Equities Outlook: Choppy U.S. and Outperformance Elsewhere

• We now forecast 5450 for the S&P500 for end 2024, but could see a move to 5200/5000 in the next 3-6 months as volatile data keeps the soft v hard landing debate alive. On our baseline of a U.S. soft landing, we would see the S&P500 at 5600 by end 2025. The tech sector is still really important to the U.S. equity market, but the AI optimism has now switch to a debate about the impact on profits in the absence of a game changing application. Even with a soft landing the market is also too optimistic about 2025 corporate earnings. Meanwhile, we do feel that a Trump victory in the presidential election would likely be a small to modest negative factor for the U.S. equity market in 2025, while a Harris victory would be neutral – Congress will be split under either president.

· In terms of other DM equity markets, we still prefer the UK over the EZ or Japan. EZ equities have valuation support/ECB easing but need an earnings recovery story. For UK equities, the market is underestimating the scale of BOE easing. Current service and wage inflation will likely slow more than the BOE projects, given the growing slack in the economy. Given our concerns over China and commodity demand we favor FTSE 250 v FTSE100. With the UK domestic market still undervalued, we see scope for a 5-10% outperformance of FTSE 250 v S&P500 by end 2025.

· Japan’s equity market has the tailwind of TSE reforms, which promises higher dividends. However, higher corporate earnings from corporate reform will take time to spread across the whole market. Meanwhile, too much optimism exists that Japan’s GDP and inflation has finally broken higher. Overall, the market is better value than at the time of the June Outlook and we now see modest outperformance versus the U.S. by around 2.5-5% by end 2025.

· We remain strategically underweight China’s equities in global and EM equity baskets, due to the cyclical and structural slowing of GDP and low EPS growth prospects. However, India is now overvalued and likely to see only modest outperformance versus the U.S. by end 2025. Over the next 15 months, we thus switch from an India centric bias to preferring EM Asia ex China. This gives some India exposure but also taps into better Indonesia/Malaysia and S Korea valuations that can benefit from the sentiment shift with Fed rate cuts.

· Risks to our views: Larger than expected lagged effects from DM monetary tightening could cause downside surprises on U.S./EZ growth and hurt the global economy and earnings outlook. Equities would see a more volatile 2025 and the S&P500 could fall to 4500 in this scenario.

