December Government Bond Volatility

Bottom Line: The Fed and ECB meetings are the most important for forward guidance this week, as they will set the tone for DM generally (BOJ is still seen to be a different phase and unlikely to have last impact on global DM government bond markets). The Fed will likely try to restrain the scale and timing of 2024 easing speculation. ECB forward guidance will be less clear, but ECB Lagarde will likely be cautious due to pressure from the hawks.

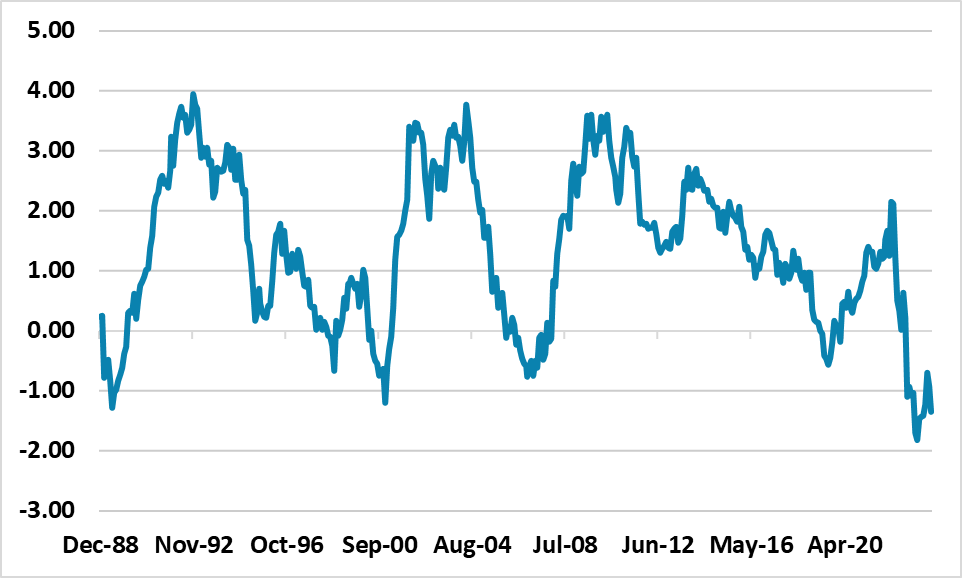

Figure 1: 10yr-Fed Funds (%)

Source: Continuum Economics/Datastream

Government bond yields so far in December have continued the November trend to lower yields, as speculation grows about the scale of easing from DM central banks in 2024/25. While numerous central banks meet this week, the bond market will most closely examine the Fed (here) and ECB (here) meetings on 13 and 14 December. It would be a surprise if Fed Powell changed tone substantially from his pre blackout period guidance, which is designed to leave the door open for a further hike (unlikely) but also temper 2024/25 rate cuts expectations. Even so, Powell will need to acknowledge the dots, which will likely see more easing discounted than the September dots (here), though less than the market expects. The November CPI on Tuesday will also be a swing factor. However, the 10-2yr curve is still fairly inverted if an easing cycle is approaching, as is 10-yr-Fed Funds (Figure 1). Thus 10yr could struggle to move any lower unless the Fed take a dovish pivot on Wednesday or data materially disappoints in the next few weeks.

Meanwhile, ECB forward guidance will likely remain unclear. Hawks want to fight the idea of early interest rate cuts, with the market now fully discount a 25bps cut in official rates in April. This suggests that ECB president Lagarde communication will be cautious and not provide any hints that could encourage market speculation. However, the bond market knows that the ECB forward guidance in press conferences is weak and will likely focus on the staff inflation forecasts out to 2026. Recent number suggest that the ECB will have no choice but to reduce 2024 inflation forecasts, but 2025/26 will also be dependent on the drop in money market futures and bond yields since the forecasting round before the September ECB meeting (here). These mean 2025/26 inflation forecasts may not decline much, which will discourage the market from becoming too aggressive in discounting more than the 125bps of cuts already discounted for 2024. BOE (here), Norges Bank (here) also meet this week.