Powell Jackson Hole Guidance

Fed Powell clearly signaled a Sep 18 FOMC cut, but his analysis on the economy is softer than harder landing. Though the option of 50bps was not ruled out, the comments from Powell and other Fed officials are more consistent with 25bps than 50bps. Nevertheless, the Fed is now more focused on the labor market, which suggests the need to be proactive at the start of the easing cycle and this reinforces our view of 25bps at the November and December FOMC meetings.

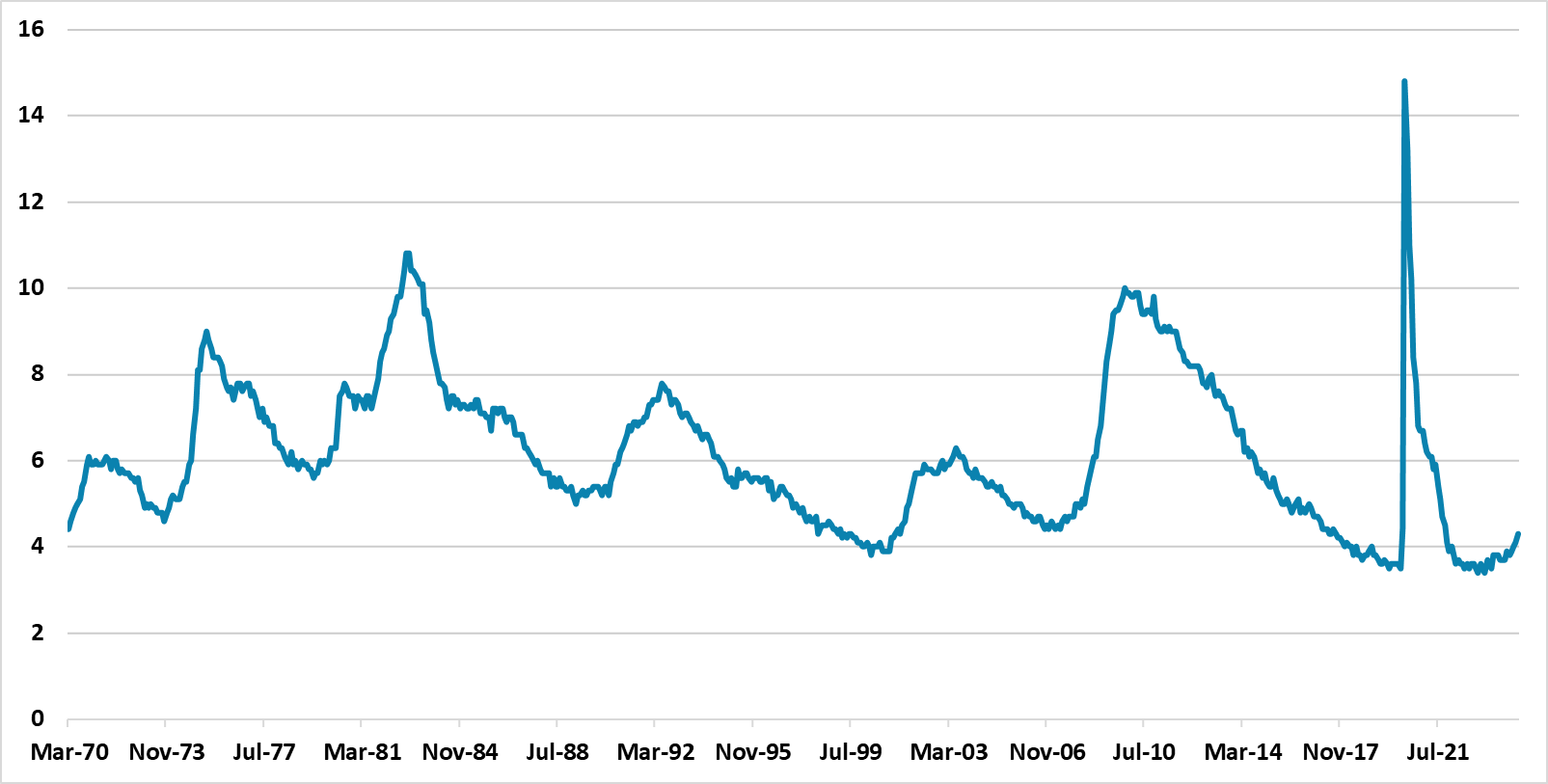

Figure 1: Unemployment Rate Rising (%)

Source Datastream/Continuum Economics

Fed Powell has done a good job in the last few years of incrementally changing expectations on future Fed policy moves. What we have learnt from Powell Jackson Hole speech are

· Time has come to adjust in September. The Fed chair signaled that the time has come to adjust (here), which is not a big surprise given data and also the July FOMC minutes that signaled that the vast majority of members felt it would be appropriate to cut in September. The key is 25bps or 50bps for September. Powell did note that the timing and pace of rate cuts would be data dependent and did not use “gradual”. Powell did not provide clues beyond September. Fed Collins suggested a gradual and methodical approach, but Harker noted that more data would be needed to decide on 25bps or 50bps – Schmid noted he is not ready yet to vote for a rate cut. September actual outcome is open but more likely 25bps than 50bps based on these comments.

· Data before September 18. The Fed chair is clear that the Fed is more comfortable that inflation will move sustainable back to 2%. Short leading indicators are consistent with a gradual further slowing, but not dramatic if the economy sees a soft landing. Where a change of tone is more noticeable is on the labor market, where the rise in the unemployment rate was noted more seriously than the recent past and further cooling of the labor market would be unwelcome. However, Powell did note that the rise in unemployment was more to do with the increase in the labor force rather than job losses. This suggests that the focus is on the August employment report and other labor market data. If they are really weak, it could mean 50bps at the September FOMC meeting, but this is not our baseline. The Fed analysis is of course complicated by the volatility in the household data survey that produces the unemployment rate and has a worse employment trajectory than the more robust establishment data survey. Overall, we look for a 25bps cut in September followed by 25bps cuts in November and December. The option of a 50bps will linger in case the labor market data slowed more quickly.