U.S. Outlook: Slower Growth to Sustain Improved Inflation Picture

- The U.S. economy has continued to see growth surprising to the upside but with inflation falling faster than expected. However, we do not see the recent strength in GDP growth as sustainable with anecdotal evidence already pointing to a loss of momentum in Q4 2023, which we expect to persist through 2024. This more subdued growth outlook will help progress on inflation to be sustained, and we now expect core PCE prices to return to the 2% target in 2025, while maintaining skepticism as to whether this is sustainable in the long term. While we continue to expect the economy to avoid recession, we expect GDP growth to be below 1.0% annualized in each quarter of 2024 before gradually regaining momentum in 2025 as the economy responds to rate cuts, though we will not see a return to near potential GDP growth of near 2.0% until the second half of 2025.

· Given the strength of recent GDP growth the Fed is rightly cautious about declaring victory on inflation despite recent encouraging progress. Should data surprise to the upside, the Fed could still tighten again, even if it now looks unlikely. However, we believe that data will show significantly slower growth and continued progress in reducing inflation, and that will allow the Fed to start easing policy in June of 2024, and deliver a total of 125bps of easing in 2024. Easing in 2025 will be more restrained as the economy regains momentum, but we expect 100bps of rate cuts in 2025, taking the end 2025 Fed Funds target range to 3.00-3.25%, only slightly above neutral.

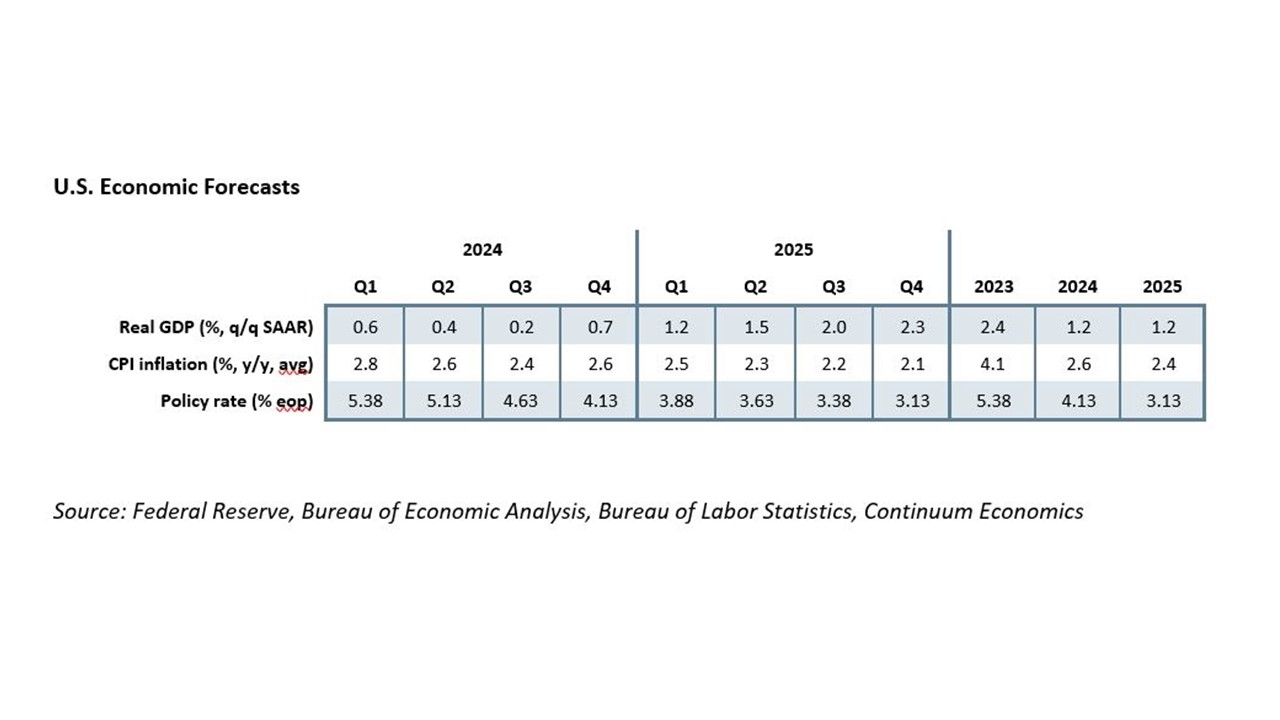

· Forecast changes: Despite the upside surprise to Q3 2023, given that we expect a slower Q4 our 2023 GDP forecast is revised only marginally higher to 2.4% from 2.3% and our 2024 forecast is unrevised at 1.2%. We expect the 2024 pace to be matched in 2025, though the quarterly profile will improve through 2025. We have revised our inflation forecasts lower, CPI to 2.6% from 3.1% in 2024 with core PCE prices now seen reaching the Fed’s 2.0% target in 2025, when we expect CPI to increase by 2.4%. A subdued GDP profile coupled with core inflation moving to target has us now projecting 125bps of easing in 2024, rather than 75bps, while we now expect the current Fed Funds target of 5.25-5.50% to prove the peak, rather than seeing a peak of 5.50-5.75%. This means our end 2024 view of 4.0-4.25% is 75bps below our September view.

