Market Turbulence and What has Changed?

• We see the recent market turbulence as being partially a reduction in risky positions. However, the U.S. economy is slowing and triggering a debate about a soft or harder landing (we see slowing rather than recession in our baseline), while EZ data shows the recovery is not gaining momentum and China data points to a H2 slowdown. This will be a bumpier environment in H2 2024 and we see scope for a further correction of the S&P500 to 5000 and potentially 4800, with USDJPY down to 140. Fed easing will likely start in September, but only support U.S. equities at lower levels.

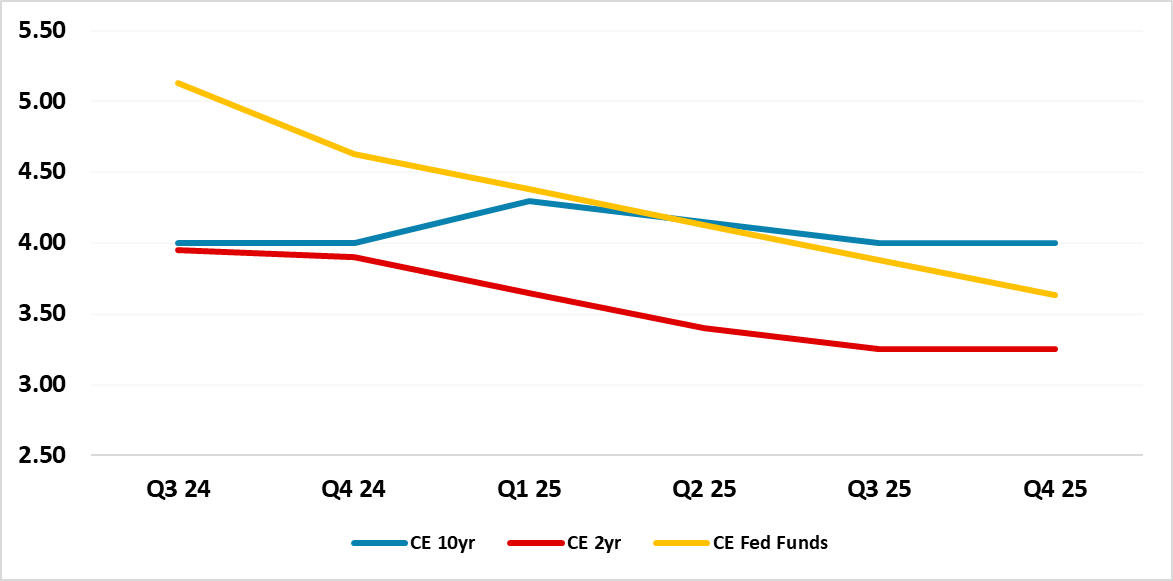

Figure 1: U.S. Fed Funds and 2 and 10yr Government Bond Yield Forecasts (%)  Source Datastream/Continuum Economics

Source Datastream/Continuum Economics

The market turbulence of the last few weeks has prompted the question whether anything significant has changed in the fundamental picture or was this just a reduction of market positioning? We feel that elements of both are true. • Tech overoptimism. AI optimism has been reduced, which has prompted liquidation of excessive long Tech stocks. However, Q2 results for Tech and other U.S. sectors have been reasonable. Even so, Alphabet/Amazon and Microsoft forward guidance has only increased the debate about when the first wave of AI investment turns into game changing applications and boost to productivity in the wider economy. Concerns that the wider impact could take years will likely be debated in the coming months and reducing momentum in tech stocks and the S&P500. Nvidia forward guidance in late August is the next key event.• JPY shorts. The reduction in risk has been amplified by the cutting of JPY shorts by speculators and structural players, with the July BOJ rate hike adding to the move. However, with the JPY weakness in the last few days, some have argued that the move was just a big clear out of positions. We do not see a further hike on the BOJ policy rate this year, as households are reluctant to accept price rises. This has hurt consumption and will likely mean a lower CPI trajectory in H2 and into 2025. Nevertheless, we do feel that the reduction in JPY shorts will reignite with a move down to 140 – the JPY also remains extremely undervalued once the Fed starts cutting rates (here).

Figure 2: USDJPY and 10yr U.S.-Japan Government Bond Spreads (%)

• U.S. Economy slowing. The fundamentals have changed in the U.S., with economic data making the case that the economy is slowing. The jump in the U.S. unemployment rate has prompted some to fear that this could led to a recession. Our interpretation of the data is that it is a move to slow growth as we outlined in the June Outlook (here). Two key headwinds exist in the form of lagged tightening effects and low income households having exhausted COVID handouts. Since this is somewhat more than the Fed SEP medians, we still project that the Fed will likely cut by 75bps this year rather than 25bps or 50bps. Much now depends on the economic data for August ahead of the September 18 FOMC meeting. If the economy is slowing more than our forecast, then this would increase the odds of a 50bps move in September rather than 25bps and more rate cuts in H1 2025. For financial markets, the slowing U.S. economy could be bumpy at times, which could see some players raising fears of recession despite the bulk of data being consistent with a slowing.