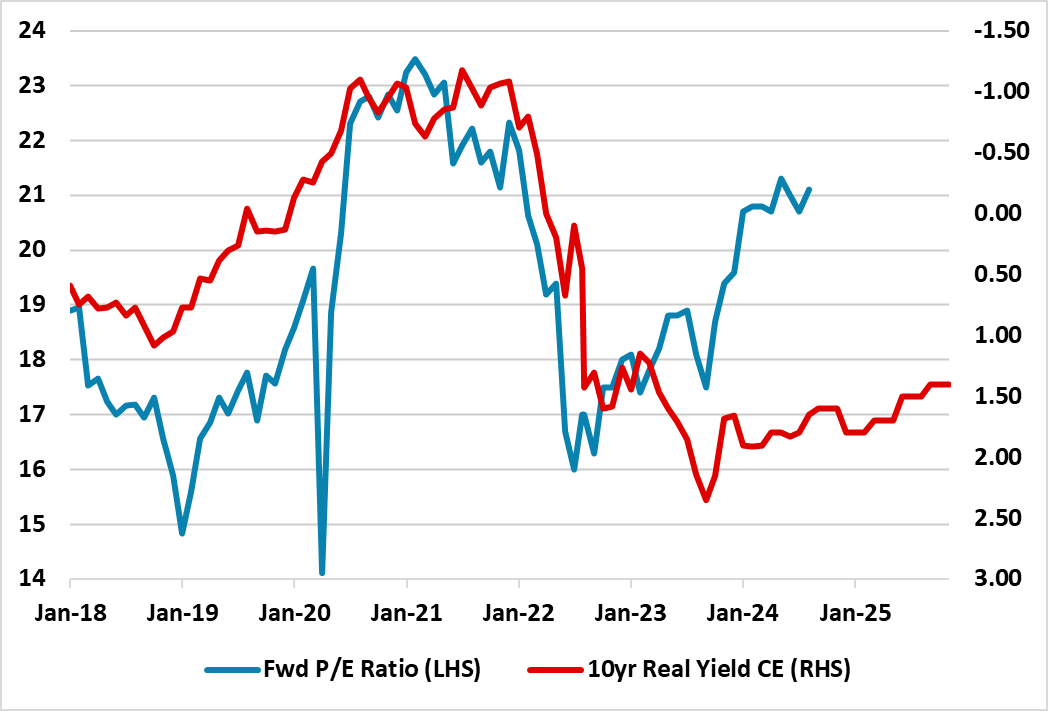

Figure 1: 12mth Fwd S&P500 P/E Ratio and 10yr U.S. Treasury Yield Inverted (Ratio and %)

Source: Continuum Economics with forecasts to end 2025

The key question for U.S. equities is corporate earnings now that the Fed has kicked off with a 50bps cut. On a soft landing, we would likely see the Fed Funds rate coming down to 3.00-3.25% by September 2025. This would likely not significantly move 10yr yields and we forecast 3.70% by end 2025 -- given that the market would then be thinking about a 2026 recovery. This is helpful to equity sentiment, but a tug of war exists with valuations and 2025 corporate earnings prospects. 10yr real yields on our baseline of a soft landing would still be clearly positive (Figure 1) and the 12mth forward P/E ratio would be out of line with real bond yields. This leaves the market vulnerable to a slowdown in corporate earnings for 2025, which look too high on the current bottom up consensus of 15% for the S&P500.

The U.S. equity market has also not taken a view on the consequences of the U.S. presidential and congressional elections, as so much focus has been on the scale of the economic slowdown and the Fed easing. The most likely outcome is that the Republicans win the Senate and the Democrats the House, which avoids a clean sweep and radical change in domestic economic policies under either presidential candidate. If Kamala Harris is elected then this would restrict the ability to raise the corporate tax rate to 28%. If Donald Trump is elected then the idea of 15% corporate tax would be sacrificed, as he would try to reach a compromise to extend the lapsing parts of the 2017 tax cuts. Strategically, this does not mean that the presidential election is neutral for the equity market. If Trump becomes president he will also place urgency on reducing immigration/accelerating deportations, which would slow the growth in the labor force and employment and could in itself be a headwind to the economy and equity market sentiment. Though Trump also threatens a trade war with China, we suspect that this is less urgent and may not occur in 2025. Either president would also face some temporary fiscal stress in H1 2025, plus the risk of a rating downgrade by one agency. While the economy/Fed policy debate will be the most important driver, we do feel that a Trump victory would likely be a negative factor for the U.S. equity market in 2025.

Overall, we still forecast 5450 for the S&P500 for end 2024, but we could see scope down to 5200/5000 in the next 3-6 months as volatile data keeps the soft v hard landing debate alive. On our baseline of a U.S. soft landing, we would see the S&P500 at 5600 by end 2025. The tech sector is still really important to the U.S. equity market, but the AI optimism has now switching to a debate about the impact on profits in the absence of a game changing application. This suggests some valuation de-rating of the tech sector to align with mid teen tech earnings expectations. Such phases have occurred before in 2022 and 2018. Meanwhile, as 2025 corporate earnings are trimmed, this will act as a headwind to the market. A choppy 15 months is likely on our baseline soft landing view.

A 20-25% probability exists of a harder landing for the U.S. economy (stagnation/mild recession). This is bad enough to push S&P500 earnings to flat or negative, which would in itself hurt the market. However, it would also likely prompt a significant de-rating of the forward P/E ratio. While this could go all the way to 16 and circa 4000 on the S&P500, U.S. tech sector superiority means that stabilisation could be seen around an 18 P/E ratio and 4500 on the S&P500 in a harder landing scenario.

