Asset Allocation 2024: Tricky Seven Months Remaining

Fed easing expectations for 2025 and 2026 can shift from a terminal 4% Fed Funds rate towards 3%, as the U.S. economy slows due to lagged tightening effects. Combined with Fed easing starting in September this should mean a consistent decline in 2yr yields. However, 10yr U.S. Treasury yields will likely not fall consistently below 4%, due to normal yield curve steepening and medium-term fiscal concerns. This will be a headwind for U.S. equities, alongside overvaluation in equity only terms and we see a tricky and choppy remainder of 2024 for U.S. equities – we forecast 5200 for the S&P500 by end 2024. The shift in Fed expectations should also renew the weakening of the USD and we now see 1.12 on EURUSD by end 2024.

Q2 has started with a pause in the U.S. and Japan equity market rally; a pick-up in UK/China/HK equities and less fears that 2024 Fed rate cuts will be fully unwound. What are the asset allocation prospects for the remainder of 2024?

· Elsewhere, the arrival of ECB easing should help produce lower yields, but a lot is already discounted and the decline in government bond yields will be concentrated at the short-end – we see 10yr Italian government bond yields as being vulnerable versus Bunds. EZ equities benefit from ECB easing will likely be largely counterbalanced by a slow economic recovery and EZ equities will likely see a choppy period through year-end. UK equities are preferred in DM, as Labour will likely win the expected October election and boost hopes of an improved relationship with the EU.

· In EM, we still feel that India has 10% upside in the remainder of 2024, due to healthy corporate earnings growth and any BJP government likely to be reform minded. We do see a tactical bounce in China equities, helped by cheap valuations and less pessimism. However, we are still strategic cautious on China, as we see GDP growth slowing to 4% in 2025. The main EM currency call is for 7.40 on USDCNY by end 2024.

