U.S. Outlook: Economy Starting to Lose Momentum

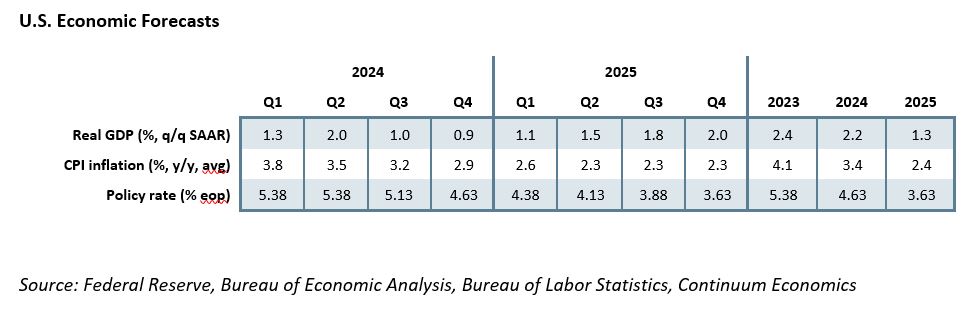

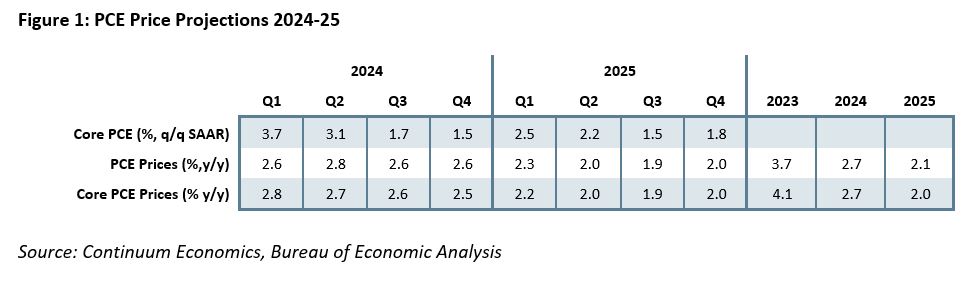

• The U.S. economy is starting to lose momentum after a surprisingly strong second half of 2023, and we expect the loss of momentum to become more apparent in the second half of 2024, causing a slowing in employment growth from its current strong pace. We expect inflation to resume a gradual loss of momentum after strength in Q1 of 2024 corrected surprisingly soft data in the second half of 2023. The economy will enter 2025 with limited momentum, with election uncertainty a potential weight and fiscal policy concerns likely to rise in early 2025. However, assisted by Fed easing, the economy is likely to regain momentum through 2025, starting the year at a pace near 1.0% on an annualized basis but picking up to near 2.0% by the end of the year. We expect core PCE prices to reach the Fed’s 2.0% target on a y/y basis in Q2 2025 before stabilizing around that pace.

• While the data needs to soften before easing starts, the Fed is not hawkish, and the bar for further tightening looks high. Easing is unlikely before September, but on the view that data loses momentum soon, we look for the Fed to start easing with a 25bps move in September and to deliver two more 25bps moves in Q4 by which time signs of slowing in both the economy and inflation are likely to be clear. In 2025 we expect a cautious pace of easing with one 25bps move per quarter, on the view that the economy will regain momentum and inflation, while likely to reach the 2.0% target for the core PCE price index in Q2 of 2025, is unlikely to move significantly below that. This will leave the Fed Funds target at 4.5-4.75% at the end of 2024 and 3.5-3.75% at the end of 2025.

• Forecast changes: Our 2.2% GDP forecast for 2024 is only marginally below the 2.3% we projected in March, but we have revised 2025 lower to 1.3% from 1.7% (on a calendar year basis). Our inflation forecasts are significantly higher for 2024, with core PCE prices at 2.7% from 2.2% and CPI at 3.4% from 2.6%. For 2025 our views have not changed significantly, with core PCE prices seen at 2.0% rather than 1.9%, and CPI at 2.4% from 2.2%. We continue to expect the FOMC to deliver 75bps of easing in 2024 and 100bps of easing in 2025, though risk is for less rather than more in 2024. Should only 50bps be seen in 2024, we would look for 125bps in 2025.

