt corporate ea

September 22, 2025

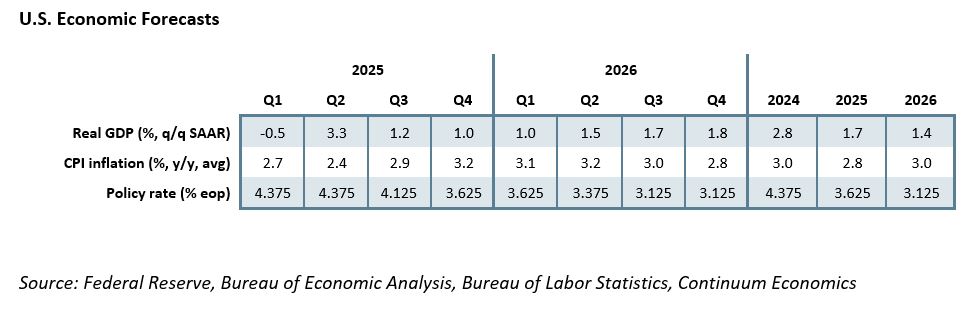

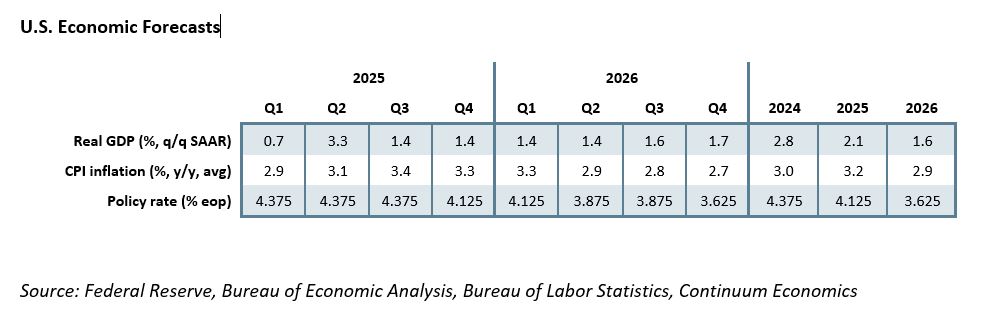

U.S. Outlook: Fed Easing to Prevent Recession, but May Also Keep Inflation Above Target

September 22, 2025 10:15 AM UTC

• GDP growth, supported in particular by business investment, was resilient in Q2, but growth in employment is now minimal and that will weigh on consumer spending, particularly with tariff-supported inflation set to restrain real wage growth. Recession is a risk if we see a vicious circle

September 16, 2025

Succession and Strongmen Leaders

September 16, 2025 10:53 AM UTC

In the unexpected scenario of an early death, Putin and Xi have no clear successors, and any new Russia or China leader would have to spend time building domestic strength and compromising on external goals. Erdogan also has no clear successors, which could create political uncertainty. For Trump su

September 01, 2025

Aging: Slow Growth for Some in 2020’s

September 1, 2025 8:35 AM UTC

Population aging always seems to be beyond the market horizon, but the 2020’s are already seeing population aging in some countries. What is the economic impact? Aging is already causing a peak in labor force in China and the EU. Meanwhile, the population pyramid also means less consumptio

August 04, 2025

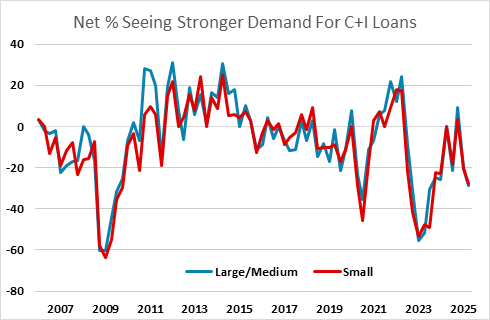

Fed Senior Loan Officer Opinion Survey Suggests Weaker Demand For Business Investment

August 4, 2025 6:44 PM UTC

The Fed’s July Senior Loan Officer Opinion Survey of bank lending practices suggests uncertainty is restraining investment demand, with supply signals on balance fairly neutral but demand signals weaker.

