U.S. Outlook: Fed to Ease as Economy Gradually Slows

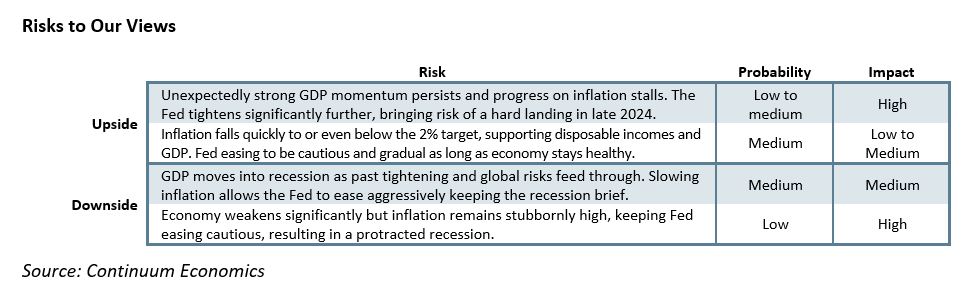

• The U.S. economy has continued to see growth surprising to the upside supported in particular by consumer spending. While the momentum of the second half of 2023 will be difficult to sustain the economy now looks poised for a soft landing, with risk that continued resilience in the economy will delay Fed easing. Recession now looks unlikely, though we still expect growth in the economy to slow below potential in mid-2024, leading to a modest rise in unemployment as employment growth falls below that of the labor force. While inflation has fallen significantly even as growth remained solid due to improving supply getting inflation back to the 2% target is likely to require some loss of momentum in demand. We expect inflation to edge slightly below target in early 2025 but as the economy regains momentum through 2025 keeping inflation on target may be difficult.

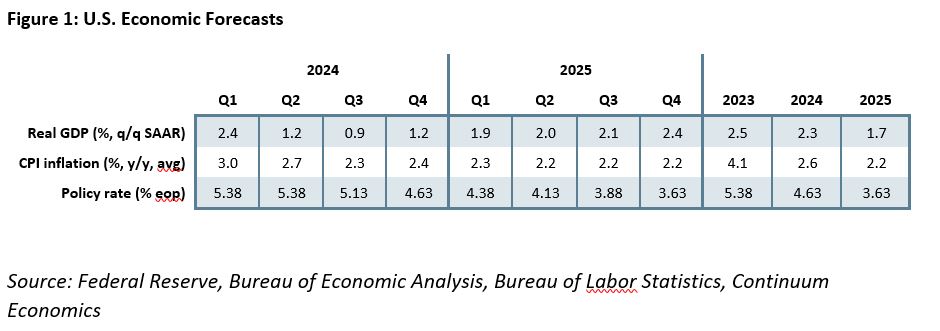

• Given the strength of recent GDP growth the Fed is rightly cautious about declaring victory on inflation despite the encouraging progress seen in late 2023. If growth remains solid even if inflation data comes in consistent with target easing is likely to be cautious, with the Fed moving by 25bps per quarter. We feel Q3 is more likely as a start date than Q2 unless inflation data comes in consistently soft into the June meeting. We expect one 25bps easing in Q3 (most likely in July) but two 25bps moves in Q4 after GDP growth moves below potential. As GDP growth improves in 2025 we expect the Fed to revert to moving by only 25bps per quarter, meaning 100bps of easing in 2025 to follow 75bps in 2024, leaving the end 2025 Fed Funds target at 3.5-3.75%.

• Forecast changes: While still expecting the economy to slow, we have revised our GDP forecasts significantly higher, 2023 to 2.3% from 1.2% and 2024 to 1.7% from 1.2%. We still expect the slowest quarter on an annualized basis to be Q3 2024, though now expect a rise of 0.9% annualized in that quarter rather than 0.2%, and now expect that quarter to be the only quarter of 2024 to fall below 1.0% annualized, when previously we had expected each quarter to do so. Our inflation forecasts have seen less change with CPI still seen averaging at 2.6% in 2024 though we now see 2025 at 2.2% rather than 2.4%. We have revised our core PCE price forecasts slightly lower for both years, 2024 to 2.2% from 2.5% and 2025 to 1.9% from 2.0%. With our GDP forecasts upgraded, if still slightly below the Fed’s also upgraded view, we now expect 75bps of easing in 2024 rather than 125bps, though we continue to expect 100bps of easing in 2025.

