U.S. Outlook: Healthy Economy Facing Policy Risks

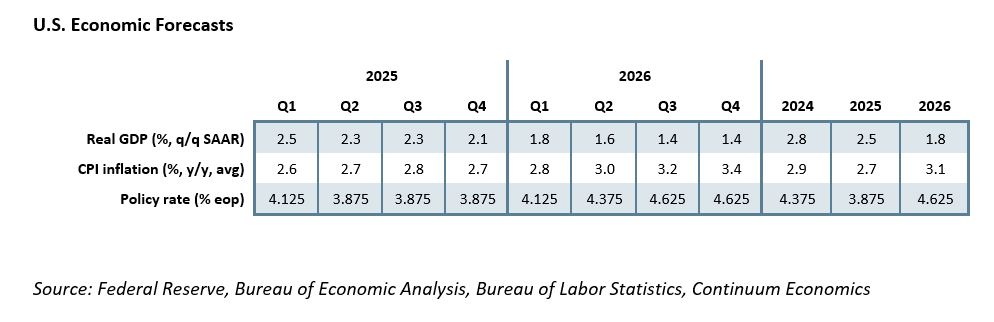

• The U.S. economy, consumer spending in particular, has continued to show surprising resilience, and is growing at a pace probably in excess of long-run potential near 2.0%. Inflation has fallen significantly from its highs, with core PCE inflation now running slightly below 3.0%, but remains stubbornly above the 2.0% target. The labor market has lost momentum, but unemployment remains low. Without significant policy changes, a slowing in GDP growth to near potential and inflation to near target would be likely. However, the economy faces policy risk from tax cuts, which would support growth but add to upside inflationary risk, and tariffs, which would likely be negative for growth while lifting inflation. We expect a modest slowing in GDP in 2025 to 2.5% from 2.8% in 2024 and a modest slowing in CPI to 2.7% from 2.9%. In 2026 we expect the impact of tariffs to pick up while the impact from lower taxes fades, seeing GDP slowing to 1.8% while CPI picks up to 3.1%.

• The FOMC has started easing but with the labor market still healthy and inflation running above target the pace of easing is likely to be cautious in 2025, and we expect only one 25bps move in each of the first two quarters of the year, taking the Fed Funds target down to 3.75-4.0%. With inflation expected to bottom out above the 2% target and pick up in 2026, we expect tightening to resume, with 2026 to see three 25bps rate hikes, in Q1, Q2 and Q3, lifting the Fed Funds target range to 4.5-4.75%. Easing is likely to resume in 2027 as a slowing economy and Fed tightening in 2026 reduce inflationary pressures.

• Forecast changes: Since September, we have revised our 2024 forecasts slightly higher, GDP to 2.8% from 2.6% and CPI to 2.9% from 2.8%. For 2025 we have revised our forecasts significantly higher, GDP to 2.5% from 1.5%, on existing momentum and prospect of supportive fiscal policy, and CPI to 2.7% from 2.3%, on the stronger GDP view and prospects for tariffs. We no longer expect core PCE prices to reach the 2.0% target in 2025. While we previously had expected 2026 to see GDP and inflation both stabilize near 2.0%, we now expect GDP to slow to 1.8% and CPI to rise by 3.1%, lifted by tariffs. In September we expected the Fed Funds target range to fall to 3.0-3.25% in 2025 before stabilizing. We now expect the target range to bottom at 3.75-4.0% in 2025 before being tightened to 4.5-4.75% in 2026.

US Economy Healthy but Facing Policy Uncertainty

The U.S. economy, consumer spending in particular, continued to show impressive resilience in 2024, with the resilience of the consumer becoming more understandable after personal income was revised higher with annual GDP revisions released in September. Employment growth has slowed but an uptrend in the unemployment rate has paused after reaching a 33-month high of 4.3% in July. Consumers have been supported by falling inflation, with core PCE prices now below 3.0% on a yr/yr basis after having spent 2022 above 5.0%, though the downside progress has lost momentum in recent months. Entering 2025, without any major policy changes we would expect progress on inflation to resume as strong data in early 2024 drops out of the yr/yr comparison, while we would expect some loss of momentum from consumers with early 2025 not expected to see the sharp boost seen in early 2024 to disposable income when Social Security recipients were compensated for strong past inflation. Under stable policy, the US economy looked poised to stabilize with growth near potential and inflation near target, both close to 2.0%. There was however uncertainty over how much Fed easing would be needed to reach neutral. Given a large budget deficit in excess of 6% of GDP, we suspect the neutral policy rate would have been a little above 3.0%.

The election of Donald Trump as President with the Republican Party in control of both houses of Congress, however, brings potential for major policy changes, most notably on taxes, tariffs and immigration. Ahead of the election, we could see two different directions a Trump presidency could head. Firstly, there was a moderate scenario, under which Trump realized he was inheriting a growing economy with inflation well off its highs and a monetary easing cycle underway. If he did little other than extend his 2017 tax cuts public sentiment of the economy would gradually improve under his watch, as memories of the post-COVID inflation surge faded, and he could take the credit.