July 30, 2025

DM Household Sluggish Borrowing

July 30, 2025 10:45 AM UTC

· Overall, restrained credit supply from banks; abundant employment/income or wealth for most households but restrained financial conditions for low income households could have restrained household lending growth to GDP. However, the surge in government debt and ensuing fear of fut

July 03, 2025

U.S. Assets and Valuation

July 3, 2025 9:30 AM UTC

The U.S. equity market has returned to be clearly overvalued on equity and equity-bond valuations measures and is vulnerable to a new correction in H2 on any moderate bad news (e.g. further economic slowing and corporate earnings downgrades). In contrast, U.S. Treasuries are at broadly fai

July 02, 2025

DM Central Banks: Overlooking Lagged 2021-23 Tightening and QT?

July 2, 2025 8:30 AM UTC

We are concerned that DM central banks are underestimating the lagged impact of 2021-23 tightening and ongoing QT, which impacts the transmission mechanism of monetary policy. Central banks need to consider cyclical and structural issues, but also need a more rounded view of the stance and implica

June 24, 2025

Equities Outlook: Choppy Then 2026 Gains

June 24, 2025 8:15 AM UTC

Though the U.S. equity market has rebounded, we still scope for a fresh dip H2 2025 to 5500 on the S&P500 as hard data softens further to feed into weaker corporate earnings forecasts and CPI picks up and delays Fed easing. However, the AI story is still a positive, while share buybacks

June 23, 2025

DM Rates Outlook: Yield Curve Steepening?

June 23, 2025 8:30 AM UTC

• We see the U.S. yield curve steepening in the next 6-18 months. 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias in H2 2026. 10yr U.S. Treasury yields face a tug of war between lower short-dated y

June 20, 2025

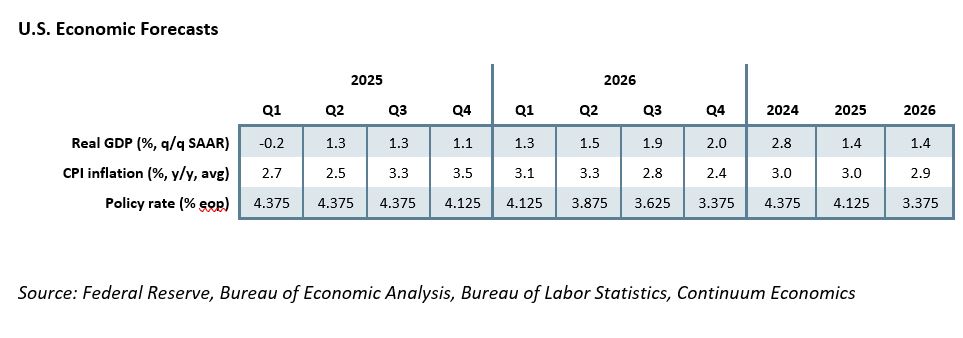

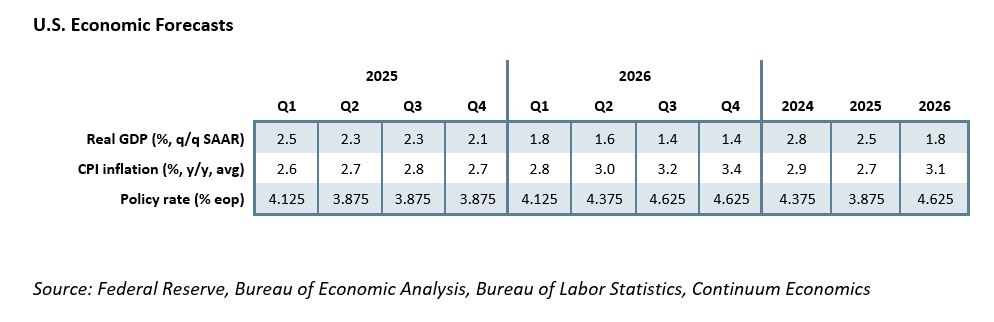

U.S. Outlook: Slowdown but not Recession, Cautious Fed Easing

June 20, 2025 2:14 PM UTC

• Policy uncertainty remains high and final details of the tariffs will depend on the decisions of the courts as well as those of President Trump. However the magnitude of the tariffs is becoming easier to predict than the detail. Trump looks set to insist on a minimum average tariff of at

