Fed Senior Loan Officer Opinion Survey Suggests Weaker Demand For Business Investment

The Fed’s July Senior Loan Officer Opinion Survey of bank lending practices suggests uncertainty is restraining investment demand, with supply signals on balance fairly neutral but demand signals weaker.

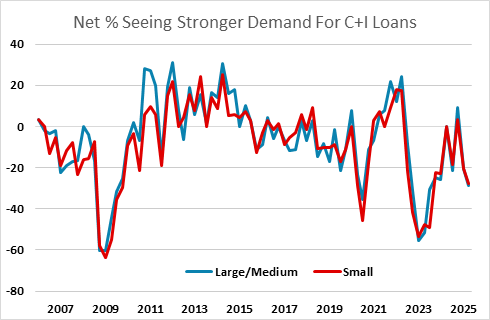

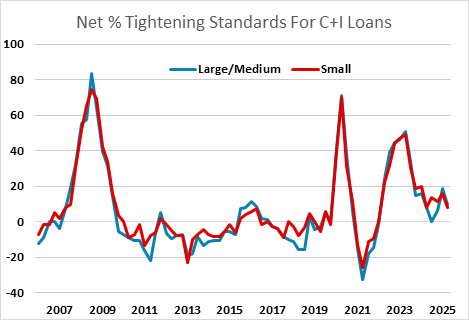

The net percentages of respondents reporting stronger demand for C+I loans at -28.6% for large and medium firms and -27.9% for small firms compare to -20.3% and -20.6% respectively in April and are the weakest since Q4 2023. The net percentage of respondents tightening standards however is lower, 9.5% for large and medium firms and 8.2% for small firms, compared to 18.5% and 15.9% respectively in Q1.

For commercial real estate measures of supply are little changed from April but measures of demand are weaker. For residential loans supply signals are near neutral but demand is increasingly negative relative to April, though still less negative than in January. For consumer loans standards eased and demand improved for autos, though elsewhere standards were slightly tighter and demand remains negative, if slightly less so than in April. Consumers may be less sensitive to policy uncertainty than businesses.

I,Dave Sloan, the Senior Economist declare that the views expressed herein are mine and are clear, fair and not misleading at the time of publication. They have not been influenced by any relationship, either a personal relationship of mine or a relationship of the firm, to any entity described or referred to herein nor to any client of Continuum Economics nor has any inducement been received in relation to those views. I further declare that in the preparation and publication of this report I have at all times followed all relevant Continuum Economics compliance protocols including those reasonably seeking to prevent the receipt or misuse of material non-public information.