DM Rates Outlook: Rate Cuts Arrive Except Japan

• For U.S. Treasuries, we see 2yr yields coming down further on our baseline soft landing view, as the Fed moves consistently to a 3.00-3.25% Fed Funds rate. However, with considerable Fed easing already discounted, 2yr yield decline should be modest and 2yr yields should bottom mid-2025. 10yr yields should see a broader consolidation, dragged lower in the coming months by the soft v harder landing debate but then fiscal worries stopping the decline in yields. • EZ short-end yields are already discounting a terminal ECB policy rate close to 2%, but concerns that the economic recovery could be very slow will likely produce one final decline in 2yr German yields in the next 6 months. 10yr Bund yields should see choppy consolidation, as a small positive real yields is required against this backdrop and a slow recovery into 2025.• For JGB’s, given the BOJ guidance that it will hike further if growth and CPI meets its projections, we see a BOJ hike by 25bps in Q4 (most likely October) and two further 25bps hike in Q1 and Q2 before a pause at 1.0%. This is not discounted in the money market or 2yr yields and we see 2yr yields rising consistently. We would expect in the next 6 months that 10yr yields shift up with 2yr yields, but healthy domestic institutional buying for 10yr in the 1.25-1.50% area prompts a bear flattening process in H2 2025. Risks to our views: Stagnation or a small recession in the U.S. would lead to larger than projected Fed easing in 2024 and 2025 to 2.50% or 2.00% Fed Funds (here), which would bring yields down more across the curve – though still with a swing to a positive shaped yield curve. The spill over would impact 10yr government bond yields in other DM countries.

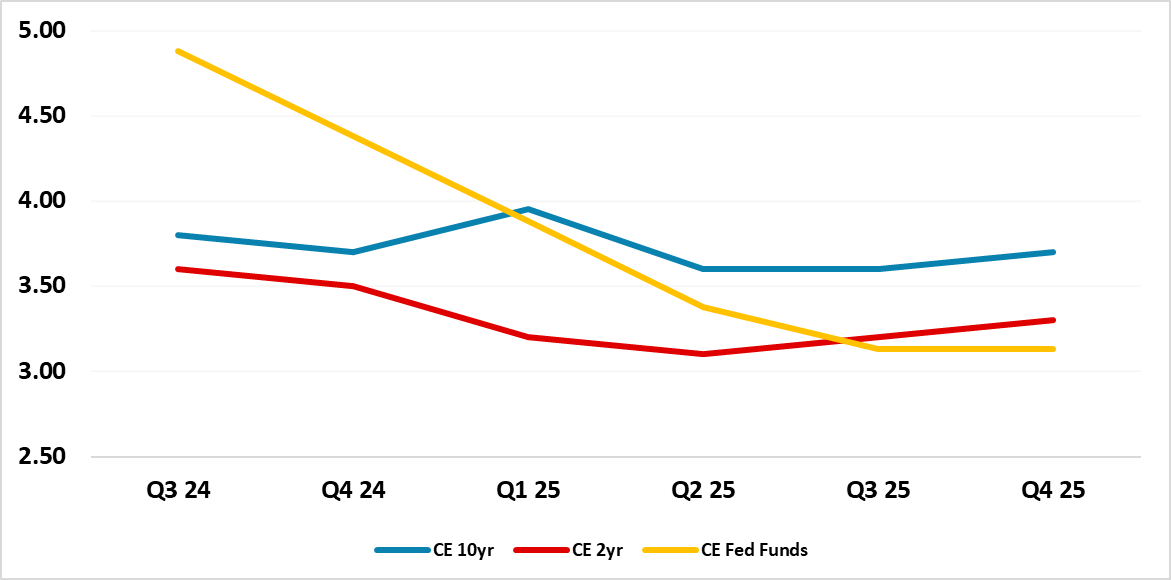

Figure 1: Continuum Economics Forecast Fed Funds, 2 and 10yr U.S. Treasury Yields (%)