April 11, 2025

Volatile Treasuries But Economic and Foreign Holdings Key

April 11, 2025 9:30 AM UTC

Long-dated U.S. Treasury yields were being pushed up by deleveraging among leveraged players, before the 90 days pause on reciprocal tariffs easing deleveraging. Multi quarter the key question for yields is whether real sector data sees a soft or hard landing. We see a slowdown to sub trend growth

March 26, 2025

Equities Outlook: Turbulence Ahead

March 26, 2025 9:05 AM UTC

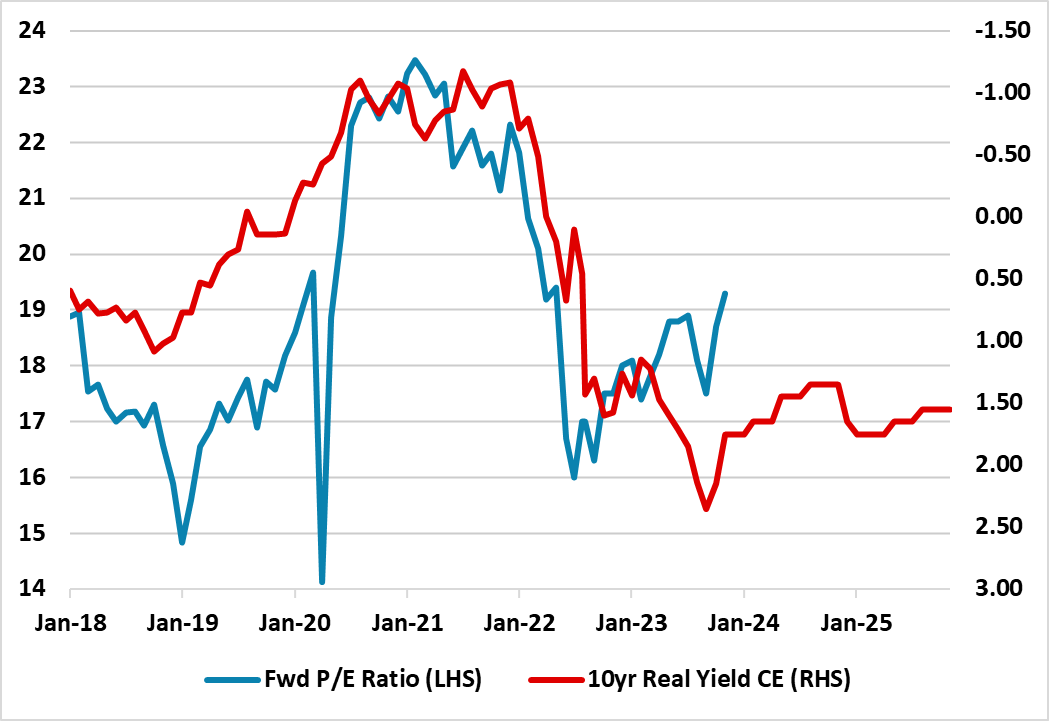

· U.S. trade wars will likely hurt U.S. growth and raise inflation, with only small to modest Fed easing and a 10yr budget bill that will likely be neutral to negative for the economy. With valuations still very high (Figure 1), we see scope for a correction to extend into mid-year th

March 25, 2025

DM Rates Outlook: Policy Divergence

March 25, 2025 9:30 AM UTC

• 2yr U.S. Treasury yields can step down with cautious Fed easing on a modest/moderate growth slowdown and also if the Fed keeps an easing bias. 10yr U.S. Treasury yields can be helped by this easing and see a move down through 2025. However, the budget deficit will likely be 6.5-7.0%

March 24, 2025

U.S. Outlook: How Much Damage Will a Trade War Do?

