Bunds and ECB Easing/Trump Tariffs

It is highly likely in April that the U.S. will announce a 25% tariff on EU cars and pharmaceuticals (here) and also reciprocal tariffs against the EU. The majority could be implemented given Trump’s desire to raise revenue/dislike of the EU as well as negotiate trade deals. This would rightly be viewed as an adverse growth and disinflation effect, which can see the ECB delivering cuts in the deposit rate to 2.0% or 1.75% in 2025. This can anchor 2yr Bund yields, with a small premium to 10yr yields to reflect the need for a small positive real yield.

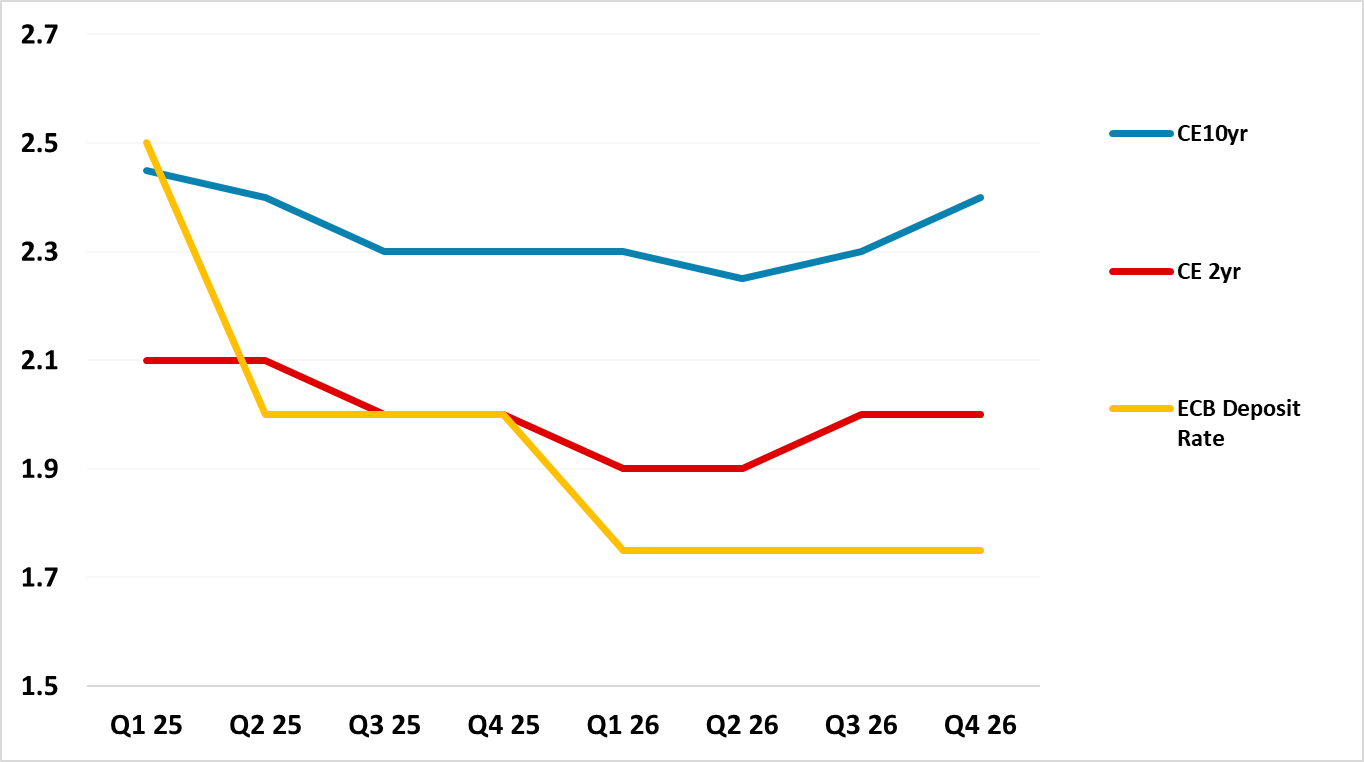

Figure 1: ECB Deposit Rate and 2 and 10yr Bund Yield Forecast (%)