Source: Continuum Economics

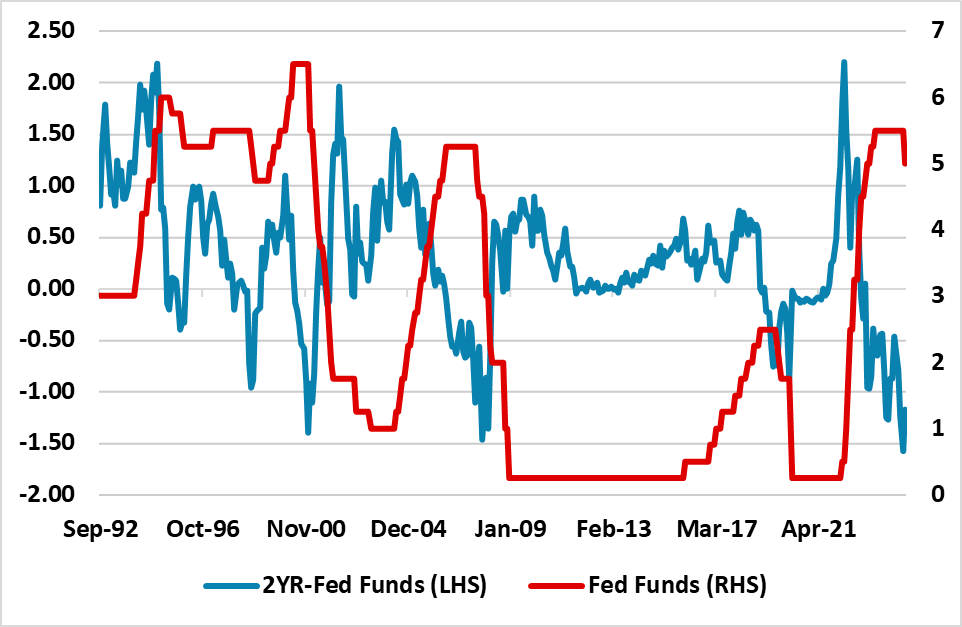

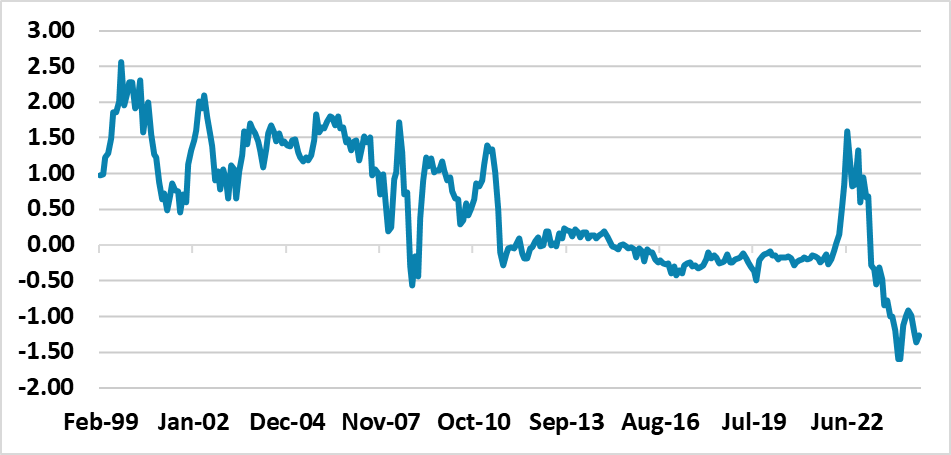

The 50bps cut at the September FOMC meeting (here) will likely be followed by 25bps cuts at every meeting until June 2025 and then one further 25bps cut to bring the Fed Funds rate to 3.00-3.25% by September 2025. However, the Fed could still consider 50bps at the next couple of meetings should the real sector data be softer than expected and point to a harder landing (Figure 3). Though this baseline cycle is discounted in the money market curve, 2yr yields should still be able to gradually decline (Figure 1) as the cuts arrive and as the market looks to 2026 policy expectations of a stable Fed. Currently, the market looks for the Fed Funds rate to end at the Fed neutral rate estimate of 2.9%. We would see the market expecting no hikes in 2026 and this should help 2yr yields in 2025. This is important as 2yr-Fed Funds normally goes fairly positive at the end of an easing cycle (Figure 2), reflecting expectations of a tightening cycle within 6-12 months! If neutral interest rate expectations for 2026 can be maintained, then 2yr yields can be 3.30% by end 2025. If the market fears H2 2026/2027 hikes, then 2yr could rise more from the Q3 2025 lows.