March 24, 2025 3:45 PM UTC

• The U.S. economy, consumer spending in particular, ended 2024 looking healthy, but with inflation still above its 2.0% target if well off its highs. The Trump administration’s more aggressive than expected trade war has made a return to the inflation target more difficult and raised dow

February 20, 2025

Bunds and ECB Easing/Trump Tariffs

February 20, 2025 8:03 AM UTC

It is highly likely in April that the U.S. will announce a 25% tariff on EU cars and pharmaceuticals (here) and also reciprocal tariffs against the EU. The majority could be implemented given Trump’s desire to raise revenue/dislike of the EU as well as negotiate trade deals. This

January 16, 2025

BOE QT: A Heavier Burden than Fed/ECB QT

January 16, 2025 11:05 AM UTC

BOE QT is 3.4% of GDP and means the 2025 total funding is 8% of GDP, which helps explain part of the current pressure on gilt yields (here). This pace is unlikely to change before the BOE review in September 2025, but the QT is partial monetary tightening and will offset some of 125bps of BOE rate

January 14, 2025

U.S. Yields Drag Germany and France Higher

January 14, 2025 8:15 AM UTC

The EUR real exchange rate is well above the 2014 low, while ECB officials are guiding that more rate cuts are coming. 2yr German yields are unlikely to rise much further and will likely come back down in Q2 (here). A January 30 ECB cut will likely build more easing expectations, though more of

January 10, 2025

U.S. Treasuries versus Bunds and Gilts

January 10, 2025 8:10 AM UTC

· UK Gilts have been dragged higher by rising Treasuries and market concerns that BOE rate cuts will be limited (here), while 10yr Bund yields have also been dragged higher by Treasuries concerns on Fed rate cuts/budget deficit and tariffs. Multi quarter we see this as overdone. We

January 09, 2025

Gilt Yields Rise on U.S. and Fiscal Slippage Concerns

January 9, 2025 9:40 AM UTC

· 10yr Gilts yields are rising on concerns of UK fiscal slippage, but also higher U.S. yields and funding pressures as GBP100bln of BOE QT adds to the budget deficit targeted at 4.5% of GDP in 2024/25. Chancellor Reeves will likely recommit to the fiscal rules (ie further small correc

December 19, 2024

DM Rates Outlook: Policy and Spread Divergence

December 19, 2024 12:07 PM UTC

• 2yr U.S. Treasury yields can decline initially as the Fed finishes easing (Figure 1), but as the sense grows that the rate cut cycle is stopping, we see the 2yr swinging to a small premium versus the Fed Funds rate – as the market debates the risks of a future tightening cycle. For 10y

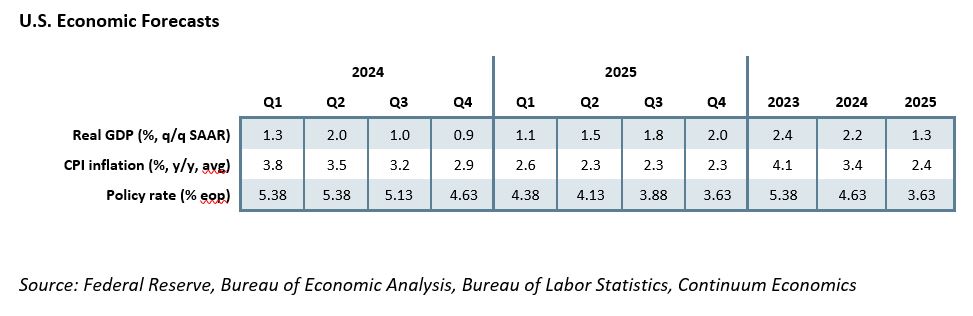

U.S. Outlook: Healthy Economy Facing Policy Risks

December 19, 2024 8:01 AM UTC

• The U.S. economy, consumer spending in particular, has continued to show surprising resilience, and is growing at a pace probably in excess of long-run potential near 2.0%. Inflation has fallen significantly from its highs, with core PCE inflation now running slightly below 3.0%, but rema

December 18, 2024

Equities Outlook: U.S. Exceptionalism v Valuations

December 18, 2024 10:05 AM UTC

· The glory days of exceptionalism for U.S. equities will likely extend in Q1 2025 to bring the S&P500 to 6200-6300. The problem is that valuations have now become stretched with S&P500 ex magnificent 7 on a forward P/E of 19 and valuations out of line with real bond yields (Figure 1)