Source: Continuum Economics

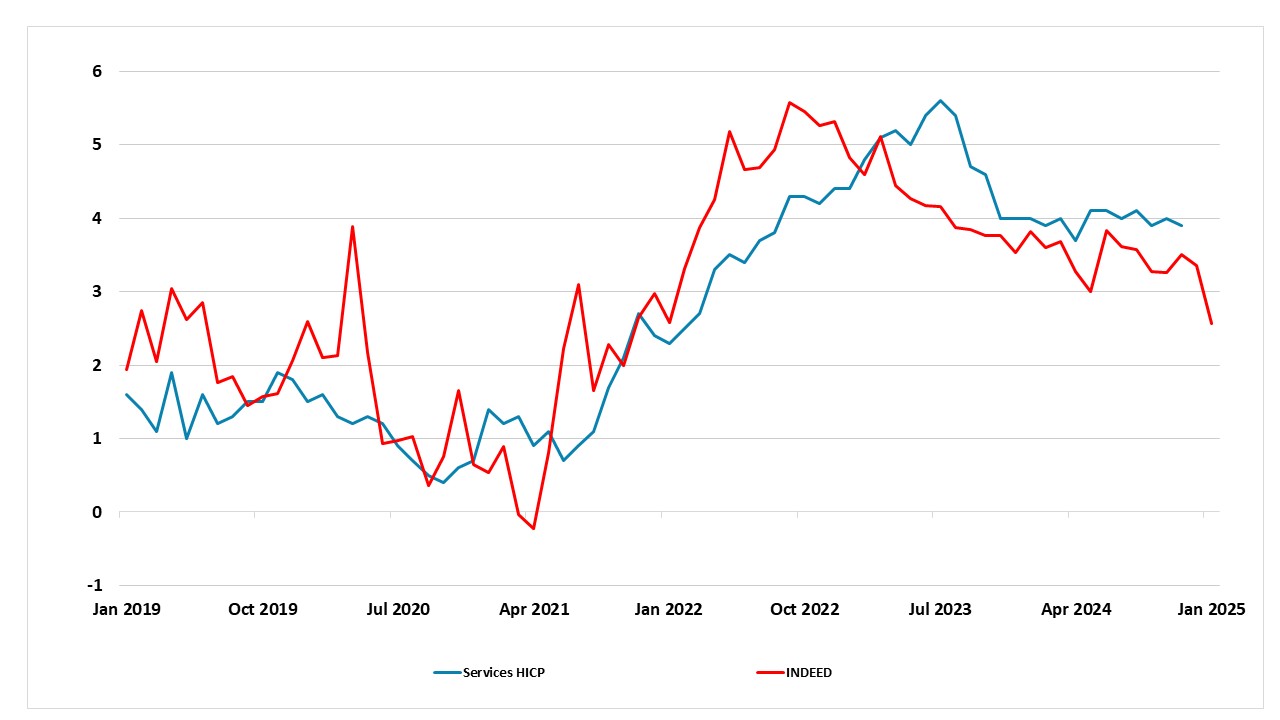

The EZ money market widely expects a 25bps ECB cut at both the March 6 and June 5 meetings, but then a pause before a cut late 2025/early 2026. ECB Hawks like Schnabel are starting to wonder whether the ECB should pause later in the spring. However, the underlying details of CPI inflation (here) point to controlled core inflation and EZ wage tracker pointed to a further slowdown in core inflation in the coming quarters. In fact, the Indeed wage indicator has fallen to new lows into this year at well under 3%, pointing to lower services inflation in due course. The EZ recovery also looks to have stalled (here). Meanwhile, ECB guidance on the neutral rate around 1.75-2.25% (here) is anchoring money market expectations. Finally, though the ECB is likely to revise 2025 and 2026 staff inflation forecasts higher on March 6 due to rise in gas prices since the autumn, this could be small to modest after the partial reversal in gas prices after EU gas price flexibility and anticipation that a Ukraine war peace deal could mean cheap Russian gas medium-term.