Figure 2: Fed Funds Rate and 2yr-Fed Funds Spread (%)

Source: DataStream/Continuum Economics

10yr yields can benefit from the lower 2yr yields in the next 12 months, but the uncertainty is on the scale. Traditionally, the 10-2yr yield curve steepens as Fed cuts are delivered and fears of a harder landing either turn to soft landing or the worst of the recession has passed and asset allocators switch back to equities. However, this did not occur in 2018-19 prior to COVID, when 2yr yield declines were largely matched by 10yr yield declines. Meanwhile, temporary upside risks exist for 10yr yields in H1 2025 from likely fiscal stress. If Kamala Harris is elected U.S. president then Republicans will likely drag out the debt ceiling, while a President Trump would want to avoid parts of his 2017 tax cuts from lapsing. Either candidate also faces the real risk of a rating downgrade from one of the major agencies, given the deficit and government debt trajectory.

Debate over a soft v harder landing can help 10yr yields fall marginally over the next few months to end 2024 at 3.7055% yields (Figure 1). Then we look for a temporary 20bps rise in 10yr yields on fiscal stress in H1 2025. However, as cumulative Fed easing comes through, we would see 10yr yields then come down and reaching a low in summer 2025. Finally, as soft landing and 2026 economic recovery views become accepted in H2 2025, we would see a mild drift up in 10yr yields. In a big picture this is a broader consolidation of 10yr yields, where modest positive real yields are required to finance the still large budget deficit. On our baseline soft landing view, total returns will be dominated by 10yr starting yields.