GDP growth to slow, but not into recession

The U.S. economy consistently surprised on the upside through 2023, accelerating well above potential in the second half of the year, despite widespread expectations at the start of the year that the economy would enter recession. We repeatedly revised our forecasts higher through 2023 and have done so again, now expecting GDP to increase by 2.3% in 2024 on an annual average compared to our December forecast of 1.2%. 2025 we now see at 1.7% rather than 1.2%. We still expect some slowing in the coming quarters, with Q4/Q4 growth seen at 1.4% in Q4 2024 versus 3.1% in Q4 2023, before improving to 2.1% in Q4 2025. However in December we expected each quarter of 2024 to come in below 1.0% on an annualized basis. We now expect only the weakest quarter, Q3 2023, to do so with a 0.9% annualized increase. Thus the economy will see growth move below potential, but without getting close to recession. We expect growth to regain momentum through 2025, with GDP growth near 2.0% in each quarter on an annualized basis.

The U.S. economy consistently surprised on the upside through 2023, accelerating well above potential in the second half of the year, despite widespread expectations at the start of the year that the economy would enter recession. We repeatedly revised our forecasts higher through 2023 and have done so again, now expecting GDP to increase by 2.3% in 2024 on an annual average compared to our December forecast of 1.2%. 2025 we now see at 1.7% rather than 1.2%. We still expect some slowing in the coming quarters, with Q4/Q4 growth seen at 1.4% in Q4 2024 versus 3.1% in Q4 2023, before improving to 2.1% in Q4 2025. However in December we expected each quarter of 2024 to come in below 1.0% on an annualized basis. We now expect only the weakest quarter, Q3 2023, to do so with a 0.9% annualized increase. Thus the economy will see growth move below potential, but without getting close to recession. We expect growth to regain momentum through 2025, with GDP growth near 2.0% in each quarter on an annualized basis.

The key to the economy will be consumer spending, where strong growth in the second half of 2023 ran well ahead of that in real disposable income, seeing the savings rate fall from above 5% in Q2 to below 4% in Q4. Consumers remain supported by savings built up during the pandemic, which is likely to fade as a source of support in 2024, and increasingly the wealth effects of a rising stock market, which remain supportive. However the savings rate looks set to stabilize with future growth in personal spending likely to be dependent on real disposable income, and that looks likely to lose some momentum as the labor market does so. Recent gains in mortgage rates suggest little upside scope for housing investment. Business investment is likely to remain quite subdued though the Fed’s most recent Senior Loan Officer Survey showed a less negative picture on demand for commercial and industrial loans. This suggests risks in the banking sector have faded since early 2023, though downside risks for 2024 have not disappeared, particularly with commercial real estate remaining vulnerable. Net exports and inventories also contributed to the upside GDP surprise of Q4 2023, though this saw the most recent FOMC minutes downplaying the strength with these two components seen as having little signaling value. Early Q1 2024 data has been mixed, suggesting some loss of momentum in GDP growth, though weakness in some January releases was seen as weather-induced.

The moderate slowing in the economy we expect will be induced by the current restrictive Fed policy. We expect annualized gains of 2.4% in Q1 2024, 1.2% in Q2 and 0.9% in Q3, which we expect to prove a low before a 1.2% increase in Q4 with momentum set to build further through 2025, that assisted by Fed easing. Our upgraded GDP forecast for 2024 of 1.4% Q4/Q4 is below the Fed’s recently upgraded projection of 2.1%. For 2025 we expect a rise of 2.1% Q4/Q4, marginally above the FOMC’s 2.0%. That for the year as a whole our 2024 forecast of 2.3% is stronger than our 2025 view of 1.7%, reflects 2024 starting with more momentum than 2025 is likely to.