December 16, 2024

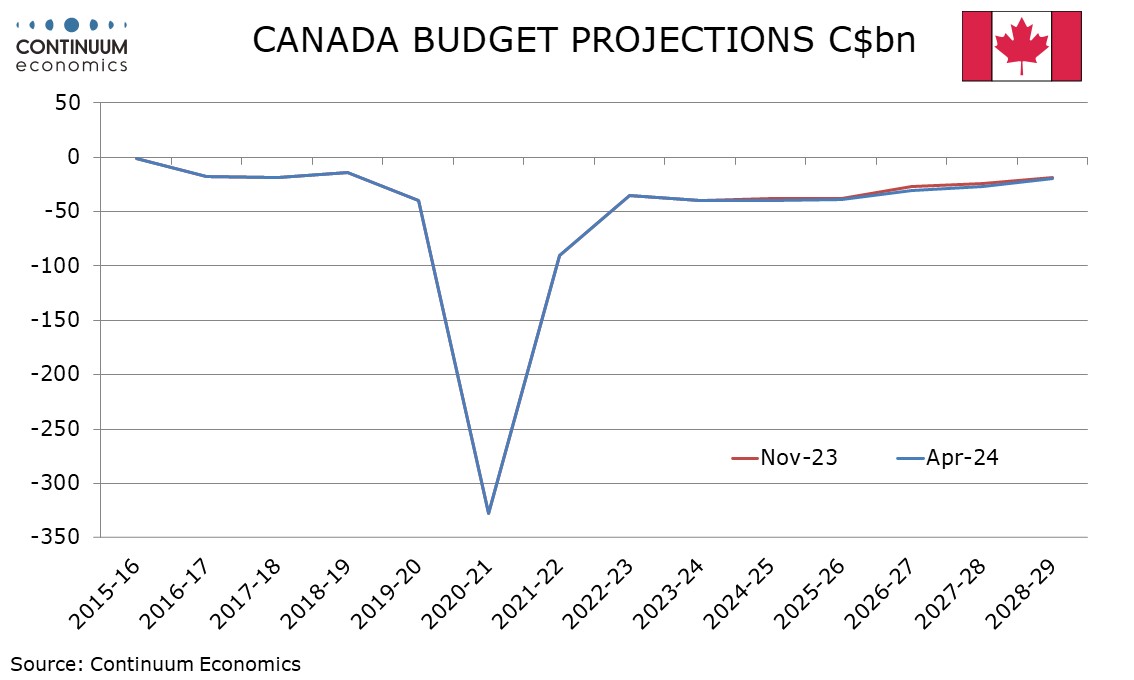

Trump Tariff Threats Causing Policy Division in Canada

December 16, 2024 6:19 PM UTC

Trump’s tariff threats are being felt in Canadian politics, with Finance Minister Chrystia Freeland’s resignation, due to disagreements with Prime Minister Justin Trudeau’s plans to give the economy fiscal support, with Freeland preferring to “keep the powder dry” given the risks Canada fa

September 30, 2024

Israel/Hezbollah Scenarios

September 30, 2024 9:26 AM UTC

The most likely scenarios between Israel and Hezbollah are Israel/Hezbollah intermittent attacks/counterattacks (40%) or significant ground invasion Southern Lebanon (45%). Both would be difficult in human terms and raise geopolitical tensions, but are unlikely to cause a lasting impact on global

September 24, 2024

DM Rates Outlook: Rate Cuts Arrive Except Japan

September 24, 2024 9:00 AM UTC

• For U.S. Treasuries, we see 2yr yields coming down further on our baseline soft landing view, as the Fed moves consistently to a 3.00-3.25% Fed Funds rate. However, with considerable Fed easing already discounted, 2yr yield decline should be modest and 2yr yields should bottom mid-2025. 1

Equities Outlook: Choppy U.S. and Outperformance Elsewhere

September 24, 2024 8:30 AM UTC

• We now forecast 5450 for the S&P500 for end 2024, but could see a move to 5200/5000 in the next 3-6 months as volatile data keeps the soft v hard landing debate alive. On our baseline of a U.S. soft landing, we would see the S&P500 at 5600 by end 2025. The tech sector is still really i

