Preview: Due December 8 - U.S. November Employment (Non-farm Payrolls) - Slightly firmer due to returning strikers

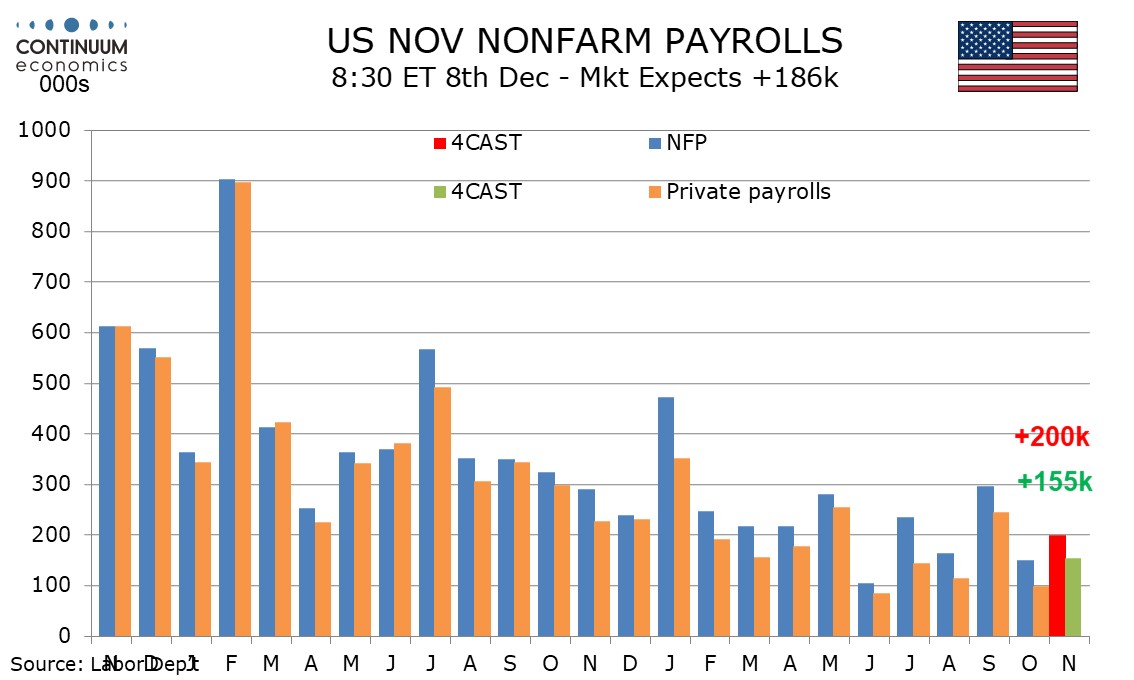

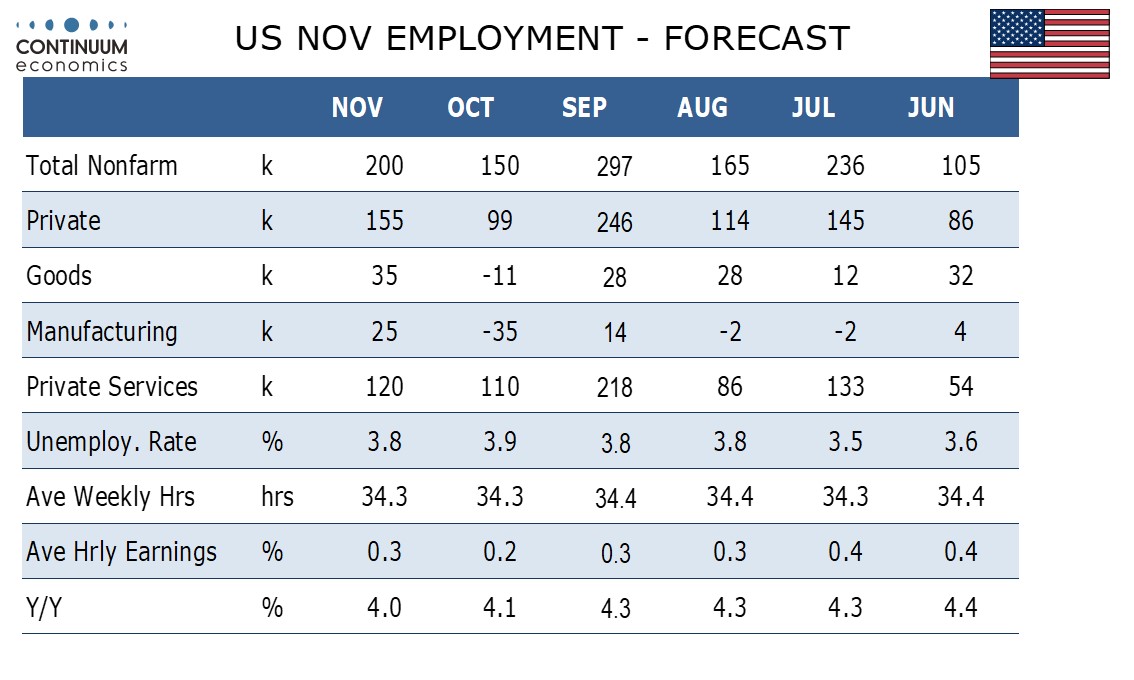

We expect a 200k increase in November's non-farm payroll, stronger than October's 150k though excluding the impact of returning strikers the data will be consistent with a modest slowing. We do however expect a correction lower in the unemployment rate to 3.8% from 3.9% and a 0.3% rise in average hourly earnings, stronger than October's 0.2%.

October's payroll saw a decline of 35k in manufacturing with 33k of that due to autos, where the monthly strike report reported that 25k were on strike. We expect a 25k increase in manufacturing in November, more than fully due to autos. October's strike report also showed 16k on strike in the motion picture industry, a strike that started in July and, like autos, should see a return to work in November's report. A final special factor in November could be a late survey and an early Thanksgiving inflating the retail sector.

Rising initial and continued claims trends however suggest some underlying slowing, and a 200k increase even with some supportive special factors would be slightly below October's 3-mopnth average of 204k and its 6-month average of 206k. We expect private payrolls to increase by 155k, with a 45k rise in government a slight slowing from three straight gains of 51k. Risk from October's revision is on the downside with the sum of state data showing only a 44k increase in employment in that month.

October's unemployment rate of 3.9% increased after two straight months at 3.8% due to a 348k decline in employment underperforming a 201k decline in the labor force. We expect employment to show the stronger rebound in November.