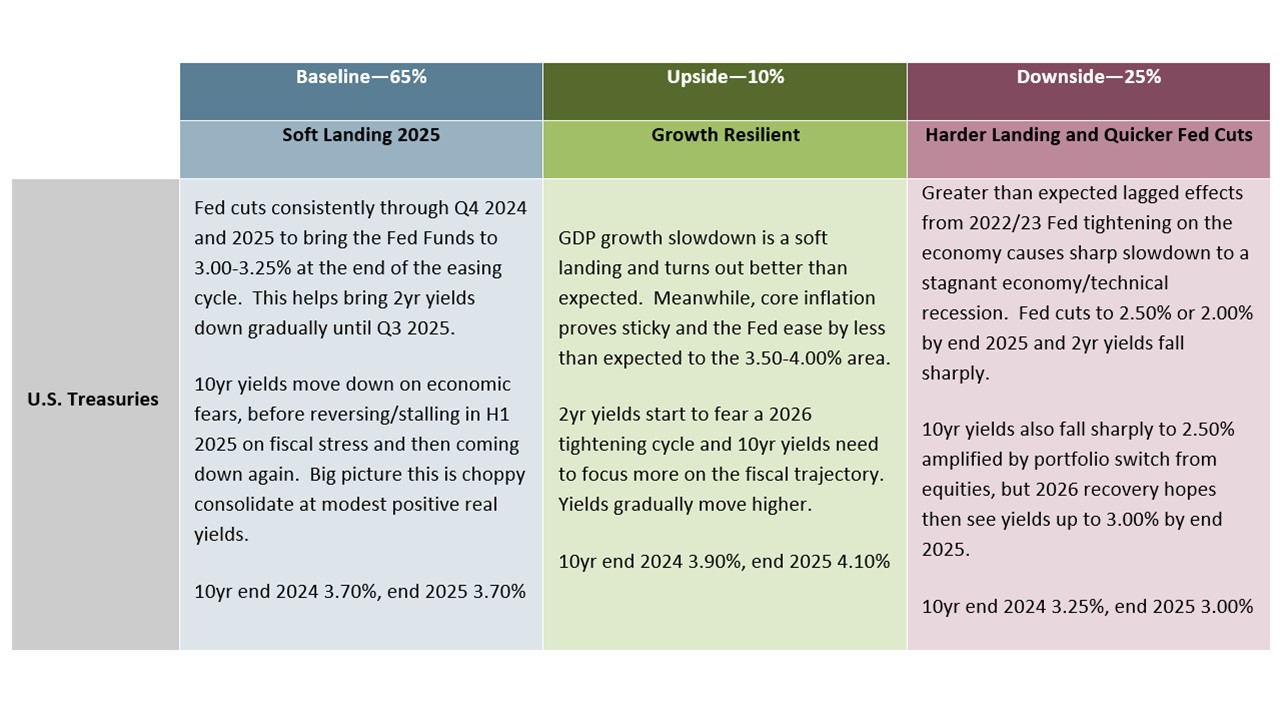

Our main alternative view is a harder landing, which would be stagnation or technical recession where we attach a 20-25% probability. A low probability also exists of a moderate recession, as the economy is not overextended and the Fed is already cutting interest rates. Evidence of stagnation or technical recession would be meet with more aggressive Fed easing that could bring the Fed Funds rate down to 2.50% or 2.00% by end 2025 (here). This would see a larger decline in 2yr yields and also spillover to dominate 10yrs, where yields could fall to 2.50% but end 2025 around 3.00% as aggressive Fed action eventually causes yield curve steepening (Figure 3).