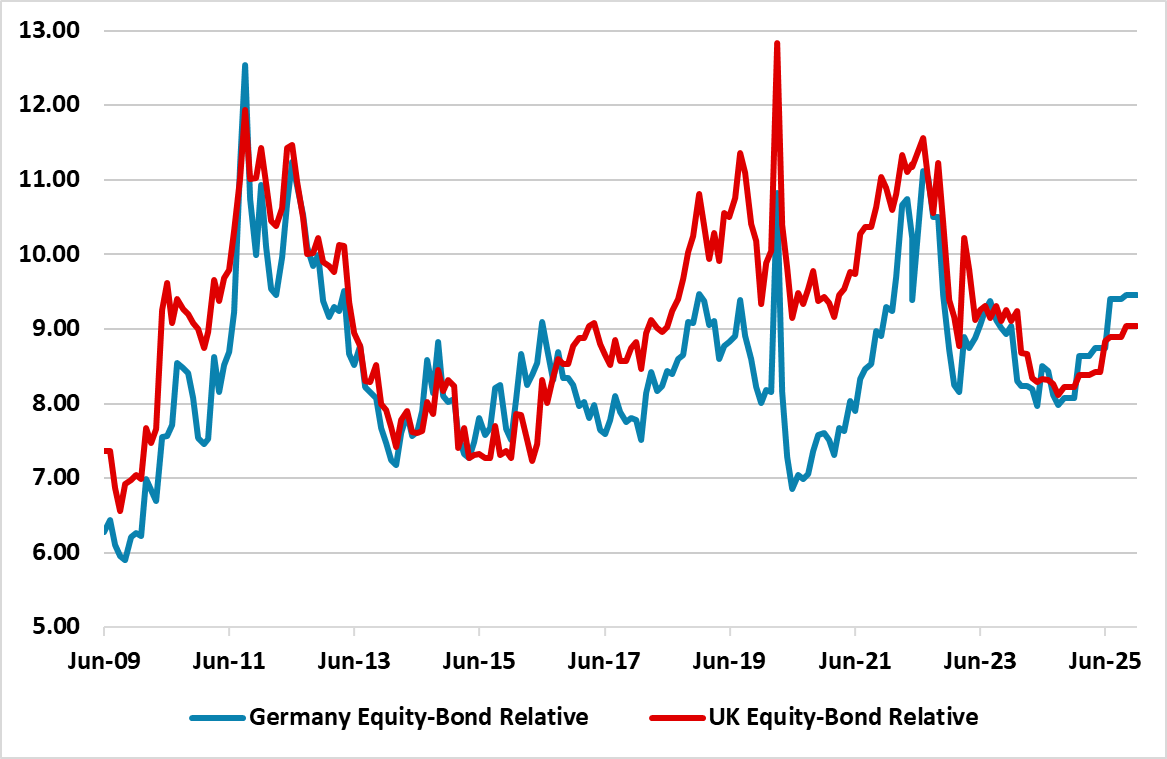

Figure 2: Germany/UK 12mth Earnings Yield minus 10yr Real Government Bond Yield (using 10yr breakeven inflation)

Source: Continuum Economics. Continuum Economics projections until end-2025 using 10yr breakeven inflation and Bund/Gilt yield forecasts.

In terms of other DM equity markets, we still prefer the UK over the EZ or Japan. EZ equities have valuation support but need an earnings recovery story. It will take time for cumulative ECB easing to come through and boost the economy, given that the effects of restrictive policy are still evident and the ECB will only ease at a quarterly pace due to internal divisions. The ongoing political paralysis in France is not helpful, but not a major negative and the German election in October 2025 should see a CDU led victory. Cumulative ECB easing can help in 2025 and we look for a 2.5-5% outperformance versus U.S. equities in our baseline case. If Donald Trump is elected it is also a sentiment risk for EZ equities, given the risk that Trump tries to broker a Ukraine peace deal that meets Russian desire to retain occupied lands.

Japan’s equity market has the tailwind of TSE reforms, which promises higher dividends. However, higher corporate earnings from corporate reform will take time to spread across the whole market. Meanwhile, too much optimism exists that Japan’s GDP and inflation has finally broken higher. Japan is against mass immigration that would boost trend growth, while cyclical growth is being restrained by consumption as households are reluctance to accept higher inflation! This can also restrain inflation momentum into 2025 and Japan trend GDP remains 0.75-1% and trend inflation is likely around 1%. We also feel that USD/JPY is heading to 125 by end 2025, which will reverse the cyclical boost to corporate earnings. Japan’s equity market remains in favor among asset allocators, which will help sentiment. Additionally, the market is better value than at the time of the June Outlook and we now see modest outperformance versus the U.S. by around 2.5-5% by end 2025.