Figure 2: Indeed EZ Wage Tracker (%)

Source: Continuum Economics

However, as ECB Lane has noted the neutral rate is a concept that is most useful when you are far away and in reality, the ECB assessment of inflation and growth undershoot risks will be key in the remainder of 2025. It is highly likely in April that the U.S. will announce a 25% tariff on EU cars and pharmaceuticals (here) and also threaten reciprocal tariffs against the EU that could include a top up for EU VAT. President Trump see tariffs both as a threat for trade deals and a revenue raising opportunity. The EU will likely only partially stop some tariffs by buying more LNG and military hardware, but a majority could be introduced. This would rightly be viewed as an adverse growth and disinflation effect, as EZ exports to the U.S. would be hurt and cause domestic production/ business investment/wage and inflation slowdown risks into H2 2025. This could be enough for the ECB to also deliver an extra 25bps at the April 17 meeting or in July or September. It could also get the ECB considering bring forward a cut from 2.0% to 1.75% that we have pencilled in for Q1 2026.

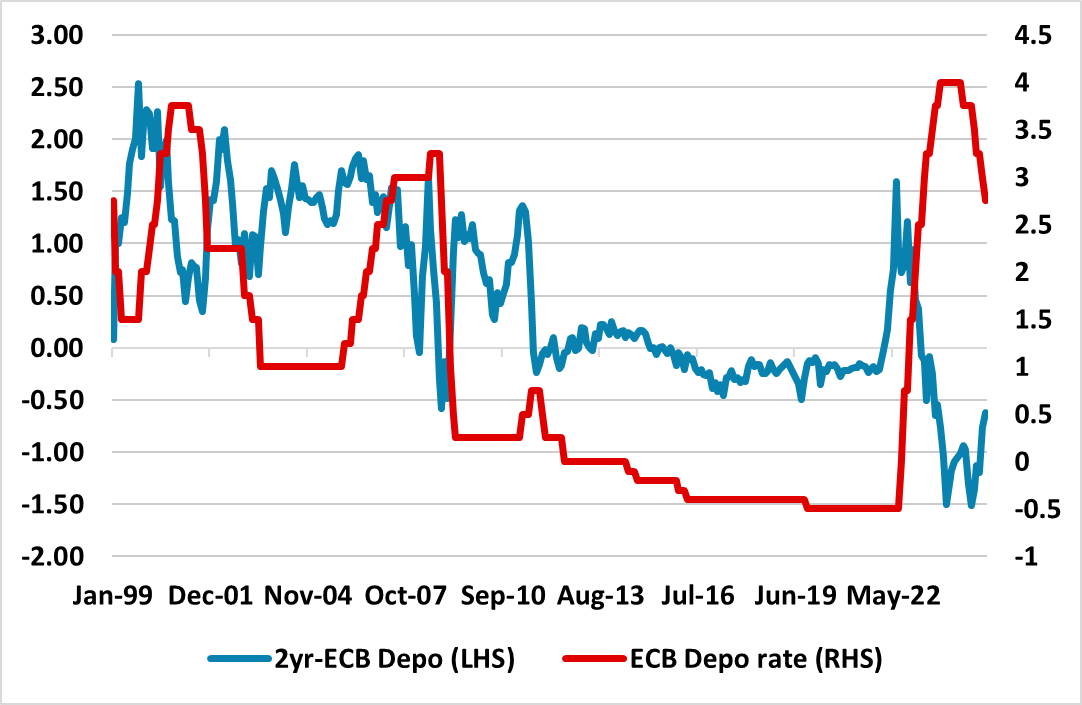

For 2yr yields, it is a long-time since the end of a normal easing cycle has been seen. Normally, this sees 2yr Bund yields go to a premium versus the ECB deposit rate (Figure 3), as the markets debates whether the next cycle is to higher policy rate. However, we would see the front end being worried by the adverse economic effects of tariffs and the ECB needing to leave the door open to further easing. Thus, 2yr Bund yields could be a small premium to small discount to the ECB depo rate in H2 2025 (Figure 1).