Figure 3: 10yr U.S. Treasury Scenario Analysis

Source: Continuum Economics

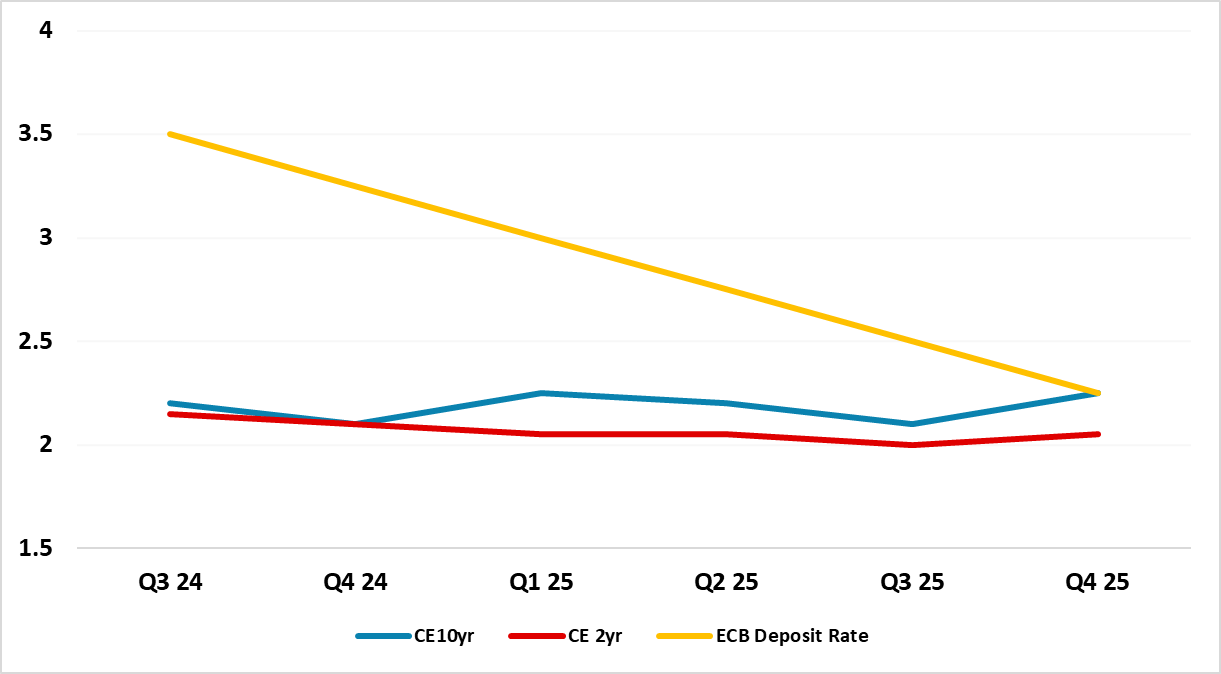

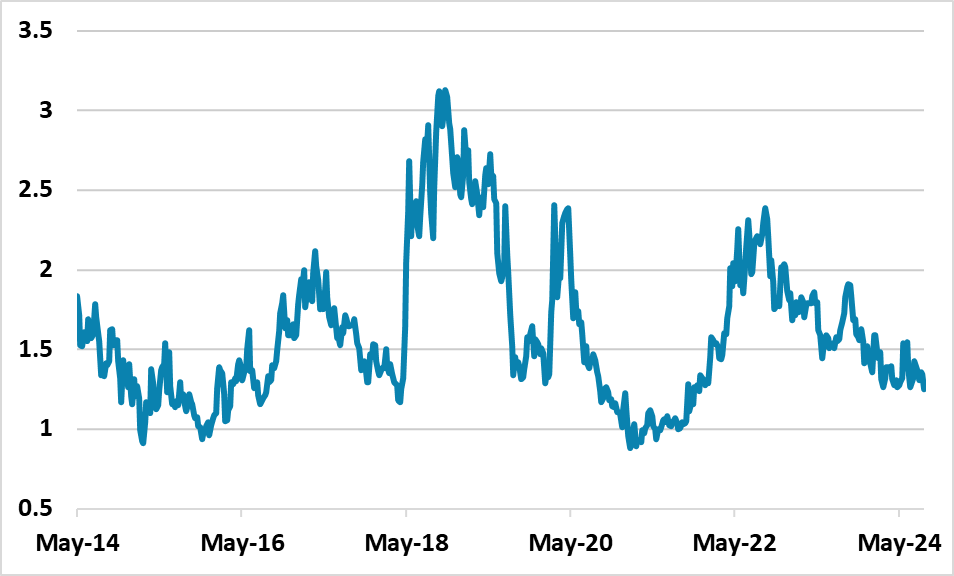

For EZ government debt, money markets are discounting a terminal ECB deposit rate of 2.0%, with 2.25% fully discounted by June 2025. The market is now more aligned with the forecasts we have produced in the last three Outlooks. However, we would suspect that our baseline economic view of a slow recovery in H1 2025, will not be enough in itself to see the ECB deviating from a quarterly pace of 25bps interest rate cuts. We do project that the policy rate will come down to 2.25% by end 2025. However, we have a skew on our alternative scenarios that could see no recovery and push the ECB into cutting policy rates more quickly in 2025 and for the ECB depo rate potentially moving below 2.0%, see September EZ Outlook. For 2yr German yields this fear of no recovery will not be dismissed in the next 3-9 months and this mean a little further scope for 2yr yields to come down (Figure 4). However, 2yr yields are now at a noticeable discount to the ECB depo rate (Figure 5) and the downside scenario would have to come become the baseline to get 2yr yields consistently down to 2% and below. Without this 2yr yields could stabilize by end 2025, as the market anticipates that the easing cycle is mature.

Figure 4: Continuum Economics Forecast ECB Deposit Rate, 2 and 10yr Germany (%)

Source: Continuum Economics

Figure 5: 2yr Germany to ECB Deposit Rate (%)

Source: Continuum Economics

For 10yr Bund yields, this does not provide a major benefit. Additionally, we remain skeptical that Bund yields can move consistently below 2% in the next 15 months, though a temporary dip is always possible on a EZ or global growth scare. Small positive real yields are required in an environment where ECB QT is the norm rather than QE and some major EZ governments face persist budget deficits. In particular, it is difficult to see a stable majority centrist government being formed in France in the likelihood that parliamentary election occurs May 2025. This means that genuine progress on the budget deficit will be limited throughout 2025. This is not bad enough however to produce a safe haven bid for Bunds. Thus we look for choppy consolidation for 10yr Bund yields close to current levels throughout the period (Figure 4).