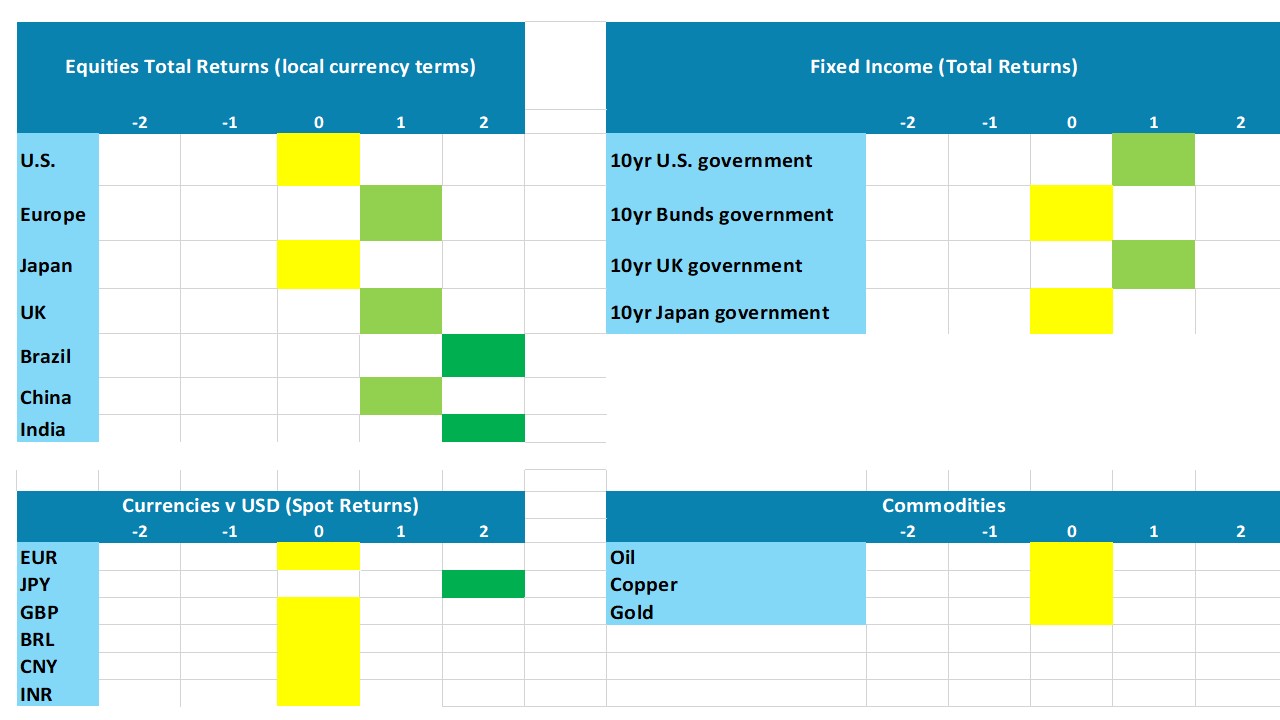

Figure 1: Asset Allocation Views to End 2024

Source: Continuum Economics. Note: Asset views in absolute total returns from levels on May 9 2024 (e.g., 0 = -5 to +5%, +1 = 5-10%, +2 = 10% plus).

Government Bonds: Short-End Preferred

The May FOMC meeting has stopped the trend towards the market undiscounting rate cuts and two 25bps cuts are now expected before the end of the year, with little chance of a rate hike. Indeed, we feel that some of the U.S. survey numbers through April do suggest that the lagged impact of Fed tightening is coming through and this can see the economy slowing further into H2. The rundown of pandemic savings, plus the slowing jobs market, will mean that consumption also slows. This is enough in itself to get the Fed easing, but we also see a slowing of core PCE inflation to below 2.5% by H2 2024 and this will also give the Fed comfort that inflation is heading back towards target. We see three 25bps cuts in 2024 and then an additional 100bps in 2025, as the Fed reduces the degree of restriction.

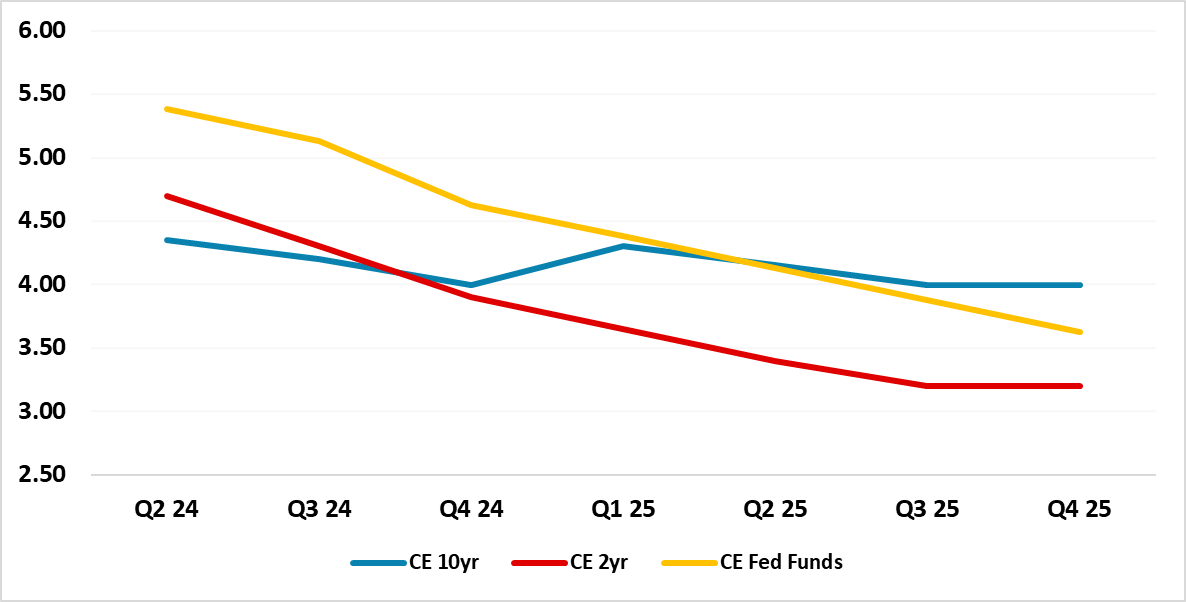

This can led to a consistent decline in 2yr U.S. Treasury yields, as the market is discounting that the Fed will only ease to 4.0% in the next 2 years whereas we see a path clearly to a 3% Fed Funds rate by end 2026. The 2yr is only at a moderate discount to the Fed Funds rate compared to previous period just before a Fed easing cycle. Uncertainty over the scale of easing below 3.5% could creep in at a later date, but 2yr yields will likely fall to 3.20% by end 2025.

