Preview: Due December 12 - U.S. November CPI - Flat again overall but not quite as soft in the core

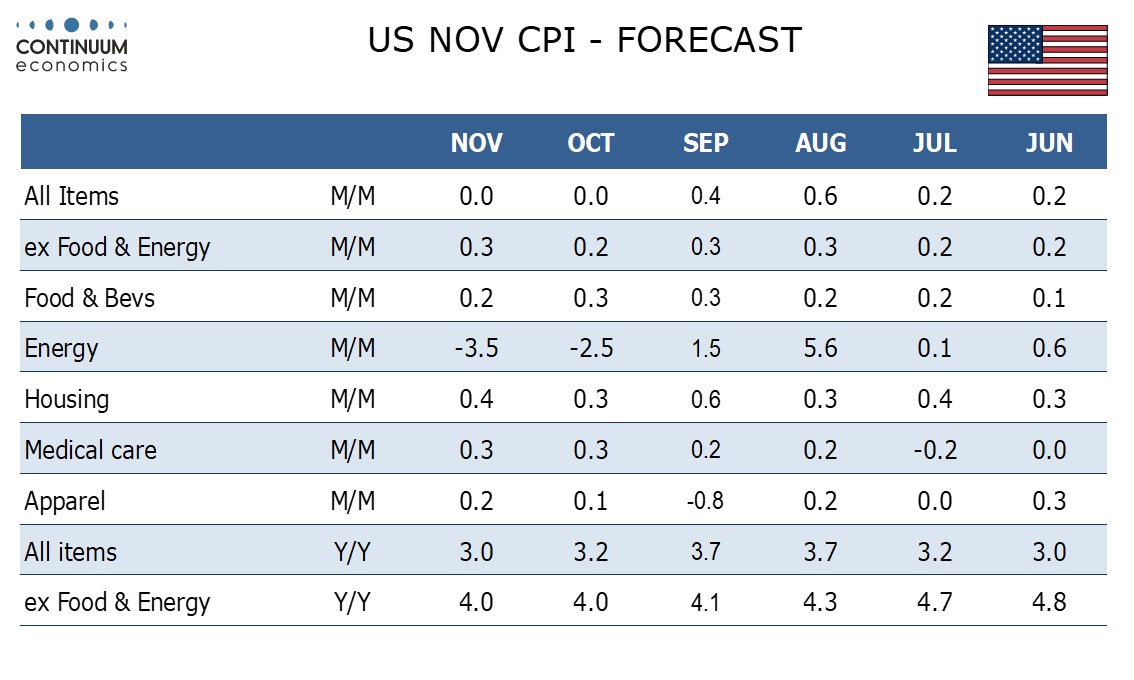

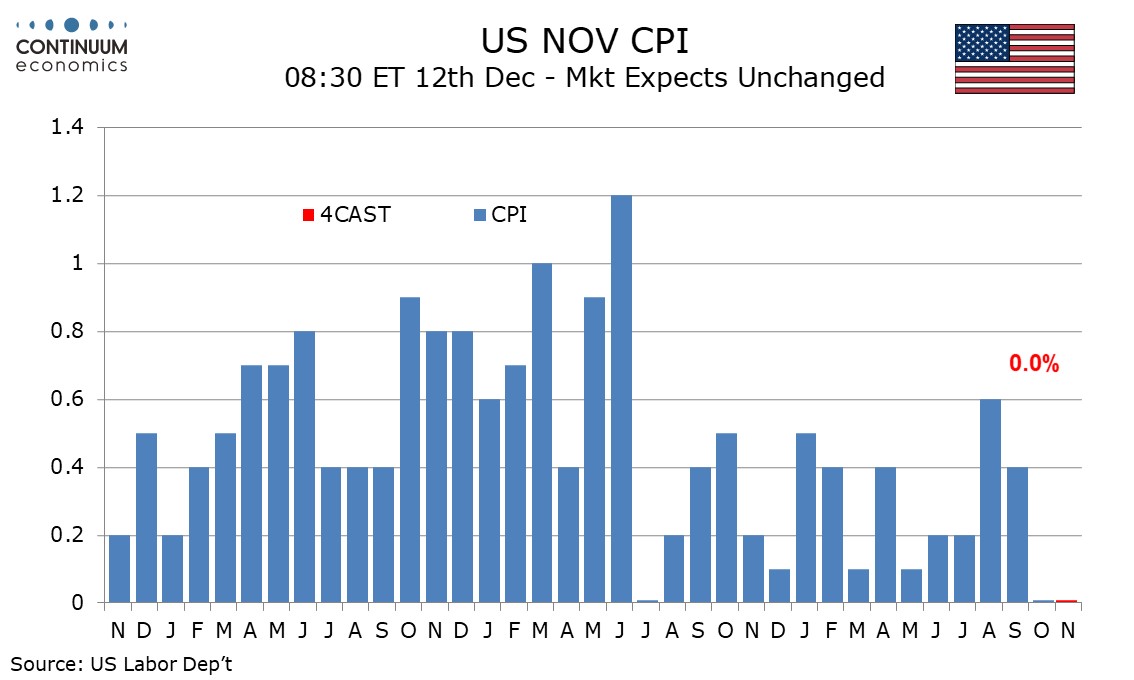

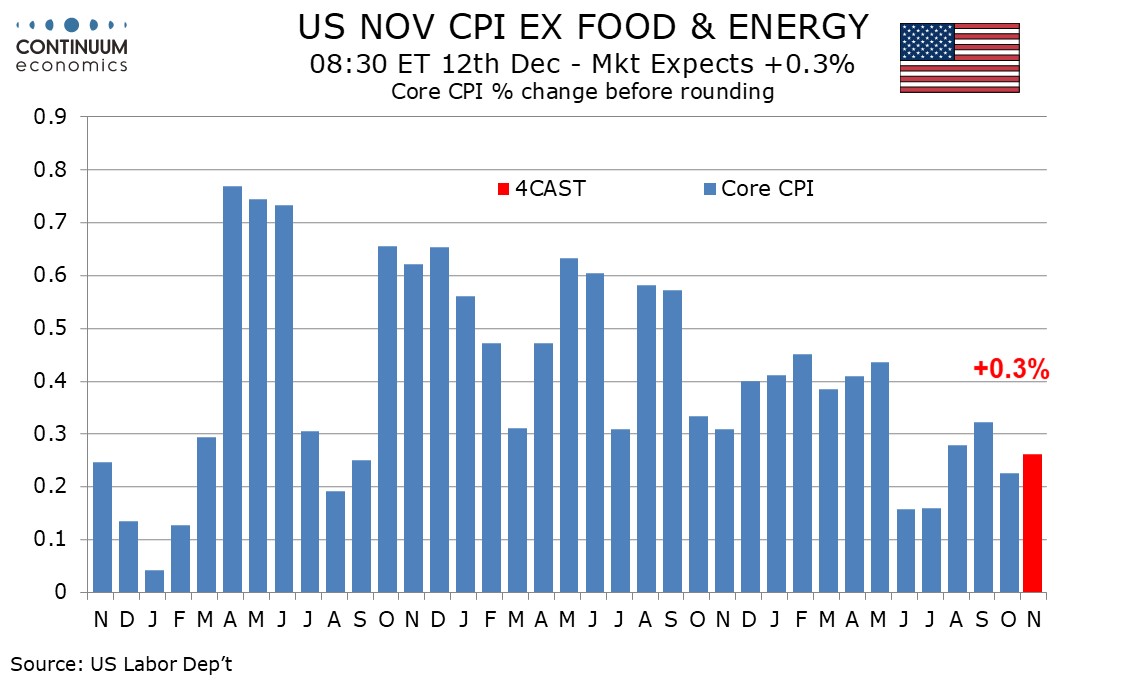

We expect November CPI to be unchanged for a second straight month, though ex food and energy we expect a 0.3% increase to follow October’s 0.2% rise. Before rounding however we expect a core rate of 0.26%, meaning that a second straight 0.2% rise is more likely than 0.4%.

Gasoline prices saw accelerated declines in November and this could feed through to other components such as air fares. In the core rate, October’s downside surprise was mostly due to shelter, which came in below trend after an above trend September, and we expect shelter in November to look similar to the September and October average. Medical care was seen as an upside risk in October due to a changed methodology, but the 0.3% gain, although a ten month high, was less strong than some feared. We expect a similar rise in November. Elsewhere we expect mostly modest gains, and only a modest negative from autos, which have been trending lower in recent months.

We expect overall yr/yr CPI to slip to 3.0% from 3.2%, reaching its lowest since March 2021, but the ex food and energy rate to remain at 4.0% yr/yr. October’s core rate was the slowest since a matching 4.0% in September 2021.