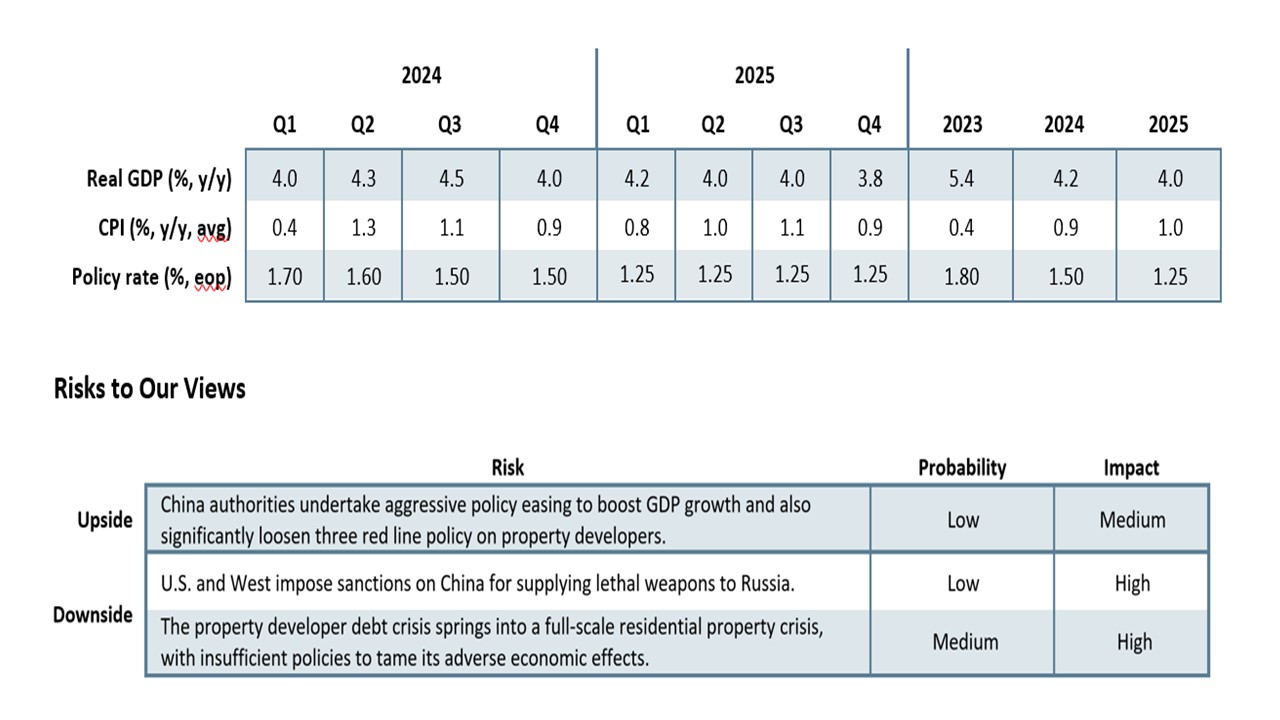

U.S. Economic Forecasts

Source: Federal Reserve, Bureau of Economic Analysis, Bureau of Labor Statistics, Continuum Economics

GDP avoiding recession but momentum is set to fade

2023 has seen the United States economy confound widespread predictions seen early in the year for recession, maintaining respectable growth near 2.0% into the first half of the year and growing by a startling pace exceeding 5.0% annualized in Q3. The resilience in the economy has been accompanied by a significant loss of inflationary pressure, with core PCE prices rising by less than 0.2% in four of the five months ending in October, and by only marginally more than 0.3% in the other. Falling inflation, along with continued strength in employment growth, helps to explain the resilience of consumer spending and acceleration in GDP in Q3.