Inflation and Fed Policy

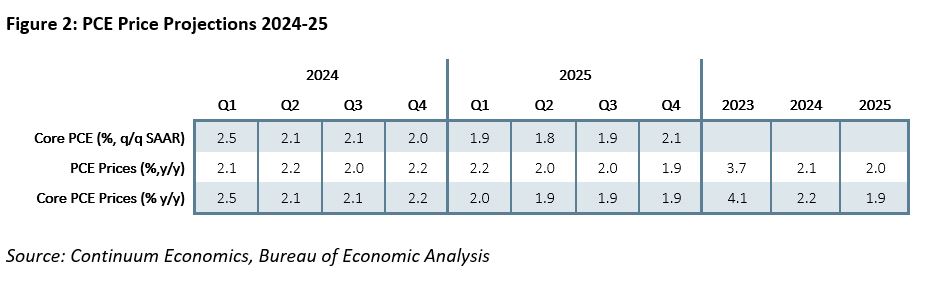

Our forecasts for inflation have not changed much since December. We still expect CPI to average 2.6% in 2024 though we have revised our core PCE price forecast down to 2.2% from 2.5%, with the CPI outperformance of core PCE prices having increased in late 2023, though both were strong in January 2024. We do not expect the strength seen in CPI at the start of 2024, reflecting price decisions taken at the start of the year, to be sustained. While a second straight disappointment in February was more concerning than that seen in January, most recent months have produced subdued inflationary figures, particularly core PCE which saw only one month above 0.2% before rounding in the second half of 2023. Still, the January and February CPI data suggests that demand and wage pressures on inflation persist in services, despite price restraint coming from supply improvements in the goods sector. Getting inflation sustainably back to target is likely to require some cooling in demand, particularly with the potential for continued improvement in supply likely to fade by late 2024.

Our forecasts for inflation have not changed much since December. We still expect CPI to average 2.6% in 2024 though we have revised our core PCE price forecast down to 2.2% from 2.5%, with the CPI outperformance of core PCE prices having increased in late 2023, though both were strong in January 2024. We do not expect the strength seen in CPI at the start of 2024, reflecting price decisions taken at the start of the year, to be sustained. While a second straight disappointment in February was more concerning than that seen in January, most recent months have produced subdued inflationary figures, particularly core PCE which saw only one month above 0.2% before rounding in the second half of 2023. Still, the January and February CPI data suggests that demand and wage pressures on inflation persist in services, despite price restraint coming from supply improvements in the goods sector. Getting inflation sustainably back to target is likely to require some cooling in demand, particularly with the potential for continued improvement in supply likely to fade by late 2024.

For 2025, we expect CPI to average 2.2%, versus our December forecast of 2.4%, and core PCE prices to average 1.9%, versus a December forecast of 2.0%. This will mean core PCE prices moving slightly below the 2.0% target in 2025 as a whole, but by the end of the year we expect underlying momentum to be starting to increase again, nudging marginally above 2.0% on an annualized basis in Q4 of 2025.

The economy is currently growing at or even above potential, with some persistence in inflationary pressures, justifying caution towards easing, though if as we expect GDP growth moves slightly below potential and inflation moderates to near target then gradual easing will be justified. Our forecast for 75bps of easing in 2024 matches the FOMC’s latest median dots. Our GDP view is slightly softer than the Fed’s, but the FOMC dots are skewed to the upside for 2024, suggesting 75bps is reasonable if GDP slightly underperforms the FOMC view. Timing will be data-dependent, though it would probably take only one more disappointing inflation outcome, in March, April or May, to prevent easing in Q2. We expect one 25bps move in Q3, marginally more likely in July than September, and two 25bps moves in Q4 by when we expect GDP growth to be more clearly below potential. With 2025 likely to see growth back near potential but inflation hitting target, we expect a cautious pace of easing, with one 25bps move in each quarter. This is slightly more than the 75bps seen in the Fed’s dots for 2025, though this time the Fed view is skewed to the downside. 100bps is reasonable for 2025, particularly if core PCE prices reach the 2.0% target. This would see the Fed Funds target ending 2024 at 4.5-4.75% and 2025 ending at 3.5-3.75%, still well above the Fed’s current neutral estimate of 2.625%. If GDP growth and inflation gain some momentum in 2026, estimates of the terminal policy rate would need to be raised.

With Fed Chairman Jerome Powell saying after the recent meeting that it is likely to be appropriate to reduce the pace of balance sheet run-off fairly soon, a tapering of quantitative tightening could begin in Q2, before when we expect easing to start. The tapering of QT would be gradual and it is unlikely to be concluded until well into 2025.

The election and 2025

The contests for control of Congress will also be very close. Currently the Republicans have a narrow majority in the House but their difficulties in agreeing on policy and leadership give the Democrats a good chance of regaining control. The Senate, where the Democrats currently have a narrow majority, in contrast sees the Republicans having a good chance of gaining control, with more Democrats than Republicans defending close states this year. Whoever wins the election, the budget deficit looks set to remain near 6% of GDP though the next presidential term, a level which is high enough to justify concern over the cost of future interest payments, and make a sustained return to 2% inflation more difficult to achieve. A downgrade from one of the major credit rating agencies in 2025 is a significant risk, particularly if another standoff on the debt ceiling is seen. Republicans would tax less than Democrats who would spend more, but the net differences in terms of the size of the budget would be modest. Neither party looks willing to tackle the primary driver of future deficits, the rising costs of Medicare and Social Security, which would probably be electoral suicide.