Figure 6: 10yr BTP-Bunds (%)

Source: Continuum Economics

The 10yr BTP-Bunds spread remains tighter than early 2024 or 2023 as lower global government bond yields have encouraged some search for higher yields and as the Meloni government makes the right noises on the budget. However, the budget deficit continues to overshoot projections and the spread looks too tight versus Bunds. As global slowdown fears ebb, this could actually see the spread drifting out. We see 155bps by end 2025, assuming that political stability continues in Italy.

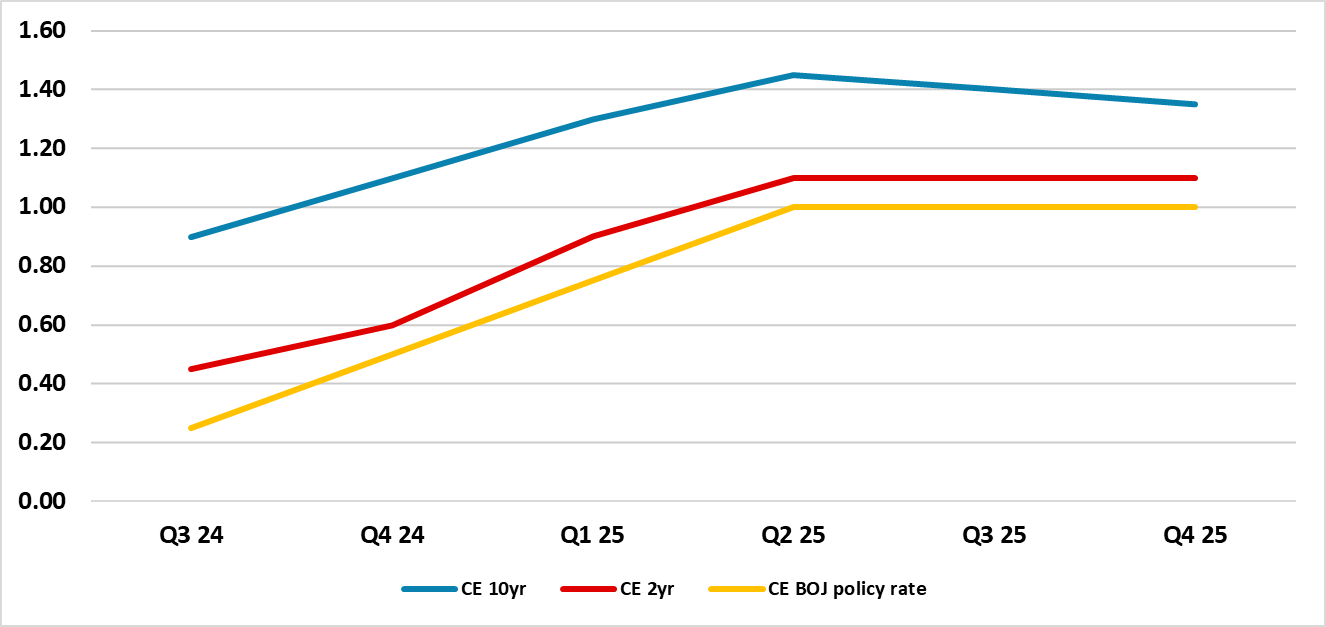

For JGB’s, the BOJ has consistently moved ahead of the market, with forward guidance at times having been misleading. Given the BOJ broader signal that it will hike further if growth and CPI meets its projections, we see a hike by 25bps in Q4 (most likely October) and two further 25bps hikes in Q1 and Q2 before a pause at 1.0% (Figure 2). This is not discounted in the money market or 2yr yields and we see 2yr yields rising consistently. The question is whether this push 10yr yields up in tandem or 10-2yr bear flattens due to proactive BOJ policy. We would expect in the next 6 months that 10yr yields shift up with 2yr yields, but healthy domestic institutional buying for 10yr in the 1.25-1.50% area prompts a bear flattening process in H2 2025.