For 10yr U.S. Treasuries, we see the traditional yield curve steepening process through this period (Figure 2). Additionally, we remain concerned that H1 2025 will likely see U.S. fiscal concerns push up 10yr yields by 30-40bps (here), either as Biden has trouble with the debt ceiling or Trump faces rating agency concerns about making his tax cuts permanent. With the U.S. economic slowdown likely to be soft landing rather than a recession, this means that falling 2yr yields only drag 10yr U.S. Treasury yields down to 4.0% (Figure 2). Though the total returns from 10yr Treasuries is reasonable on our baseline to end 2024, the fiscal risks means that more volatility and risk surrounds this view than our 2yr yield forecast and we thus prefer the short-end of the curve.

Figure 2: U.S. Government Bond Yield Forecasts (%)

Source: Continuum Economics

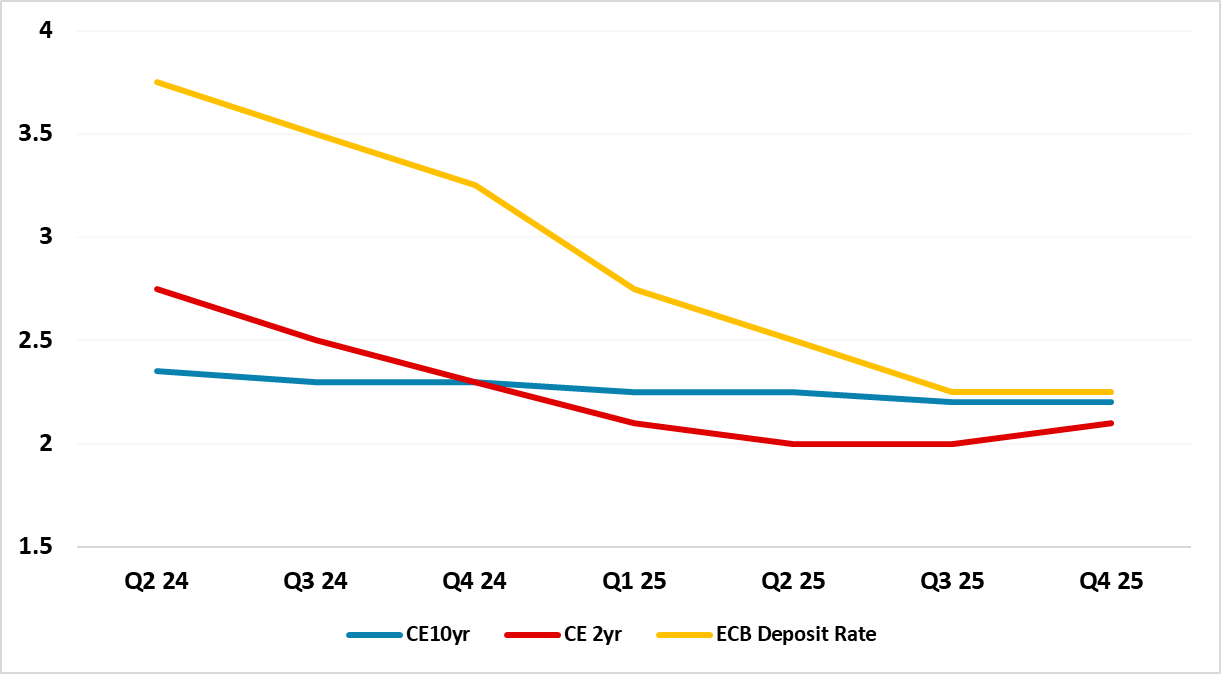

Europe is at a different point in the easing cycle, with the ECB (here) and BOE (here) likely to follow the SNB and Riksbank with 25bps at their June meetings. EZ inflation is on a more controlled trajectory than the U.S., while the EZ recovery is weak in contrast to above trend growth in the U.S. We see the ECB undertaking a cumulative 75bps easing in 2024 and a further 100bps in 2025. This will help 2yr German government bond yields to come down, but the discount to the ECB policy rate is still large at this stage of the rate cycle and the ECB will be reluctant to provide much forward guidance – this will slow the decline in 2yr yields. 10yr yields in Germany are also lower in real terms (CPI or breakeven inflation) than the U.S. and thus we see little decline in 10yr German yields and a move towards a positive yield curve. Meanwhile, we feel that the hunt for yield has gone too far with 10yr Italian yields and they are vulnerable to any further fiscal overshoot nevermind any political instability. We look for the 10yr spread versus Bunds out to 130bps by end 2024.