For UK equities, the market is underestimating the scale of BOE easing. Current service and wage inflation will likely slow more than the BOE projects, given the growing slack in the economy and the scale of fiscal tightening for UK households already in place and likely to be reinforced by the October budget. Meanwhile, the October budget will provide comfort with the fiscal trajectory, while UK politics will be an island of stability in a difficult world. Finally, we see some progress in 2025 to a better trade relationship with the EU, though this will stop short of the game changing customs union/single market entry. Given our concerns over China and commodity demand we favor FTSE 250 v FTSE100. With the UK domestic market still undervalued, we see scope for a 5-10% outperformance of FTSE 250 v S&P500 by end 2025.

Emerging Markets

Our U.S. soft landing view and Fed cutting to 3.00-3.25% by end 2025 is constructive for EM equities, as it softens the USD and also allows scope for some major EM countries to cut interest rates. However, the positive impact comes against a backdrop that China remains in the doldrums, which is a restraint to EM equity investment given China large weight in benchmark indices.

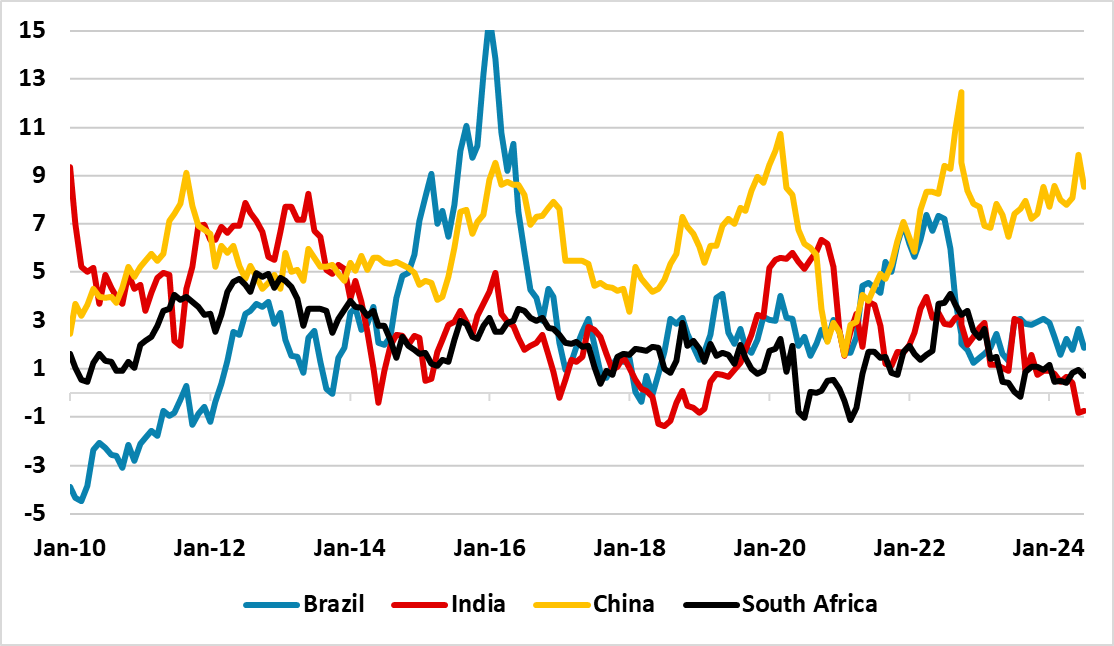

China’s equity valuations are cheap in equity only terms and versus 10yr real government bond yields (Figure 3). The problem is that corporate earnings growth is slowing for cyclical (residential investment/consumption) and structural reasons (population aging/slow productivity/less friendly business polices). New share issues then dilute EPS growth.