September 23, 2024

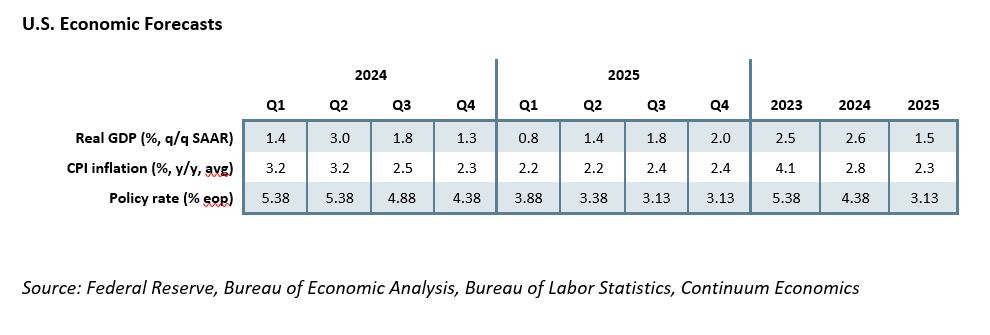

U.S. Outlook: Fed Focus Turning To Downside Risks

September 23, 2024 2:16 PM UTC

• The U.S. economy is showing clear signs of labor market slowing which poses downside risks to the still impressive resilience of consumer spending, which has sustained healthy GDP growth through Q2 2024. We expect GDP growth below potential in the second half of 2024 and the first half of

August 26, 2024

Israel/Hezbollah War Risks

August 26, 2024 8:02 AM UTC

The probability of an Israel/Hezbollah war in the next 12 months has move up from low to modest probability, but would be a high impact event geopolitically and for global markets. For global markets, a distinction would be drawn between an Israel/Hezbollah war that did not involve Iran/U.S. and o

August 23, 2024

Powell Jackson Hole Guidance

August 23, 2024 2:38 PM UTC

Fed Powell clearly signaled a Sep 18 FOMC cut, but his analysis on the economy is softer than harder landing. Though the option of 50bps was not ruled out, the comments from Powell and other Fed officials are more consistent with 25bps than 50bps. Nevertheless, the Fed is now more focused on

August 19, 2024

Fed Decision Making/H1 2025 Fiscal Tensions and Yield Curve Steepening

August 19, 2024 8:15 AM UTC

2yr U.S. Treasury yields can fall gradually by end 2025 to 3.25%, as a more neutral Fed Funds era is discounted. 10yr yields ability to decline on a soft landing is more difficult, given high net supply facing the market. We also remain concerned that the U.S. will see some temporary fiscal stre

August 13, 2024

Market Turbulence and What has Changed?

August 13, 2024 12:22 PM UTC

• We see the recent market turbulence as being partially a reduction in risky positions. However, the U.S. economy is slowing and triggering a debate about a soft or harder landing (we see slowing rather than recession in our baseline), while EZ data shows the recovery is not gaining moment

July 12, 2024

EZ and UK Government Bonds: Decoupling From the U.S.?

July 12, 2024 9:37 AM UTC

Different economic and inflation dynamics, plus no constraint from trade weighted exchange rates, means that the ECB and BOE can cut irrespective of the Fed in the coming quarters. This can see 2yr yields decline, though less so in Germany where a 2.5% ECB depo rate is already discounted. 10yr y

June 25, 2024

Equities Outlook: Choppy U.S. and Outperformance Elsewhere

June 25, 2024 7:05 AM UTC

• U.S. equities are overvalued and waiting for earnings growth to catch-up, which leaves the market choppy, directionless and vulnerable to intermittent 5% corrections. Our forecast slowing of the U.S. economy before Fed rate cuts or nervousness about the post-election prospects are potenti

June 24, 2024

DM Rates Outlook: Rate Cuts Arrive Except Japan

June 24, 2024 8:45 AM UTC

• For U.S. Treasuries we see a steady easing process from the Fed from September, which can allow 2yr yields to fall consistently. However, the decline in H2 2024 will be slower at the long-end from traditional yield curve steepening pressures and then we see fiscal stress in H1 2025 unde

June 20, 2024

U.S. Outlook: Economy Starting to Lose Momentum

June 20, 2024 6:17 PM UTC

• The U.S. economy is starting to lose momentum after a surprisingly strong second half of 2023, and we expect the loss of momentum to become more apparent in the second half of 2024, causing a slowing in employment growth from its current strong pace. We expect inflation to resume a gradua

