U.S. Outlook: Fed Focus Turning To Downside Risks

• The U.S. economy is showing clear signs of labor market slowing which poses downside risks to the still impressive resilience of consumer spending, which has sustained healthy GDP growth through Q2 2024. We expect GDP growth below potential in the second half of 2024 and the first half of 2025, causing further increases in unemployment, though probably not quite as high as 5.0%. We expect GDP growth to return to potential near 2% in the second half of 2025 supported by Fed easing. Inflation has lost momentum and while wage growth still looks a little too high to be consistent with 2% inflation, we expect the target will be reached in Q3 2025 as the labor market continues to lose momentum. Sustaining 2% inflation into 2026 as the economy regains momentum however may prove difficult in a less globalized world with continued high U.S. budget deficits, which neither political party is showing any interest in reducing.

• While it is too early for the Fed to declare the battle against inflation has been won, downside risks to the labor market are becoming the Fed’s primary concern and we expect Fed easing at a 25bps pace per meeting through Q2 2025, with risk for a more aggressive pace if the labor market starts to deliver job losses rather than the continued below potential growth that we expect. We expect the second half of 2025 to see only one further 25bps easing, in September, leaving the end 2025 Fed Funds target range at 3.0-3.25% where we expect it to stabilize. The election for president looks too close to call but we expect the Democrats to gain control of the House and Republicans to gain control of the Senate, meaning whoever is president will not have a free hand on policy. Should Donald Trump be elected, higher tariffs are a substantial risk but not assumed in our central scenario.

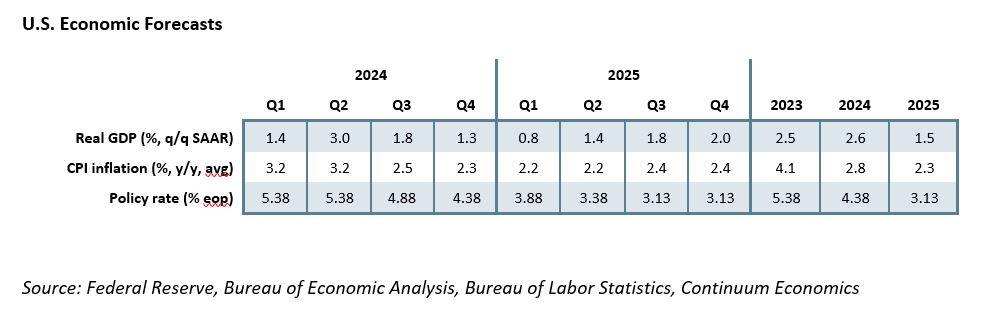

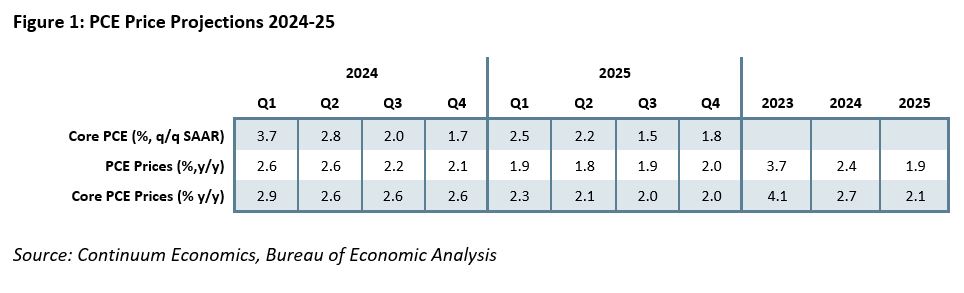

• Forecast changes: Our views on the economy have not changed dramatically since June. Strength in Q2 has lifted our 2024 GDP view to 2.6% from 2.2% and we now see 2025 up by 1.5% rather than 1.3%. We now expect overall PCE prices to average 2.4% in 2024 rather than 2.7% and 1.9% in 2025 rather than 2.1%. CPI is likely to remain a little stronger than PCE prices, averaging 2.8% in 2024 and 2.3% in 2025. However, we continue to expect core PCE prices to average 2.7% in 2024 and have revised the 2025 average marginally higher to 2.1% from 2.0%. We now expect a total of 100bps of easing in 2024 rather than 75bps, but continue to expect 25bps moves in the final two meetings of the year. We now expect 125bps of easing in 2025 rather than 100bps.

GDP growth slowing, but few warning signs for recession

The U.S. economy showed impressive resilience in 2023, and continued to do so into Q2 2024. The resilience came most clearly from consumer spending, which has continued to outpace real disposable income such that in Q2 2024 the former was up by 2.7% y/y compared with only 0.9% for the latter. However, with the labor market now showing clear signs of slowing, the resilience of the consumer looks increasingly hard to sustain. The 3-month non-farm payroll average, which looked reasonably stable a little above 200k in May, has fallen to 116k in August. This is not a warning sign for recession, with employment growth still positive and wage growth now running moderately ahead of reduced inflation, but is likely to signal a loss of consumer momentum, and that could extend the loss of momentum in the labor market.

Elsewhere, the U.S. economy is showing some signs of weakness but with few warning signs of recession. The Fed’s Senior Loan Officer Opinion Survey on bank lending practices has shown its findings on demand for loans becoming significantly less negative into Q3 of 2024, suggesting limited near term downside risks for business investment. Inventory growth has been in line with sales, suggesting major cutbacks are not needed. Housing looks vulnerable though should receive some support from Fed easing. Imports are running ahead of exports and recent strength in government is likely to fade if state and local governments see slower growth in tax revenues.

