BOE QT: A Heavier Burden than Fed/ECB QT

BOE QT is 3.4% of GDP and means the 2025 total funding is 8% of GDP, which helps explain part of the current pressure on gilt yields (here). This pace is unlikely to change before the BOE review in September 2025, but the QT is partial monetary tightening and will offset some of 125bps of BOE rate cuts we see coming through. A slower pace of QT is likely from Q4 2025.

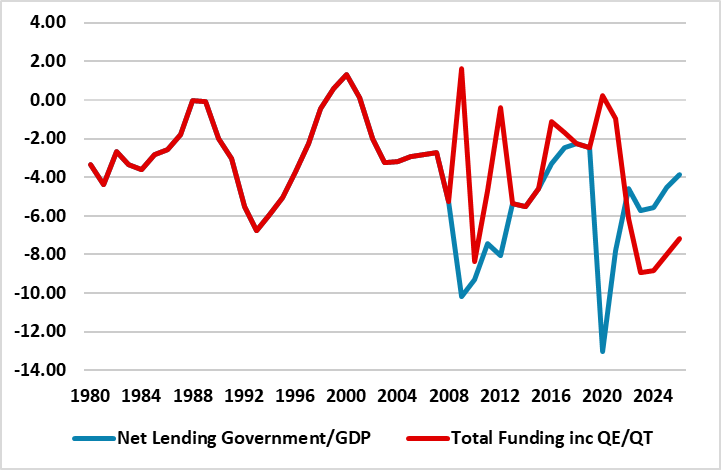

Figure 1: UK Net Lending Government and Total Funding Including QE/QT (% GDP)

Source: Continuum Economics/OECD

One of the reasons that the UK gilt market is feeling funding pressure in early 2025 is that QT is a heavy burden on total funding. Figure 1 shows the net lending government/GDP and then the total funding to GDP including QE or QT. In 2020, huge BOE QE was equal to 13.3% of GDP versus net lending of 13.1% of GDP meaning that the BOE indirectly funded all UK government borrowing at the height of the COVID crisis. However, the switch to QT means that the BOE actions now add to UK government net lending. With the BOE committed to £100bln per annum rundown in asset holdings, this should add around 3.4% of GDP in 2025 meaning a total funding of 8.0% of GDP.

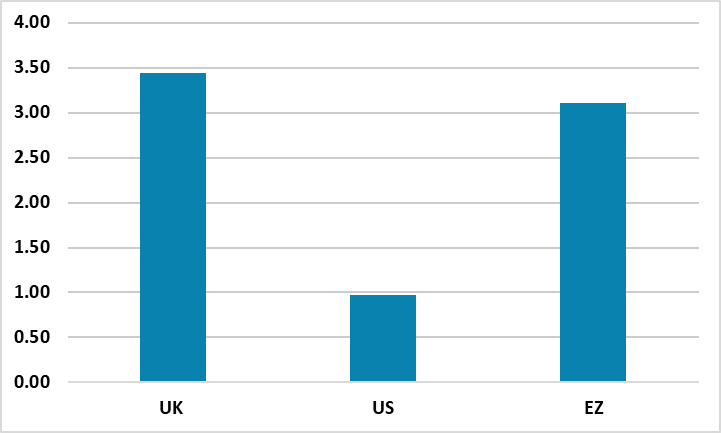

This is also heavier than QT government bond rundown than the Fed or ECB (Figure 2). The Fed has already slowed to a monthly cap of USD25bln pm and will likely slow this further in H2 2025, as excess reserves decline and the Fed want to avoid a repeat of the 2019 money market debacle. The ECB APP and PEPP QT are 3.1% of EZ GDP, which the ECB council has been committed too. However, if the 10yr France-Germany spread spikes through 100bps, then the ECB could consider slowing QT on a temporary basis. ECB QT is also partial tightening in the face of ECB rate cuts, with the latest ECB research estimating that EUR1trn bond portfolio rundown will likely add 35bps to long-term yields via a higher risk premia (here). If the ECB decides to go below the neutral rate, an argument would also exist to slow the pace of QT as well.

Figure 2: QT/GDP UK/US and EZ 2025 (%)

Source: Continuum Economics

The BOE currently appears committed to the £100bln of bond reductions for the period to September 2025. The BOE also feel that they can rundown Gilt holdings without severely impacting excess liquidity in the money market due to the partial offset from the new repo facility. However, we feel that the BOE will become more activist in cutting interest rates and we look for a cumulative total reduction of 125bps in 2025 (here). As the year progress, the pace of QT will likely come into question, as it is a partial tightening that offset BOE rate cuts. We would feel that the BOE will likely compromise and cut the pace to around £75bln per annum from September 2025, though to really be more consistent in easing monetary conditions it should be £50bln or less.