Scaling up the Yuan300bln purchase of completed homes for affordable housing to Yuan3-4trn; Yuan2-4trn income transfer or shopping vouchers to households; targeting 12-15% M2 money growth or structural lifts to health/unemployment and pension safety nets are four potential game changers but are all low probability (here). Sentiment is so negative, that the market will likely outperform the U.S. by 2.5-5% by end 2025. However, this is a trading opportunity, rather than a strong asset allocation view. We remain strategically underweight China Equities in global and EM equity baskets, due to the cyclical and structural slowing of growth and low EPS growth prospects.

Figure 3: China Earning-Bond Yield Relative Cheap Compared to Other Big EM’s (%)

Source: Continuum Economics. CAPE Earnings Yield-10yr Real government bond yield

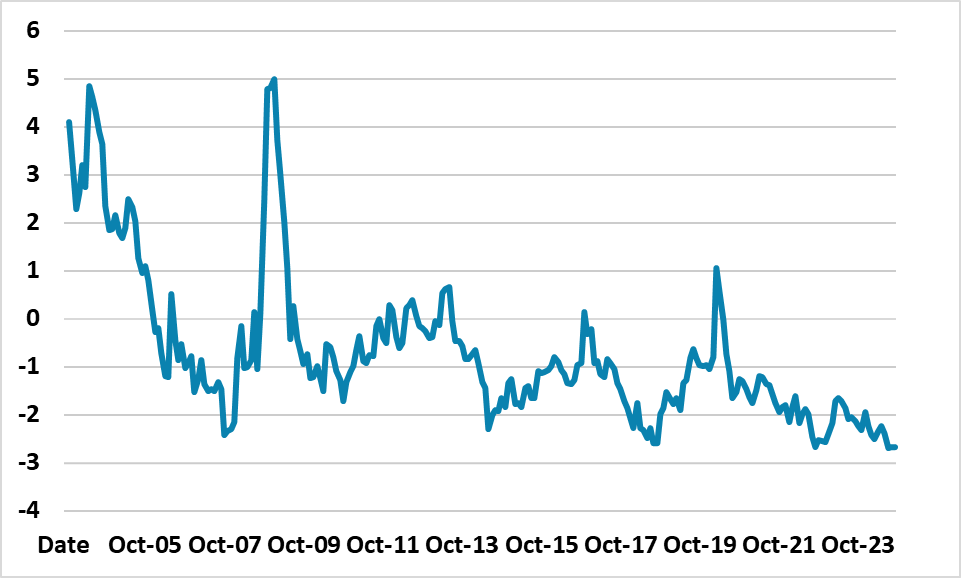

Figure 4: India 12mth Fwd Earnings Yield and 10yr Government Bond Yield (%)

Source: DataStream/Continuum Economics

India has led EM equity investments over the last 18 months and remains our strategic choice on a 2-5yr view. The government maintains reform momentum and circa 10-12% nominal GDP backs 15% per annum corporate earnings prospects. However, the market has become overvalued in equity terms and also against government bonds yields (Figure 4). Global investors are already reducing exposure, while the government will likely crackdown further on domestic retail investors use of derivatives. This can see the market undergoing a de-rating of forward price/earnings ratio. With a U.S. soft landing this will likely come through earnings growth not fully feeding into the market level and we look for only a 7.5-10% outperformance of the S&P500 by end 2025. A U.S. harder landing would be more challenging and would likely cause a modest bear market with India forward price/earnings ratio falling to 20.

Over the next 15 months, we thus switch from an India centric bias, to prefer EM Asia ex China. This gives some India exposure but also taps into Indonesia/Malaysia and S Korea better valuations and that can benefit from the sentiment shift with Fed rate cuts.

Brazil has performed really well in the last 3 months, helped by a portfolio switch away from China equities and as the U.S. rate cycle and USD are more clearly expected to turn and helping Brazil government bond yields to peak. However, BCB remains cautious for now and two further hikes can follow this month’s 25bps hike. We see BCB easing resuming through 2025, as core inflation slowly declines and the BRL rebounds. With low starting valuations this can help the market outperform the U.S. by around 10% over the next 15 months.