May 10, 2024

Asset Allocation 2024: Tricky Seven Months Remaining

May 10, 2024 1:06 PM UTC

Fed easing expectations for 2025 and 2026 can shift from a terminal 4% Fed Funds rate towards 3%, as the U.S. economy slows due to lagged tightening effects. Combined with Fed easing starting in September this should mean a consistent decline in 2yr yields. However, 10yr U.S. Treasury yields wil

March 25, 2024

Equities Outlook: Cyclical Recovery Versus Structural Headwinds

March 25, 2024 9:00 AM UTC

· In the U.S., a tug of war between momentum and U.S. exceptionalism on the one side versus valuations and any deviations from the U.S. goldilocks scenario now means volatility and a risk of a correction. We feel that the U.S. equity market recovery can push onto 5250 for the S&P5

March 22, 2024

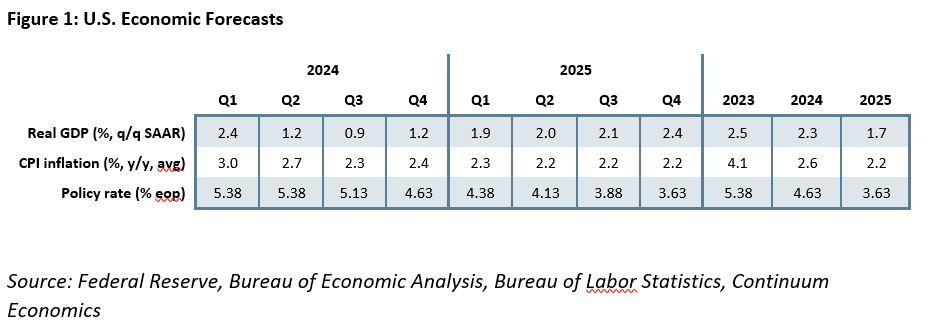

U.S. Outlook: Fed to Ease as Economy Gradually Slows

March 22, 2024 10:00 AM UTC

• The U.S. economy has continued to see growth surprising to the upside supported in particular by consumer spending. While the momentum of the second half of 2023 will be difficult to sustain the economy now looks poised for a soft landing, with risk that continued resilience in the econom

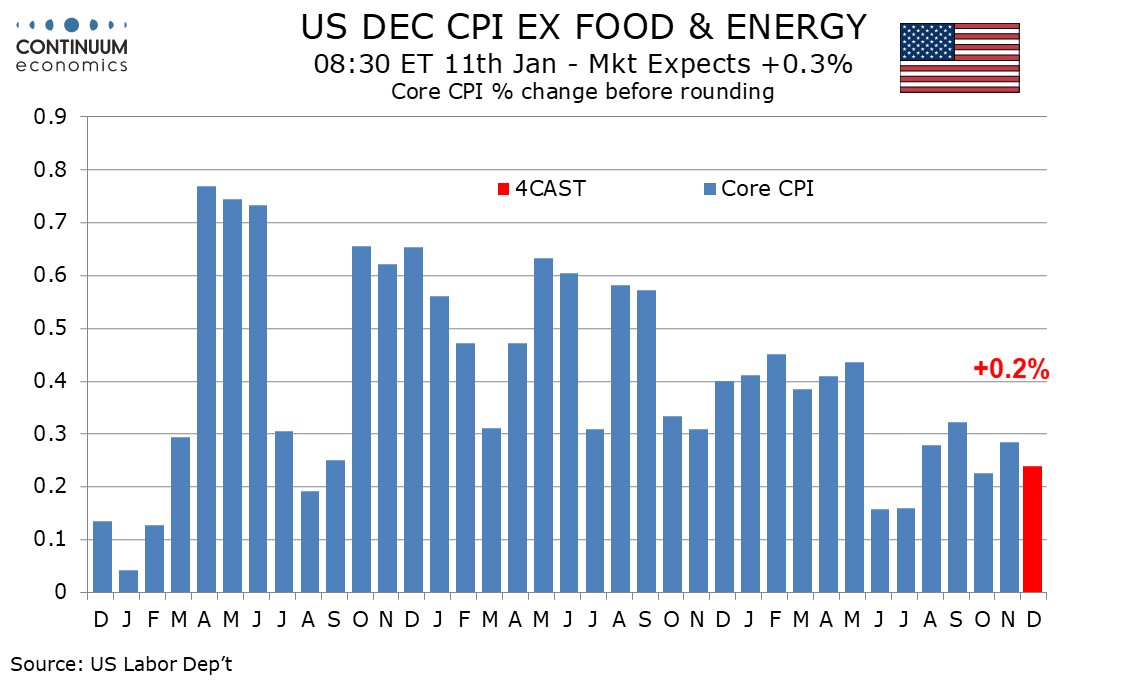

January 10, 2024

Preview: Due January 11 - U.S. December CPI - Marginally above 0.2% before rounding