Figure 3: German Government Yield Forecasts (%)

Source: Continuum Economics

Equities: Tricky

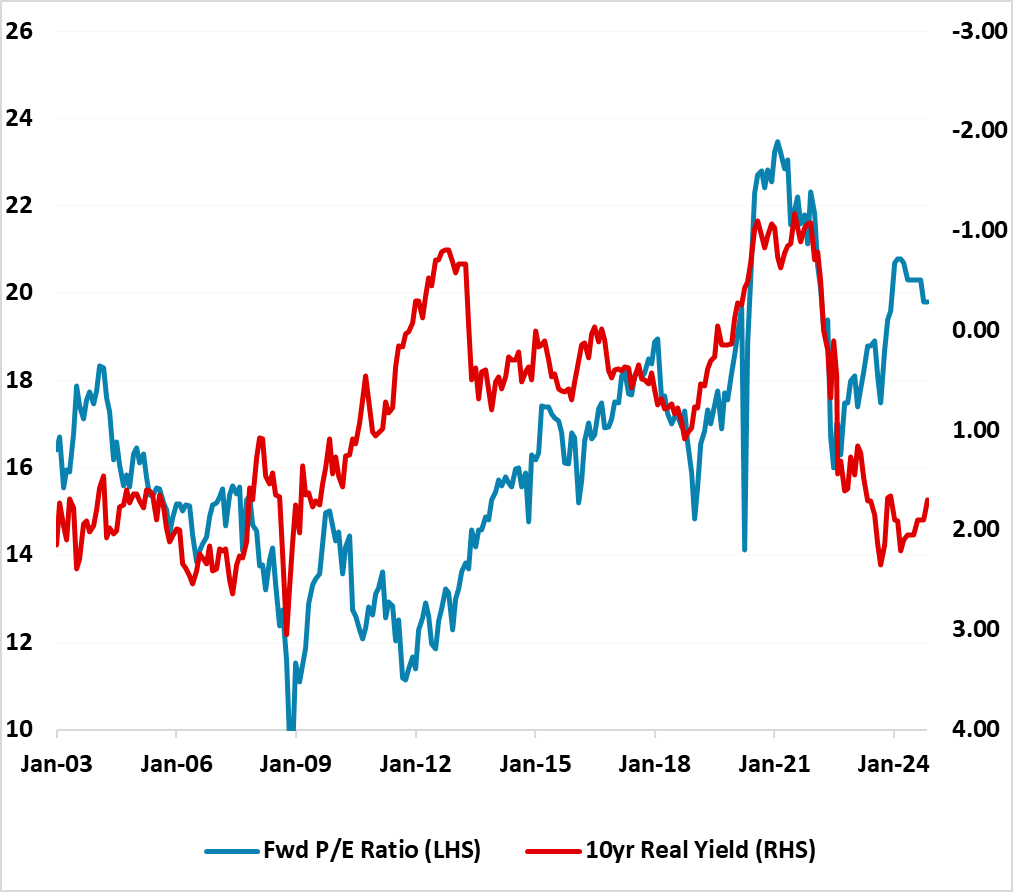

U.S. equities remain a tug of war between goldilocks optimism and already high valuations. We feel that the U.S. economy will slow with lagged monetary policy still feeding through and cause an increase in uncertainty over corporate earnings. Additionally, the approach of the U.S. presidential election will also likely increase risks around the U.S. equity market, as Donald Trump policies are less market friendly than his first term due to rule of law and fiscal risks (here). Thus we feel that the U.S. equity market will likely be choppy with intermittent modest corrections, as it works off the overvaluation (Figure 4). We still see the S&P500 ending 2024 at 5200.

