U.S. Treasuries versus Bunds and Gilts

· UK Gilts have been dragged higher by rising Treasuries and market concerns that BOE rate cuts will be limited (here), while 10yr Bund yields have also been dragged higher by Treasuries concerns on Fed rate cuts/budget deficit and tariffs. Multi quarter we see this as overdone. We see faster ECB easing than the money market and much more BOE easing (125bps), which will help the short-end of the German and UK curve to outperform the U.S. We feel that this can help persistent 10yr Gilt outperformance versus the U.S., as fears of sticky UK inflation are overdone and weak growth will produce a rethink.

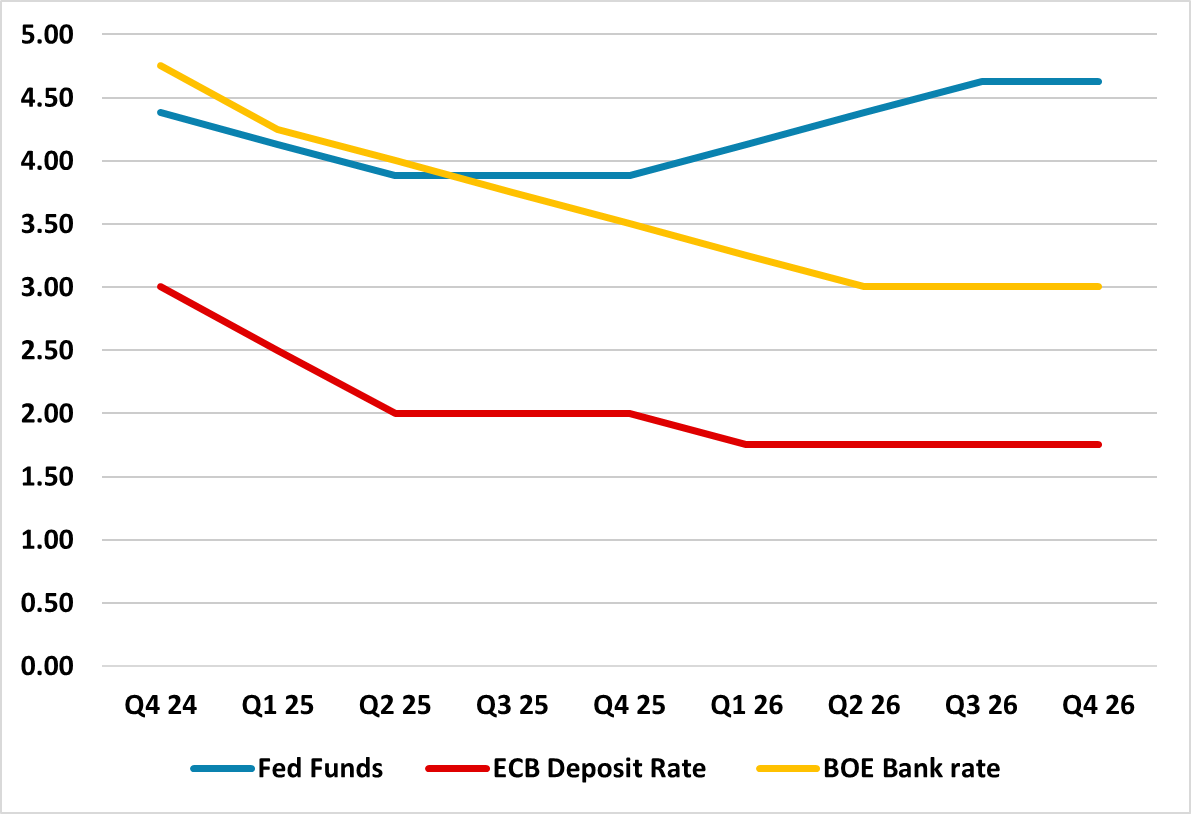

Figure 1: Fed Ease and Tightening Versus ECB/BOE Easing (%)

Source: Continuum Economics

Divergence between the Fed and ECB/BOE will likely be a feature for 2025. We look for more than money markets with two 25bps Fed Funds cuts in March and June before the Fed goes on hold. Re the ECB, we are in agreement with the market that the ECB will get to a 2.0% deposit rate but we see all four being delivered by the ECB in H1 2025 versus market expectations of January/March/June. The contrast between reasonable U.S. growth and sluggish EZ growth is stark, while EZ fiscal policy is set for 2025 consolidation and the U.S. looks set for further fiscal stimulus (here). On the inflation front, core EZ inflation came in at 2.7% in December, which is still too high for the ECB hawks. However, economic slack, plus a further downgrade to overly optimistic ECB growth projections will likely be enough to shift the ECB board consensus towards more disinflation being delivered. We forecast a drop to EZ CPI Yr/Yr to 1.6% by Q3, with money and credit numbers also warning about risks to the recovery from lagged overly tight monetary policy.