In the near term, we expect US GDP to grow below potential, with employment growth insufficient to prevent further increases in the unemployment rate. We expect annualized GDP growth to see a low of 0.8% in Q1 of 2025 before regaining momentum with the support of Fed easing, returning to potential near 2.0% in the second half of 2025. Unemployment is likely to peak a little below 5.0%. We expect Q4/Q4 GDP growth of 1.9% in 2024 and 1.5% in 2025. Comparing calendar years, we expect 2024 to look quite firm at 2.6% but 2025 to be subdued at 1.5%.

Inflation and Fed Policy

Inflation has slowed significantly after surprising on the upside in Q1 2024, though with 2023 also having started the year strongly before a subdued second half of the year there appears to be some residual seasonality in the numbers, with data at the start of the year overstating the underlying picture and subsequent data understating it. The slowing in inflation has been exaggerated by negative data from some key components of the goods breakdown, most notably used autos, though slowing pressures in non-housing services are becoming increasingly clear and housing inflation, while still relatively elevated, is trending lower. Wage growth still looks a little too strong to be consistent with inflation falling sustainably to the 2% Fed target but further slowing in the labor market should allow core PCE prices to reach the target, we expect in Q3 2025. With the economy likely to be regaining momentum in the second half of 2025, we do not expect core inflation to move below target, and in a less globalized world risks for 2026 may be on the upside.

Fed focus has shifted away from upside inflationary risks towards downside risks to employment. Should the labor market deterioration escalate significantly, the Fed would be prepared to deliver further 50bps moves, with 50bps moves at any meeting likely to be seen if non-farm payrolls turn negative. However, our forecasts for continued, if below potential, growth, and the Fed’s latest dots, suggest a pace of 25bps per meeting is more likely, something that we expect to continue through the second quarter of 2025. That would mean 150bps of easing in the upcoming three quarters, taking the Fed Funds target range to 3.25-3.50% at the end of Q2 2025. With the economy likely to be regaining momentum in the second half of 2025, we expect the Fed to ease only once in the second half of 2025, in September, taking the Fed Funds target to 3.0-3.25%, where we expect it to stabilize. This is a little above the current median FOMC estimate of the neutral rate of 2.875%, with persistently large budget deficits and a less globalized world likely to lift the neutral rate.

The election and risks for 2025

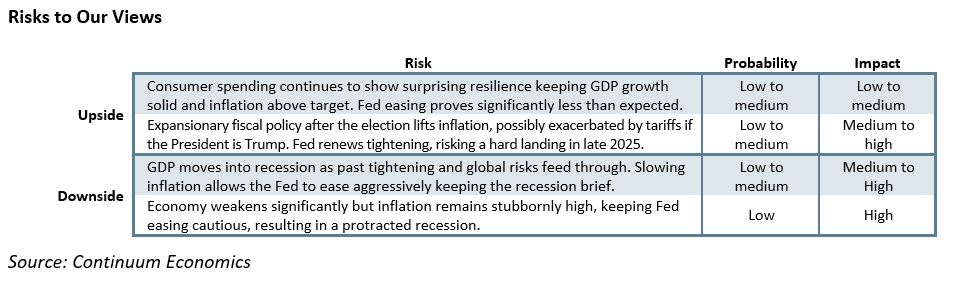

There are risks on both sides of our Fed call, and continued resilience in the economy leaving inflation stubbornly above target cannot be ruled out. However, the near term risks are now larger on the downside, given the possibility of slowing consumer spending and a weakening labor market becoming mutually reinforcing, and pushing the Fed policy more quickly towards, or even below, neutral. Downside risk could be increased by uncertainty surrounding the election, which could persist beyond the election if the results are close enough to bring protracted disputes over the result. The latter is highly likely if the election delivers a narrow win to Kamala Harris.

The election for President looks too close to call, though whoever wins the election is unlikely to have full control of Congress, with the Democrats expected to regain control of the House and the Republicans expected to regain control of the Senate. Neither call is certain, though the Senate appears more likely to turn Republican than the House is likely to turn Democratic, which means a slightly larger possibility of Donald Trump having the backing of a supportive Congress than does Kamala Harris.

Whoever wins the election, the size of the budget deficit is a cause for concern. Current law has the Congressional Budget Office estimating the budget deficit will average 6.3% of GDP from 2025 through 2034, though that assumes the Trump tax cuts expire as scheduled. Sustaining the tax cuts, which Trump plans to keep their entirety and Harris only plans to partially reverse, would add around 1% of GDP to the deficit. Harris’s other plans are reasonably balanced between revenue and expenditure proposals suggesting she would run deficits of around 7% of GDP. Trump’s plans, in particular not taxing social security benefits, would add still more to the deficit, though he would be tempted to offset much of this with higher tariffs on imports, which would have negative implications for global growth while adding to upside US inflationary risks. Given that a Trump presidency is close to a 50% bet and that he did not rush into tariffs in his first term we do not assume a large rise in tariffs in our forecast, but it is a significant risk.

Fiscal policy concerns are likely to be a significant issue in early 2025 unless the incoming president implements tighter fiscal policies than both candidates are advocating in the campaign. The debt ceiling will need to be raised, which will generate a standoff if Harris is President and Republicans control at least one chamber of Congress, though if the Republicans control only the Senate the risk of the standoff leading to a default on the debt are low. Risks would be larger under a Republican-controlled House, though a last minute deal would probably still be done. Additionally, under either president the risk of a downgrade from one of the rating agencies in 2025 is high, due to the medium-term fiscal deficit and debt trajectory.