However, the strength of Q3 GDP looks difficult to sustain. Consumer spending ran well ahead of real disposable income, a Q3 inventory buildup looks due to be corrected, and while housing construction increased home sales have fallen significantly. Business investment, while still positive, is losing momentum. GDP is running ahead of Gross Domestic Income, and anecdotal evidence, such as in the Fed’s Beige Book, suggests the economy now has little momentum. Consumers still have some support from savings built up during the pandemic, but this is likely to fade in 2024. The Canadian economy, which surprised on the upside in Q1 2023 fueled by a surprisingly strong performance from the consumer, but has subsequently stagnated, may be a leading indicator for what will happen in the United States as the consumers’ sources of support start to fade.

A weak Q4 2023 could be seen as corrective from the strong Q3 and would not be conclusive evidence of a loss of momentum, but we expect a loss of momentum to persist through 2024, with growth coming in below 1.0% in each quarter with the momentum likely to fall to near zero in the middle of the year before starring to recover. We do not expect a recession, but do expect a sufficient loss of momentum to push unemployment modestly higher, and to restrain consumers’ disposable income. Continued falls in inflation will probably be largely offset by a loss of momentum in wages, keeping consumer spending subdued. Business investment will not collapse but is likely to turn modestly negative, while we are likely to see more significant negatives from housing. Weak imports will see net exports make a modest positive contribution, but inventories are in need of trimming. Government will remain positive but will lose momentum, particularly at the State and Local level as growth in tax receipts slows.

As interest rates start to fall, the economy will gradually gain momentum through 2025, though we expect growth to remain below potential at an annualized pace a little above 1.0% in the first half of the year before gaining momentum to near 2.0% in the second half of 2025. The acceleration in momentum is likely to come more from investment than consumer spending.

Figure 1: PCE Price Projections 2024-25

Source: Continuum Economics, Bureau of Economic Analysis

Inflation and the Fed Policy Trajectory

Trend in inflation started to lose significant momentum in the core rates, both CPI and PCE prices, with the June data, and thus the improvement looks more convincing now than it did when we published our last outlook in September. The improvement has become broader based, and while there is some progress still needed in services, both housing and elsewhere, core PCE trend over the last five releases looks consistent with a pace near the Fed’s 2.0% target. PPI trends, which led the improvement in consumer prices, remain soft. Wage data remains mixed, with some data stubbornly strong and others showing signs of slowing. We still have doubts on whether the Fed can deliver a sustained return to 2% inflation in a less globalized world, but we now expect the Fed to reach its target temporarily in 2025, assisted by an extended period of below potential GDP growth. We expect yr/yr growth in core PCE prices to reach 2.0% in mid-2025 while on a quarterly annualized basis 2% can be achieved in late 2024. Core inflation moving back above 2.0% is a story for 2026 rather than 2025.

The Fed has welcomed recent inflationary data, but is rightly cautious over declaring victory. Should the strength of Q3 GDP growth be sustained, a move back to the 2.0% inflation target would be unlikely. We however expect that by Q2 2024 the economy will be on its third straight quarter of subdued GDP growth, and a fifth straight quarter of core PCE prices below 3.0% on an annualized basis, and this will allow a first Fed easing, by 25bps, in Q2 2024, most likely in June, though May is possible. Continued below potential GDP and near target inflation would allow the Fed to ease by 25bps at each of the four meetings in the second half of 2024, leaving the Fed Funds target at 4.0-4.25% at the end of 2024. With GDP growth likely to regain some, albeit modest, momentum in 2025 the pace of easing would moderate, we expect to 25bps a quarter, leaving an end 2025 Fed Funds target of 3.0%-3.25%. This would be only modestly above the Fed’s current 2.5% estimate of the neutral rate. If we are correct that 2.0% inflation will be difficult to maintain in the long term, the end 2025 Fed Funds target may in fact be close to neutral.

When the Fed starts easing, it is likely to continue with Quantitative Tightening, though we feel that by early 2025 reserve balances for depository institutions could have fallen sufficiently to risk money market tightness, prompting the Fed to slow QT (here). Should the combination of policy easing and continued QT bring a sharp steepening of the yield curve however, the Fed may feel compelled to start slowing QT in late 2024.