• EZ/China not accelerating. Perhaps somewhat overlooked in the market turbulence has been the slow and uneven EZ economy, with the recovery story not really building momentum (here). With inflation coming under control, this leaves us confident of 25bps ECB rate cuts in September and December. Meanwhile, China data suggests that the economy is being hurt by slowing consumption, with some Q2 multinationals’ results suggesting a harder landing for the China consumer. With depressed housing being the largest part of China household wealth (here) and private sector jobs/income growth being slow, H2 will likely see a slowing in consumption and GDP. The implementation of government infrastructure programs should provide support combined with further targeted fiscal measures, but we see GDP growth slowing to 4% in 2025 – with downside risks (here).

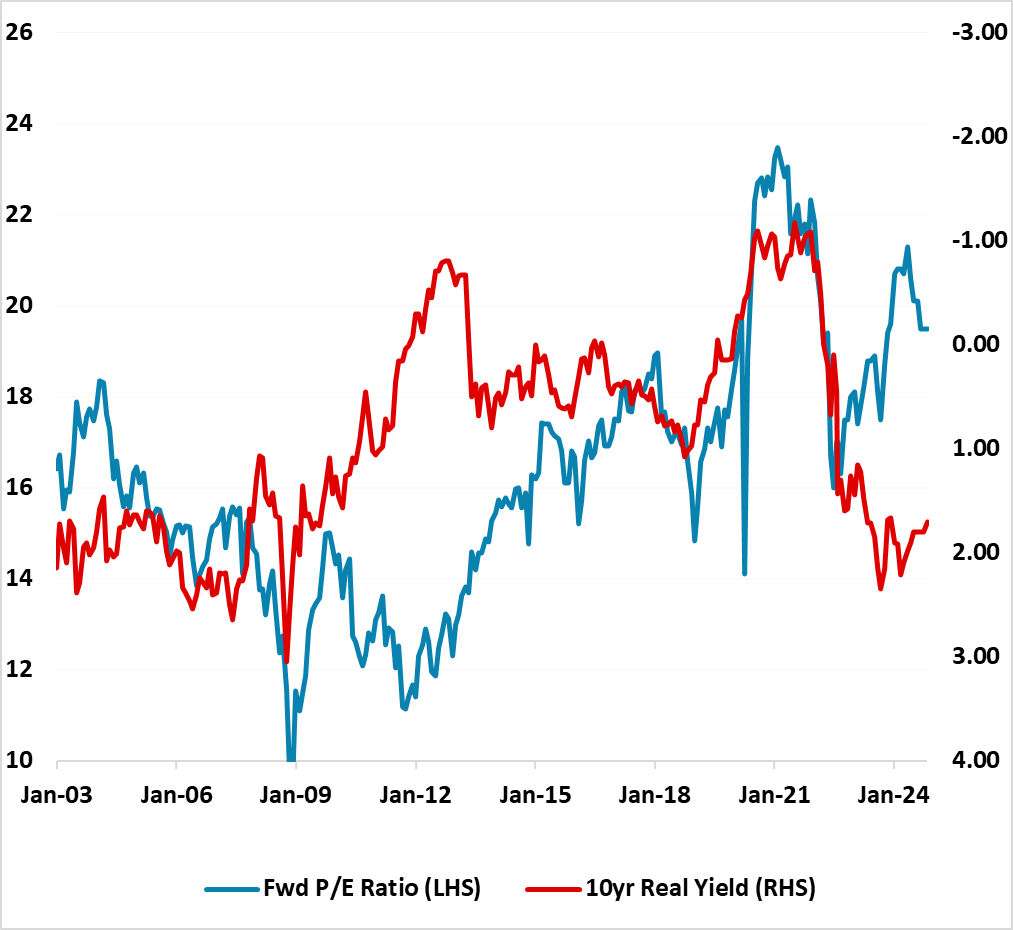

Figure 3: S&P500 Still Overvalued Versus Real 10yr Government Bond Yields (%)  Source Datastream/Continuum Economics

Source Datastream/Continuum Economics

We would see further correction risks for U.S. equities and the S&P500 could rotate down to 5000 and as far 4800, as corporate earnings become more uncertain and as the market remains overvalued. Additionally, the close U.S. presidential and congressional races add to U.S. equity uncertainty before and after November (here) and under either president we see some temporary fiscal stress in H1 2025 (here). This could mean that 10yr U.S. Treasury yields do not go much lower, unless a harder landing is seen for the U.S. economy. Other major global equities markets ex India are more fairly valued, but a large catalyst is needed to trigger substantive rotation. A further U.S. equity selloff could spillover and outperformance occur from lower levels (here). Geopolitics is not helping. A risk exists of an Iran attack against Israel, though Iran and Israel are not interested in escalating for domestic reasons. Ukraine’s incursion into Russia (here) will likely see Russian retaliation and could involve threats to use tactical nuclear weapons in Ukraine – though we still see the odds of this occurring as being low, as it would likely prompt a huge backlash from EM countries.