GDP growth slowing, but little risk of recession

The U.S. economy is showing tentative signs of slowing. A 1.3% annualized increase in Q1 GDP was the slowest since a decline in Q2 2022. Though with weakness most notable in inventories and net exports, the breakdown showed continued momentum in domestic demand. The quarter was restrained by bad weather in January, with March data showing a strong end to the quarter. Q2 arithmetic will be supported by the weakness in January, but signals are mixed. April data was consistent with a loss of momentum, though it may have been corrective from March strength, and May looks more positive, particularly non-farm payrolls and surveys of service sector activity. Q2 GDP will probably be a little stronger than Q1 but we expect the loss of momentum to resume in the second half of the year.

Consumer spending will be key. Q1 saw a moderate increase of 2.0% annualized, in line with a 1.9% increase in real disposable income. This may signal a more balanced consumer picture, after the second half of 2023, which saw spending rise at a surprisingly strong pace in excess of 3.0%, providing the main reason GDP surprised on the upside in late 2023, despite real disposable income rising by less than 1.0%. Consumers were supported by the final unwinding of savings built up during the pandemic, which are now largely exhausted, and buoyant equities, which remain supportive but will probably become less so. Going forward, spending is likely to move more closely with real disposable income, where growth is moderate and vulnerable to a slowing in employment growth.

Non-farm payroll growth remains strong but labor market signals are mixed, with job openings back near pre-pandemic rates and initial claims starting to rise. The household survey, which calculates the unemployment rate (which is creeping higher) is underperforming non-farm payrolls unusually sharply. We feel the error is more in the household survey, which may be missing recent immigrants, though payrolls could be overestimating the strength of start-up firms, which are estimated rather than surveyed. The labor market remains strong, but even a modest slowing will feed into disposable income and consequently consumer spending, and that will feed back into the labor market. We expect GDP growth near 1.0% annualized in the second half of 2024.

Also contributing to a slowing in GDP will be a loss of momentum in housing, which was particularly strong in Q1, but most recent data has suggested that trend is peaking. Downside risks are modest in business investment, though a recent picture of subdued growth is more likely to lose than gain momentum, with commercial real estate an area of vulnerability. Government remains quite strong but will be responsive to tax revenues at the state and local level. Net exports extended their Q1 deterioration in April, while Q1’s inventory slowdown looked corrective from strength in late 2023 rather than a signal that renewed inventory building is needed. The US economy is not at serious risk of recession, but does appear to be losing momentum.

Restrictive Fed policy is weighing on growth, which gives the Fed scope to take effective action should growth slow clearly below potential. The Fed has made it clear that a sharp unexpected weakening of the labor market would be likely to prompt easing. Once the Fed starts to ease, the economy is likely to gradually regain momentum through 2025, with the economy starting the year near a 1.0% annualized pace and ending the year near potential at 2.0%.

Inflation and Fed Policy

Inflation surprised on the upside in Q1, with core PCE prices up by an annualized 3.7% after two straight quarters consistent with the Fed’s 2.0% target. We believe that the second half of 2023 overstated the extent of the inflation slowdown and Q1 2024 data was corrective from that. There appears to be some residual seasonality even after seasonal adjustments, with Q1 data having been strong in 2023 too and with January particularly so in both 2023 and 2024 as New Year pricing decisions were made.

We expect forthcoming data to show a similar seasonal pattern to 2023 but with the data consistently a little softer than the equivalent quarters of 2023, meaning that the second half of 2024 will see core PCE prices rising by less than 2.0% on an annualized basis, though progress on the y/y pace will be modest, from 2.8% currently to 2.5% in Q4. A slowing economy should help reduce inflationary pressure and while we expect the first half of 2025 to see annualized growth a little above 2.0%, we expect y/y core PCE prices to reach the 2.0% target in Q2 2025. We expect the pace to stabilize near 2.0% for the remainder of 2025 and risks for 2026 are probably on the upside if growth returns to potential in a less globalized world.

