Gilt Yields Rise on U.S. and Fiscal Slippage Concerns

· 10yr Gilts yields are rising on concerns of UK fiscal slippage, but also higher U.S. yields and funding pressures as GBP100bln of BOE QT adds to the budget deficit targeted at 4.5% of GDP in 2024/25. Chancellor Reeves will likely recommit to the fiscal rules (ie further small corrective tightening), while we also see US yields stabilising in Q1. This could stop a further major surge in 10yr Gilt yields, but funding and supply remain adverse for the long-end.

· The rise in 2yr yields is adverse sentiment and not grounded in fundamentals. We look for a 25bps BOE cut in February and a dovish monetary policy report. Indeed, BOE members could feel that they need to sound more dovish in the coming weeks to prepare for a February cut and calm the short-end of the UK curve.

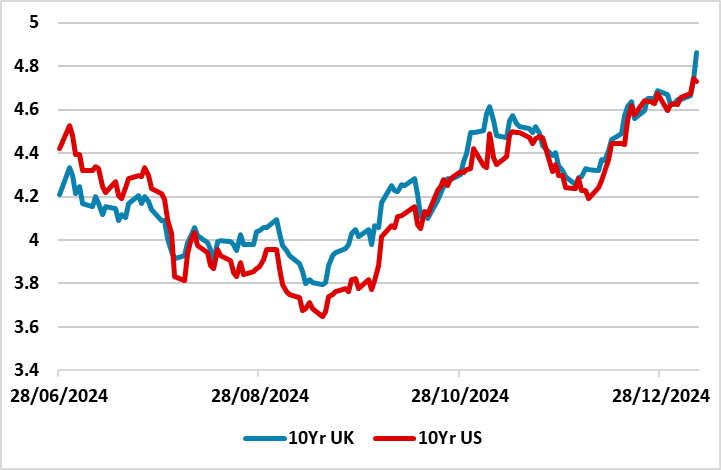

Figure 1: 10yr U.S. and UK Government Bond Yields (%)

Source: Datastream/Continuum Economics

10yr UK Gilt yields have surged in the last couple of days of a number of factors. Firstly, slower than expected economic growth is raising concerns that the Labour government will miss its fiscal target of getting the current expenditure budget deficit on a path towards zero. The weak popularity of the Labour government is then compounding the situation, given the backlash against higher taxes on employers national insurance and the winter fuel tax being scapped for households. This raise questions about the ability and willingness to fix the budget deficit. However, the move is small compared to the 250bps surge in 10yr Gilt yields seen August-September 2022 under Truss. If 10yr Gilts reach 5%, then domestic buyers could be tempted back in and stabilize the market. Otherwise, Chancellor Reeves could state that she remains committed to the fiscal rules and will review the situation in March i.e. be willing to take corrective action. The 2nd driving force is simply higher U.S. yields (Figure 1), which we feel are unlikely to surge much further and could stabilize in Q1 (here). The 3rd issue is that the BOE is undertaking more aggressive QT than other major central banks at GBP100bln per annum, which is adding to a budget deficit of 4.5% and causing funding/supply pressures. This is unlikely to change near-term, but the rise in Gilt yields is a tightening of financial conditions and argues more strongly for rate cuts. 10yr Gilts could remain volatile until these calming forces are seen.

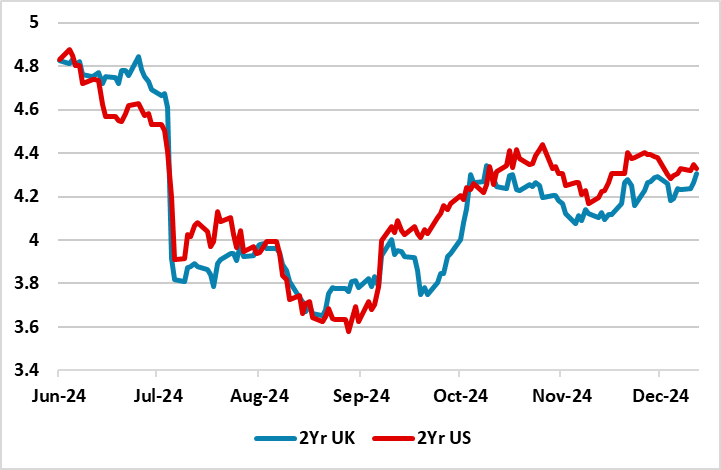

Figure 2: 2yr U.S. and UK Government Bond Yields (%)

Source: Continuum Economics

2yr Gilt yields have also surged as long-end yields have dragged up the front end. Additionally, 2yr U.S. yield rise has also caused a spill over to Gilts (Figure 2). UK money markets are now only discounting a 25bps cut in May and a further 25bps in December. Fed policy and higher UK CPI inflation are prompted concerns of only small BOE easing. However, we see further disinflation coming through from the tax increase also hitting jobs growth and squeezing profit margins. Re the MPC bias it is clearly shifting towards a Feb 6 rate cut where we look for 25bps. In December three dissents were in favor of a cut with a further member advocating a more activist strategy (presumably ahead). Meanwhile, BOE Chair Bailey continues to guide towards 100bps of cuts in 2025. The December minutes also saw several less hawkish aspects to the statement, including that the labor market may no longer be tight; less reference to inflation persistence; that growth risks had risen to a degree where current quarter GDP may be flat and where the Bank Agents Report suggested a clear slowing in wage pressures into 2025. In addition, the minutes noted that core (and even for services), adjusted m/m data showed a weaker backdrop than headline y/y numbers. We look for a 25bps cut in February and a dovish monetary policy report. Indeed, BOE members could feel that they need to sound more dovish in the coming weeks to prepare for a February cut and calm the short-end of the UK curve.

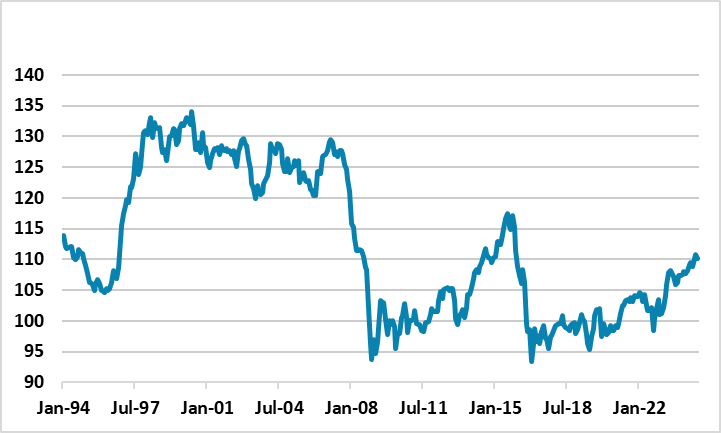

Figure 3: GBP Real Effective Exchange Rate

Source: Datastream/Continuum Economics

Finally, GBP is not a constraint on BOE rate cuts. The pound has gone down in early 2025, but this is mainly against a strong USD and was strong in 2024! The broad GBP real effective exchange rate is still strong versus 2016 or 2022 (Figure 3).