Figure 4: 12mth Fwd S&P500 P/E Ratio and 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics projections until end-2025 using 10yr breakeven inflation and government bond yield forecasts

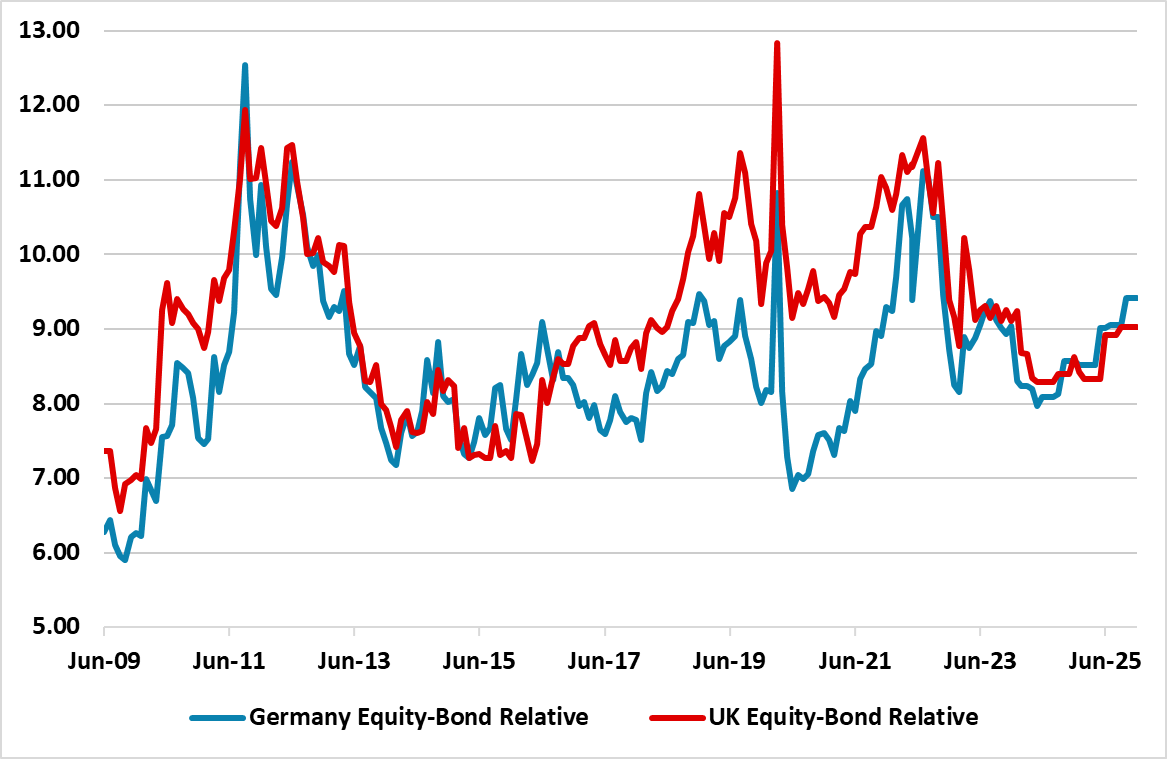

EZ equities can be helped by the ECB rate cutting cycle most likely starting in June, though multi quarter it is more important that the real sector gains ground to help corporate earnings momentum. EZ equities are also reasonable versus government bond yields (Figure 5). However, the EZ economy is suffering from the lagged effects of higher interest rate and restrictive lending growth in 2022/23 while a swing to positive real wage growth (due to inflation coming down quicker than wages so far) is the only plus. We look for 0.5% GDP growth in 2024. The recovery will only swing towards 1.3% trend growth in 2025. Thus EZ equities benefit from ECB rate cuts coming before the Fed could be short-lived and it will be back to following U.S. equities for the remainder of 2024 (here). This suggests a choppy environment for EZ equities.

Meanwhile, we still like UK equities, as they are undervalued on 12mth forward P/E ratio basis and reasonable against government bonds. Additionally, we expect that Labour will win the general election (likely in October) and this will led to hopes of a closer relationship with the EU that could boost trade/GDP growth and corporate earnings multi year. We see a further 5% outperformance by the UK for the remainder of 2024 versus the U.S. and EZ equity markets.

Figure 5: Germany/UK 12mth Earnings Yield minus 10yr Real Government Bond Yield (using 10yr breakeven inflation)

Source: Continuum Economics projections until end-2025 using 10yr breakeven inflation and government bond yield forecasts

Japan equities have undergone a correction and we had been concerned in the March outlook that the market had become overoptimistic. Corporate earnings are at risk both from a rebound in the JPY and also as Japanese consumers reject higher prices from companies. Moreover, the BOJ’s Ueda has noted that ETF sales are one option and QT ETF sales could a concern for the market later in the year. We see a flat Nikkei by year-end (here for Equities Outlook).