Fed policy is data dependent though the Fed is not hawkish with the bar for further tightening appearing to be high. Should inflation clearly lose momentum, and evidence for that is unlikely to be sufficiently persuasive before September, easing would be likely to follow, though the pace of easing is likely to be cautious if the economy and labor market remain resilient. We believe that by September there will be sufficient evidence of falling inflation to allow a 25bps easing, though this remains a close call. We expect both of the meetings in Q4 to deliver 25bps easings, though two easings in a quarter is likely to require evidence of a significant slowing in growth as well as inflation.

We doubt the Fed will find signs of a slowing economy alarming for very long, particularly once easing starts, and we expect reviving growth and inflation near target, but not moving significantly below, will see them moving at a 25bps per quarter pace through most of 2025. If three easings are delivered in 2024, we would expect four in 2025, but if only two are seen in 2023, we would expect five in 2025, with Q1 seeing two moves. Given our leaning towards the former scenario, this would see the Fed Funds target ending 2025 at 3.5-3.75% after ending 2024 at 4.5-4.75%. Our forecast for the Fed Funds rate at the end of 2025 is well above the Fed’s current estimate for neutral of 2.75%. If GDP and inflation gain momentum of 2026, estimates of the terminal policy rate may need to be raised.

The election and 2025

November’s election between two unpopular candidates, President Joe Biden and former President Donald Trump, remains too close to call. Trump’s legal issues, the economy and developments in the Middle East are just some of the issues that could swing the small number of undecided voters. A close election, particularly if Biden is the winner, could be followed by disputes and instability that could weigh on the economy heading into January.

The contests for Congress will also be very close. Currently, the Republicans have a narrow majority in the House but their difficulties in agreeing on policy and leadership give the Democrats a good chance of regaining control. The Senate, where the Democrats currently have a narrow majority, in contrast sees the Republicans having a good chance of gaining control, with more Democrats than Republicans defending close states this year. Whoever wins the election, the budget deficit looks set to remain near 6% of GDP through the next presidential term, high enough to justify concern over the cost of future interest payments, and make a sustained return to 2% inflation harder to achieve.

Early 2025 could see budget issues coming to a head, either with a standoff over the debt ceiling if Biden is re-elected or an attempt by a re-elected Trump to make his tax cuts permanent. Extending the tax cuts would bring a rise in bond yields, but would be unlikely to bring a crisis similar to that seen in the UK in 2022. A debt ceiling standoff would carry greater risks under a Republican House, even if the Democrats hold the Senate, than under our more likely scenario of a Democratic House and a Republican Senate. Still, a downgrade from one of the major credit rating agencies in 2025 is a significant risk. Neither party is showing any interest in tackling the primary driver of future deficits, the rising costs of Medicare and Social Security, as that would be electoral suicide.

A Trump presidency would carry far greater uncertainty and thus risk than a Biden one. Lower taxes under Trump would be positive for equities, and to a modest extent, growth, but this could be outweighed by a sharp rise in tariffs or an attempt to replace experienced professionals with Trump loyalists in key government departments. However, the history of Trump’s first term suggests that tariffs would not be a priority early on, with immigration and tax cuts a more likely early focus, while turnover of staff would take time to have a significant impact.

Trump is likely to move to replace Fed Chairman Jerome Powell, whose term expires in in May 2026, and is likely to push for a more dovish Fed. A more dovish Fed, prospects for tax cuts and higher tariffs suggests that inflationary risks would be significantly higher under Trump than Biden. Even under Biden, keeping inflation at the 2% target, which we expect to be hit in Q2 2025, would be difficult to sustain in 2026.