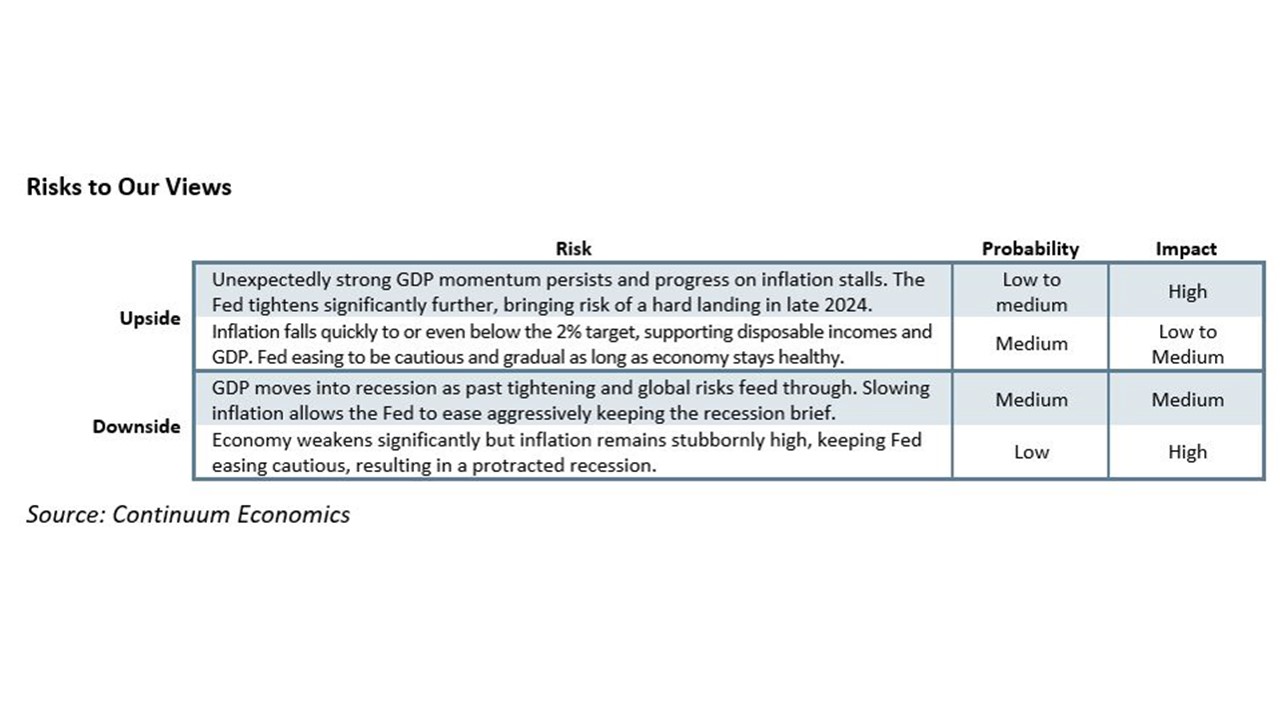

Risks to Our Views

Source: Continuum Economics

2024 elections will have limited economic implications

The election will be seen as a key event for 2024, though the implications for the 2024 economic outlook are modest. The election looks likely to be a close contest between President Joe Biden and former President Donald Trump. Currently opinion polls show Trump in the lead though they may be reflecting voter judgements on Biden more than they are of Trump. We still see Biden as more likely than Trump to prevail in choice between the two candidates, though the race will be very close and down to a small number of votes in the swing states of Pennsylvania, Michigan, Wisconsin, Georgia, Arizona and Nevada. Our view on the economy has subdued inflation becoming more firmly entrenched but unemployment edging higher. The former will probably benefit Biden more than the latter hurts him, with high inflation having hurt Biden politically more than low unemployment has helped him. The contests for control of Congress will also be very close. Currently the Republicans have a narrow majority in the House but their difficulties in agreeing on policy and leadership give the Democrats a good chance of regaining control. The Senate, where the Democrats currently have a narrow majority, in contrast sees the Republicans having a good chance of gaining control, with more Democrats than Republicans defending close states this year.

Whoever wins the election, the budget deficit looks set to remain near 6% of GDP though the next presidential term, a level which is high enough to justify concern over the cost of future interest payments, and make a sustained return to 2% inflation more difficult to achieve. Democrats may tax and spend more than Republicans would, and that would see equities prefer a Republican administration, but Democrats would be unlikely to raise taxes on anyone other than the very rich, and Republicans, particularly under Trump, would be reluctant to tackle spending on entitlements, particularly Medicare, which is the main source of future spending growth. Should Republicans run with someone other than Trump, they would have a better chance of victory and that President may show some willingness to tackle entitlement spending. While that could excite the markets, reforms would still be unlikely to be approved by Congress.

Should Trump win the election his proposal for an across the board 10% import tariff would cause concern, and if implemented would be likely to hit global growth and boost inflation in the United States. That Trump is less willing to support Ukraine than Biden could be another important difference, though if by election time the front lines in the conflict remain close to where they have been through 2023 differences on Ukraine might become less significant.