China equities can see a tactical bounce of 5-10% in the coming months (here). Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do not see a strategic opportunity into 2025 given cyclical and structural headwinds.

Elsewhere in EM equities will be a combination of policy and politics. Elections in S Africa (May 29), Mexico (June 2) and India (results June 4) mean that politics will be followed closely and will be the dominant theme shaping markets. India (here) and Mexico (here) should have no surprises and stable or positive policy momentum. India equities are overvalued and some volatility could be seen if the BJP does not achieve a majority, but they should still form a coalition that is reform minded. Combined with the long-term corporate earnings growth story, we see a further 10% upside by end 2024 for India equities.

In S Africa, we expect a coalition government (75% chance) bringing some political uncertainty (here), and this is likely to struggle with structural issues that the country faces. However, given the results in India and Mexico, this will likely be seen as S Africa specific and not having EM spillover. Meanwhile, geopolitical risks are unlikely to escalate. In the Ukraine war, we see a stalemate between the two sides, as Putin hopes for a Trump victory in the U.S. (here). The war in Gaza will also have a heavy human toil, but will likely remain a local affair without wider Middle East spillover. Finally, the election of a pro-China speaker to the Taiwan parliament presumably means that China will not escalate tensions too far with Taiwan (here) and fears of a war in the next few years are overdone.

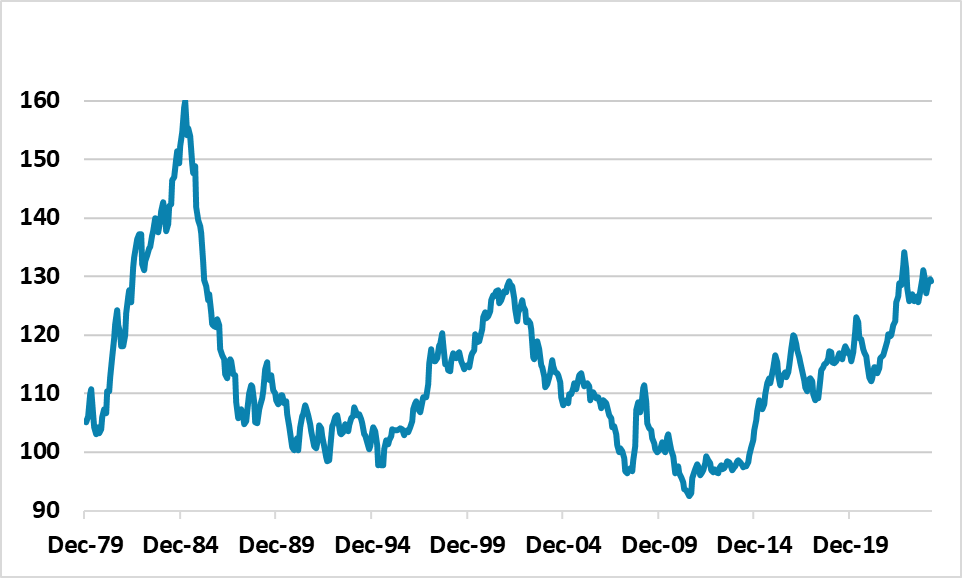

Figure 6: Real Trade Weighted USD (2010=100)

Source: Datastream/Continuum Economics

Finally, the USD has been resilient in 2024 so far, as the market has shifted from discounting seven to two Fed rate cuts. We do not see this swing in sentiment going further and indeed we feel that the money market can shift from discounting a terminal Fed policy rate of 4% to 3%, which we see hurting the USD against DM currencies. Though the ECB and BOE will start easing before the Fed, the cumulative 2024 and 2025 easing prospects is more in money market pricing. Thus we see a softer USD given the starting point of clear USD overvaluation (Figure 6). However, we have fine-tuned our end 2024 EURUSD forecast to 1.12 from 1.15. We still also feel that JPY bearishness is extreme and looking for 140 on USDJPY by end 2024.

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive (here). These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African National Congress (ANC) infighting post-election. India Rupee resilience should be maintained, though we do see China authorities accepting a weaker Yuan and forecast 7.40 on USDCNY by end 2024 (here). Finally, if Donald Trump is elected as the president in the U.S., then it could cause Mexican Peso jitters on fears that an immigration crackdown could sour U.S.-Mexico relations.