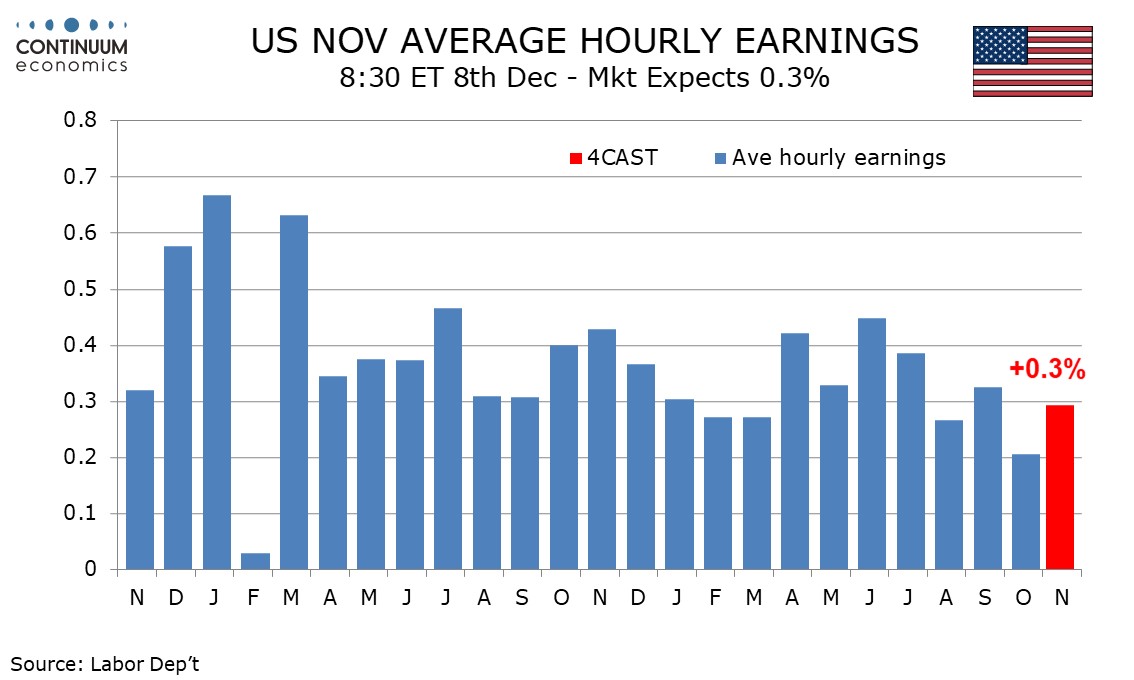

October's 0.2% increase in average hourly earnings, following two straight gains of 0.3%, was below trend, and while trend is probably slowing we do not expect a second straight below trend gain, looking for a rise of 0.3%. This would see yr/yr growth falling to 4.0% from 4.1%.

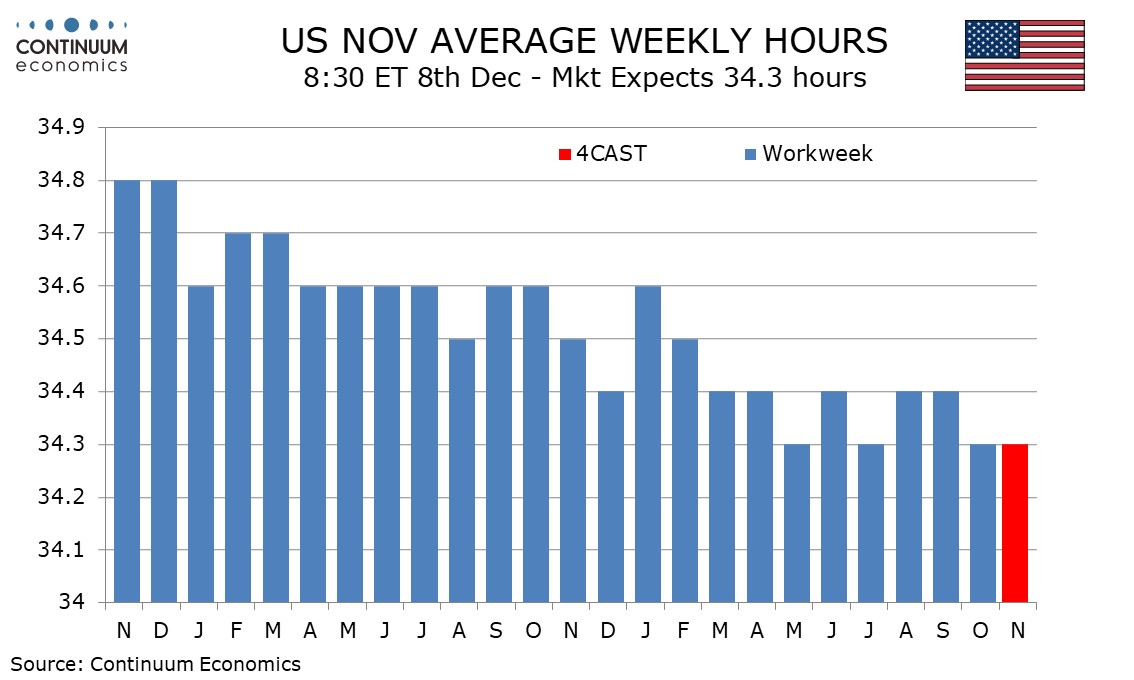

Also on the weak side of trend in October was the workweek, which slipped to 34.3 hours from 34.4. We expect a second straight month at 34.3, which would be consistent with the economy losing momentum in Q4 after a strong Q3.