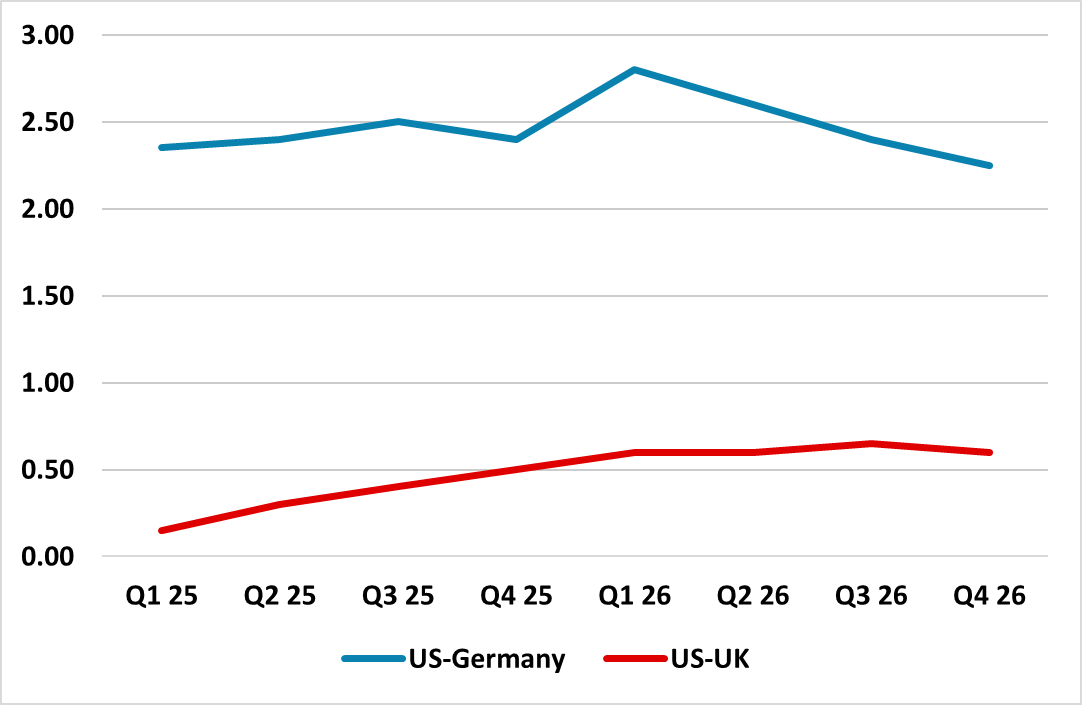

It cannot be ruled out that the ECB cut to a 1.75% deposit rate in H2 2025, rather than 2026 as we have pencilled in (Figure 1). Certainly money markets will speculate that the ECB will consider sub 2% deposit rates as the year progresses. Though 2yr Germany already discounts a lot of the ECB easing, we still see scope for a further small to modest decline. 10yr Bund yields can also fall below 2% on a temporary basis, especially if France’s budget deficit crisis pushes the spread consistently through 100bps. Nevertheless, a small real yield is still required, given yields in other major markets – a relaxation in the German debt brake is likely after the February election, but is likely to be modest and not really impact Bunds. Thus we see 10yr German yields at 2.30% end 2025, due to the spill over of higher U.S. yields – we look for 4.70% 10yr U.S. Treasury yields by end 2025 as a large budget deficit causes issuance worries into 2026 (here). Indeed, in H1 2026 we are projecting 10yr U.S. Treasury yields to hit 5.0% and this can see the spread widening versus 10yr Bunds (Figure 1).

Figure 2: 10yr U.S. Treasury Yields versus Germany and UK Forecasts (%)

Source: Continuum Economics

In terms of the UK, we see five 25bps cuts from the BOE for a cumulative 125bps easing versus current money and gilt market expectations of cuts in May and September 2025 and 100bps for the median of economist’s forecasts. The money market view appears to be based on concern that UK core inflation will remain sticky and dramatically slow the pace of BOE easing, with fears that some of the budget’s employer’s national insurance increase feeding through to boost underlying inflation.