The second scenario would be to fully implement the radical promises of his campaign. Early signals suggest Trump is leaning towards such a scenario. The range of potential outcomes is massive. Extending the 2017 tax cuts would add around USD5 trillion to the budget deficit over 10 years, which would increase the deficit from a CBO estimate of 6.3% of GDP to 7.7%, though this would preserve the status quo and not force a major reconsideration of the economic outlook. Adding the full extent of Trump’s campaign tax cut proposals could add as much again to the deficit, meaning risk for deficits of around 9% of GDP. Tariffs could provide a maximum of around USD 4 trillion in revenue over 10 years, though implementing tariffs on this scale suddenly could add around 3% to inflation. Whether it would be a one-time boost or have secondary effects would depend on the strength of the economy. Actual tariffs revenue and discretionary spending saving will likely be much less and point to an 8-9% budget deficit. The labor market will be tighter if immigration is reduced and large numbers of undocumented workers expelled, though even with aggressive effort this will take time to have its full impact. Still, a tighter labor market would add to upside inflationary risks.

Our Central Scenario

Our initial forecasts made in the immediate aftermath of the election assumed tax cuts would be the early priority and quickly delivered, but that tariffs would wait, possibly until 2026, and brought about in part by a need to address anxiety over the size of budget deficits inflated by tax cuts. However, Trump’s announcement that tariffs would be implemented on Canada, Mexico and China on day one suggests potential for more aggressive action, though we are currently assuming he will back off his threats against Canada and Mexico in return for pledges on border security. A trade war against China in late 2025 does, however, appear likely, though we assume a hike to 30% average tariffs for China from the current 20% first (here), and the risk that Trump will step up tariffs in 2026 in an attempt to finance tax cuts remains real.

Tax cuts are likely to be a positive for the economy in the short term, but carry risks of increasing the budget deficit, and interest rates, and thus the longer-term benefits would be limited. Corporate tax cuts would be on balance growth-supportive, but ending taxation on social security benefits could further depress labor supply, though this appears to be a lower priority than corporate tax cuts. Tariffs would be a drag on growth particularly if met by retaliation and would add to inflation. After initially expecting the benefits from lower taxes to outweigh the damage from tariffs in 2025, we now expect the impact to be more balanced, leaving the economy to see the moderate slowing that would have been likely with no policy changes. 2026 is likely to see further slowing in GDP if trade wars escalate. We expect GDP, after rising by 2.8% in 2024, to slow marginally to 2.5% in 2025 and further to 1.8% in 2026.

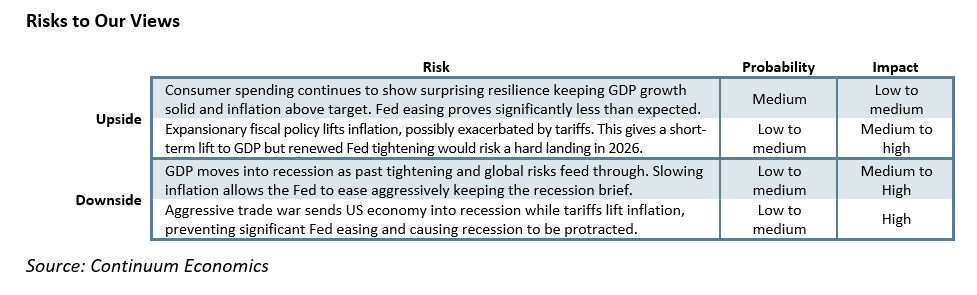

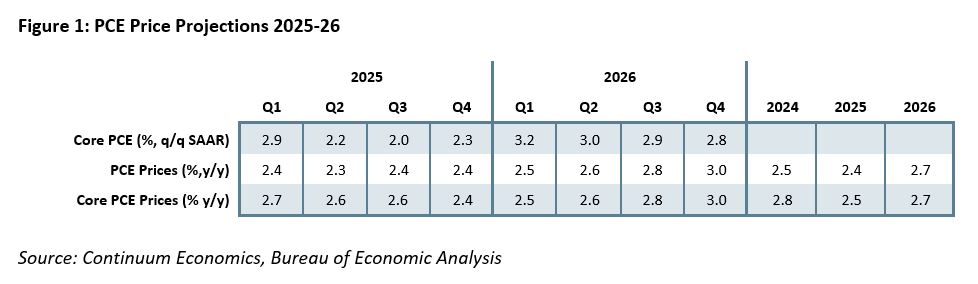

Modest recent disappointment in inflationary data, coupled with prospects for tax cuts and tariffs, mean that we no longer expect core PCE prices to reach the 2.0% target in 2025, though further slowing is likely, we expect to 2.5% for 2025 as a whole compared to 2.8% in 2024, with yr/yr growth seeing a low of 2.4% in Q4 2025 and annualized growth seeing a low of 2.0% in Q3 2025. We expect inflation to regain momentum in 2026, with the year as a whole seeing a rise of 2.7%, and yr/yr growth ending 2026 at 3.0% in Q4, though we expect the strongest quarter on an annualized basis to come in Q1 of 2026, at 3.2%. Fed easing looks set to continue at a slower pace in the near term, and we expect one 25bps easing in each of the first two quarters of 2025, taking the Fed Funds target range to 3.75-4.0%. We expect rising inflation to bring renewed Fed tightening in 2026, with a total of 75bps of rate hikes, 25bps coming in each of Q1, Q2 and Q3, leaving the Fed Funds target range at 4.5-4.75%. This is likely to help slow the economy sufficiently to prevent significant second round effects from the tariff-led inflation, and we expect easing to resume in 2027. Risks to our view are large, dependent particularly on the timing of policy decisions, but are summarized in the table below.