Figure 3: 2yr Bunds-ECB Depo Rate and 2yr Bund Yield (%)

Source: Datastream/Continuum Economics

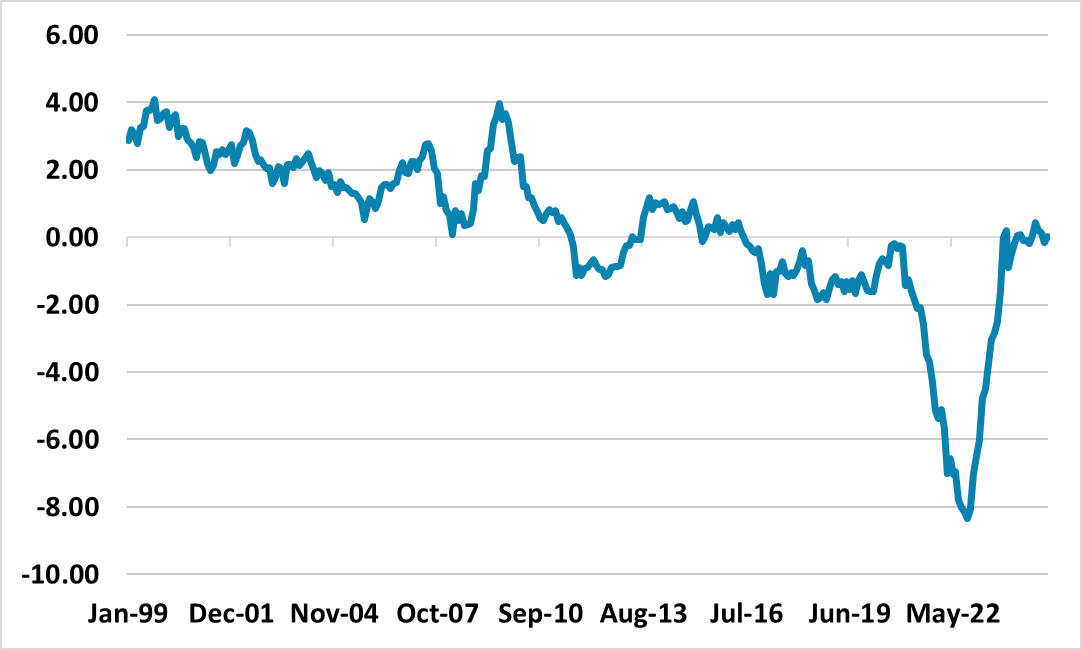

10yr Bund yields have managed to decouple from the U.S. due to the different policy and macro picture. Nevertheless, we still see it being difficult for 10yr real Bund yields to fall consistently below zero, as the era of QE and ultra-low interest rates is over (Figure 4). The ECB is also undertaking APP and PEPP QT, which ECB research suggest mildly pushes up yields. We feel that to avoid widening in sovereign spreads medium-term that the ECB should slow QT in H2 2025/2026.

Figure 4: 10yr Real Bund Yield (using EZ Headline Inflation %)

Source: Datastream/Continuum Economics

Extra EZ defense spending is coming, but European leaders will want to try to convince the U.S. not to abandon Europe first. If CDU Merz is the new German Chancellor then this is likely to be his approach initially. A major European peacekeeping force also looks unlikely in any Ukraine war peace deal. However, President Trump in the past has talked about withdrawing troops for Germany all the way to leaving NATO (some of this could be threatened again before the crucial June NATO summit), which would force EZ and EU countries to rapidly build up defense spending to GDP in the next few years. However, the U.S. actually leaving NATO or asking for article 5 to be removed is a modest probability. Most scenarios point to phased scale down and redistribution of U.S. military assets from Europe over the next 5-10 years, which will likely be enough to get EU countries to agree to 2.5% to 3% target by 2030-35 at the June NATO summit. This would reduce the positive macro impact in this economic cycle from defense spending (here) and budget deficit ramifications. However, the situation is uncertain and fluid and we will make a further assessment during the March outlook round.

Around a 0.5% real yield multi-year is a reasonable measure and this is in our baseline forecast (Figure 1). If the EZ slipped back into a technical recession then speculation could mount that the ECB could cut to accommodative territory as occurred in 2003 with the renewed easing down to 1%. In turn this could produce a flight to quality at the long-end that brings 10yr Bund yields below 2%.