Figure 7: 2, 10yr JGB and BOJ Policy Rate Forecasts (%)

Source: Continuum Economics

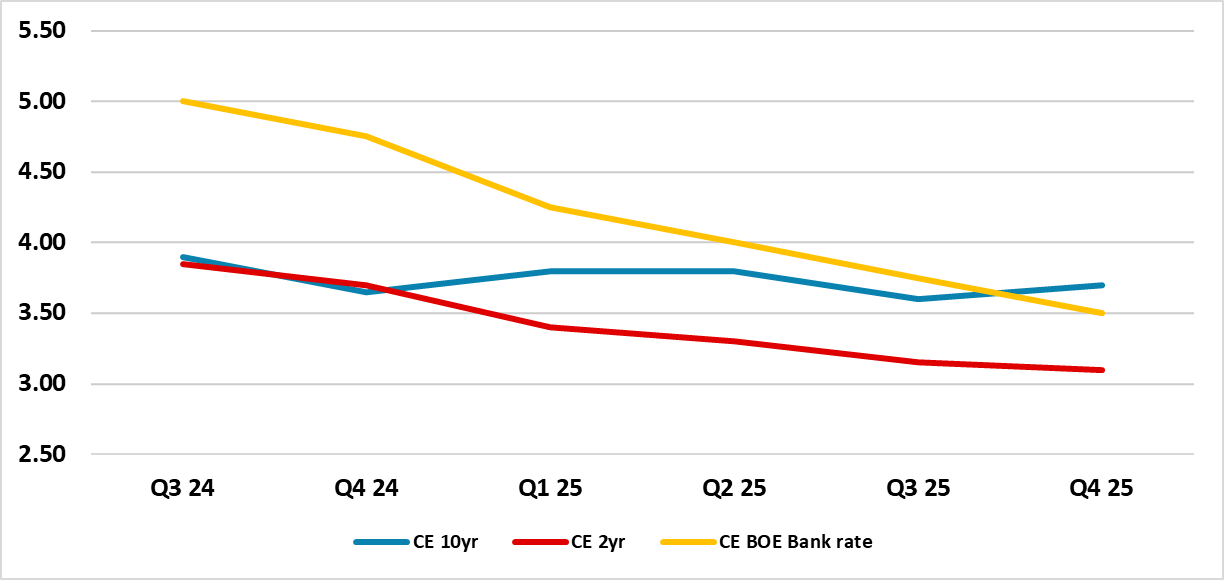

The market is discounting slower easing from the BOE than the Fed, due to perceptions of sticky wage and CPI services inflation in the UK. Though the market is discounting consistent easing by mid-2025, the policy rate is expected to be 3.5% in 2 years versus historical BOE estimates of neutral rates of 2.5-3.0%. We feel that BOE and the market is too worried and as wage and CPI services inflation normalizes more with a slack labor market and profit squeeze, that the BOE will likely carry on towards 3.0% Bank Rate in 2026 (here). This can allow 2yr yields to come down somewhat further. Thus we see 2yr yields down to 3.10% by end 2025. If the market fears that the bottom has been reached for BOE rates it would likely mean a swing to a positive spread between 2yr and the BOE rate, though not on the scale seen towards the end of the four easing cycles 1992-2002. 10yr yields look too high additionally, as a lower terminal policy rate does help the longer-end of the curve. Even with some modification to fiscal rules, the UK government will also likely reinforce fiscal control in the October 30 budget in contrast to the still wide U.S. budget deficits. Nevertheless, the UK will still require modest/moderate real yields, as our baseline does not include serious undershoots of the CPI target. We see 10yr Gilt yields at 3.70% by end 2025.

Figure 8: Continuum Economics Forecast BOE Bank Rate, 2 and 10yr UK (%)

Source: Continuum Economics