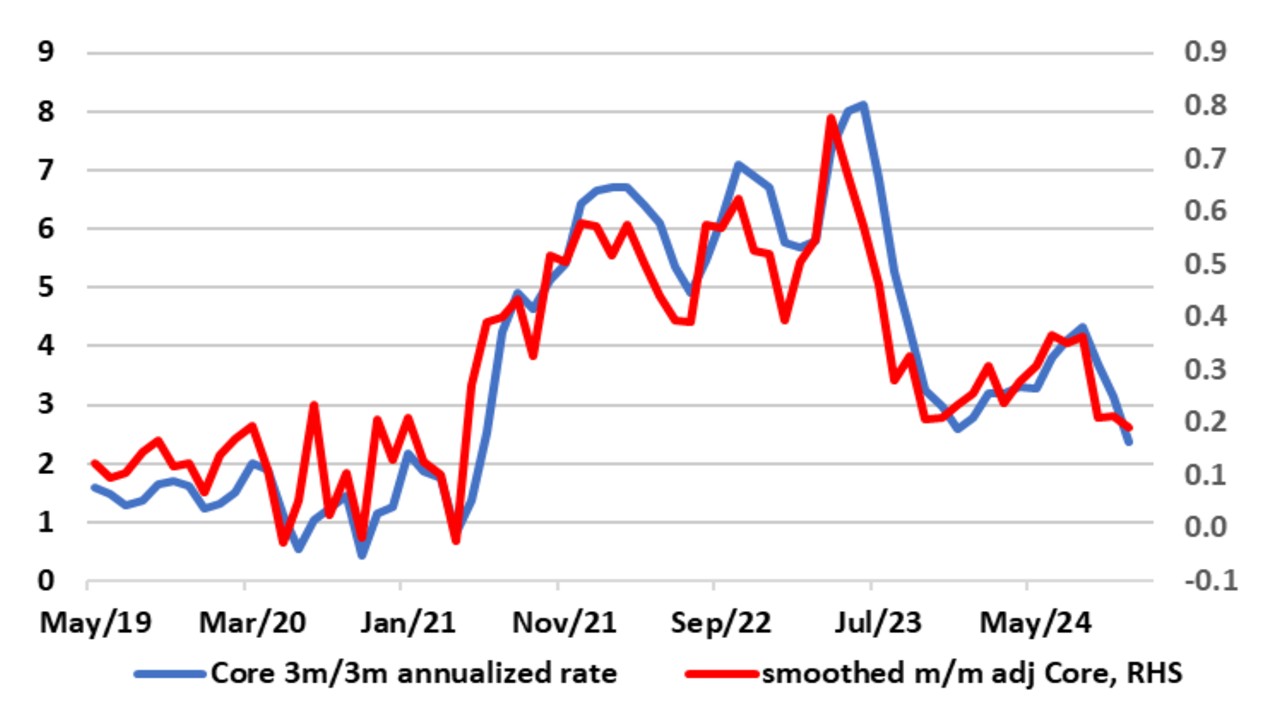

However, we see further disinflation coming through from the tax increase also hitting jobs growth and squeezing profit margins. Re the MPC bias it is clearly shifting towards a Feb 6 rate cut where we look for 25bps. In December three dissents were in favor of a cut with a further member advocating a more activist strategy (presumably ahead). Meanwhile, BOE Chair Bailey continues to guide towards 100bps of cuts in 2025. The December minutes also saw several less hawkish aspects to the statement, including that the labor market may no longer be tight; less reference to inflation persistence; that growth risks had risen to a degree where current quarter GDP may be flat and where the Bank Agents Report suggested a clear slowing in wage pressures into 2025. In addition, the minutes noted that core (and even for services), adjusted m/m data showed a weaker backdrop than headline y/y numbers (Figure 3).

UK money and short end gilt yields will likely reset to more easing in steps during 2025, with a 25bps Feb cut and dovish monetary policy report likely to be the first step. This can decouple the short-end of the UK curve from the U.S. through 2025, especially into 2026 where we see further BOE easing as medium-term fiscal policy tightening kicks in again. We feel that this can also help 10yr Gilt yields fall consistently below 10yr U.S. Treasury yields (Figure 2).

Figure 3: Clear Adjusted Core Inflation Drop Intact?

Source: ONS, CE-computed seasonally adjusted core measures