January 10, 2024 2:00 PM UTC

We expect December CPI to increase by 0.2% overall and ex food and energy, with risk being for higher rather than lower, with our forecasts before rounding being 0.22% overall and 0.24% ex food and energy.

January 09, 2024

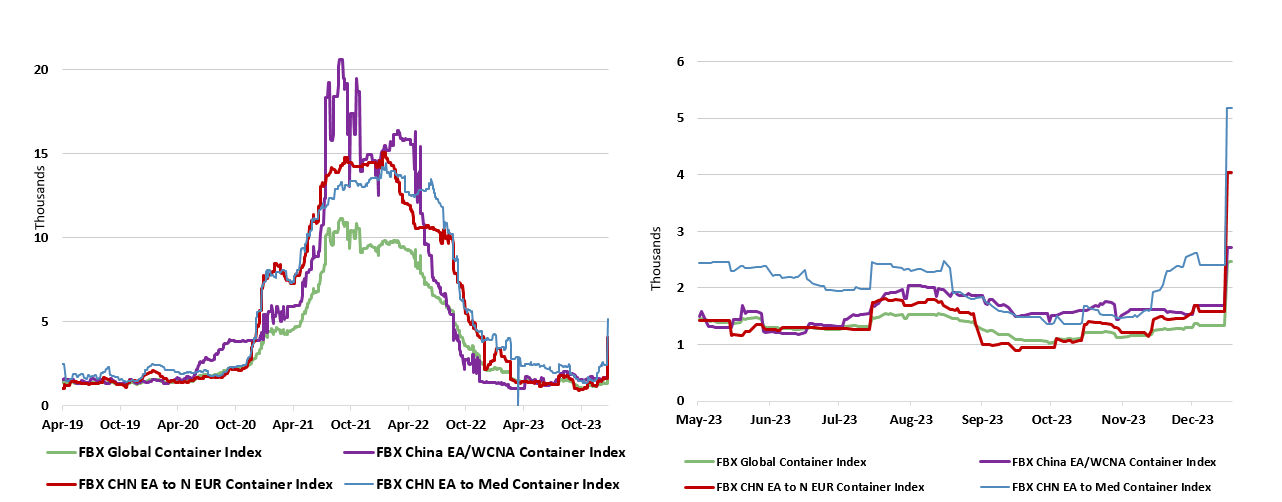

Shipping Freight Cost Jump and Inflation – Some Perspectives

January 9, 2024 2:24 PM UTC

Bottom Line: The attacks on Red Sea shipping have already triggered a marked rise in freight costs, and more broadly than just for the Red Sea route. Thus has led to some worries about the possible fresh upside risks to what have recently been sharply falling CPI inflation rates. These worries a

January 03, 2024

AI and Technology Impact on Growth and Inflation

January 3, 2024 10:30 AM UTC

Bottom Line: The full benefits of the latest AI wave will likely not kick in until the late 2020/early 2030’s.However, 5G over the last couple of years has been enabling more connectivity via the Internet of Things and allowing more big data analysis, including AI tools and algorithms. In the 2hal

January 02, 2024

Preview: Due January 11 - U.S. December CPI - Marginally above 0.2% before rounding

January 2, 2024 5:03 PM UTC

We expect December CPI to increase by 0.2% overall and ex food and energy, with risk being for higher rather than lower, with our forecasts before rounding being 0.22% overall and 0.24% ex food and energy.

December 15, 2023

Equities Outlook: Rate Cuts To Help in 2024

December 15, 2023 11:00 AM UTC

U.S. equities face a volatile Q1 2024, both because the Fed are unlikely to ease in Q1 and because a slowing economy hurts corporate earnings forecasts. With the market overvalued, a modest correction could be seen, though this would be sharper with a recession. Gains should resume with Fed ra